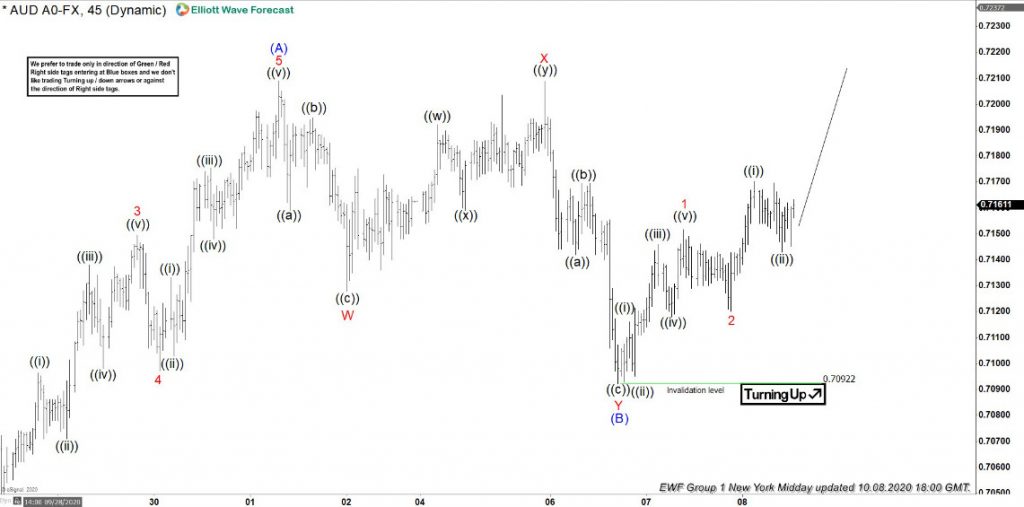

Elliott Wave view in AUDUSD suggests that the bounce from 25 September 2020 low has ended in wave ((B)) at $0.7243 high. The internals of that bounce unfolded as Elliott wave zigzag structure where wave (A) ended at $0.7209 high. Wave (B) pullback ended at $0.7092 low and wave (C) ended in 5 waves at $0.7243 high. Down from there, the decline is unfolding as Elliott wave impulse structure where wave 1 ended in lesser degree 5 waves at $0.7147 low.

Up from there, wave 2 bounce ended at $0.7190 high. While wave 3 ended with another lesser degree 5 wave structure at $0.7053 low. And wave 4 bounce ended at $0.7098 high. Below from there, wave 5 remains in progress looking to extend lower minimum towards inverse 1.236%- 1.618% Fibonacci extension area of wave 4 at $0.7041- $0.7023 area. In case of further extension lower, it can even see a 5=1 target area towards $0.7001- $0.6978. And see a potential break below the 9/25/2020 low (0.7002). Before ending 5 wave decline in wave (1) & seeing a bounce in wave (2). Near-term, as far as the pivot from $0.7243 high stays intact expect bounces to fail in 3, 7, or 11 swings for further downside.