Visa Inc. (V) is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world’s most valuable companies.

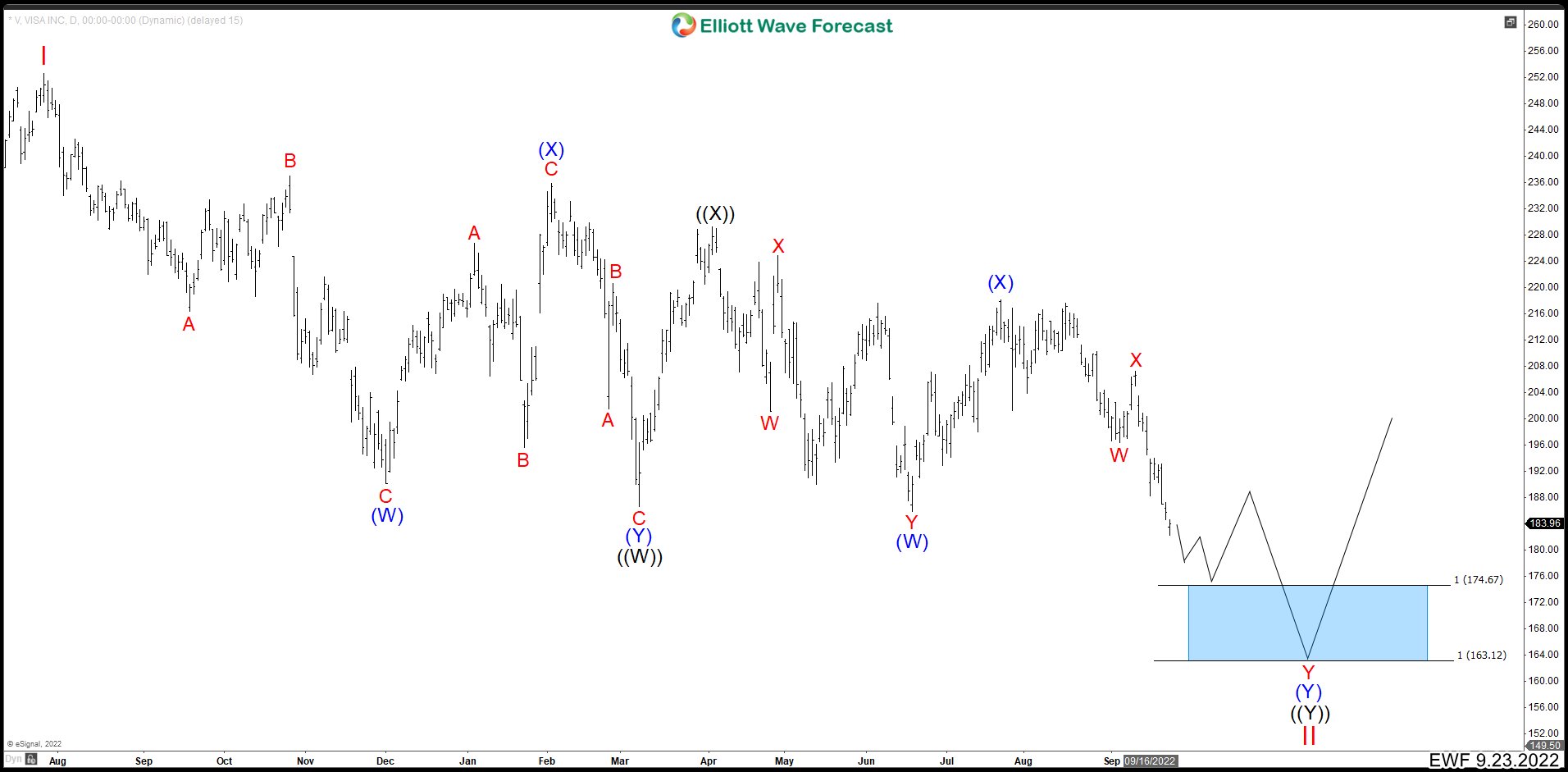

VISA (V) Daily Chart From September 2022

Visa (V) ended an important market cycle in July 2021 that started in aVrch 2020. The rally reached 252.67 which we labeled as wave I, and from there a corrective movement started. This structure has already had more than a year of sideways and this last September 23th we have broken an important support at 186.63. This break indicates that we should see more bearish movement until we find a new support.

Using the Elliott Wave Principle, we see that a complex 7-3-7 structure has been formed in V in daily timeframe. This means that the first cycle developed a double correction and we label it as wave ((W)). Then we have the connector ((X)) which corrected the drop from the peak. Lastly, we are building a new double correction to complete wave ((Y)). (If you want to learn more about double correction or Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

Visa (V) Double Correction Structure

From 252.57 we had 3 swing drop ending wave (W) at 190.12. Wave (X) bounced off another 3 swings to finish at 235.97. And then we saw another 3 swings to complete (Y) at 186.63 and wave ((W)). From there, we go up to 229.24 to finish the connector ((X)). The next correction came in 7 swings to complete wave (W) at 185.96. The 3 swing corrective rally completed wave (X) at 218.01 and we are currently developing wave (Y).

Wave (Y) could be building a double correction, just like wave (W). Wave W ended at 196.29 and wave X at 207.28. We expect 3 more swings down to complete wave Y in 163.12 – 174.67 area. Thus, V will complete wave (Y) of ((Y)) of wave II and then continue with the uptrend.

Take 14 Days Trial

Elliottwave Forecast updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Let’s trial 14 days for only $9.99 here: I want 14 days trial. Cancel Any time.

Back