Within the list Elliott Wave corrective patterns, alongside Zigzags, Flats and Complex Corrections we have triangles. Triangles are a sideways correction that occurs only prior to the final wave in the current trend. Therefore, can only present themselves in wave 4, B or X. The only exception they present themselves in wave 2 is if they are as a sub wave of another pattern such as Wave B of a Zig Zag. A triangle consists of 5 waves which are labelled as ABCDE and they contract as the pattern develops.

Running triangles

The difference with running triangles is that wave B forms a new price extreme above the origin of the triangle. This unfolds in a 3-wave sequence and can trick a handful of traders thinking we have formed a new impulse.

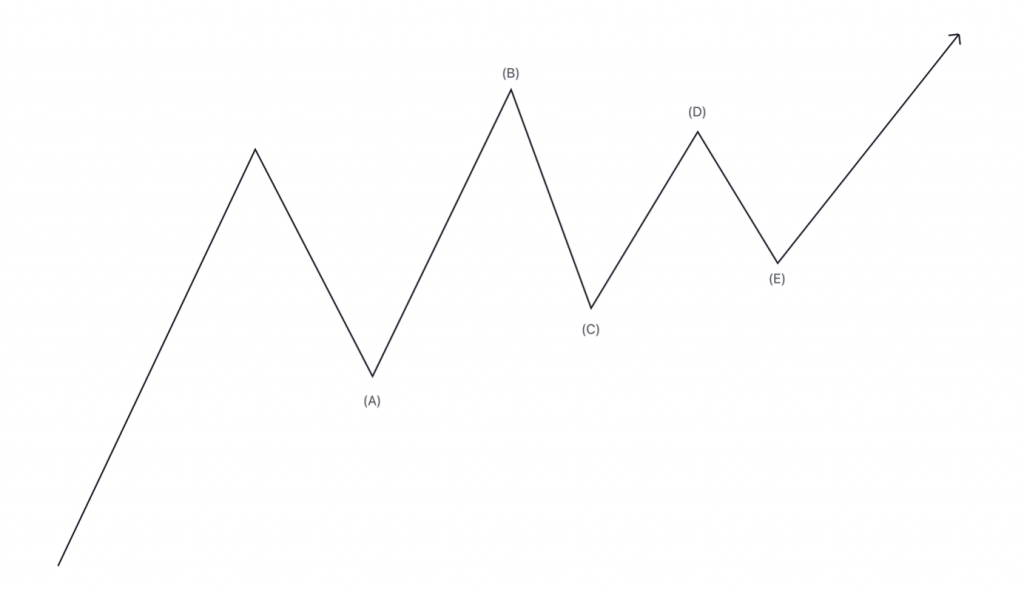

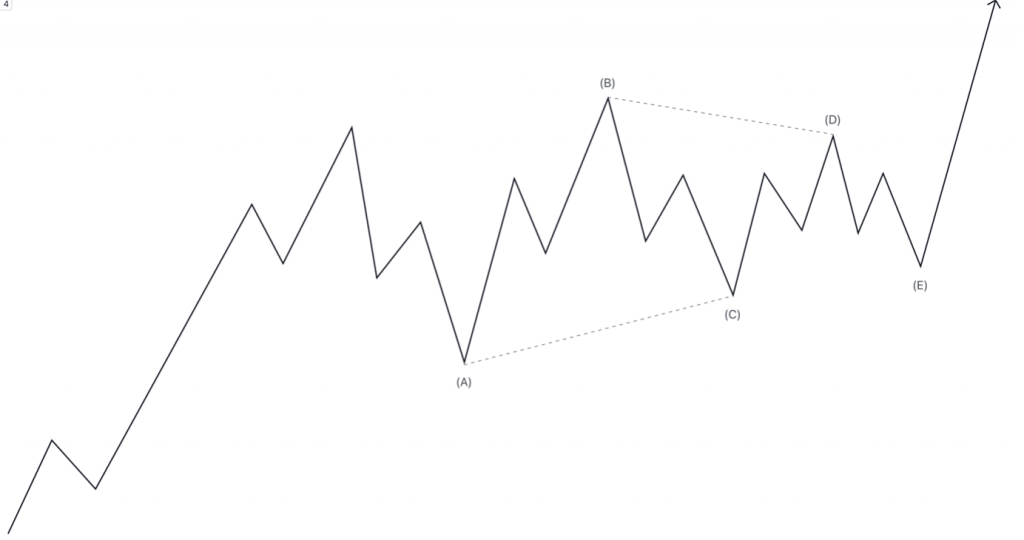

Here is an idealised diagram of a Running Triangle

As you can see here, we have a preceding trend that and then triangle with wave (B) that formed a new price extreme. But the part that tricks all traders is that we then see a continuation of some sideways action prior to unfolding to the upside.

How to spot these early?

Although priced formed a new extreme however only unfolded in a 3-wave sequence. An Impulse wave can only unfold in a 5-wave sequence. Therefore, if you see a 3 wave up whilst price formed a new extreme – there is a good chance we are still within the corrective cycle. Especially if you are in wave 4.

Except the fact that wave B can exceed the origin of wave A – the other rules still apply. Wave c cannot exceed wave A, wave D cannot exceed wave D and finally wave E cannot exceed beyond wave C. If any of these rules are broken then this is no longer a triangle.

There are many other tools and indicators we use to identify whether a triangle is valid or not which is offered in our premium educational collection to expand further on this!

Here are EWF – we primarily use Elliott Wave to label our charts to provide context of the individual waves. However, we use indicators such as the RSI and the Stochastic indicator to measure momentum. Next week I will be covering the Stochastic indicators.