Hello fellow traders. In this technical article, we are going to present Elliott Wave charts of IBEX index . As our members know, IBEX has been showing impulsive bullish sequences in the cycle from the August 13739.3 low, pointing to further strength ahead. We have been calling for a rally in IBEX. Recently we got an intraday pullback which landed right in the equal‑legs zone. In the following section, we’ll explain our Elliott Wave forecast

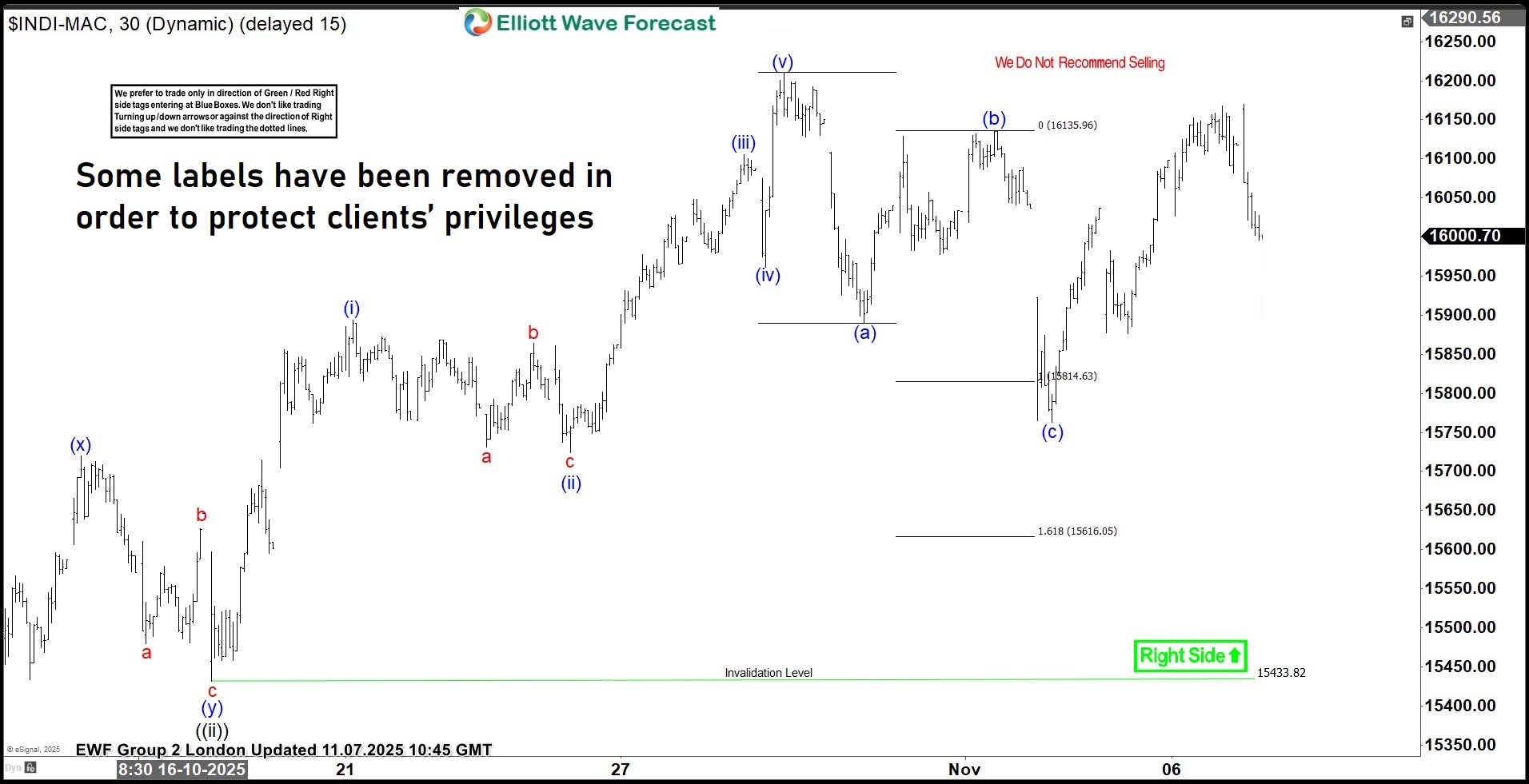

IBEX Elliott Wave 1 Hour Chart 11.04.2025

IBEX is currently undergoing a wave (iv) pullback. The correction has reached the extreme zone at 15,816.7–15,618.12, also known as the Equal Legs zone. In this area, we expect buyers to step in and initiate another rally, either toward new highs or at least a 3-wave bounce. Therefore, we recommend avoiding short positions within this zone and favoring the long side

Nearly 90% of traders fail because they don’t understand how to read market patterns. Are you among the top 10% who do?

