The S&P 500 ($SPX) had the worst December in history as the market got nervous. Many started to guess the possible reasons and came up with many different arguments. There were several reasons like the trade wars with China and the political environment in the US, among others. One particular reason about President Trump got the most attention. The president started to lash out again at the FED because of their decision to raise interest rates probably because President Trump believes that raising interest rates would cause Stock Markets to drop which won’t be good for his term. The chairman of FED is appointed by the President, but the FED is designed to operate without a political bias. Many headlines crossed the wires like “ Trump lashes out at Fed — again: ‘They’re raising interest rates too fast”, ” Did the Fed just cave to Trump?” when they raised rate in December.

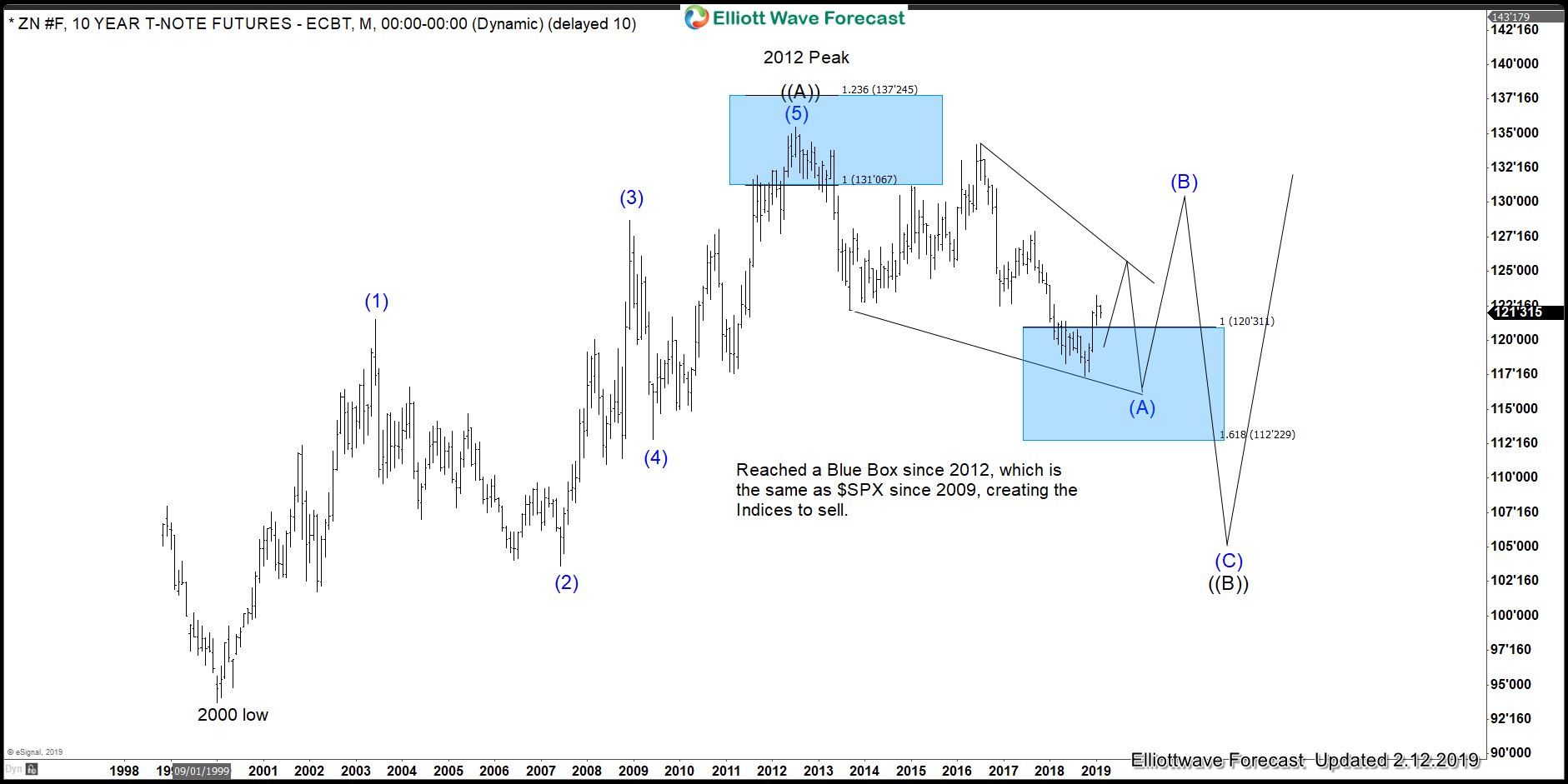

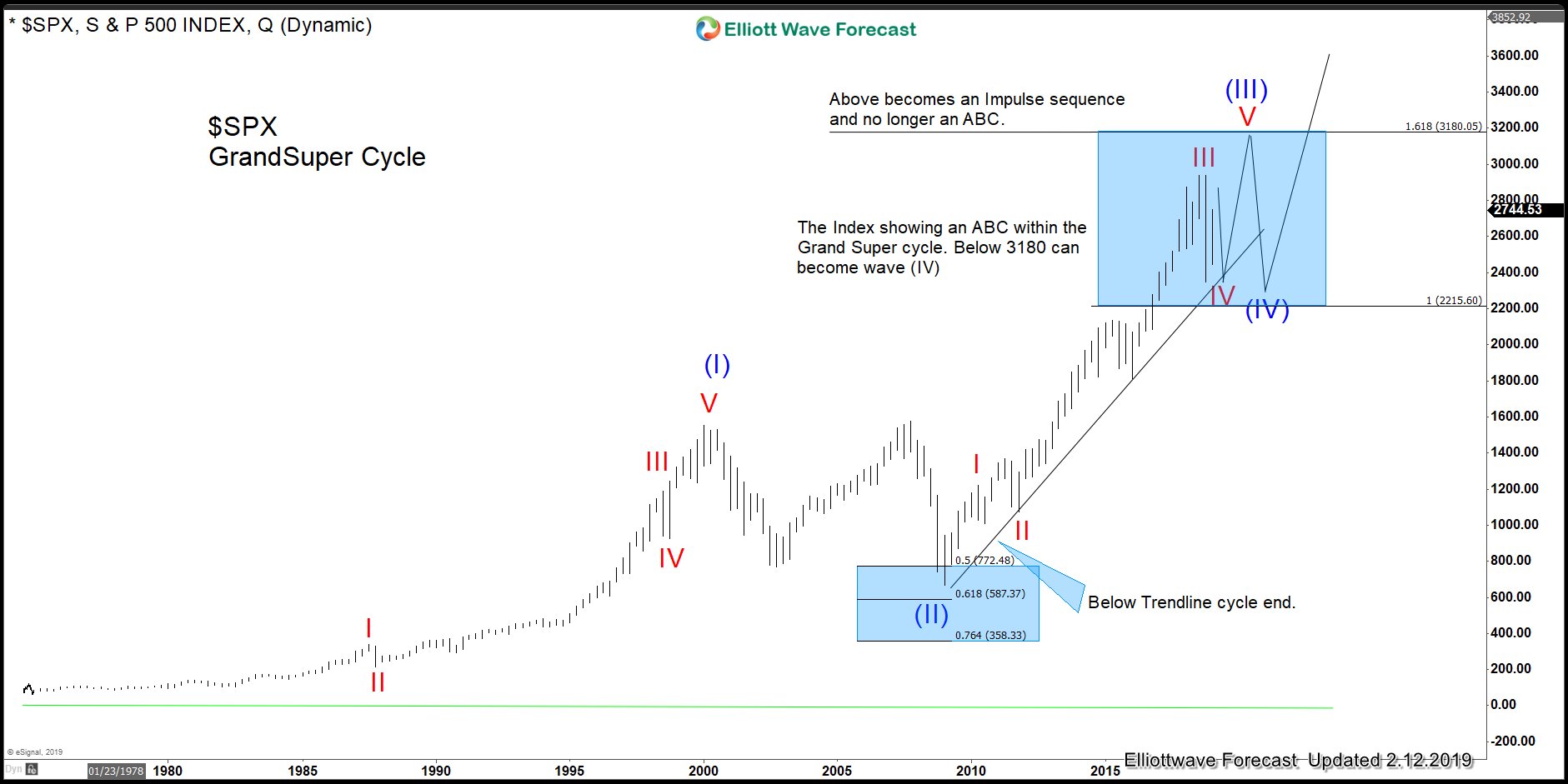

The Fed can be right if they look at the $SPX Grand Super Cycle Blue Box. Raising Interest rates will be a way to defend themselves against a sell off in case we need cheap money again. The Blue Box in the $SPX together with the $ZN#F Blue Box from the cycle since 2012 high will create a concern that any technical trader can see. We did a blog back in 2017 forecasting both to reach into a Blue Box and a possible large correction across the Market by 2020.

The blog we did in 2017 explained the relationship between the instruments and how it can affect the World Indices and the market in general. We always believe the market is purely technical and reaching these big areas are a HUGE warning. We also believe market makers trade by looking into these areas. Our daily forecasts prove it everyday. The $SPX and $ZN_F (10 Years) are important parts of the market of course. We think the FED is raising rates too fast because of this. However, we will side with President Trump because we believe Market sequence still favours more upside in Stock Markets regardless of what FED does.

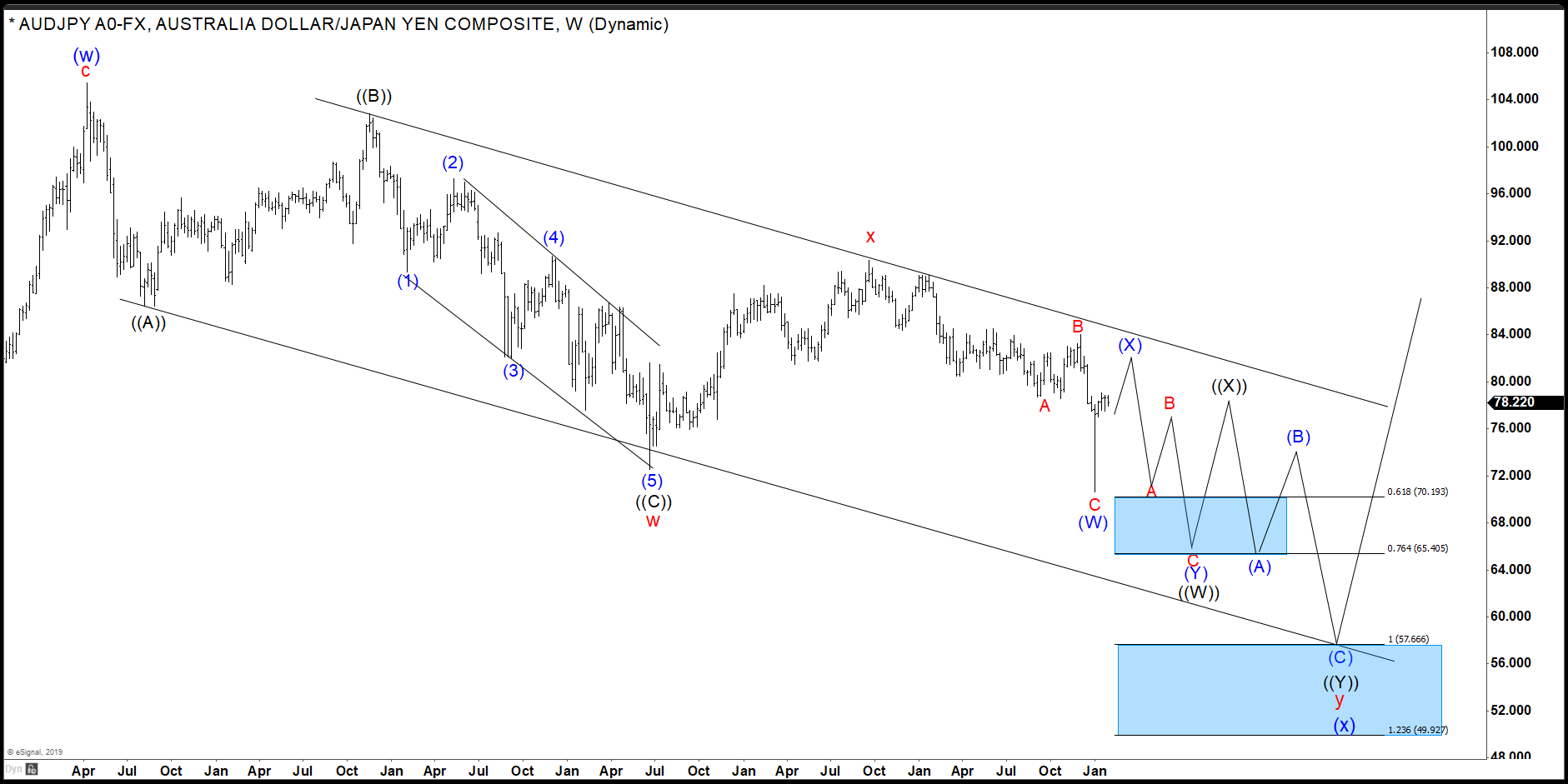

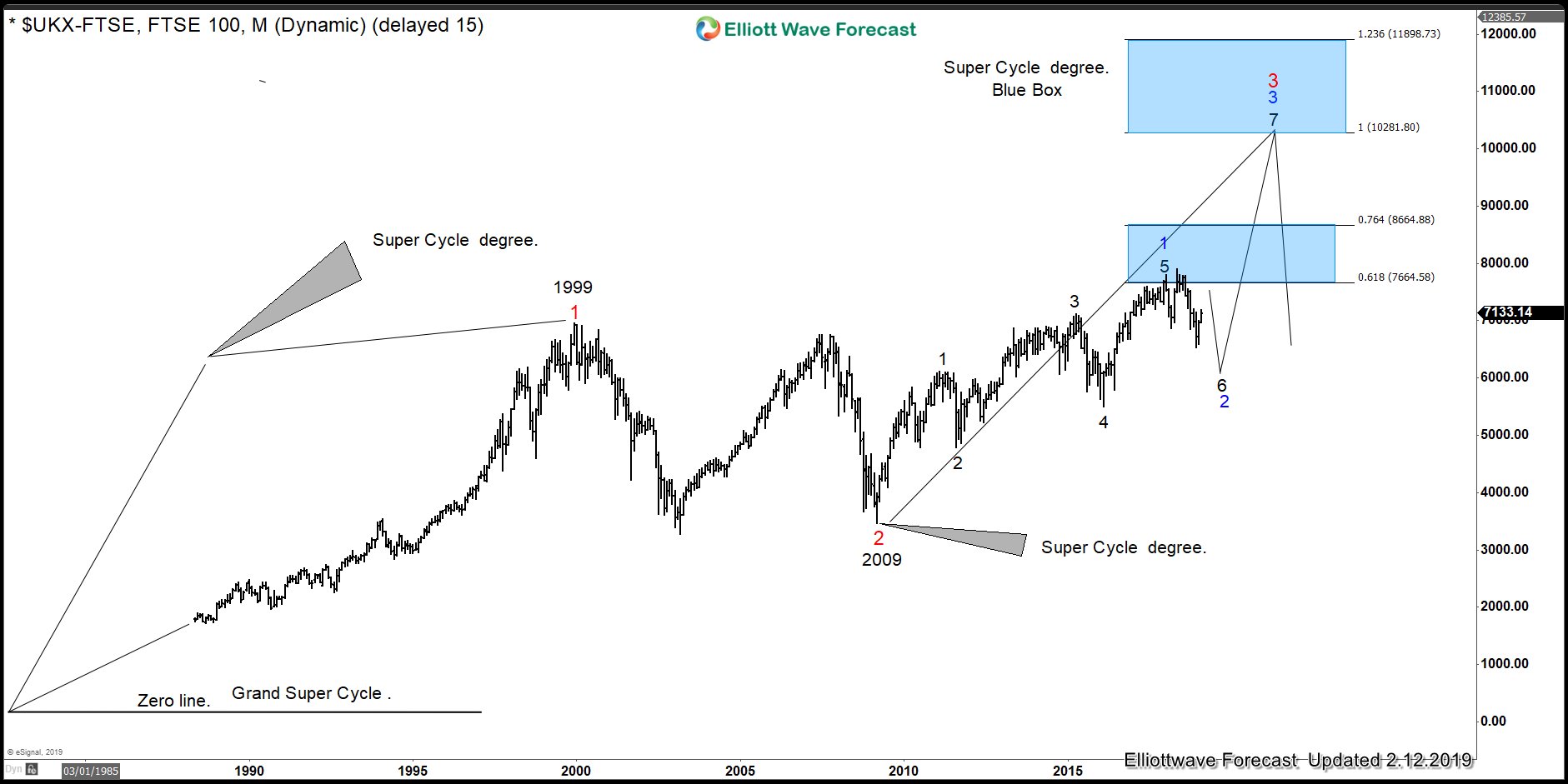

Secondly, we look at a series of instruments from around the world. We see how the YEN has been strong since 2015. The Yen is soon expected to see a huge important low. There is not much of a way to see that the downside will win. Indices will have no other way than to extend higher and follow the sequences of the $UKX-FTSE in the Grand Super cycle and extend. The market needs to be seen as a whole in reality. As humans we have instincts. In this case President Trump does not have either the fundamental or technical knowledge that the FED has. However his instincts are right.

Here is the $SPX Grand Super cycle Blue Box that is showing an ABC from all time low. It will need to extend because YEN strength soon can be over and $FTSE Grand Super cycle sequences is also favouring the extension higher.

$SPX Grand Super Cycle

Here is the $AUDJPY bearish Weekly cycle that soon price will reach. A Blue Box in 2 degrees which will create a lot of Yen weakness and consequently higher Indices. It is a downward channel and a double three correction.

$AUDJPY Bearish Weekly Cycle since 2013 peak

Here is the $UKX-FTSE Grand Super cycle sequences that supports the Indices higher which means President Trump will end up winning regardless of what policy FED adopts as that’s what this Grand Super cycle bullish sequence in $UKX-FTSE is suggesting.

$UKX-FTSE Grand Super Cycle Favours Trump and not the FED

$ZN_F (10 years) have reached the extreme Blue Box since the peak in 2012

In conclusion. When we look at everything, we believe the indices will be involved in much volatility. This should last for the next few months. At the end another cycle like 2009 will happen and President Trump will be end up being right at the end regardless of what FED does.

Back