Hello traders. Welcome to a new blog post where we discuss trade setups in the recent times. In this post, the spotlight will be on Solana – a cryptocurrency.

Solana is a high-speed blockchain launched in 2020, combining Proof of Stake and Proof of History to process thousands of low-cost transactions per second. It powers DeFi, NFTs, and Web3 applications, making it a leading crypto platform. We added Solana to the list of cryptocurrencies.

The Solana price chart dates back to April 2020. From that low, the cryptocurrency completed a 5-wave rally into November 2021. Then, according to Elliott Wave theory, a 3-wave correction should follow a 5-wave trend. Exactly! Solana soon began a 3-wave pullback.

By December 2022, the pullback was complete. Afterward, the market started another bullish cycle — this time in a clear 5-wave sequence. Interestingly, the cycle from December 2022 broke above the October 2021 peak, where the all-time bullish cycle first began. Shortly after breaching the November 2021 high, Solana began another corrective pullback. However, this pullback ended in April 2025, which marked the start of a fresh bullish cycle.

Meanwhile, our H1 charts — updated for members four times daily — have guided traders through this evolving path.

Since April 2025, SOLUSD has continued to form higher highs and higher lows. In Elliott Wave terms, this means a series of 5-3 sequences interloped together to build a bullish cycle. From the April low, a 5-wave rally ended in May 2025. Then, a 3-wave pullback followed, finishing in June 2025. Similarly, another 5-wave rally started in June 2025 and peaked in July 2025. Afterward, a 3-wave pullback unfolded and finally ended on August 20, 2025.

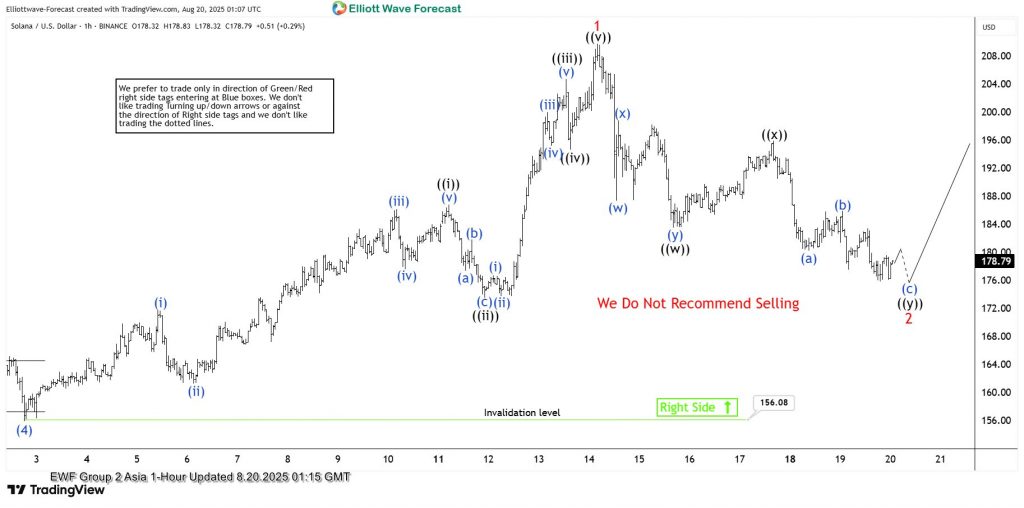

Solana – 8.20.2025 H1 Update

On 20th August, 2025 we shared the H1 chart below with members. The H1 chart shows a 5-wave bullish sequence following the corrective pullback than ended in June 2025.

The H1 chart above shows a textbook 5-3 structure. We anticipated the extreme of wave 2 and called for a new bullish cycle soon. That was exactly what happened as the 22nd August H1 chart we shared with members shows below.

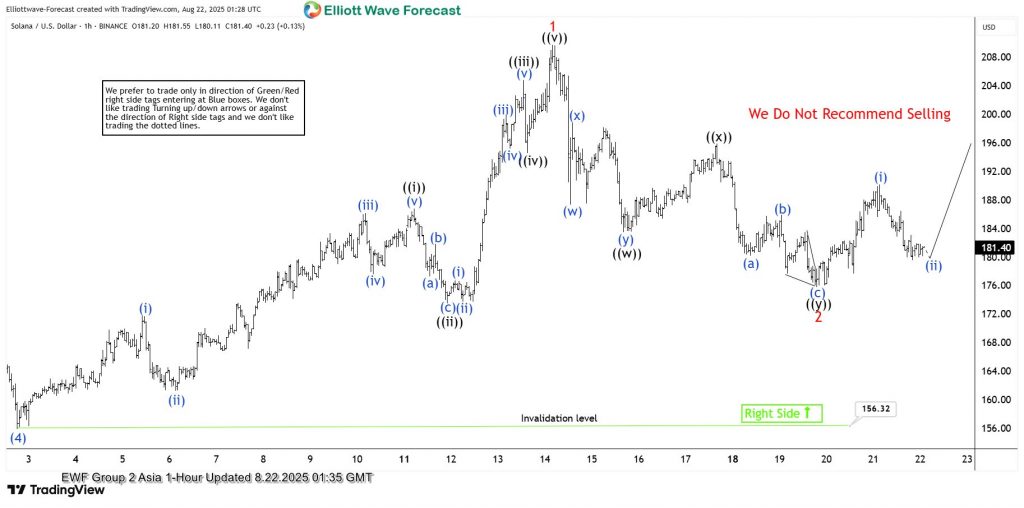

Solana – 8.22.2025 H1 Update

Wave 2 7-swing pullback ended as expected as the price bounced to show the start of a new bullish cycle. In the subsequence updates, we continued to call higher for this crypto pair. Traders understood they should not sell as the most likely path is to the upside. Members booked some profit at the 50% of ((y)) of 2 and anticipated more gains.

