2020 has brought about a lot of changes in the world. Pet care has exploded as people have been locked down in their homes looking for company. Playing off that trend is Zomedica Corp. As a result, this stock has rallied from a low of 6 cents in November 2020, to a peak of $3.00 on February 11. What does Zomedica Do? Lets take a look at their company profile:

“Zomedica is an animal health company focused on meeting the needs of clinical veterinarians in ways that promote both patient and practice health. Our mission is to advance the effectiveness and financial well-being of veterinary practitioners by delivering professionally beneficial diagnostic products and services.

Our team is comprised of clinical veterinarians, animal health professionals, innovative scientists, and business experts committed to helping practicing veterinarians remember why they chose to care for animals and recapture the joy in their career.

We recognize the emotional rewards that come from working in the animal care industry, the sacrifices made in fulfilling the noble veterinary oath, and the challenges impacting veterinarians’ success.”

Their flagship Truforma Platform has recently had its first commercial sale in March 2021. Lets take a look and see what the chart says about this company.

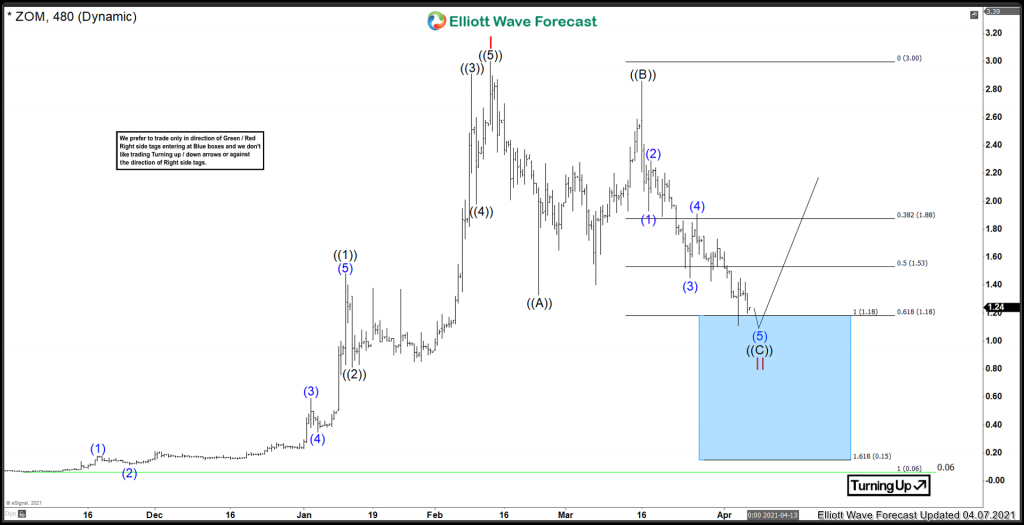

Zomedica Corp Elliotwave View:

Medium term term view from the all time low in November 2020. Zomedica is favoured to have 5 swings into the peak into Red I on Feb 11, 2021 @ a high of 3.00. After that, a very technical correction has taken place. It is favoured that this stock is in the final swings of forming a low at the blue box extreme area. What is the blue box? It is an area where algo’s are programmed to react for a bounce (if bullish) or profit taking (if bearish). Consequently, Zomedica has reached the blue box extreme while correcting a bullish impulse off the November 2020 low. In addition, prices at the 100% blue box top at 1.18, is matching the 61.8 retrace of the whole advance. As a result, these types of fib confluences can give higher odds to a low to take form.

In Conclusion, there is room for one more low, but the stock doesn’t have to. It has already entered into the blue box and found a bounce. It is favoured this stock will get at least a 3 swing bounce from this area. If not start the next leg higher.

Risk Management

Above all, using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our 14 day trial today. Get Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back