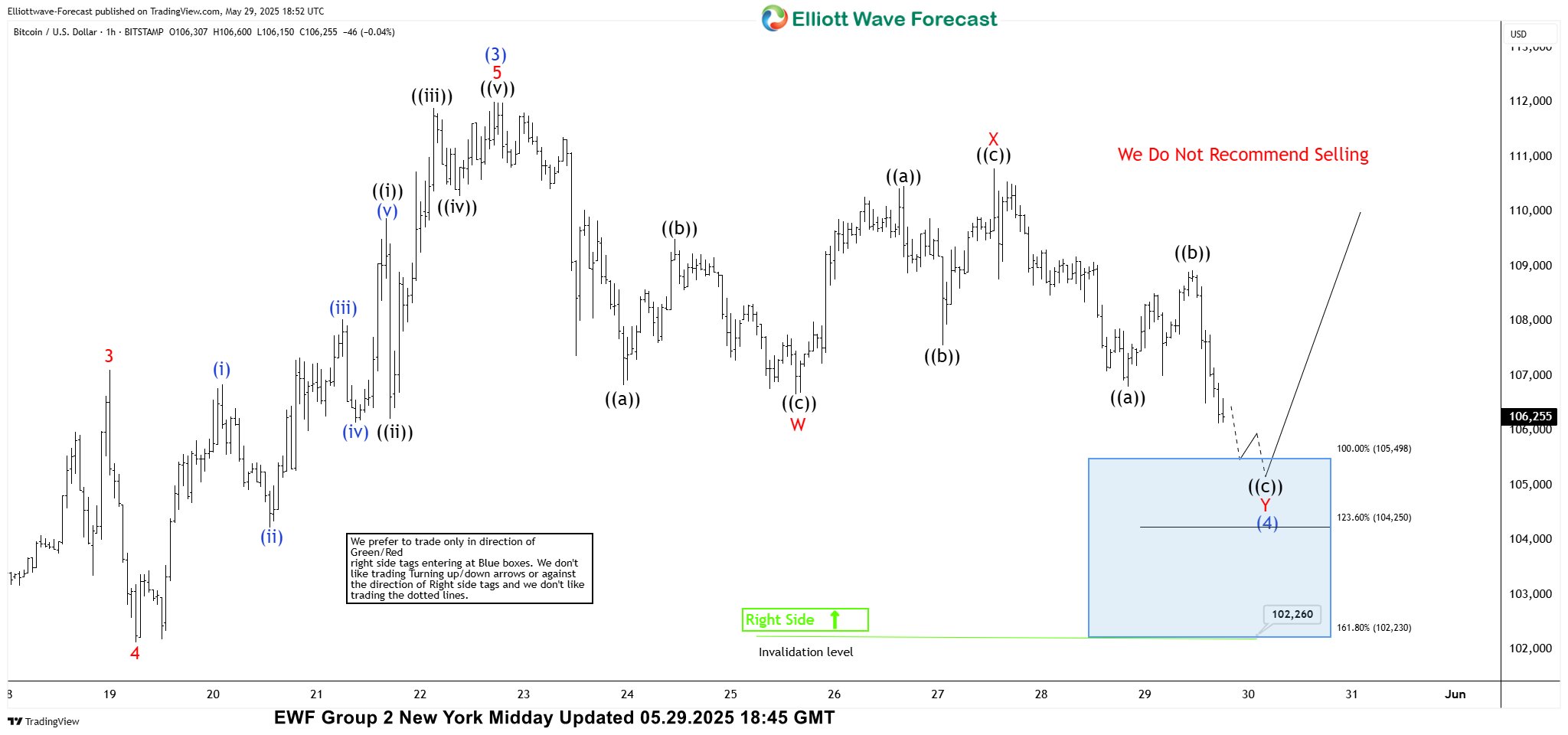

Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of BTCUSD published in members area of the website. As our members know Bitcoin has given us 3 waves pull back recently that found buyers right at the equal legs area. We have been favoring the long side due to impulsive bullish sequences the crypto is showing. In further text we’re going to explain the short term Elliott Wave forecast.