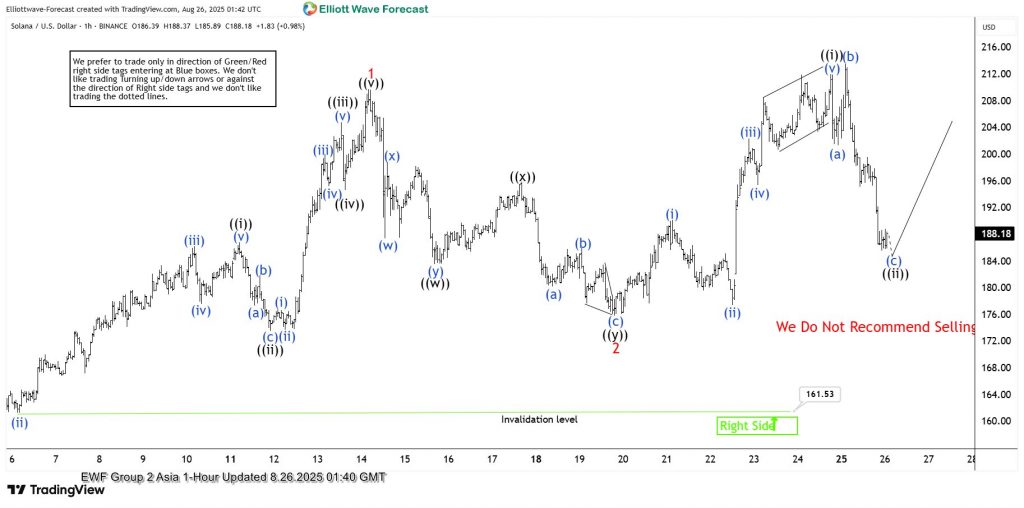

Solana – 8.26.2025 H1 Update

The H1 chart above shows Solana few days after having completed wave ((i)) of 3 and now at the extreme of ((ii)) of 3. However, before the wave ((ii)) dip, members already took profits. Anyways, a flat structure ended for wave ((ii)) and we still called higher.

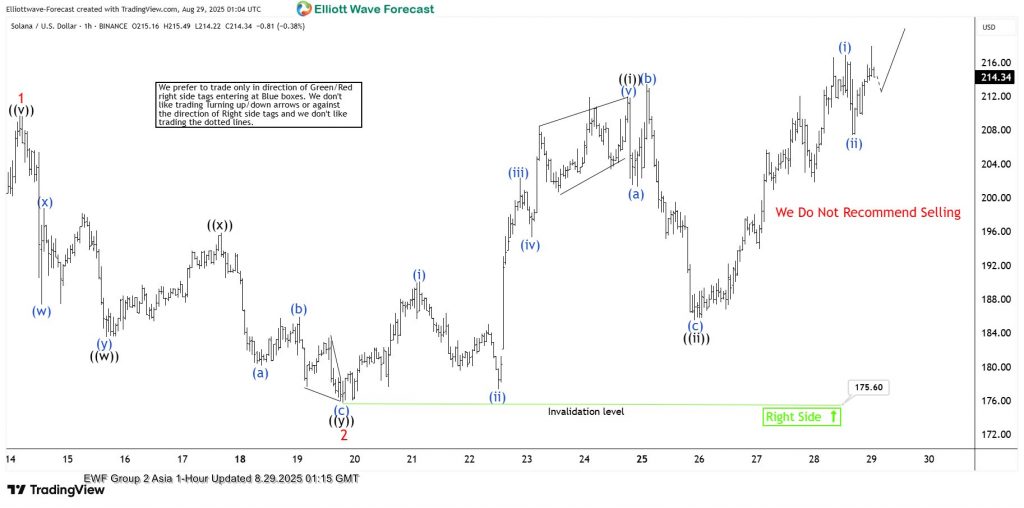

Solana – 8.29.2025 H1 Update

On 29th August, we shared the chart above with members showing wave ((iii)) of 3 playing out just as we expected it. What did you notice? Wave ((iii)) is another clear 5-wave structure emerging. Eventually, a 3-wave pullback will follow to correct it and fresh rallies will follow. This was not the end. We continued to monitor these 5s and 3s and continues to call higher for members. You can trade this easily with any entry methods by just follow our recommended path.

Solana – What next?

From the low of September 2025, we calling another 5-wave higher as we revealed in the latest H1 chart to members. When the 5-wave finishes, a 3-wave pullback will follow and then higher prices will follow. Same roadmap that will work and ensures members never get lost of the market track. Stay in tune like thousands of our members. Grab a 14-day trial for only $0.99

About Elliott Wave Forecast

At www.elliottwave-forecast.com, we update one-hour charts four times daily and four-hour charts once daily for all 78 instruments. We also conduct daily live sessions to guide clients on the right side of the market. Additionally, we have a chat room where moderators answer market-related questions. Experience our service with a 14-day trial for only $0.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.