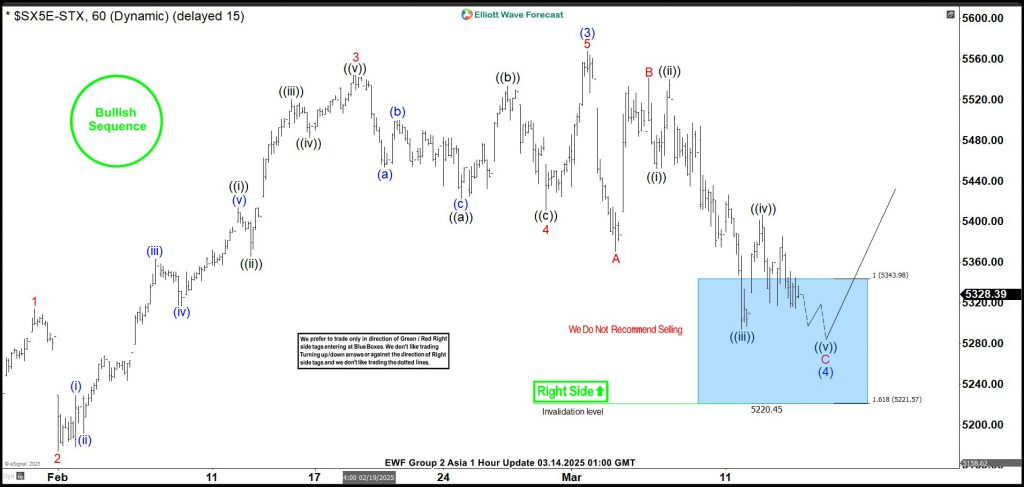

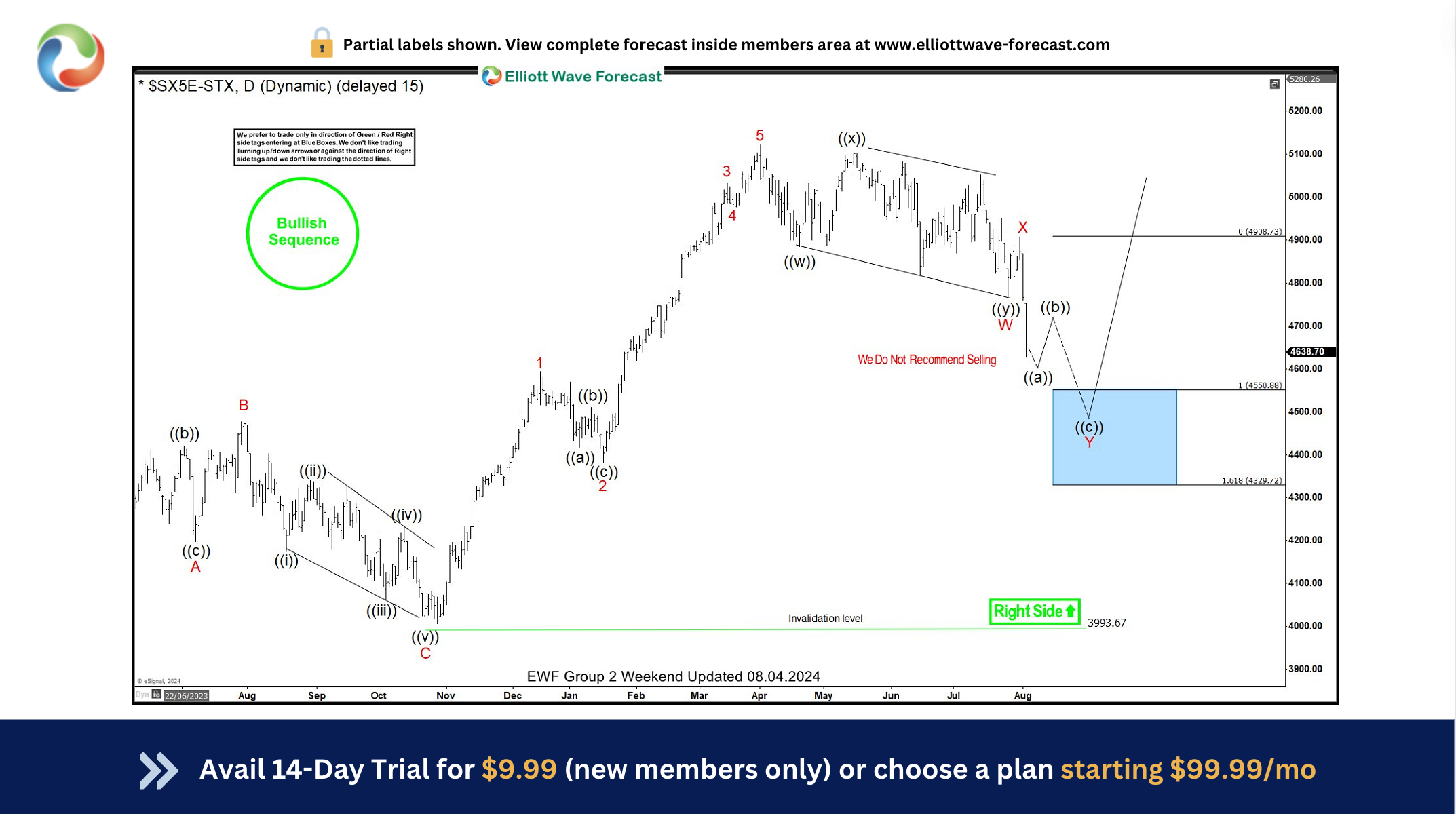

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of EUROSTOXX (SX5E). We presented to members at the elliottwave-forecast. In which, the rally from 07 April 2025 unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. Therefore, we advised members not to sell the index & buy the pullback in 3, 7, or 11 swings. Based on Elliott wave hedging area looking to get 3 wave reaction higher at least. We will explain the structure & forecast below:

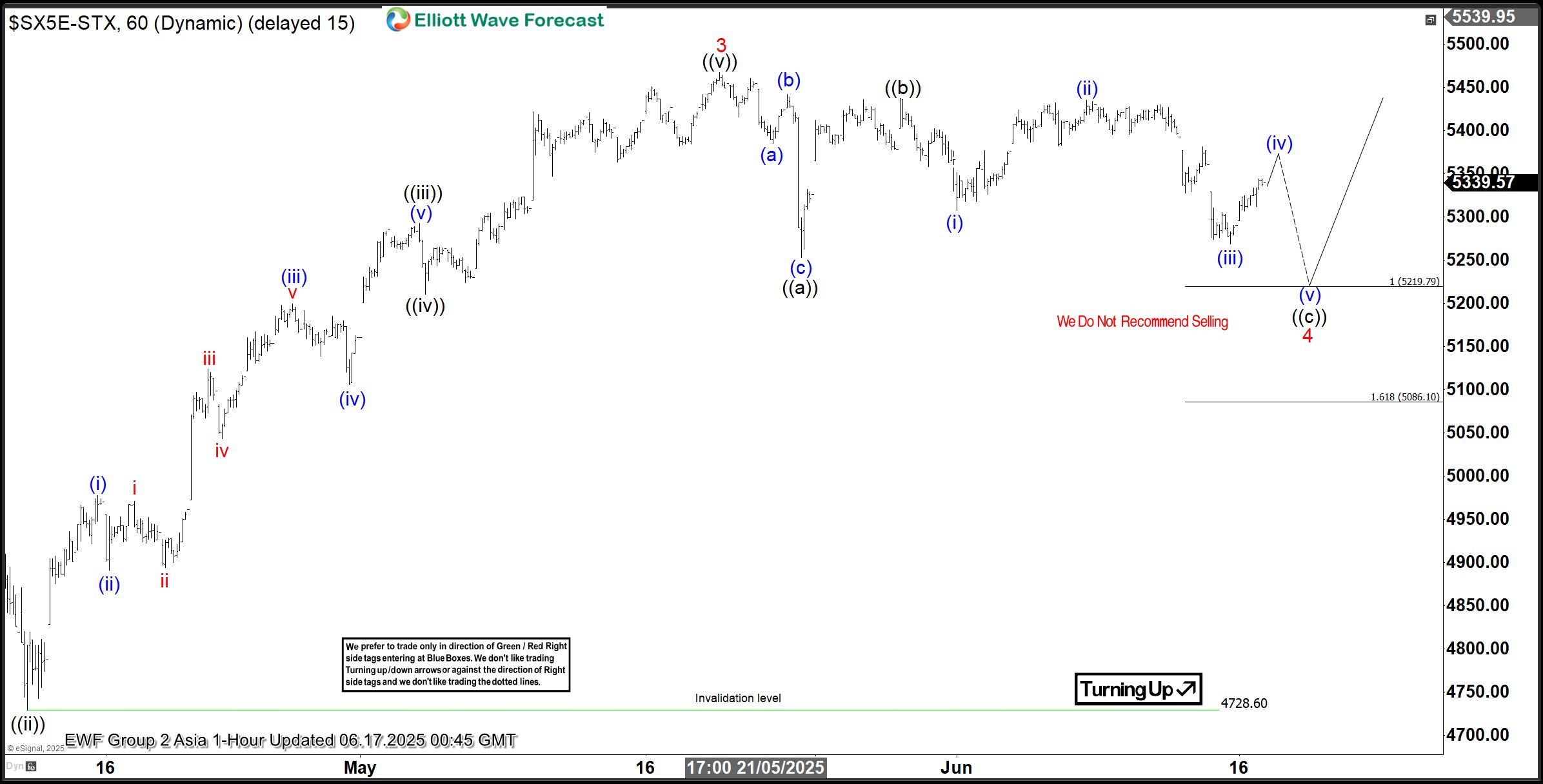

EUROSTOXX (SX5E) 1-Hour Elliott Wave Chart From 6.17.2025

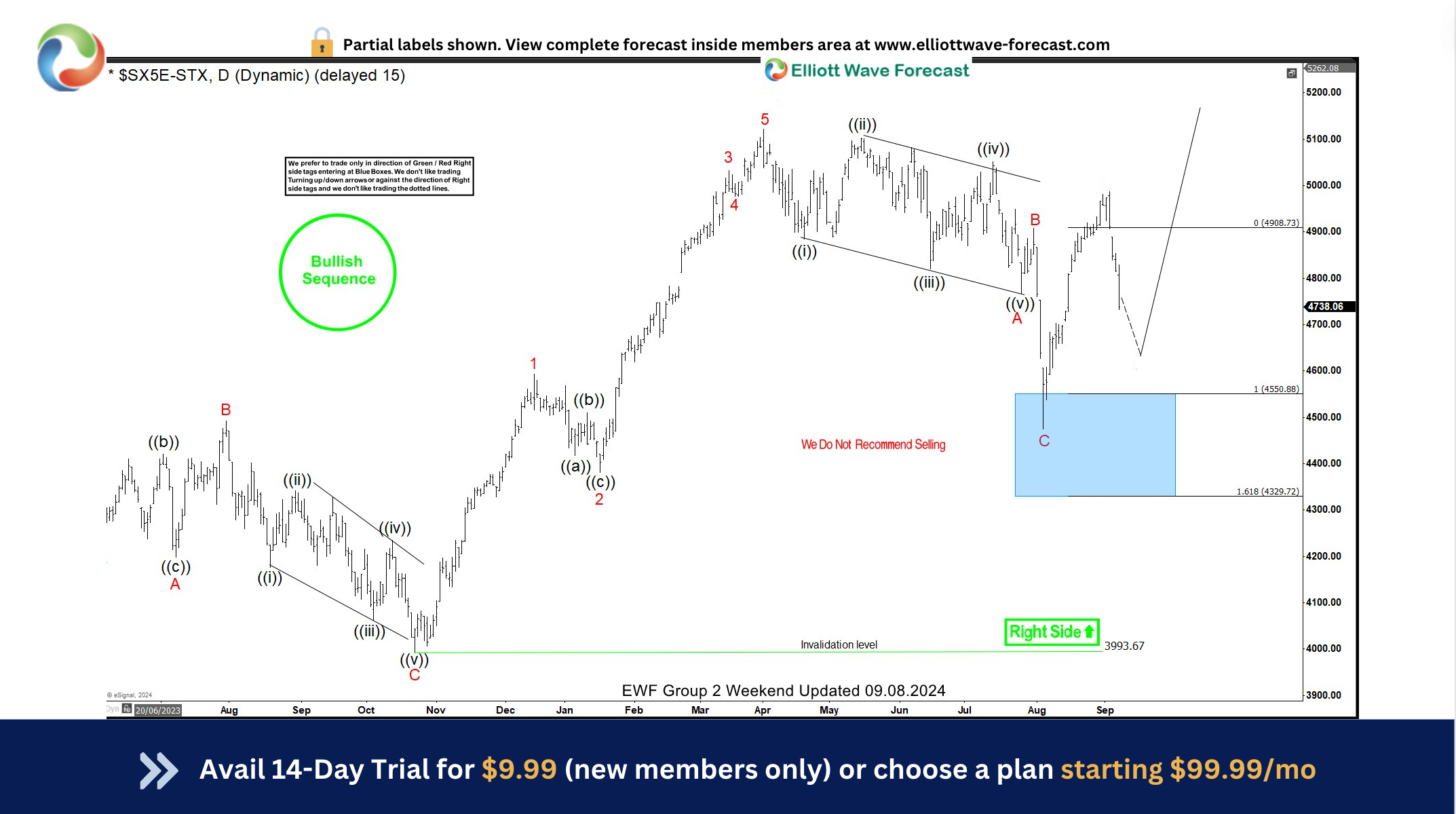

Here’s the 1-hour Elliott wave chart from the 6.17.2025 Asia update. In which, the cycle from the 09 April low ended in wave 3 as an impulse structure at 5467.28 high. Down from there, the index made a pullback in wave 4 to correct that cycle. The internals of that pullback unfolded as Elliott wave flat structure where wave ((a)) ended at 5252.94 low. Then wave ((b)) bounce ended at 5435.42 high and wave ((c)) was expected to reach the Elliott wave hedging area at 5219.79- 5086.10 equal legs area. From there, buyers were expected to appear looking for next extension higher or do a 3 wave reaction higher at least.