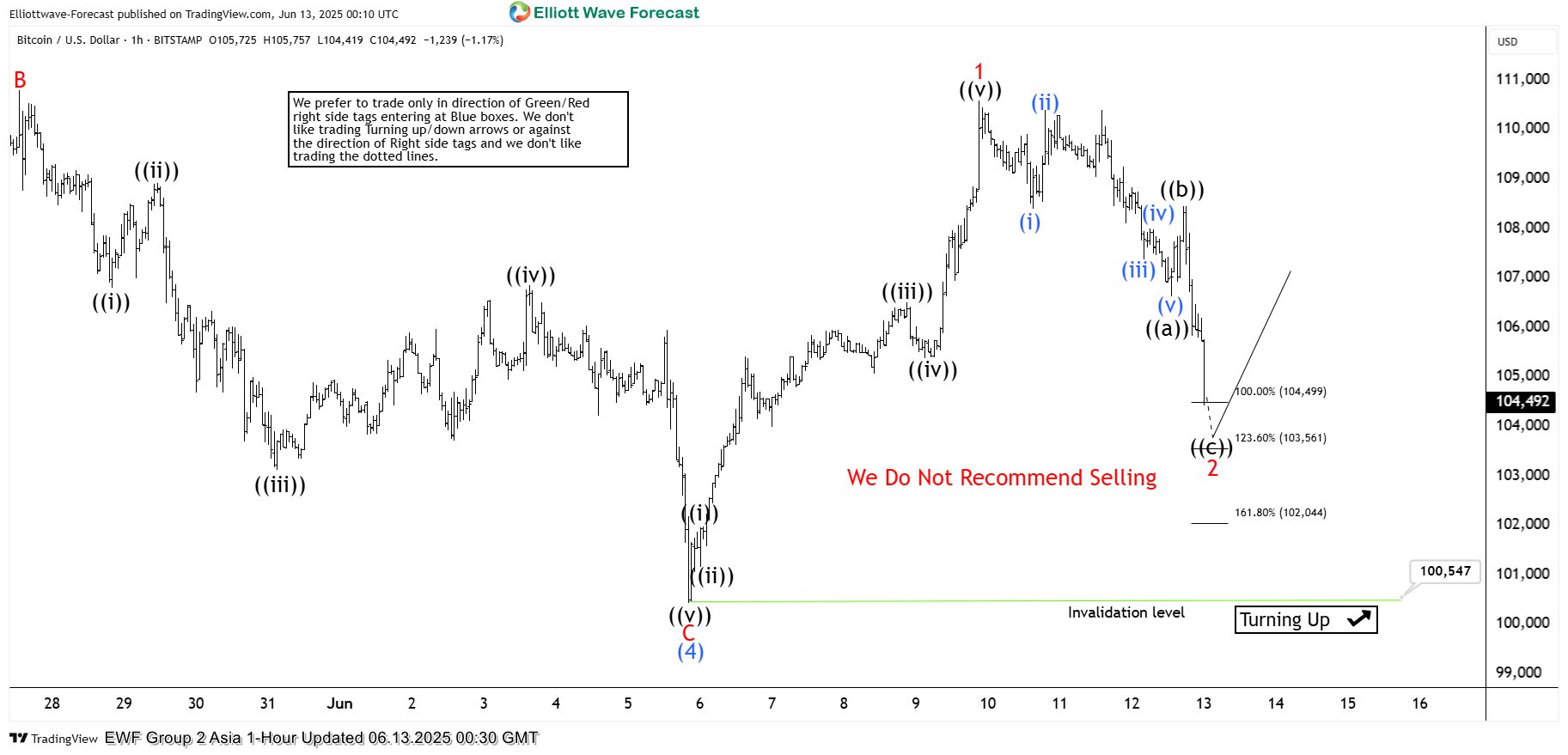

BTCUSD Elliott Wave 1 Hour Chart 06.13.2025

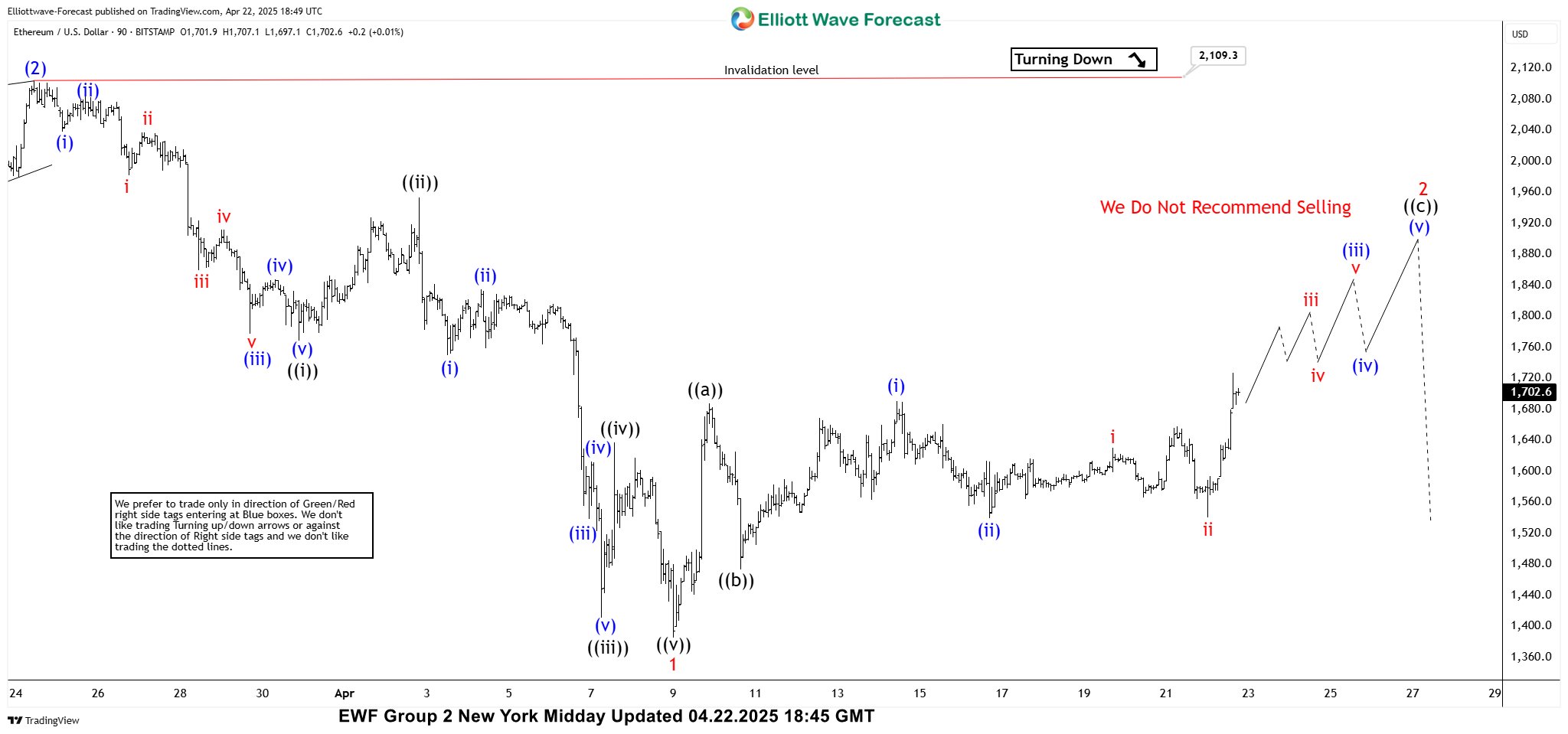

Current view suggests Bitcoin ended cycle from the 100,547 low as wave 1 red. We got 5 waves up in the rally from the mentioned low. Currently the crypto is doing intraday pull back , wave 2 red. The correction has reached the extreme zone, but it still appears incomplete at this time. We may see further short-term weakness within the highlighted area. We expect buyers to appear in the 104,499–102,044 zone, leading to a potential rally toward new highs or at least a 3-wave bounce.

Did you know ? 90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

Note: Keep in mind not every chart is trading recommendation. Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

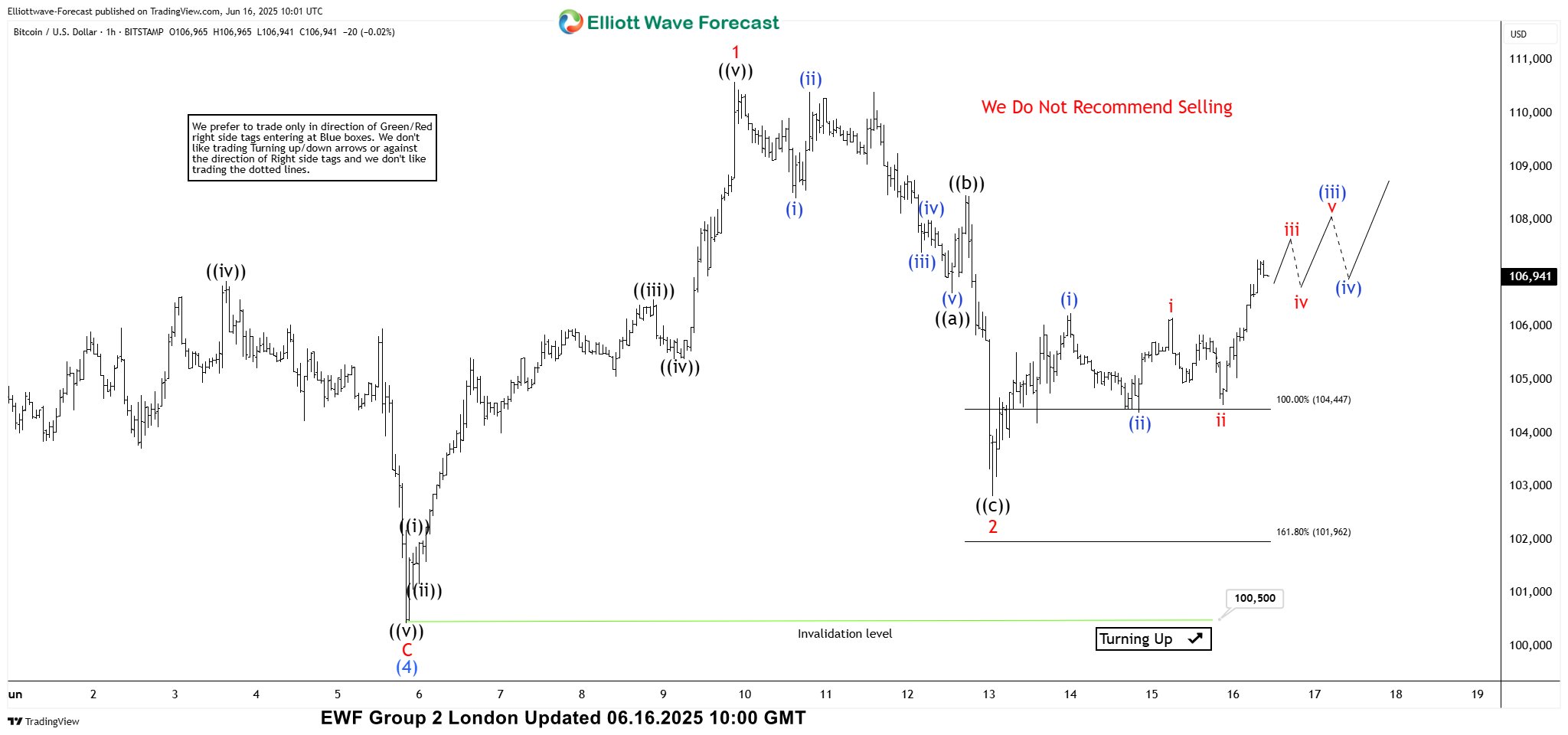

BTCUSD Elliott Wave 1 Hour Chart 06.16.2025

BTCUSD found buyers at the marked equal legs area as expected and we got good reaction from there. We count pull back completed at 102,848 low. We don’t recommend selling in any proposed pull back. The price should ideally hold above 102,848 low to keep proposed view intact. We would like to see break above 1 red peak 110,607 to confirm next leg up is in progress. Bitcoin is ideally targeting 112,794 area next.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts with target levels in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

New to Elliott Wave ? Check out our Free Elliott Wave Educational Web Page and download our Free Elliott Wave Book.

Elliott Wave Forecast

At Elliott Wave Forecast, we track and analyze 78 instruments daily — but remember, not every chart is a direct trading signal.

For real-time, actionable trades, join our Live Trading Room, where we guide you through clear, professional setups every day.

🚀 Not a member yet? Now’s the perfect time, we have limited time Promo Offer :

Unlock full access with our 14-day Trial for just $0.99!

Here’s what you’ll get:

✅ Official Trading Signals — with clearly defined Entry, Stop Loss, and Take Profit levels based on our proven strategy.

✅ Live 24 Hour Chat Room Access — ask unlimited questions and get expert support during trading hours (Monday–Friday).

✅ Expert Analysis — real-time updates across Forex, Stocks, Indices, Commodities, Cryptos, and ETFs.

✅ Hands-on Learning — sharpen your trading skills with direct mentorship from seasoned market analysts.

Take the first step toward better, smarter trading 👉 Click here to start your Trial today!