In this technical article, we are going to present another Elliott Wave trading setup we got in NASDAQ Futures (NQ_F) . The futures has extended pull back, giving us another buying opportunity. NQ_F completed correction at the Blue Box Area. In the next parts, we’ll explain the Elliott Wave pattern we saw and discuss the trading plan in detail.

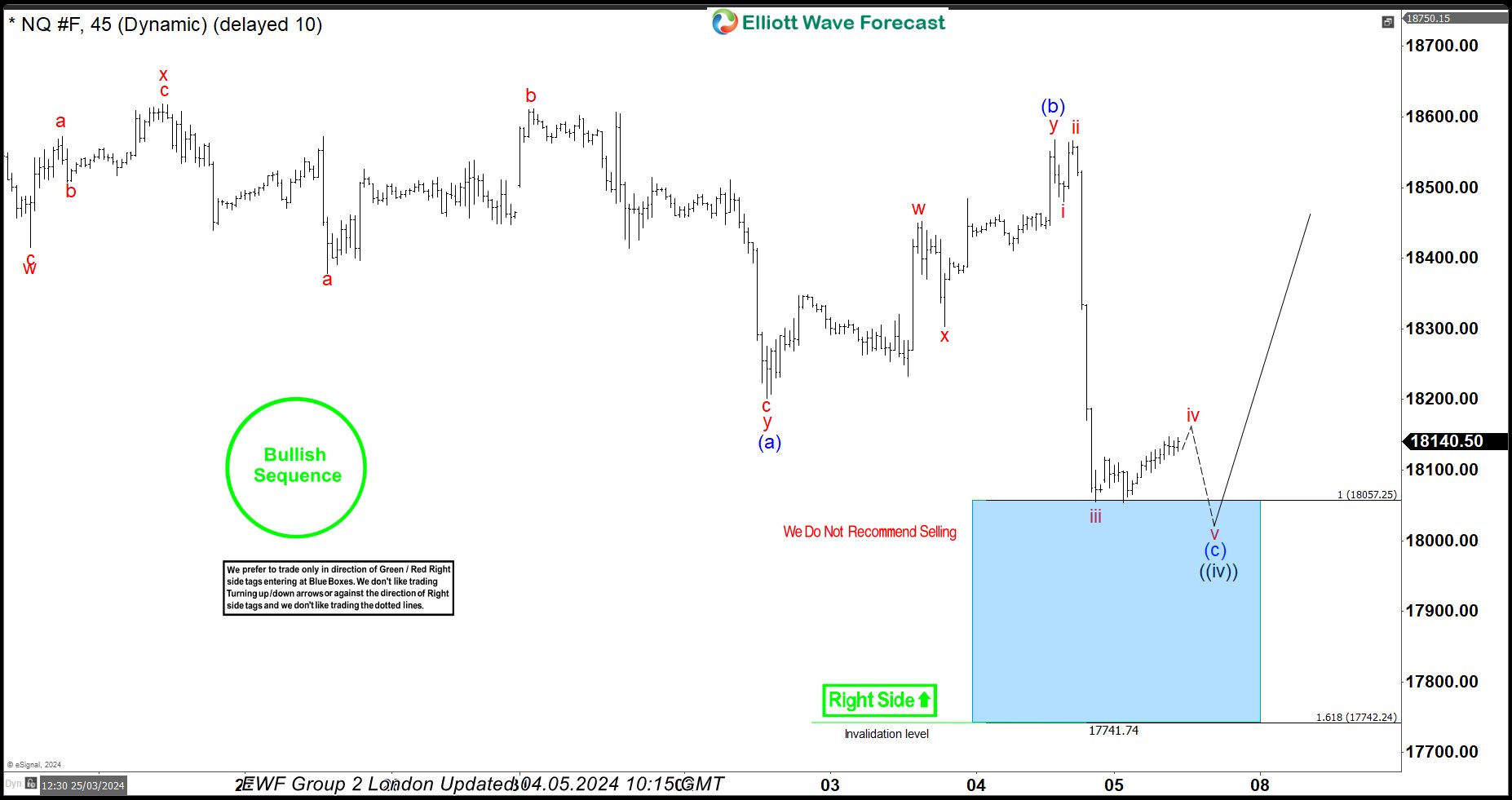

NQ_F Elliott Wave 1 Hour London Chart 04.05.2024

Current analysis indicates that NQ_F is nearing completion of wave ((iv)) pullback. The pullback has extended, and the price has reached a new extreme zone at 18057.25-17742.24. Another short-term low would be ideal to complete 5 waves down within the (c) blue leg. Nevertheless, we’re already long from the Equal Legs level at 18057.25. With the main trend remaining bullish, we anticipate at least a 3-wave bounce from this area. Once the price retraces to the 50% Fibonacci level against the (b) blue connector, we’ll secure positions, set the stop loss at breakeven, and capture partial profits. A drop below the 1.618 Fibonacci extension level at 17742.24 would invalidate the trade.