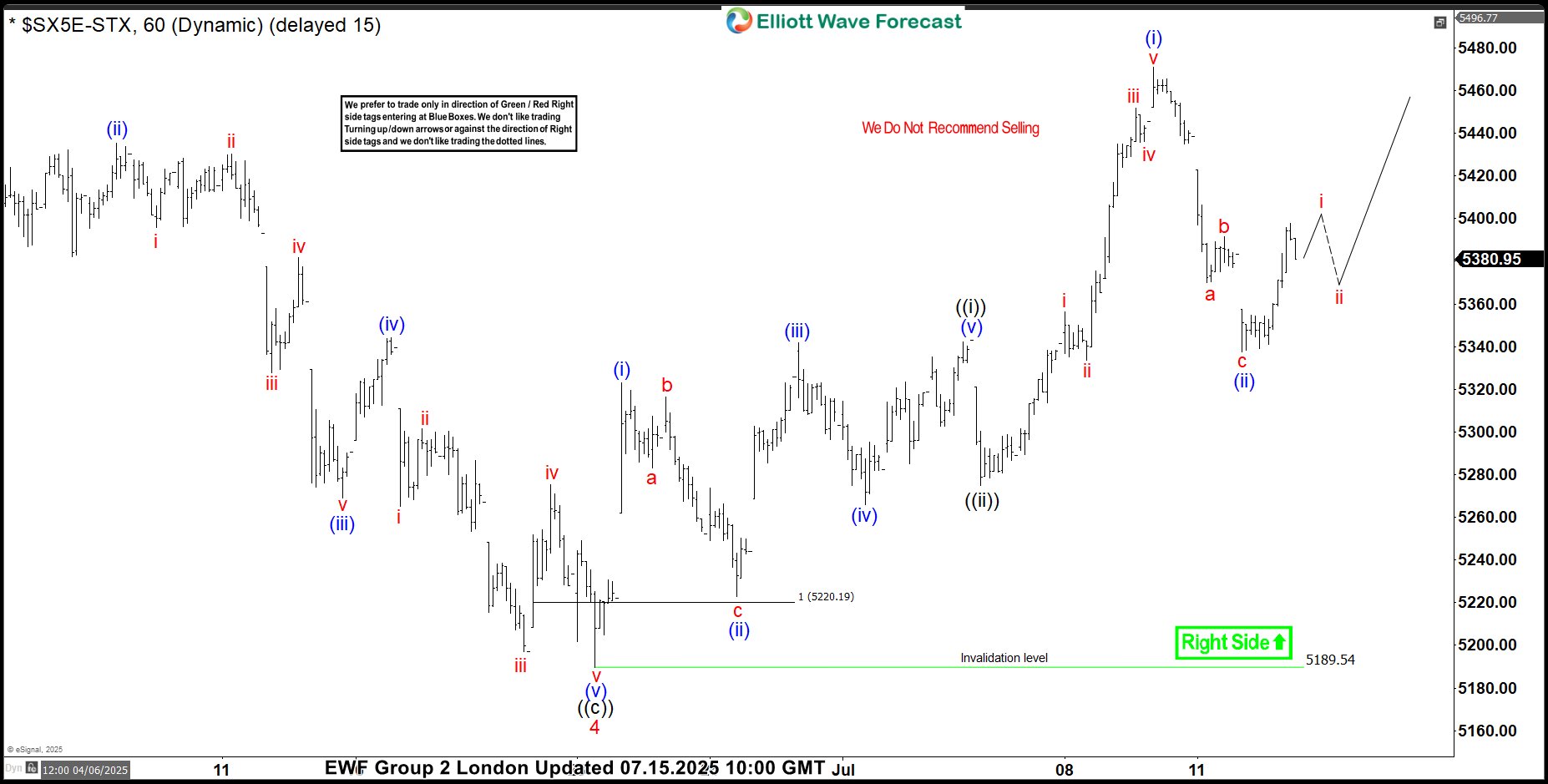

EUROSTOXX (SX5E) Latest 1-Hour Elliott Wave Chart From 7.15.2025

This is the latest 1-hour Elliott wave Chart from 7.15.2025 London update. In which the EUROSTOXX (SX5E) is showing a strong reaction higher taking place, right after ending the flat correction within the equal legs area. Allowed members to create a risk-free position shortly after taking the long position. Since than index has already made a new high confirming the next extension higher.

If you are looking for real-time analysis in EUROSTOXX (SX5E) along with the other indices then join us with a 14-Day Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial.