Hello traders. In this article, we are going to present another Elliott Wave trading setup we got in Dollar Index . As our members know DXY index remains bearish against the 101.936 pivot. Recently Dollar made a clear 3 waves recovery completed precisely at the Equal Legs zone, referred to as the Blue Box Area. In the following sections, we are going to explain Elliott Wave pattern and discuss the trading setup.

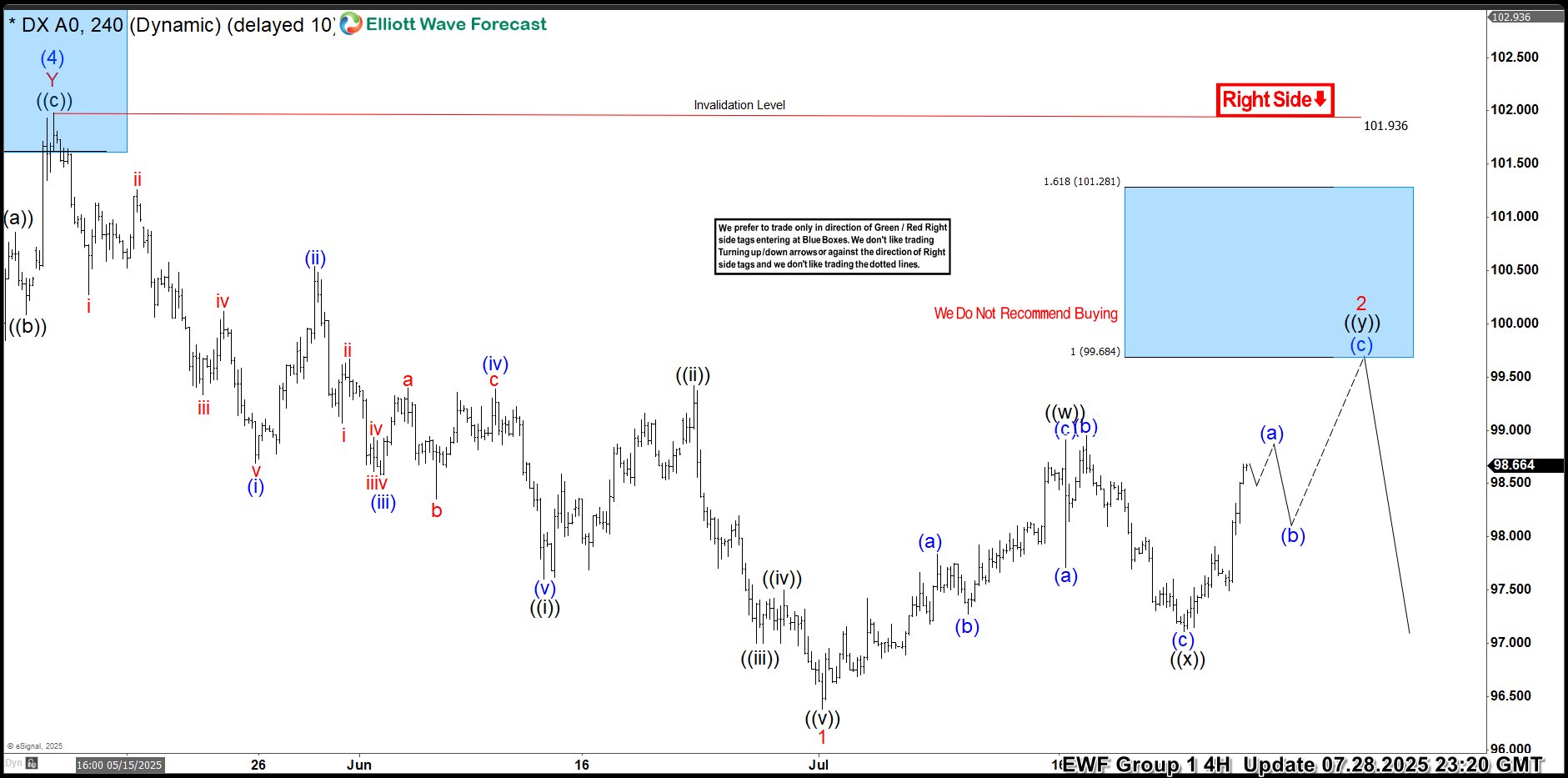

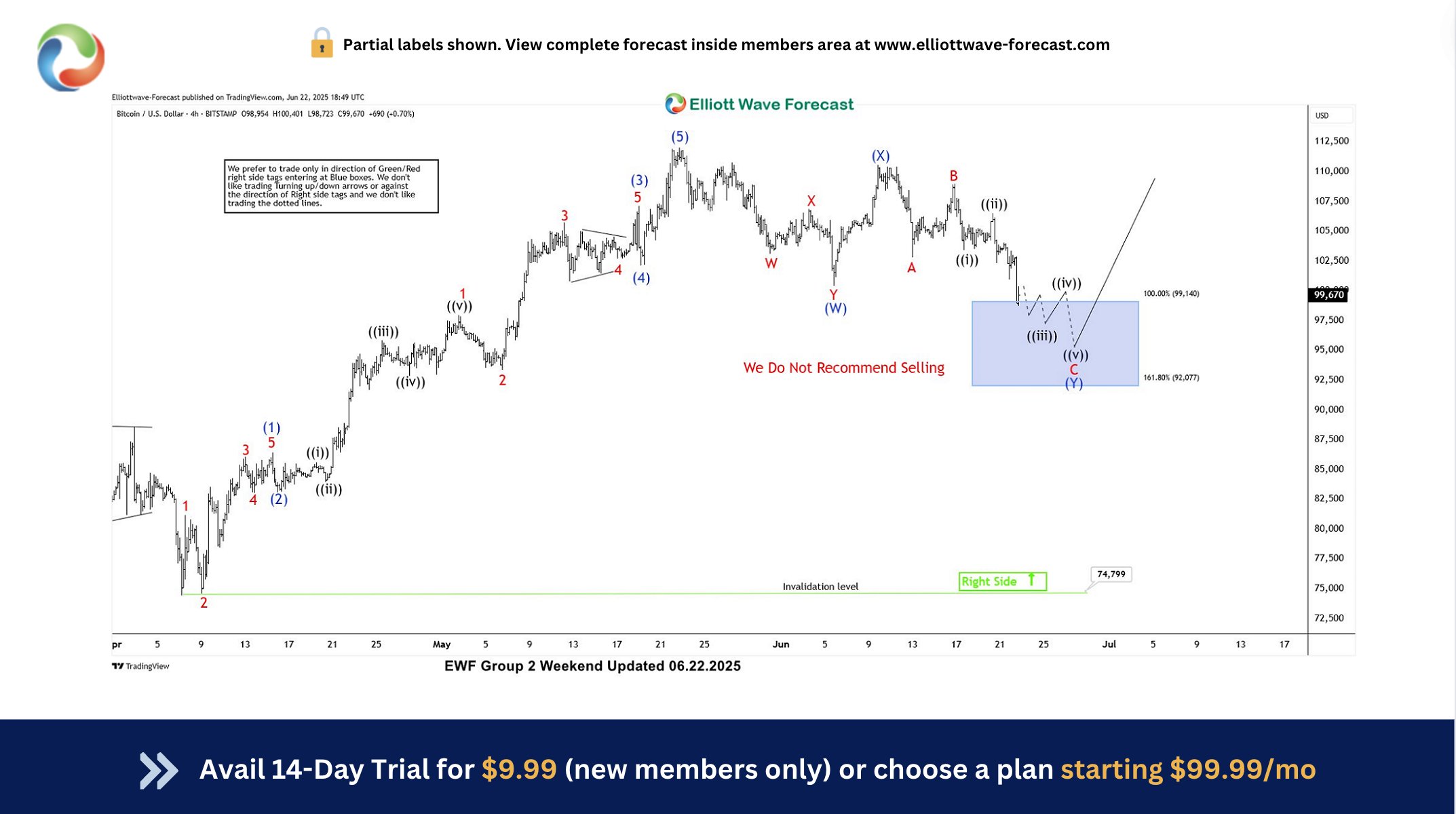

DXY Elliott Wave 4 Hour Chart 07.28.2025

Dollar is doing recovery against the 101.936 peak. The price action suggest that recovery is still incomplete at the moment , suggesting potentially more short term strength. This correction can see another leg up toward the Blue Box zone at 99.68-101.28 area, where we are looking to re-enter as sellers. We recommend members to avoid buying Dollar. As the main trend remains bearish, we expect at least a 3-wave pull back from this Blue Box area. Once the price touches the 50 fibs against the ((x)) black connector, we’ll make positions risk-free and set the stop loss at breakeven and book partial profits. On other hand, breaking above the 101.281 peak would invalidate the trade.

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

Quick reminder on how to trade our charts :

Red bearish stamp+ blue box = Selling Setup

Green bullish stamp+ blue box = Buying Setup

Charts with Black stamps are not tradable. 🚫

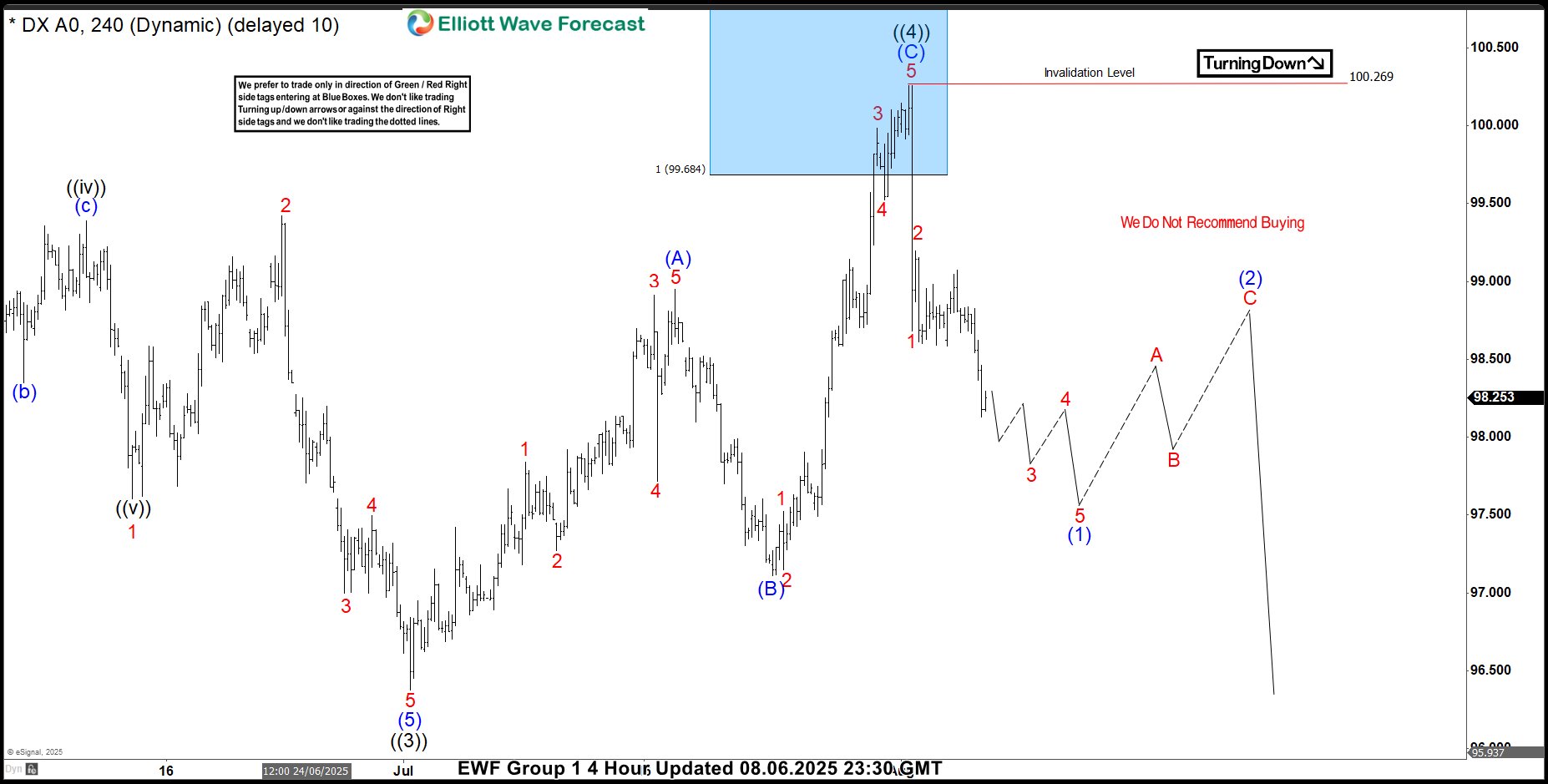

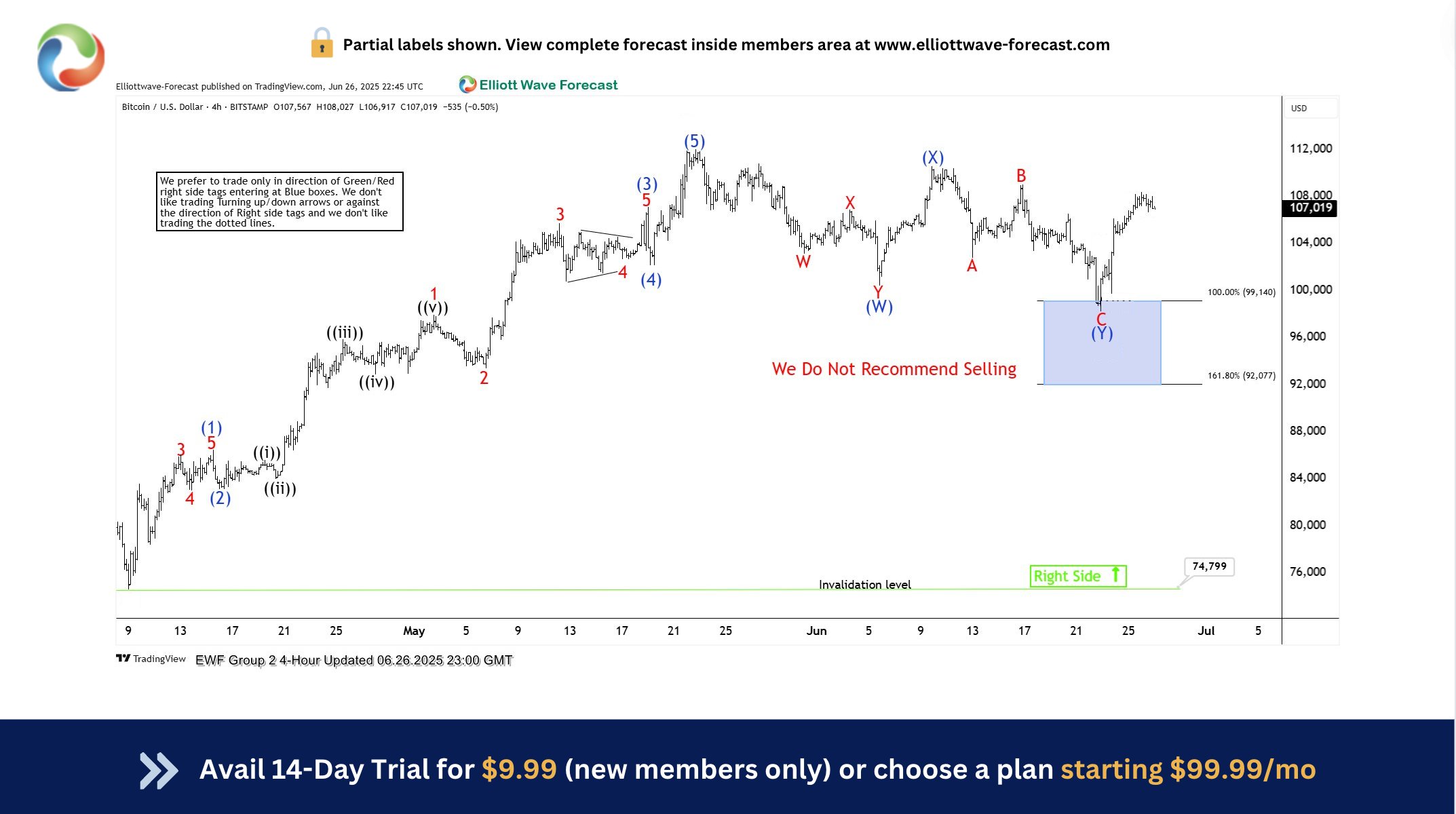

DXY Elliott Wave 4 Hour Chart 07.28.2025

Dollar reached the Blue Box area between 99.68-101.28 and, as expected, found sellers. DXY has made a solid decline from our Selling Zone. As a result, any short positions taken from the Blue Box should now be risk-free, with partial profits already booked. At this point, we would like to see a further decline and a break below the July 1st low to confirm that the next leg down is in progress.

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.

Elliott Wave Forecast

At Elliott Wave Forecast, we track and analyze 78 instruments daily — but remember, not every chart is a direct trading signal.

For real-time, actionable trades, join our Live Trading Room, where we guide you through clear, professional setups every day.

🚀 Not a member yet? Now’s the perfect time, we have limited time Promo Offer :

Unlock full access with our 14-day Trial for just $0.99!

Here’s what you’ll get:

✅ Official Trading Signals — with clearly defined Entry, Stop Loss, and Take Profit levels based on our proven strategy.

✅ Live 24 Hour Chat Room Access — ask unlimited questions and get expert support during trading hours (Monday–Friday).

✅ Expert Analysis — real-time updates across Forex, Stocks, Indices, Commodities, Cryptos, and ETFs.

✅ Hands-on Learning — sharpen your trading skills with direct mentorship from seasoned market analysts.

💬 Whether you’re an experienced trader or just getting started, Elliott Wave Forecast provides the tools, strategies, and support you need to trade with confidence.

Take the first step toward better, smarter trading 👉 Click here to start your Trial today!