In this technical article we’re going to take a look at the Elliott Wave charts charts of Ethereum ETHUSD published in members area of the website. As our members know, we generally favor the long side in cryptos, which have recently offered good trading opportunities. However, ETHUSD can be still correcting the cycle from the August low and is not yet ready for buying at this stage. In the following text, we will explain the Elliott Wave forecast.

ETHUSD 1-Hour Elliott Wave Analysis: January 5, 2025

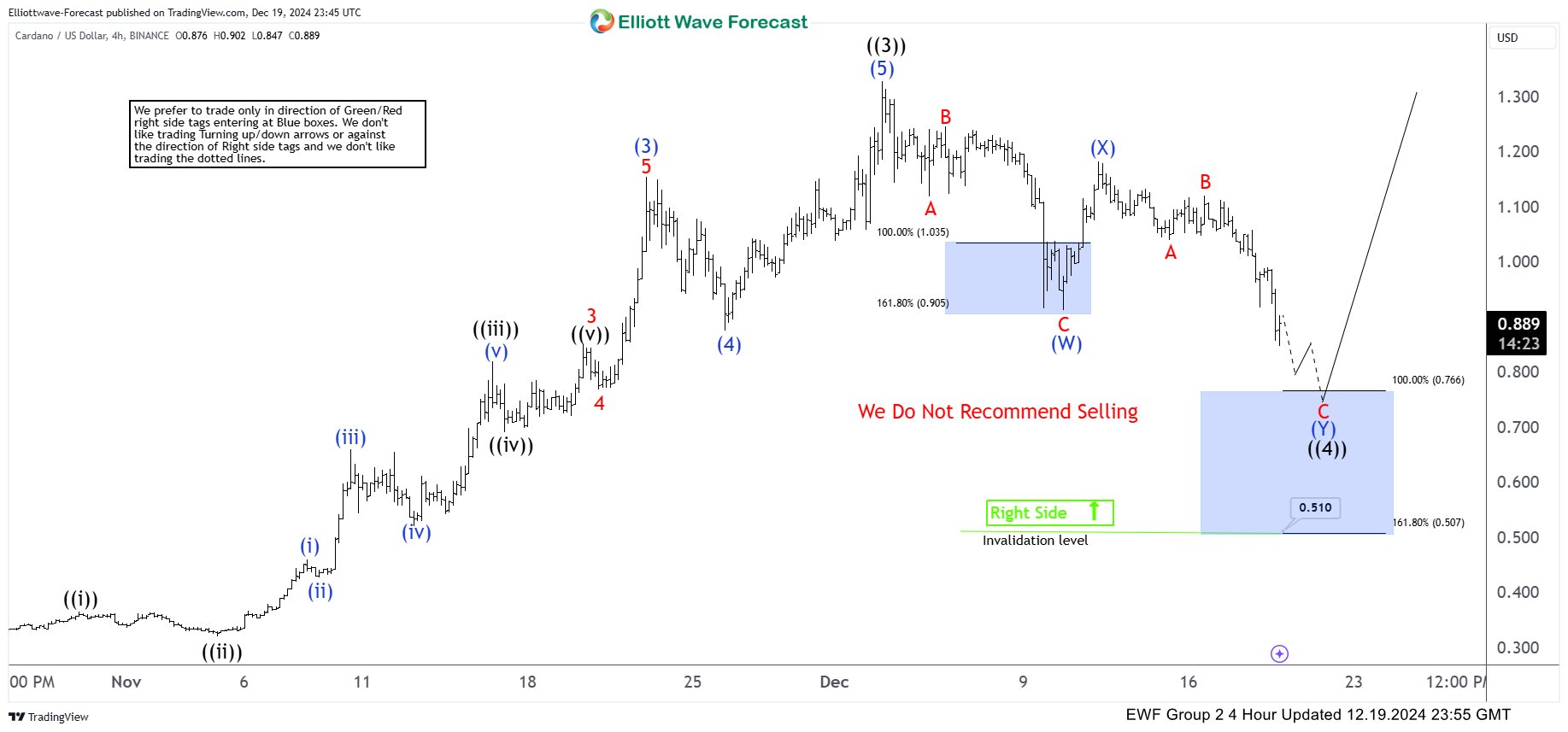

