In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of Tesla ticker symbol: TSLA. We presented to members at the elliottwave-forecast. In which, the rally from 22 April 2024 low ended in an impulse structure. But showing a higher high sequence within the cycle from January 2023 low supports more upside. Therefore, we advised members not to sell the stock & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

TSLA 4-Hour Elliott Wave Analysis: February 9, 2025

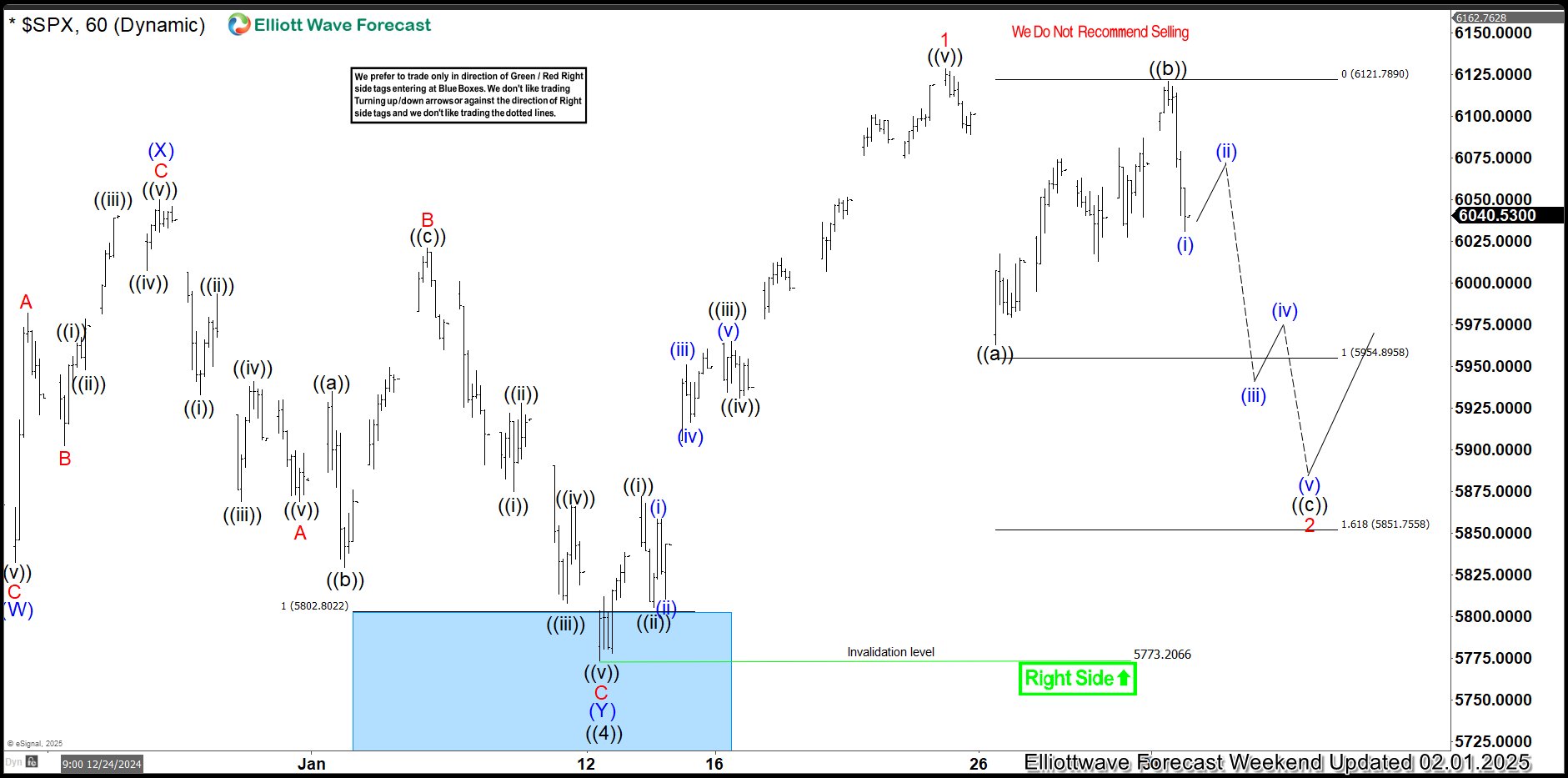

TSLA 4-hour chart showing completed impulse wave and double three correction

Here’s the 4-hour Elliott wave chart from the 2.09.2025 weekend update. In which, the cycle from the 4.22.2024 low ended in wave ((3)) at $488.54 high. Down from there, the stock made a pullback in wave ((4)) to correct that cycle. The internals of that pullback unfolded as Elliott wave double three structure where wave (W) ended at $373.04 low. Wave (X) bounce ended at $439.74 high and wave (Y) managed to reach the blue box area at $323.98- $252.46. From there, buyers were expected to appear looking for the next leg higher or for a 3 wave bounce minimum.

TSLA 4-Hour Elliott Wave Update: February 16, 2025

Latest TSLA chart showing reaction higher from blue box support

This is the latest 4-hour Elliott wave Chart from the 2.16.2025 weekend update. In which the stock is showing a reaction higher taking place, right after ending the double correction within the blue box area. However the bounce needs to react higher minimum towards $380.19 level to allow longs to get into a risk-free position. Later on, it would need to see a break above $488.54 high to confirm the next extension higher & avoid deeper pullback.

If you are looking for real-time analysis in TSLA along with the other Stocks & ETFs then join us with a 14-Day Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial