Hello everyone! In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of VanEck Gold Miners ETF ( $GDX ) . The rally from 2.28.2024 low at $25.64 unfolded as a 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & forecast below:

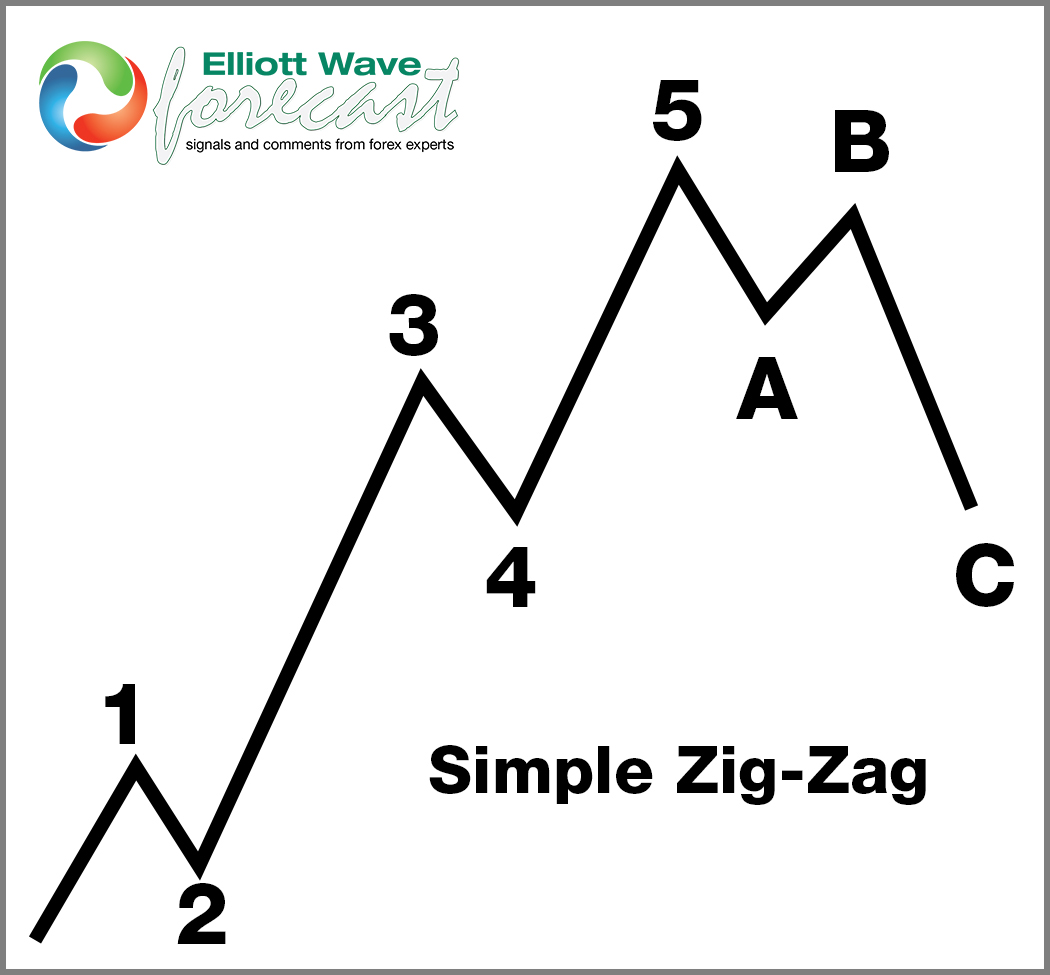

5 Wave Impulse Structure + ABC correction

$GDX 4H Elliott Wave Chart 6.12.2024:

Here is the 4H Elliott Wave count from 6.12.2024. The 5 wave impulsive cycle from 2.28.2024 ended on 5.20.2024 at red 3 and started a pullback to correct in 3 swings. We expected the pullback against 2.28.2024 low at $25.64 to find buyers at the blue box area at 32.99 – 31.04 in 3 swings.

Here is the 4H Elliott Wave count from 6.12.2024. The 5 wave impulsive cycle from 2.28.2024 ended on 5.20.2024 at red 3 and started a pullback to correct in 3 swings. We expected the pullback against 2.28.2024 low at $25.64 to find buyers at the blue box area at 32.99 – 31.04 in 3 swings.

$GDX 4H Elliott Wave Chart 7.07.2024:

Here is the latest 4H update from 7.07.2024, showing the rally taking place as expected. The cycle from the peak at red 3 has ended and the ETF has reacted higher from the blue box area allowing longs to get risk free. The ETF is expected to remain supported with a target area towards $40 – 45 area before another pullback can happen. Alternatively, the bounce can fail and continue lower in a 7 swings correction (WXY) so chasing now can be risky. A break of red 3 high will confirm that the next leg higher and negate the possibility of a double correction.

Here is the latest 4H update from 7.07.2024, showing the rally taking place as expected. The cycle from the peak at red 3 has ended and the ETF has reacted higher from the blue box area allowing longs to get risk free. The ETF is expected to remain supported with a target area towards $40 – 45 area before another pullback can happen. Alternatively, the bounce can fail and continue lower in a 7 swings correction (WXY) so chasing now can be risky. A break of red 3 high will confirm that the next leg higher and negate the possibility of a double correction.

Elliott Wave Forecast

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities.

Welcome to Elliott Wave Forecast!

Back