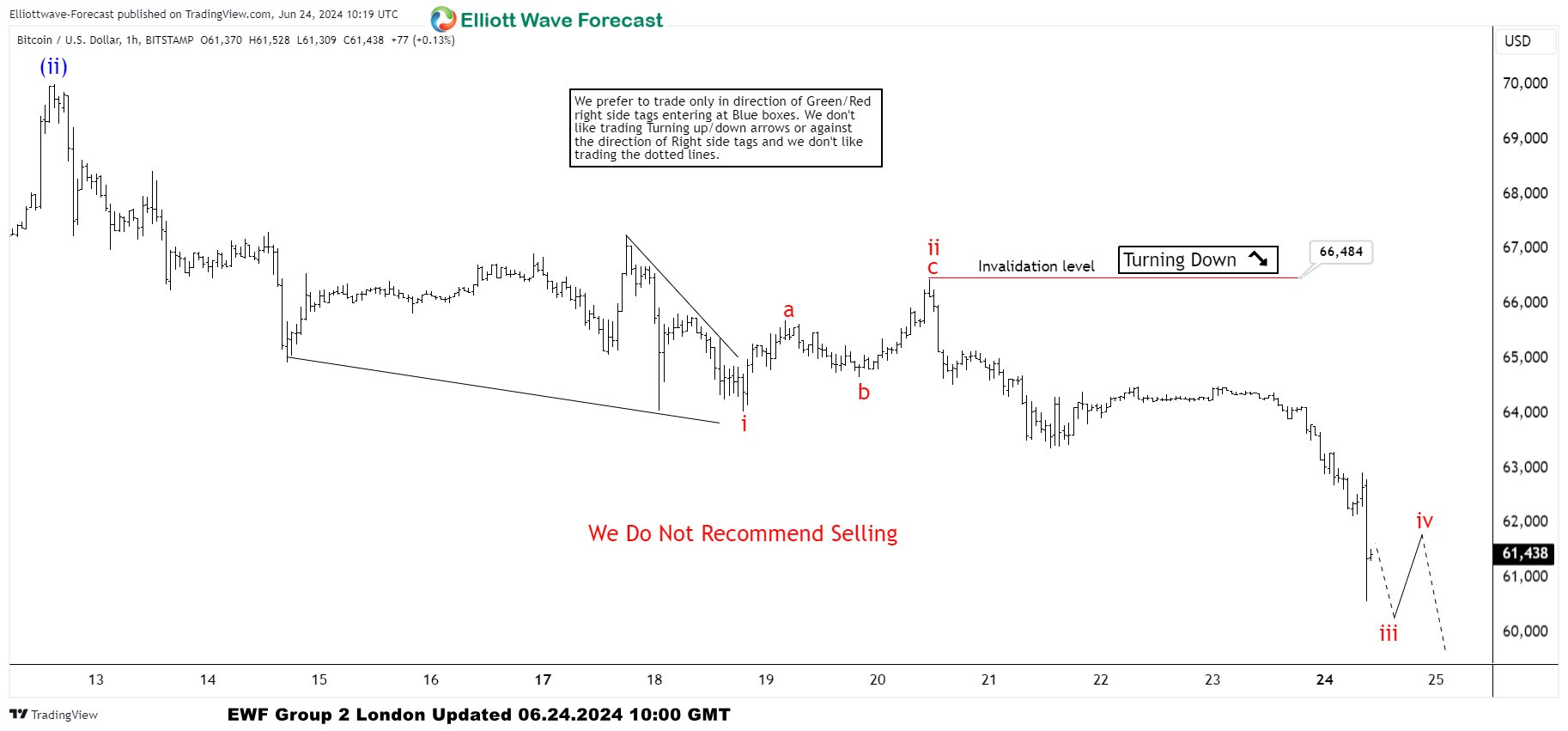

Currently, ETHUSD is correcting the cycle from the 4111.3 high. The Elliott Wave view suggests that the recovery is unfolding as Zig Zag Pattern. When we analyze the lower time frames, we can observe that the inner subdivisions of waves A and B (red) exhibit 5-wave patterns, with wave B ending as a sideways triangle. The (X) connector is approaching the 0.618 Fibonacci retracement level. We believe the (X) connector should ideally end around the 3717.7-3885.1 area. We recommend that our members avoid buying at this stage.

