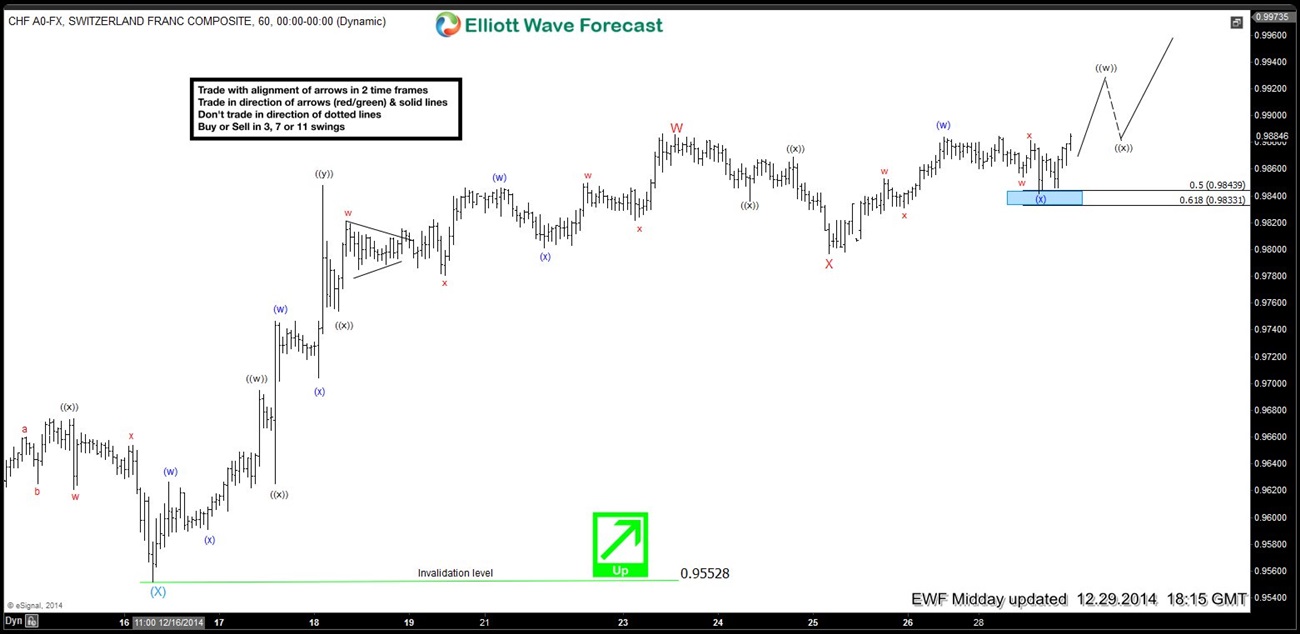

USDCHF preferred Elliott Wave view remains bullish and suggests wave “W” ended at 0.9887 and wave “X” is also proposed to be over at 0.9796. Pair has made a new high above 0.9887 adding more conviction to this view and near-term focus is on 0.9928 – 0.9949 area to complete wave (( w )) before we get a pull back in wave (( x )) and higher again. We don’t like selling the pair and expect (( x )) wave pull back to find buyers in 3, 7 or 11 swings as far as pivot at 0.9796 low remains intact. If the pivot at 0.9796 low gives up that would suggest pair is correcting the entire cycle from 0.9552 low and would still be a buy in 7 or 11 swings as far as pivot at 0.9552 low keeps on holding in our system. As there is no red arrow on the chart so we don’t like selling the pair in any of the proposed pull backs.

We do Elliott Wave Analysis of 26 instruments in 4 time frames (Weekly, Daily, 4 Hour and 1 Hour) with 1 hour charts updated 4 times a day so clients are always in loop for the next move. Please feel free to come visit around the website and click Here to Start your Free 14 day Trial (No commitments, Cancel Anytime)

New members save 50% in our End of Year Sale (Ends mid-night 31 December 2014) Click here to Subscribe & Save 50% on all our monthly plans.