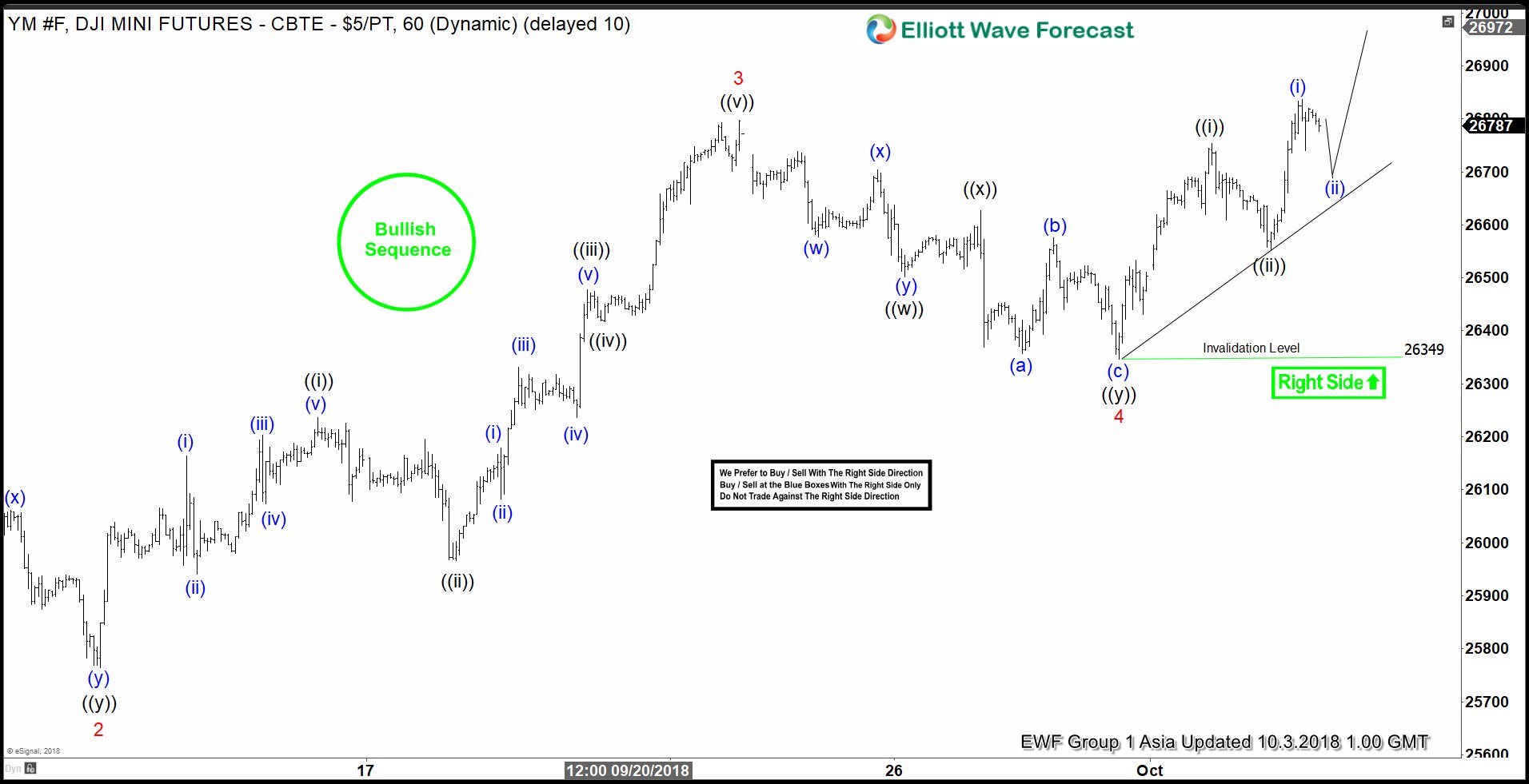

DJI Mini Futures ticker symbol: YM_F short-term Elliott wave view suggests that the index is nesting higher as impulse structure looking for more upside. The internals of lesser degree cycles is showing the sub-division of 5 waves advance in each leg higher i.e Minor wave 1, 3 & 5. While Minor wave 2 & 4 unfolded in 3 wave corrective structure. Also, it’s important to note that index is having a bullish tag & right side is up therefore selling is not recommended.

The decline to 25764 low completed in 3 swings Minor wave 2 pullback. Up from there, the rally to 26820 high ended Minor wave 3 higher in 5 waves structure as an impulse. The lesser degree Minute wave ((i)) ended in 5 waves at 26261. Minute wave ((ii)) ended at 25991 low and Minute wave ((iii)) ended at 26504 high in another 5 waves. Then a pullback to 26445 low ended Minute wave ((iv)) & finally a rally to 25764 high ended Minute wave ((v)) of 3.

Down from there, the pullback to 26349 low ended Minor wave 4 as double three structure with the sub-division of 3-3-3 structure in each leg lower i.e Minute wave ((w)) ended in 3 swings at 26501 low. Minute wave ((x)) bounce ended at 26627 high and Minute wave ((y)) of 4 ended at 26349 low. Currently, the index has managed to make a new high above 26820 prior wave 3 confirming the next leg higher in Minor wave 5 looking for more upside. Near-term, while dips remain above 26349 low expect index to extend higher. We expect buyers to appear in 3, 7 or 11 swings against 26349 low.