Hello traders. Welcome to a new blog post where we discuss how the Elliott wave theory helps traders to identify perfect turning point in the markets. In this one, the spotlight will be on the USDSEK Forex pair.

The USDSEK is one of the Forex pairs we analyze for Elliottwave-Forecast members in Group 2. It is considered an exotic pair that heavily relies on the U.S. Dollar’s path. In typical market conditions, we like to use the USDX as a guide for this pair.

Similar to the Dollar Index, USDSEK has been in a long-term bearish corrective path since September 2022. This pullback is meant to correct the preceding 5-wave impulsive cycle from January 2021 at minimum. This reflects a core principle of Elliott Wave Theory: a 3-wave correction follows a 5-wave trend.

Despite USDSEK reaching the extreme level of the September 2022 cycle, we continued to forecast lower prices. Why? Because the Dollar had not yet achieved the minimum target price to complete its cycle, and price action had not shown signs of a major recovery. As a result, we maintained a bullish bias on the Dollar across the board.

Accordingly, we looked for 3/7/11 swing bounces against the bearish sequence and sold from extremes. This has been our strategy for trading the Dollar since January 2025, when the third leg of the September 2022 cycle began. In June 2025, another corrective bounce started and lasted until August 1, 2025. We once again sold the Dollar from the extremes across markets.

From August 1, USDSEK completed a 5-wave decline on the shorter cycles. Then, beginning August 13, price started correcting that 5-wave decline, and we decided to take renewed interest in the pair.

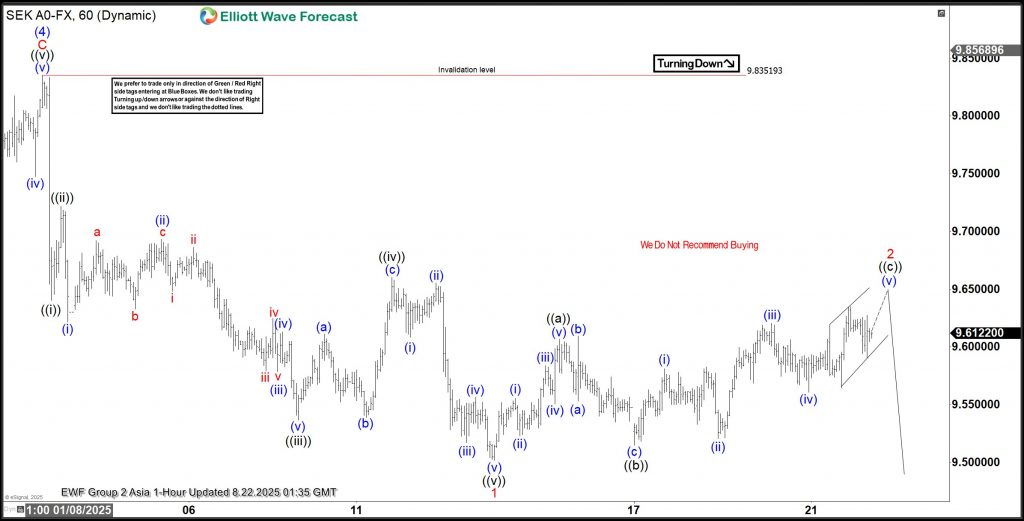

USDSEK, H1 Asia Update – 8/20/2025

We shared the chart above with members on 20th August 2025 highlighting the short-term path. We expected the corrective bounce – wave 2 to finish soon. Afterwards, the pair should resume the year-long bearish path. We expect at least two more swings higher before the corrective bounce is complete.

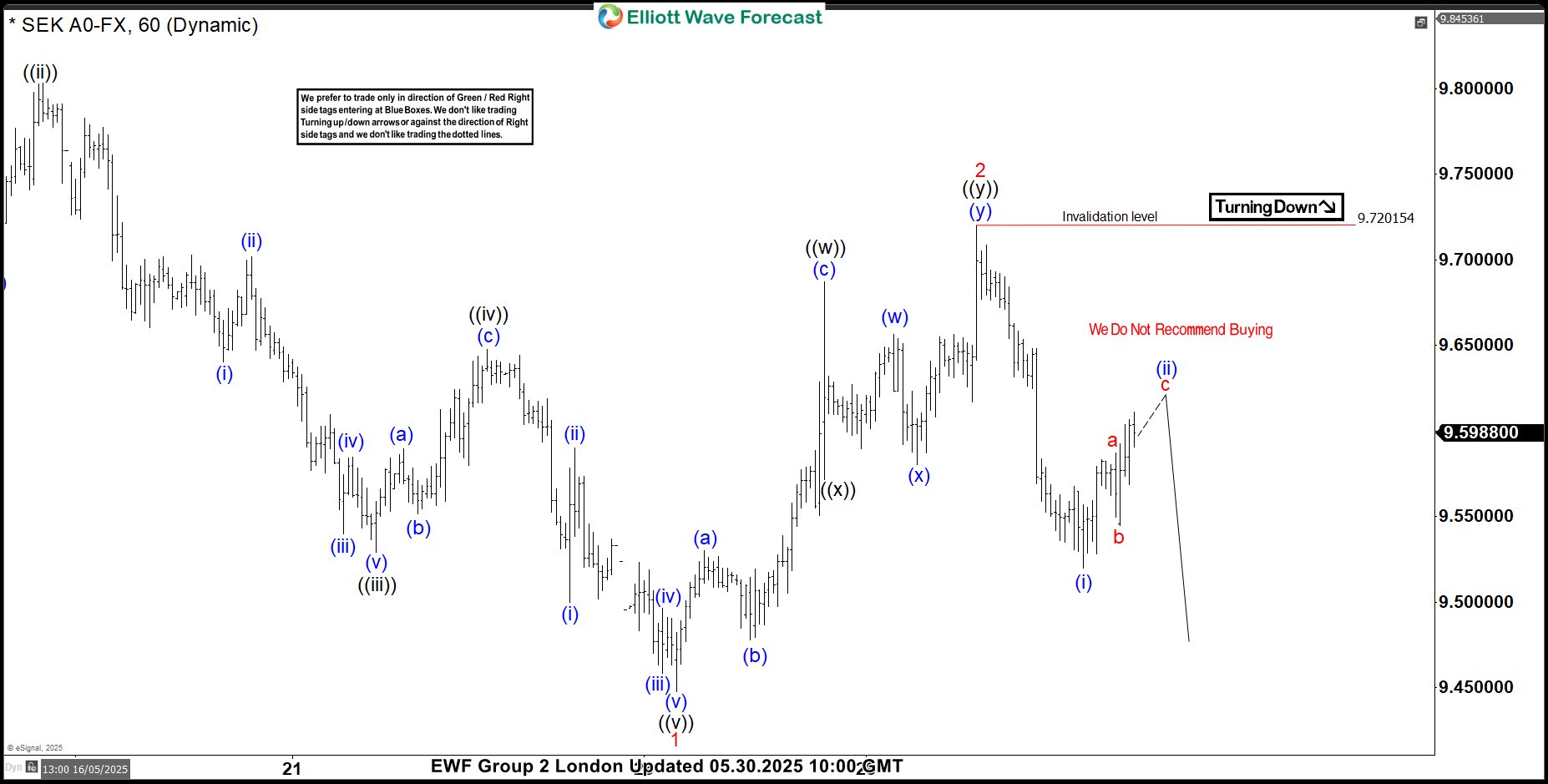

USDSEK, H1 Asia Update – 8/22/2025

We shared the chart above on 22nd August, 2025 when the corrective bounce was way more advanced. One more leg higher and then a likely sell-off would most follow, to finish wave 2 and begin wave 3 lower. In addition, we advised members to not enter long trades. Only look for shorts.

