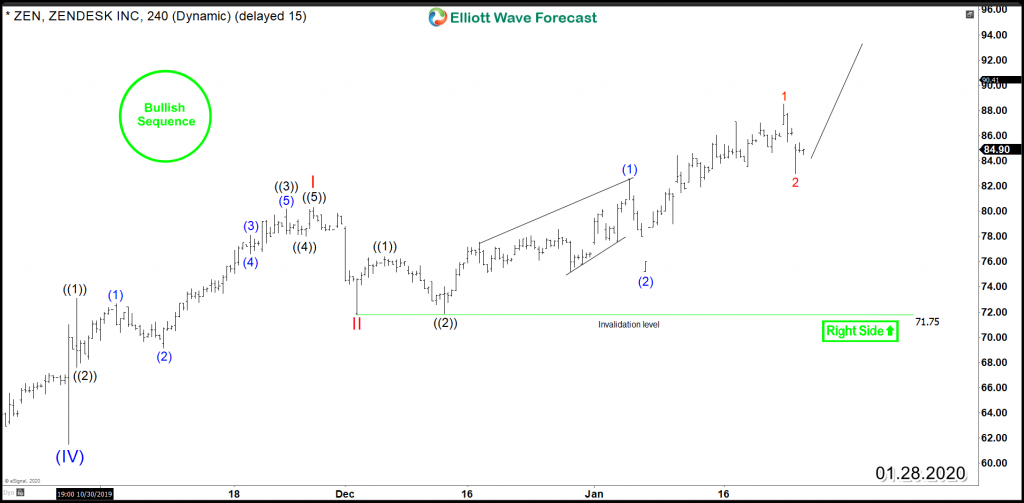

Zendesk (NYSE: ZEN) bullish trend since IPO is still in progress despite the 30% correction which took place last year. The Bulls remained in Control as the stock ended a corrective 3 swing move lower then started a new rally since October 2019.

Up from there, Zen is currently showing an incomplete bullish sequence suggesting further upside to be seen as long as the pullbacks will remain supported above $71.75 low. The move will allow the stock to establish an impulsive 5 waves advance which can aim for new all time highs with a target at $102 – $115 area.

The move higher can take 2 slightly different path with the same end result which is more upside. The aggressive bullish scenario would suggest a nest taking place within wave III and pullback will remain shallow within a higher high sequence to take Zendesk toward new all time highs. The second scenario would suggest another leg higher to end 5 waves advance from December 2019 followed by 3 waves pullback to correct that cycle before the stock resume the rally again toward new highs.

Consequently, Zendesk in the short term will be looking to see further extension higher as both forecasts are pointing higher supporting the current rally and it would suggest that buyer would remain in control during pullbacks in 3 , 7 or 11 swings.

Zendesk ZEN 4H Chart ( Scenario 1 )

Zendesk ZEN 4H Chart ( Scenario 2 )

Get more insights about Stocks and ETFs by trying out our services 14 days . You’ll learn how to trade the market in the right side using the 3, 7 or 11 swings sequence. You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

Back