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

Quick reminder on how to trade our charts :

Red bearish stamp+ blue box = Selling Setup

Green bullish stamp+ blue box = Buying Setup

Charts with Black stamps are not tradable. 🚫

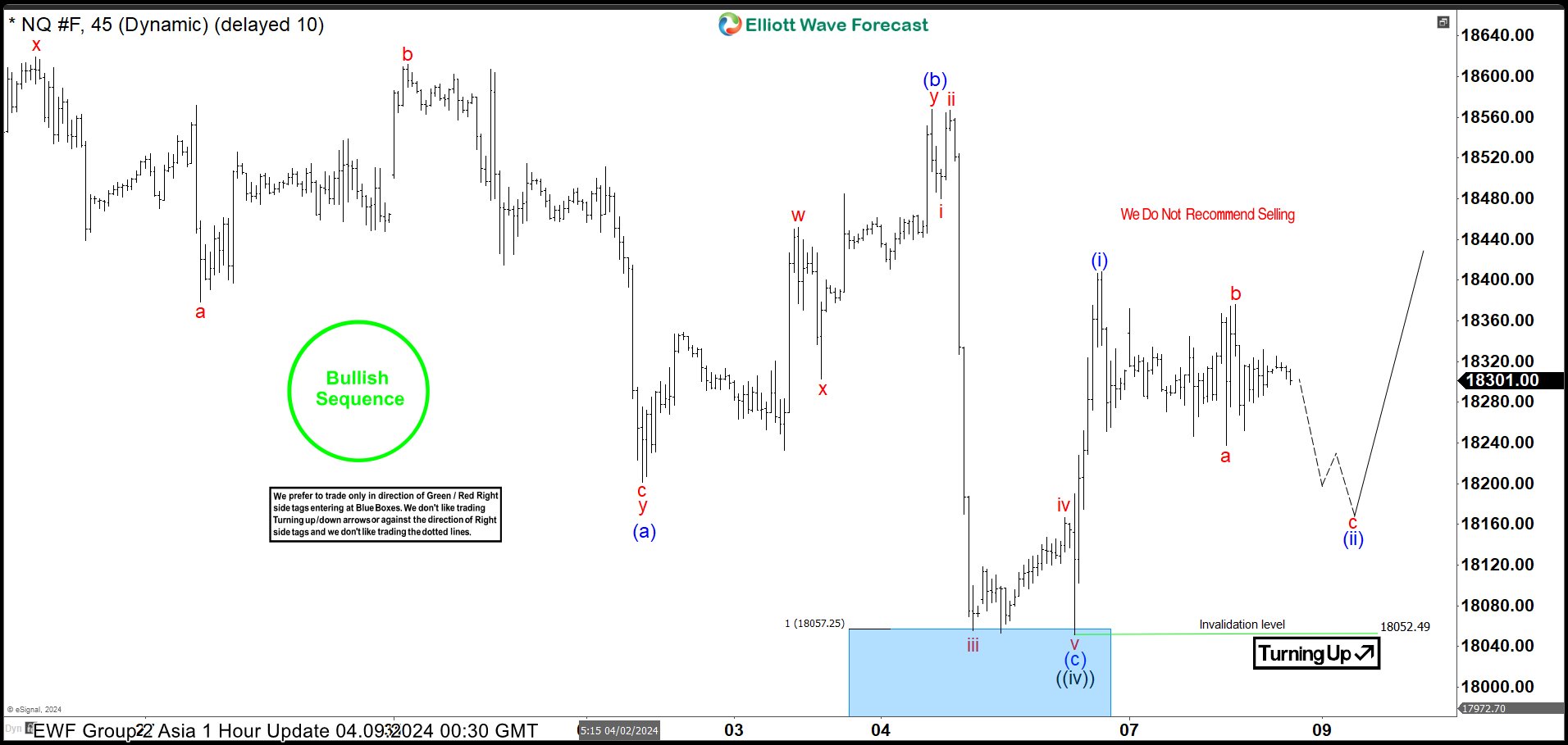

NQ_F Elliott Wave 1 Hour London Chart 04.09.2024

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts with target levels in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room

New to Elliott Wave ? Check out our Free Elliott Wave Educational Web Page and download our Free Elliott Wave Book.