Chesapeake Energy Corporation (ticker: CHK) is a company operating in hydrocarbon exploration. The company produced natural gas, petroleum, and natural gas liquids. Continued pressure on Oil and gas prices have affected the company greatly. The stock price continues to languish under selling pressure. The company’s fortune ties directly with the energy price and unless energy price can substantially recover, the stock will continue to be under pressure.

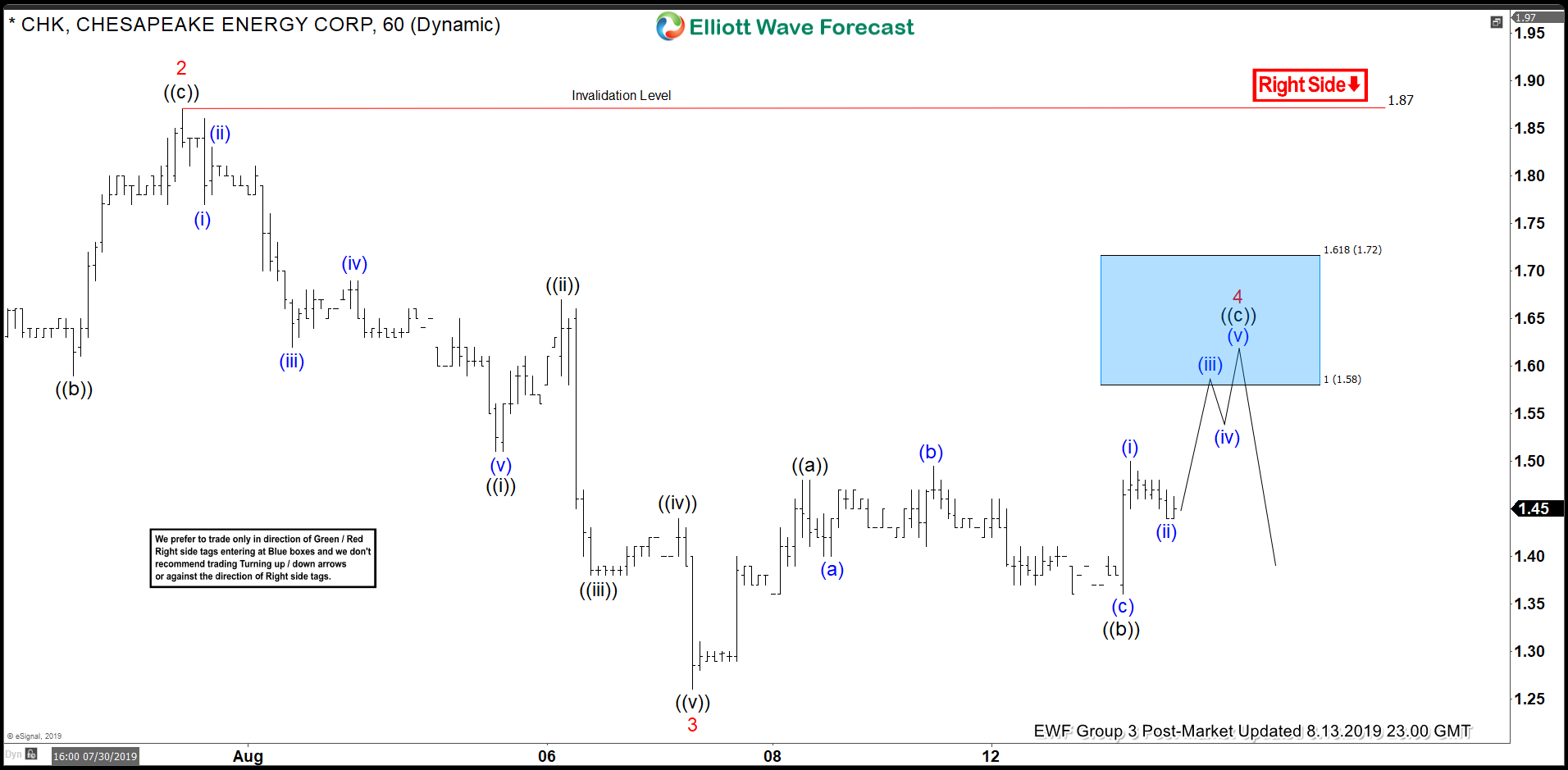

Technical wise, short term Elliott Wave view of Cheasepeake Energy (CHK) suggests that bounce to 1.87 ended wave 2. The stock has resumed lower and ended wave 3 at 1.26. The internal of wave 3 subdivides as an impulse Elliott Wave structure. Down from 1.87, wave ((i)) ended at 1.51, wave ((ii)) ended at 1.67, wave ((iii)) ended at 1.38, wave ((iv)) ended at 1.44, and wave ((v)) ended at 1.26. Wave 4 bounce is now in progress as a zigzag Elliott Wave structure. Up from 1.26, wave ((a)) ended at 1.48, wave ((b)) ended at 1.36, and wave ((c)) is expected to end at 1.58 – 1.72. The stock should then resume lower in wave 5 as far as pivot at 1.87 high stays intact.