In this article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD published in members area of the website. As our members know BTCUSD is showing impulsive bullish sequences in the cycle from the 52598 low , that are calling for a further strength. Recently we got a pull back that has ended at the Blue Box zone,our buying area. In the further text we are going to explain the Elliott Wave Forecast and trading setup.

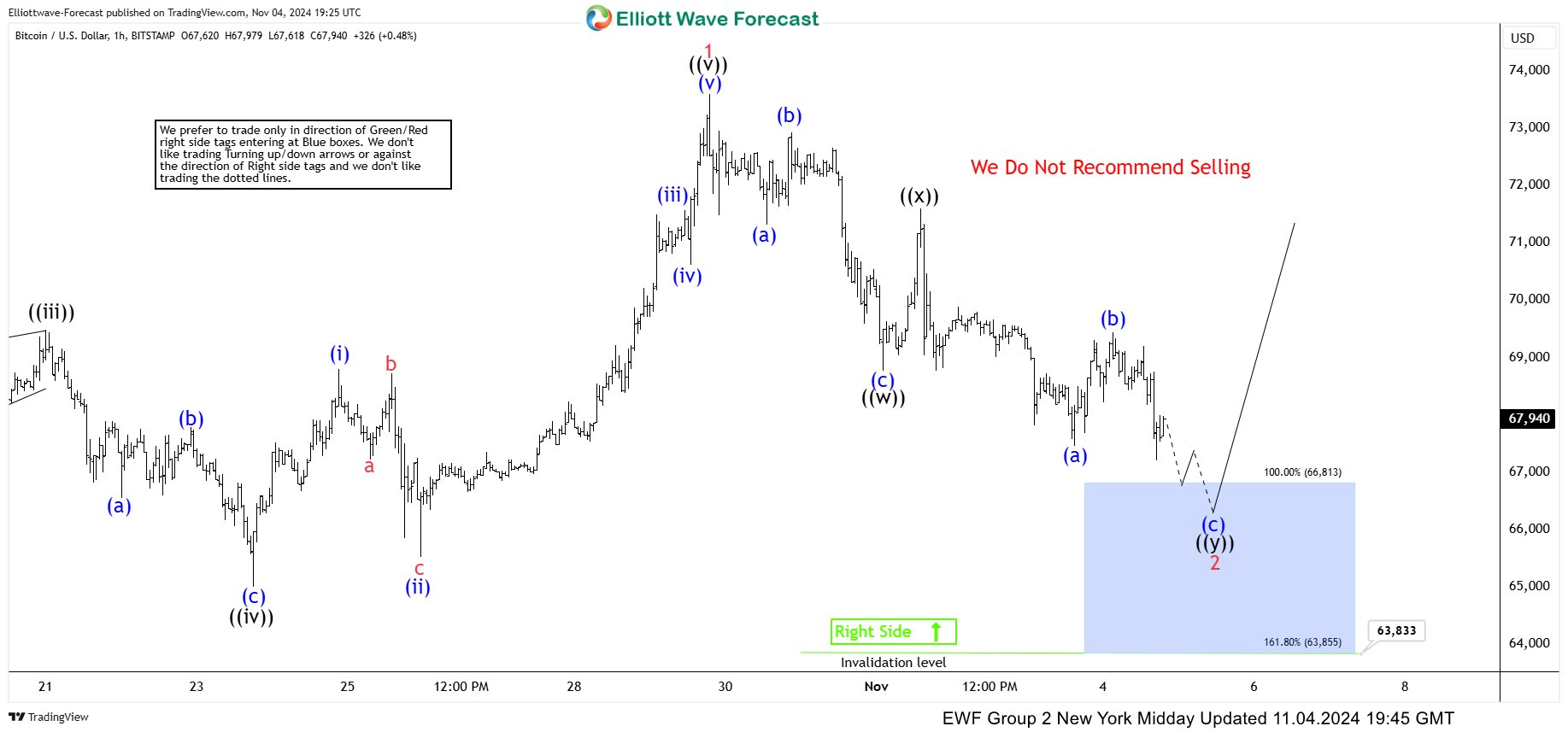

BTCUSD Elliott Wave 1 Hour Chart 11.04.2024

BTCUSD is giving us correction that is unfolding as a Elliott Wave Double Three pattern. At the moment structure is still incomplete. Pull back shows lower low sequences. Bitcoin can see more downside toward 66813-63855 blue box ( buying zone). We don’t recommend selling Bitcoin and prefer the long side. From the marked zone, BTCUSD should ideally make either rally toward new highs or in 3 waves bounce alternatively. Once bounce reaches 50 Fibs against the ((x)) black high , we will make long position risk free ( put SL at BE) and take partial profits.

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

Quick reminder on how to trade our charts :

Red bearish stamp+ blue box = Selling Setup

Green bullish stamp+ blue box = Buying Setup

Charts with Black stamps are not tradable. 🚫

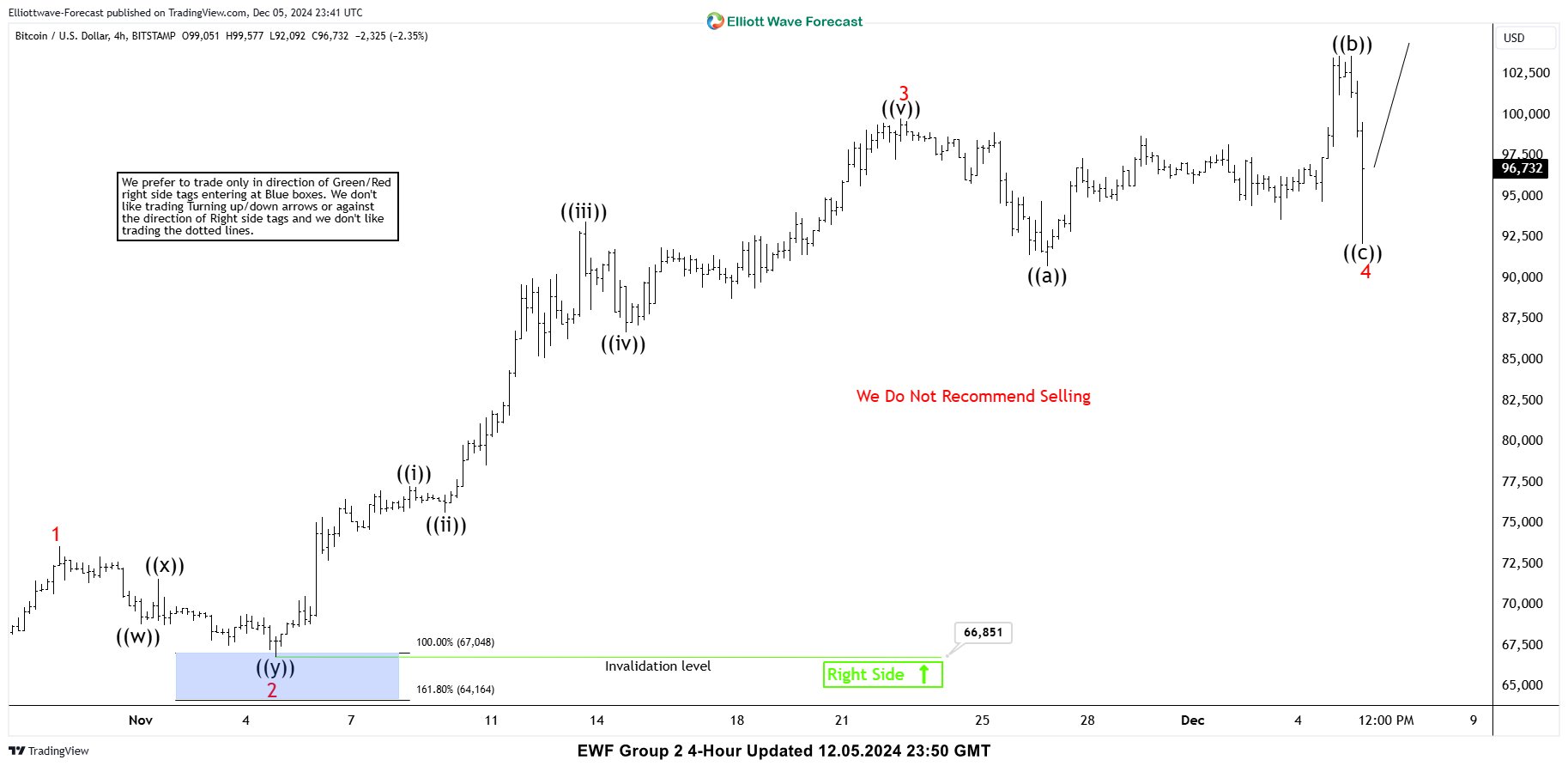

Bitcoin ( BTCUSD ) Elliott Wave 1 Hour Chart 11.06.2024

BTCUSD made an extension toward our buying zone: 66,813–63,855. The crypto found buyers at the Blue Box as expected, and we got a good reaction from there. Bitcoin made an impulsive rally that broke to new highs. As a result, traders who entered long positions are now enjoying risk-free profits. With the price holding above the 66,797 low, we expect further strength to follow.

Dear traders, before you sign up, reach out to our sales department at vlada@elliottwave-forecast.com. We’ll make sure you’re getting the best deal possible with exclusive discounts and offers. Don’t hesitate—send us an email and let’s get you some savings