CrowdStrike (CRWD) leads AI-powered cybersecurity with strong financial results and growing market presence. By mid-2025, its market value passed $104 billion. This shows investor trust, even with ongoing net losses. The Falcon platform boosts ARR through advanced endpoint protection and threat detection. As a result, recent quarters showed steady double-digit ARR growth, raising long-term revenue hopes. Its forward P/E is over 119, showing confidence in future earnings and profitability. CrowdStrike builds partnerships in finance, healthcare, and government to grow its enterprise reach. It also works with major cloud platforms, helping improve scalability and customer adoption.

Analysts stay positive about CrowdStrike, pointing to strong growth and innovation in cybersecurity. Out of 44 analysts, 25 say “Buy” and 19 say “Hold,” showing wide support for the stock. Some bullish forecasts reach $766 by 2030, driven by ARR growth and AI-powered products. Recent upgrades and “Buy” ratings show strong momentum, despite some concerns about valuation. CrowdStrike’s AI-native tools keep gaining traction across industries, boosting long-term investor interest.

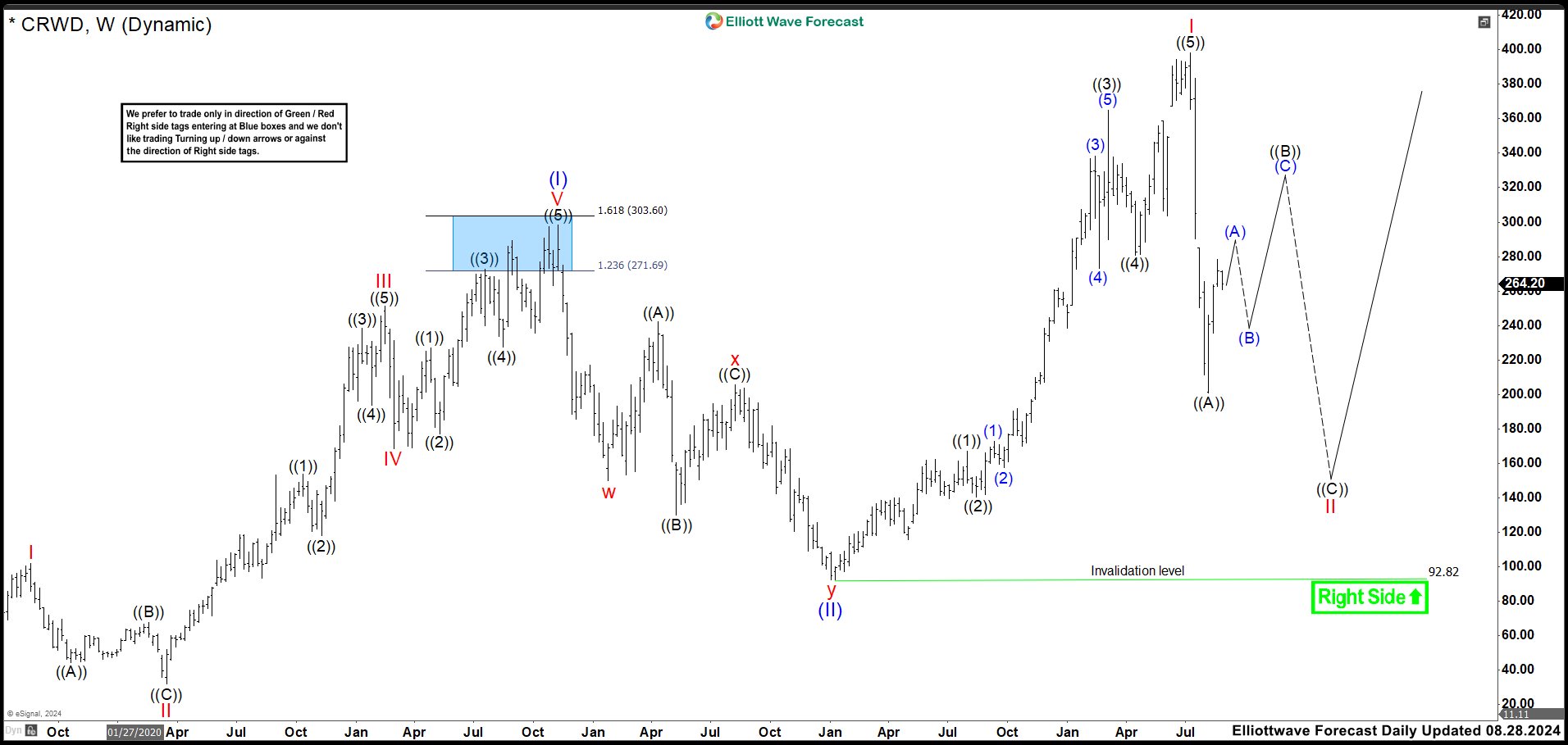

Elliott Wave Outlook: CrowdStrike CRWD April 2025 Weekly Chart

In the last update, we revised the structure and introduced a leading diagonal. The original nest concept was adjusted with wave I now labeled as wave (III) and the correction as wave (IV). From here, an impulse wave must develop to complete wave (V). Conservatively, we proposed an ending diagonal for wave (V), requiring wave IV to enter wave I’s area. This adjustment ensured wave (V) aligns with the ideal fractal, maintaining its position as the smallest within the diagonal.

Looking ahead, we expected the bullish trend to continue, forming two additional highs to finalize the structure. Then, the grand super cycle’s ideal completion zone lay between the 493.75–507.59 area, where the market could react downward, marking the end of the cycle and wave ((I)). If so, a significant correction might have followed, potentially pushing CRWD’s price below 250.

If you’re eager to dive deeper into Elliott Wave Theory and learn how its principles apply to market forecasting, you might find these resources helpful: and .

Elliott Wave Outlook: CrowdStrike CRWD September 2025 Weekly Chart

In this new update, wave III ended near the 517 zone and wave IV began its correction. Since wave IV entered wave I’s area, we now expect an ending diagonal to complete wave (V) of ((I)). To confirm this, prices must rise toward the 545.84–589.96 zone, where a strong bearish reaction may occur. Then, we could consider the cycle complete and the correction underway. However, we cannot rule out more bullish extensions in the short term. If the market breaks above 590, a new bullish structure will likely emerge and continue the rally.

Transform Your Trading with Elliott Wave Forecast!

Ready to take control of your trading journey? At Elliott Wave Forecast, we provide the tools you need to stay ahead in the market:

✅ Blue Boxes: Stay ahead in the market with fresh 1-hour charts updated four times daily, daily 4-hour charts on 78 instruments, and precise Blue Box zones that highlight high-probability trade setups based on sequences and cycles.

✅ Live Sessions: Join our daily live discussions and stay on the right side of the market.

✅ Real-Time Guidance: Get your questions answered in our interactive chat room with expert moderators.

🔥 Special Offer: Start your journey with a 14-day trial for only $0.99. Gain access to exclusive forecasts and Blue Box trade setups. No risks, cancel anytime by reaching out to us at support@elliottwave-forecast.com.

💡 Don’t wait and get a DISCOUNT for any plan!

Click in the next link, go to Home Chat and ask for a flat discount code saying that you saw this in Luis’ Blog: 🌐