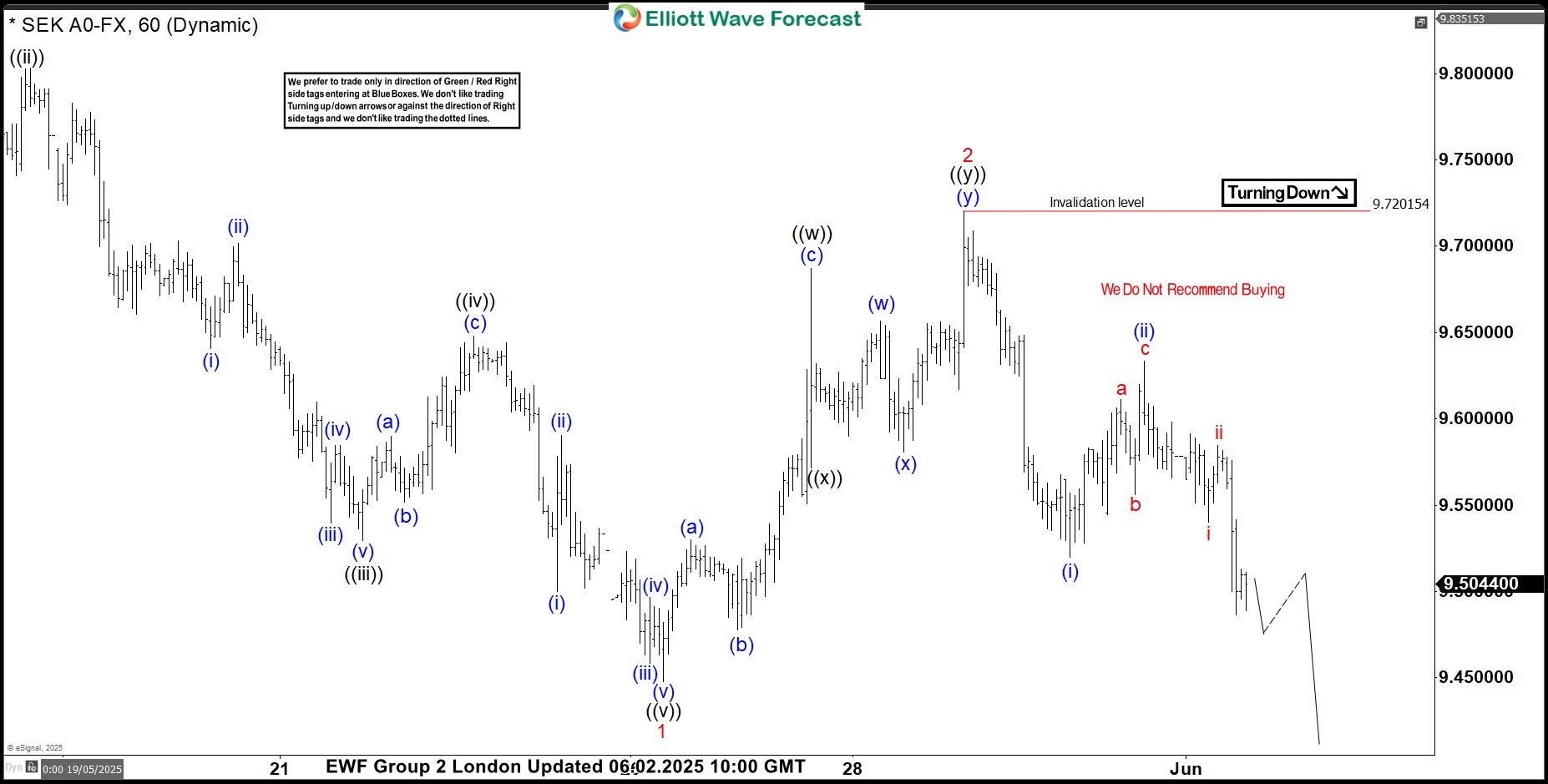

USDSEK, H1 Asia Update – 8/26/2025

On the 26th August, we shared the chart above with members showing how price had reacted just as expected. Wave 2 finished with a diagonal wave (v) of ((c)) of 2 and sold off sharply. Despite the wide sell-off, the pair corrected higher. However, this follow-up update anticipated wave 3 to extend lower as wave 2 had already completed.

USDSEK, H1 Asia Update – 8/29/2025

Price began wave ((iii)) of 3 as we had anticipated. We shared the chart above to members on 29th August, 2025 showing the sub-waves of wave ((iii)) as it develops. With these regular H1 updates ( four times daily), we ensure members are not lost in the market phobia and noises. Stay the course and reap the rewards.

The best part? This is how we do for all the 78 instruments we cover in the service. We start the week with the weekly and daily charts to show the big picture. On a daily basis, we update the H1 charts four times before rounding off the day with an update on the H4 chart. This is a 24-hour coverage to keep you in the loop and make the best decisions. Learn more about us below.

About Elliott Wave Forecast

At www.elliottwave-forecast.com, we update one-hour charts four times daily and four-hour charts once daily for all 78 instruments. We also conduct daily live sessions to guide clients on the right side of the market. Additionally, we have a chat room where moderators answer market-related questions. Experience our service with a 14-day trial for only $9.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.