In this technical blog, we will look at the past performance of the Elliott Wave Charts of the Eurostoxx (SX5E) index. We presented to members at the elliottwave-forecast. In which, the rally from the 23 October 2023 low ended as an impulse structure. But showed a higher high sequence with a bullish sequence stamp favored more upside extension to take place. Therefore, we advised members not to sell the index & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

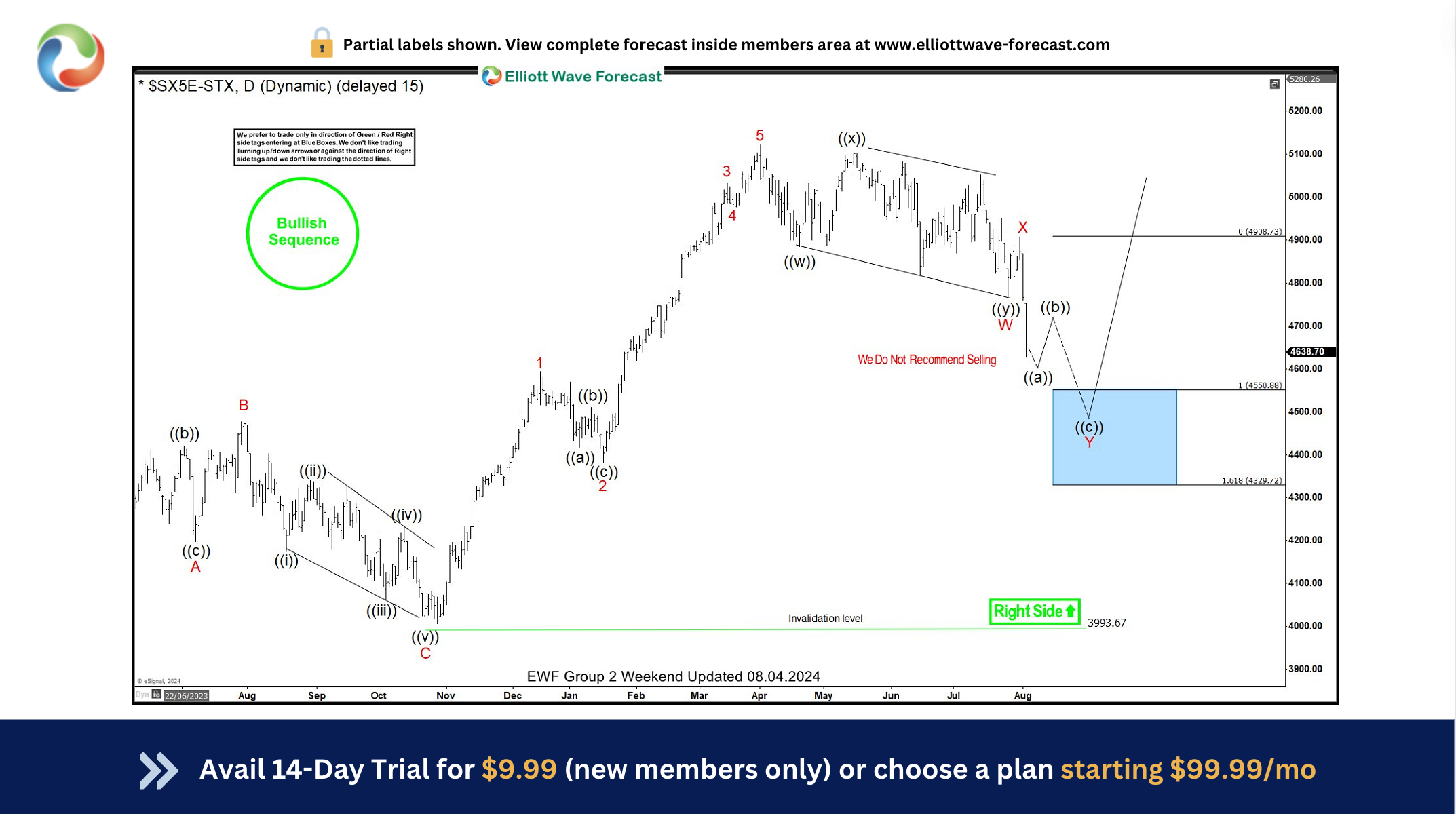

EUROSTOXX(SX5E) Daily Chart From 8.04.2024 update

Here’s the Daily Elliott wave chart from the 8.04.2024 Weekend update. In which, the cycle from the 10/27/2023 low ended as an impulse structure at 5121.71 high. Down from there, the index made a pullback to correct that cycle. The internals of that pullback unfolded as Elliott wave double three structure where wave W ended at 4767.15 low. While wave X bounce ended at 4907.39 high. Then wave Y managed to reach the blue box area at 4550.88-4329.72 equal legs area. From there, buyers were expected to appear looking for the next leg higher or for a 3 wave bounce minimum.

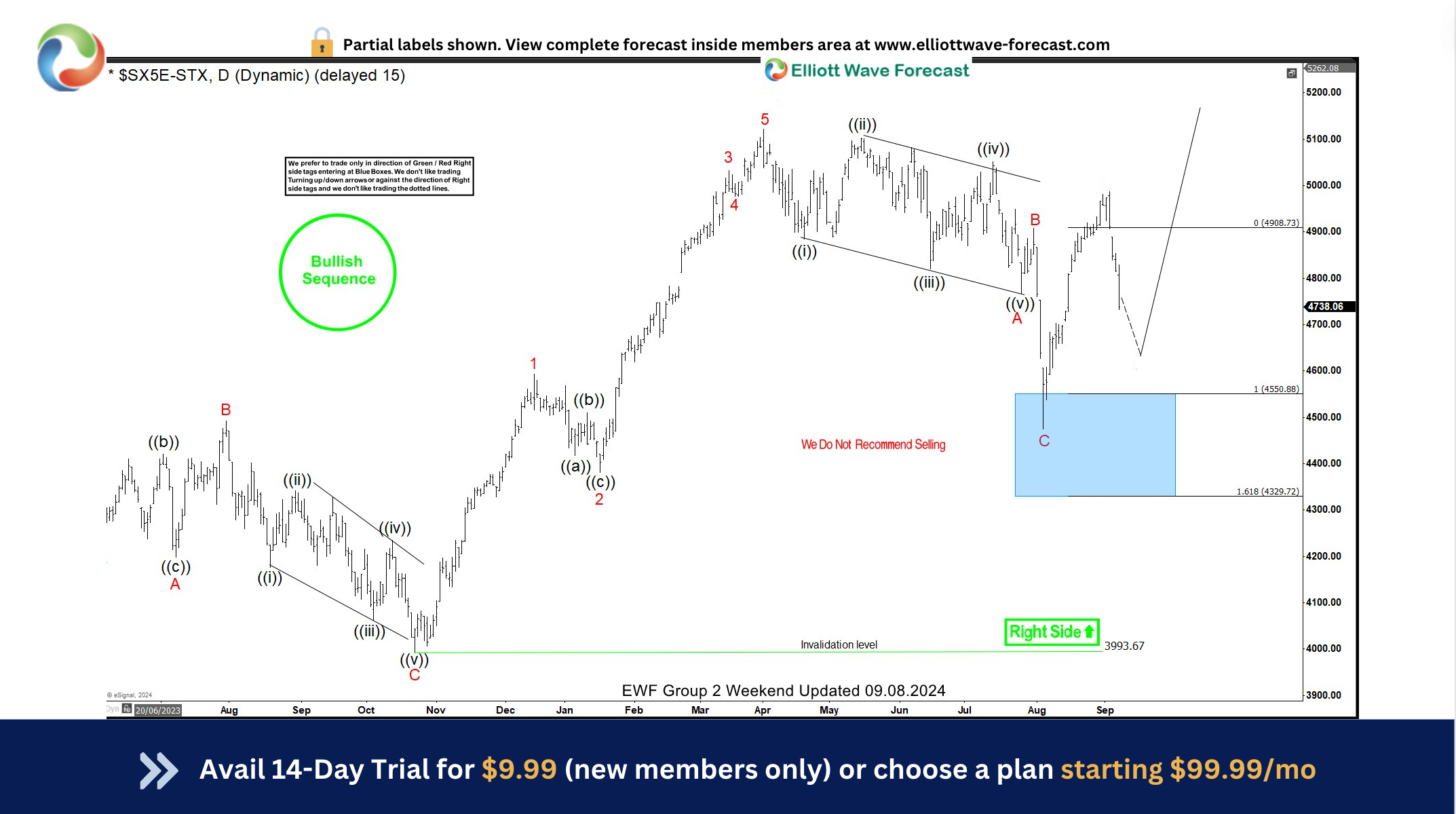

EUROSTOXX(SX5E) Daily Chart From 9.08.2024 update

This is the latest Daily Elliott wave Chart from the 9.08.2024 Weekend update. In which the index shows a reaction higher taking place, right after ending the correction within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. However, a break above the 5121.71 high is still needed to confirm the next extension higher & avoid a double correction lower.

If you are looking for real-time analysis in Eurostoxx along with the other indices then join us with a 14-Day Trial for the latest updates & price action.

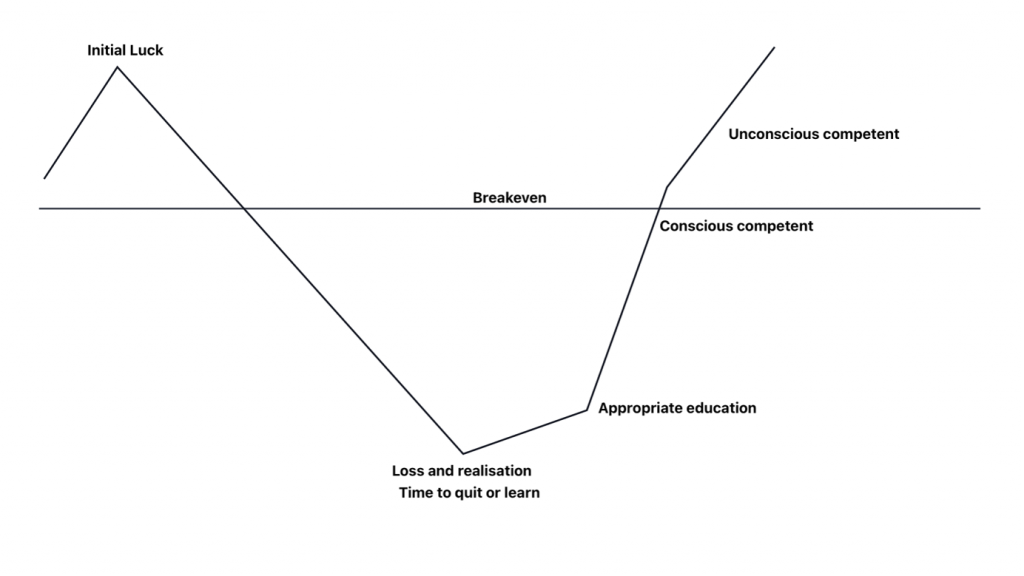

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial.