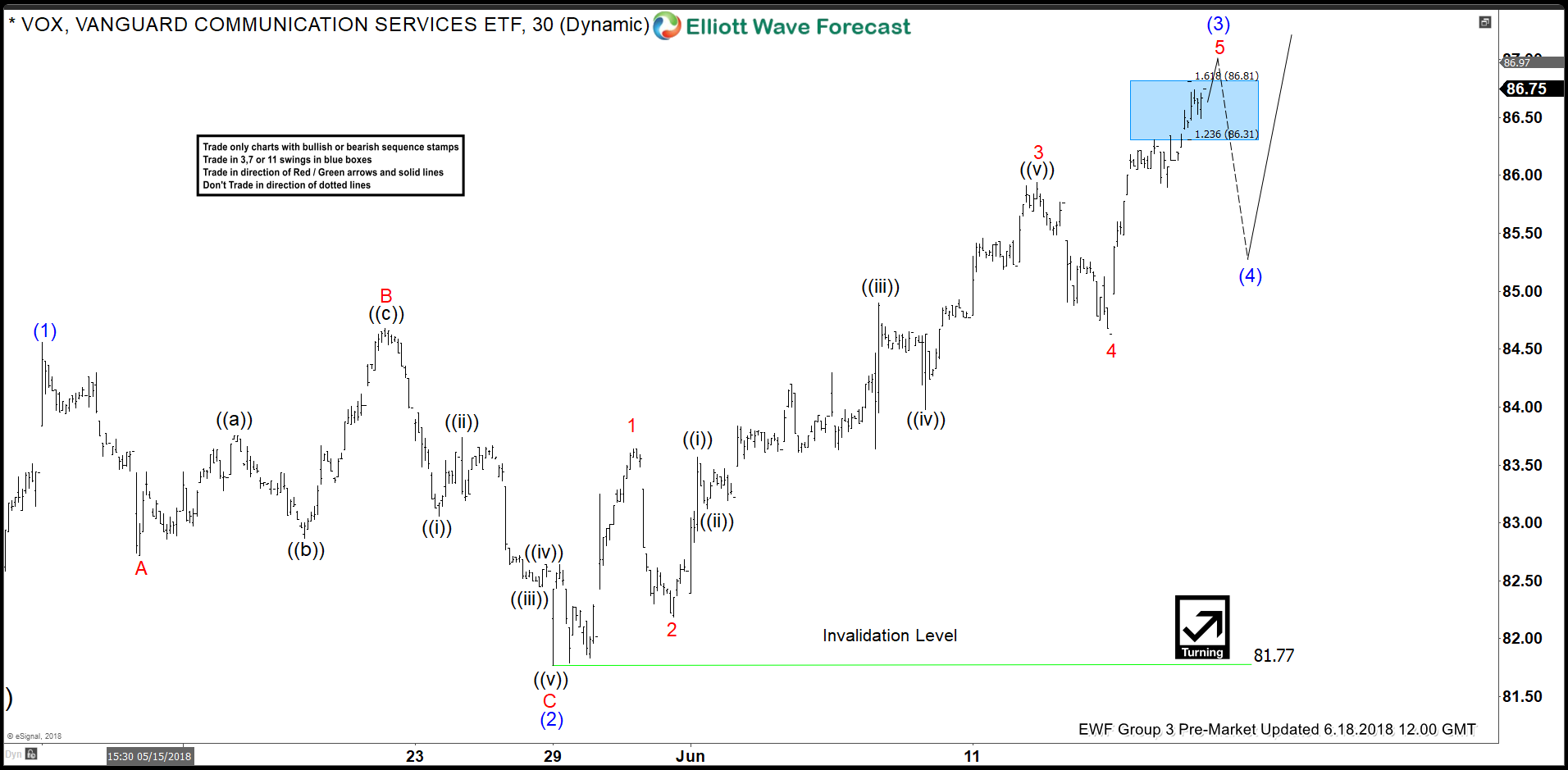

Vanguard communication services ticker symbol: VOX short-term Elliott Wave view suggests that the rally to 84.50 on 5/11 peak ended intermediate wave (1) as an impulse. Down from there, the pullback to 81.78 on 5/29 low ended intermediate wave (2) pullback as expanded Flat. The internals of a Flat correction ended Minor wave A at 82.76, Minor wave B ended at 84.67 high and Minor wave C of (2) ended at 81.78 low.

Up from there, the rally is extending higher in an impulse sequence with extension with lesser degree sub-division showing 5 waves structure in Minor wave 1, 3 & 5. Those 5 waves are expected to complete either intermediate wave (3) or can end some sort of wave (C) of a Flat correction from 5/09 low. The internal of Minor wave 1 ended in 5 waves at 83.62 high, Minor wave 2 ended at 82.19 low. Then the rally to 85.92 high completed another 5 waves in Minor wave 3 higher. The pullback to 84.63 low ended Minor wave 4.

Above from there Minor wave 5 of (3) remains in progress in another 5 waves structure & expected to complete soon as it already reached the minimum extension area already. But in case of further extension higher, the ETF can see 87.19-87.80 0.618-0.764% Fibonacci extension area of 1+3 to complete intermediate wave (3). Afterwards, the ETF is expected to do a pullback in wave (4) for the correction of 81.78 cycle in 3, 7 or 11 swings before further upside is seen. We don’t like selling it into a proposed pullback.

VOX 1 Hour Elliott Wave Chart

Keep in mind that the market is dynamic and the view could change in the meantime. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader, then join our service by selecting any membership plan here.

Back