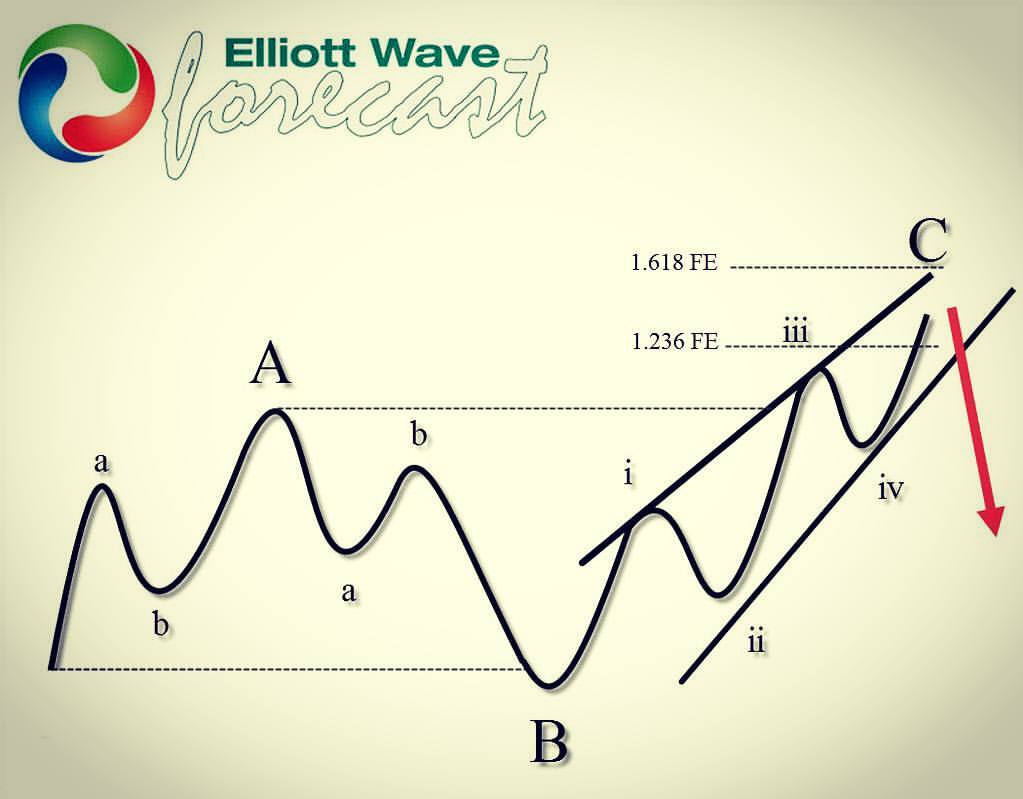

Learn More About Elliott Wave Patterns

You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page

ETHUSD 1-hour chart showing current correction pattern and key resistance zones