👉 Challenge yourself with this advanced Elliott Wave Test and find out.

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

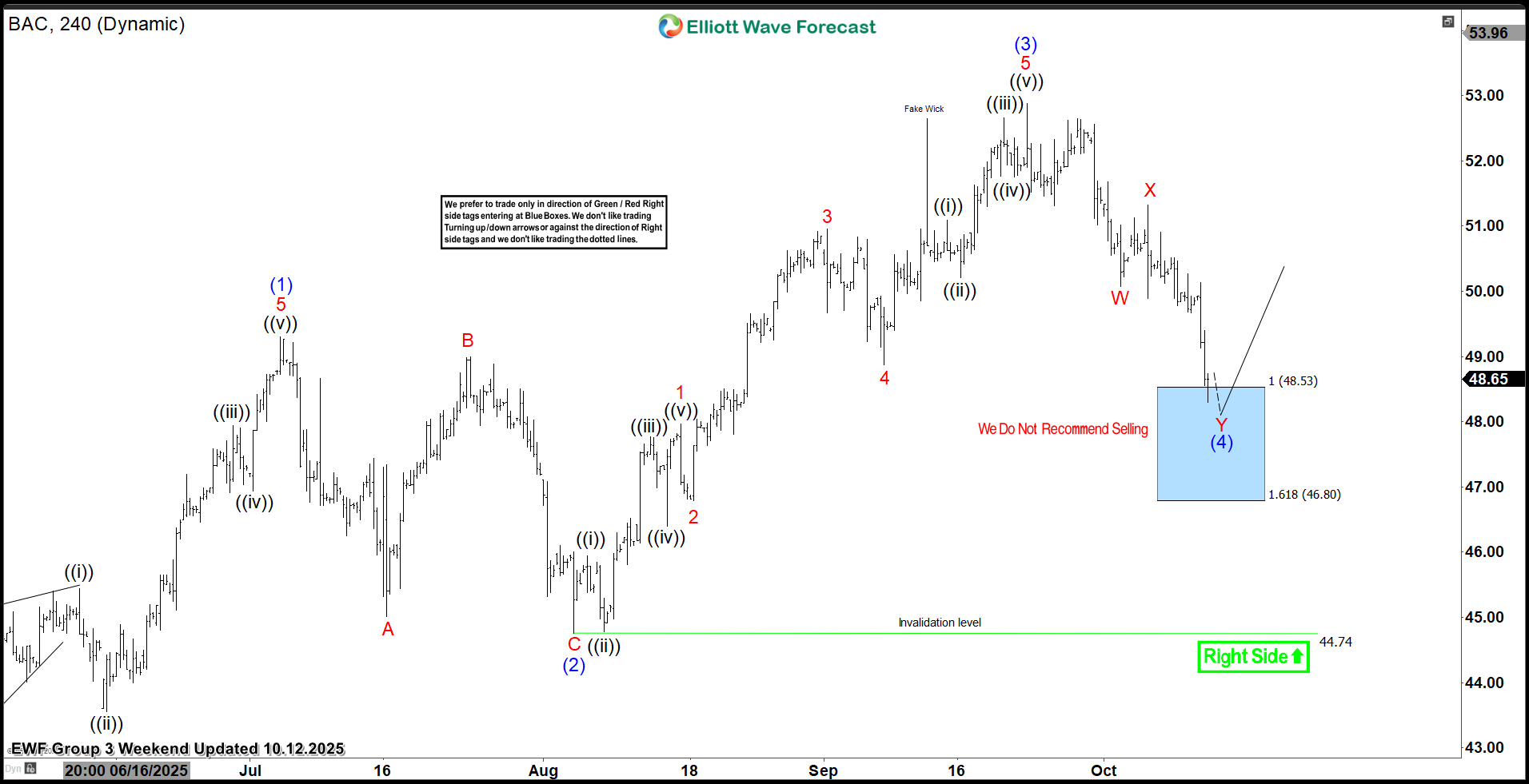

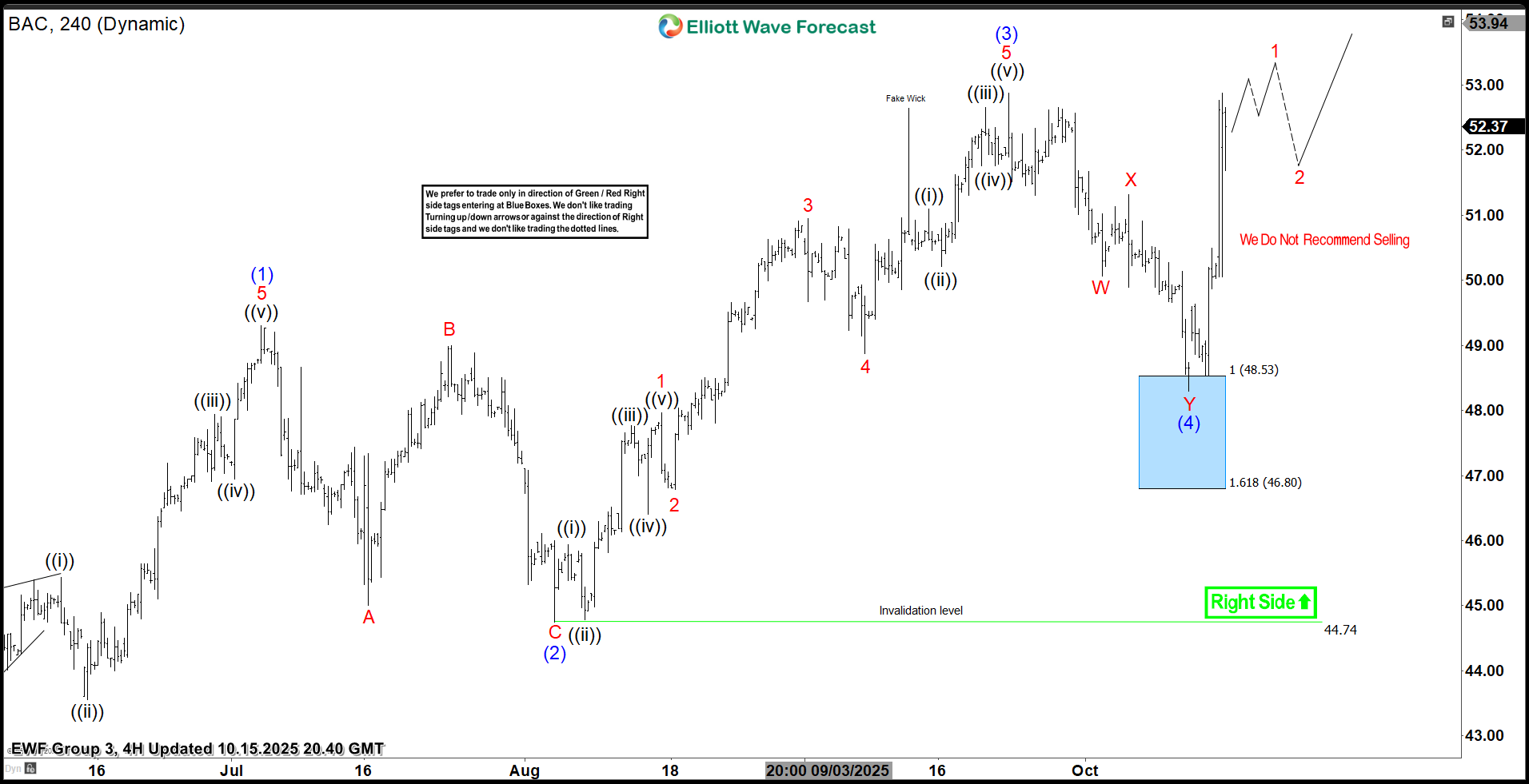

IBEX Elliott Wave 1 Hour Chart 11.07.2025

IBEX made a decent bounce from the Equal Legs zone. Any long positions entered from this area should now be risk-free, with partial profits taken. We don’t favor selling at this point. If the pair breaks the last low, we will look to the next Equal Legs zone as another buying opportunity.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts with target levels in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room

Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help

🚀 Not a member yet? Unlock full access with our 14-day Trial for just $9.99!

Here’s what you’ll get:

✅ Official Trading Signals — with clearly defined Entry, Stop Loss, and Take Profit levels based on our proven strategy.

✅ Live 24 Hour Chat Room Access — ask unlimited questions and get expert support during trading hours (Monday–Friday).

✅ Expert Analysis — real-time updates across Forex, Stocks, Indices, Commodities, Cryptos, and ETFs.

✅ Hands-on Learning — sharpen your trading skills with direct mentorship from seasoned market analysts.

💬 Whether you’re an experienced trader or just getting started, Elliott Wave Forecast provides the tools, strategies, and support you need to trade with confidence.

Interested in joining us? 👉 View pricing and plans.

14 Days Trial 👉 Click here to start your Trial today!

Free Elliott Wave Educational Page : 👉 Click here to learn more

⏳ Offer Expires Soon!

Get full access to real-time Signals, Live Sessions, 24 Hour Chat Room Support and Expert Analysis — all for only

$0.99 during your 14-day trial.

⚠️ This limited-time price will expire soon — don’t miss out!