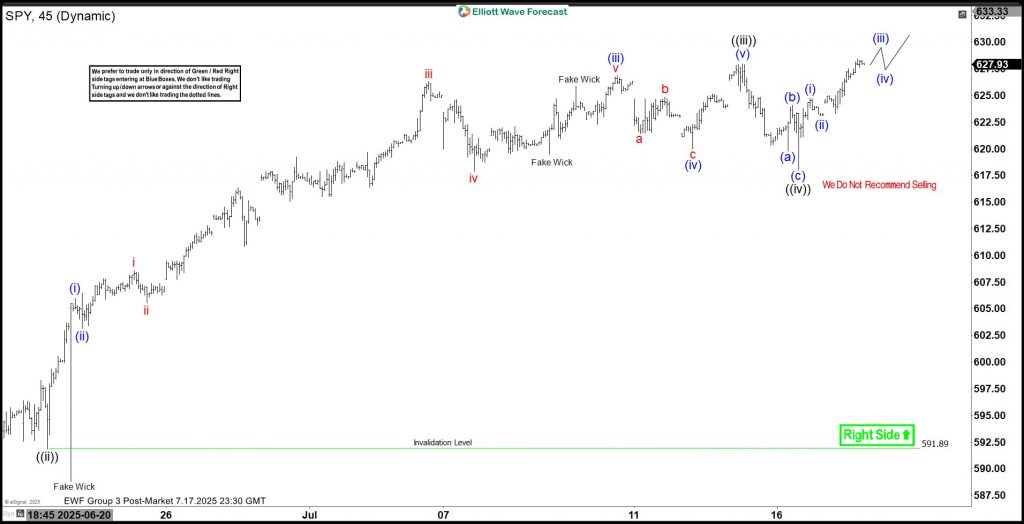

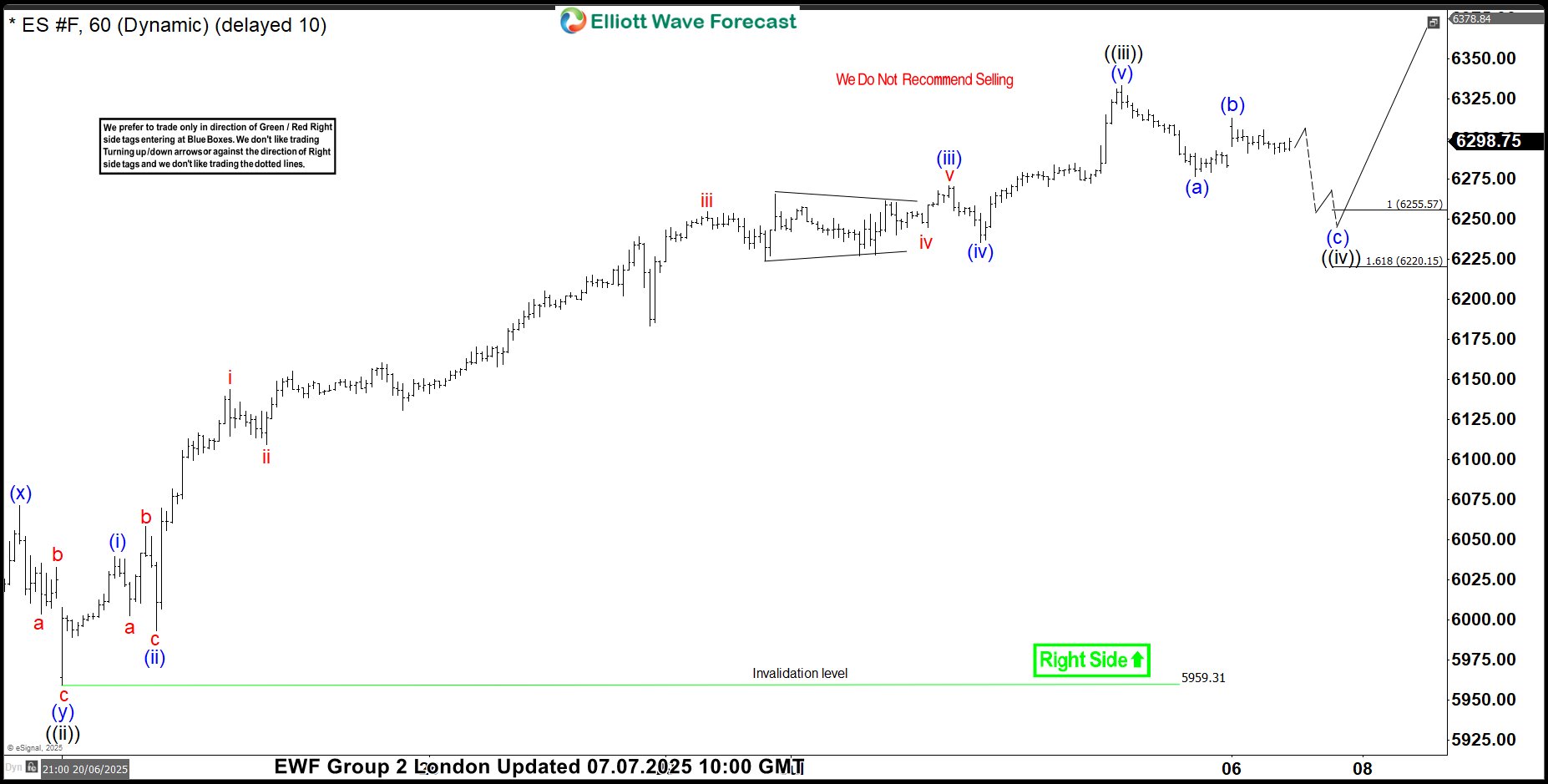

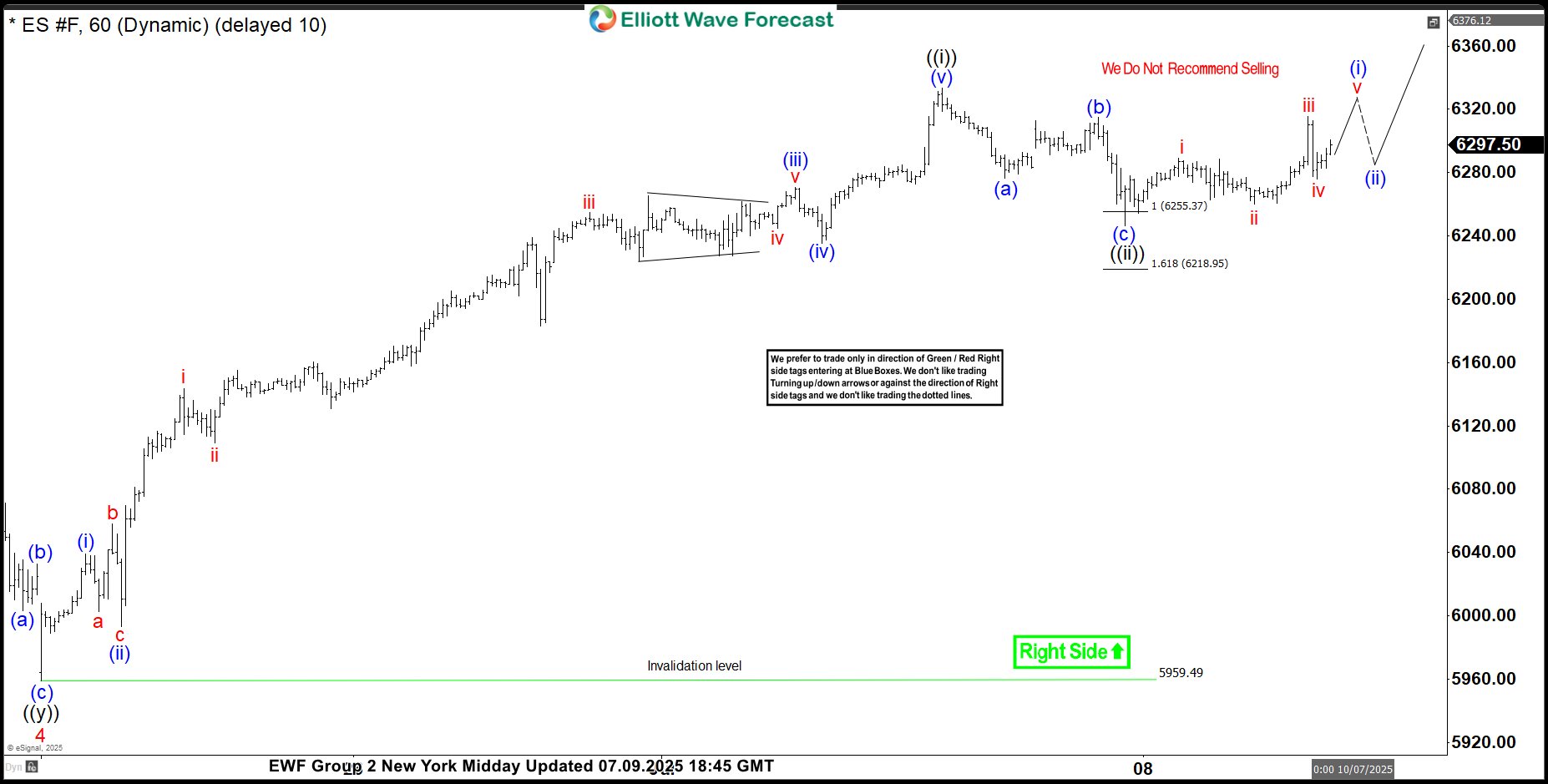

SPX completes wave ((ii)) correction at Fibonacci support and begins the next bullish sequence

S&P 500 Index ticker symbol: SPX has completed its corrective pullback and is now turning higher. The broader bullish structure remains intact. Price respected key support and confirmed the correction as complete. After finishing wave ((i)) at the last high, SPX moved lower in wave ((ii)). This decline unfolded as a clear A-B-C correction. Wave (a) initiated the pullback, followed by Wave (b) which created a temporary bounce. Wave (c) then drove prices lower into the Fibonacci extension zone, ultimately ending near the 1.618 projection around 6693. This area also aligns with the blue box support on the chart.

Price stabilized near the lows and began to turn higher. This reaction signals that wave ((ii)) has already finished. From that low, SPX is now starting a new bullish sequence in black wave ((iii)). Within this, the first advance represents wave (i) followed by a shallow pullback as wave (ii). As long as price stays above the 6519.34 invalidation level, the index should continue higher in wave (iii) targeting 100%-161.8% fib. extension area of wave (i) which would be a price range of 6854-6914. At this stage, we do not recommend selling. The risk-to-reward favors the upside. Any dips are expected to remain corrective and find support.

Overall, the Elliott Wave structure supports further upside. SPX appears ready to resume its broader bullish trend.