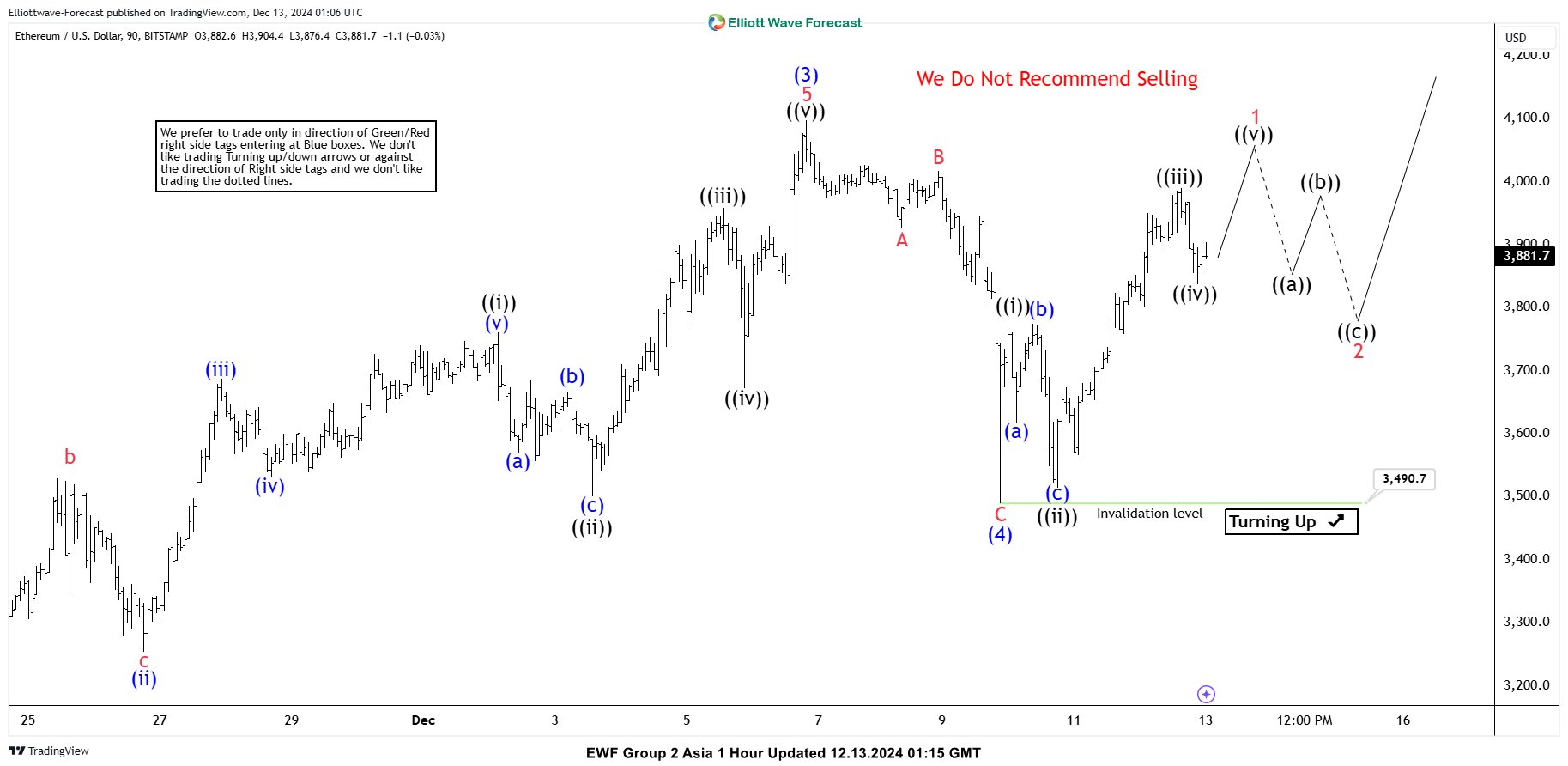

ETHUSD 1-Hour Elliott Wave Update: January 7, 2025

The current view suggests the (X) connector may have ended at the 3477 peak. As long as the price stays below that level, we expect to see further weakness.

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

ETHUSD 1-hour update showing potential resistance at 3477 level

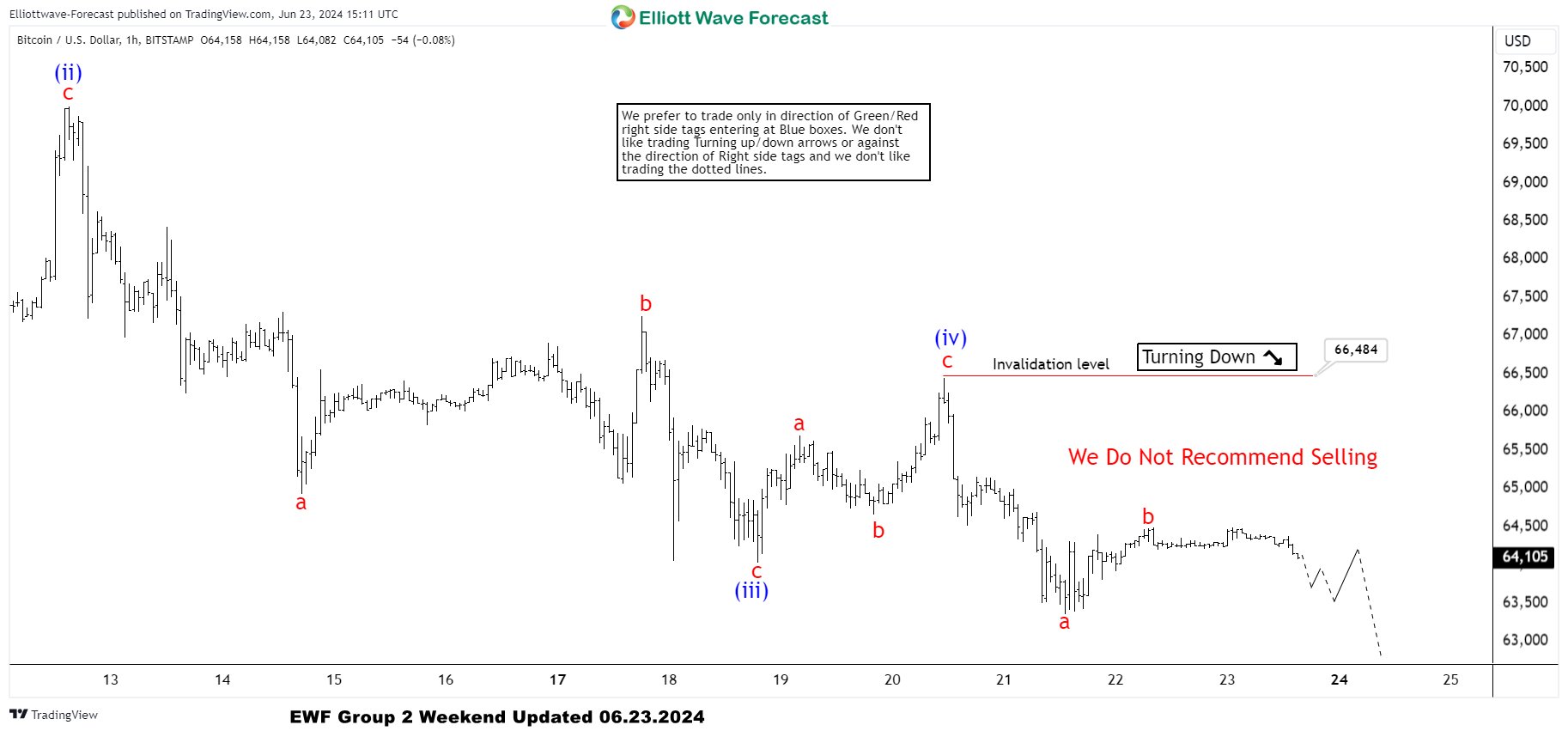

ETHUSD 1-Hour Elliott Wave Update: January 10, 2025

The 3744 peak held well, and we saw further separation from that high as expected. The crypto made a decent drop, forming a clear 5-wave pattern from the 3744 high. We expect to see a 3-wave bounce in red wave B before the further decline continues, ideally toward new lows. ETHUSD can target the 2713 area, as long as the pivot at the 3744 high holds. Overall, the view remains bullish. So .we don’t favor selling and would wait for an extreme zone to be reached before looking to buy again.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. For additional information on the best trading strategies for Bitcoin, visit our Live Trading Room and stay updated with the latest insights in our 24H Chat Room.

ETHUSD 1-hour chart showing completed 5-wave decline and projected targets