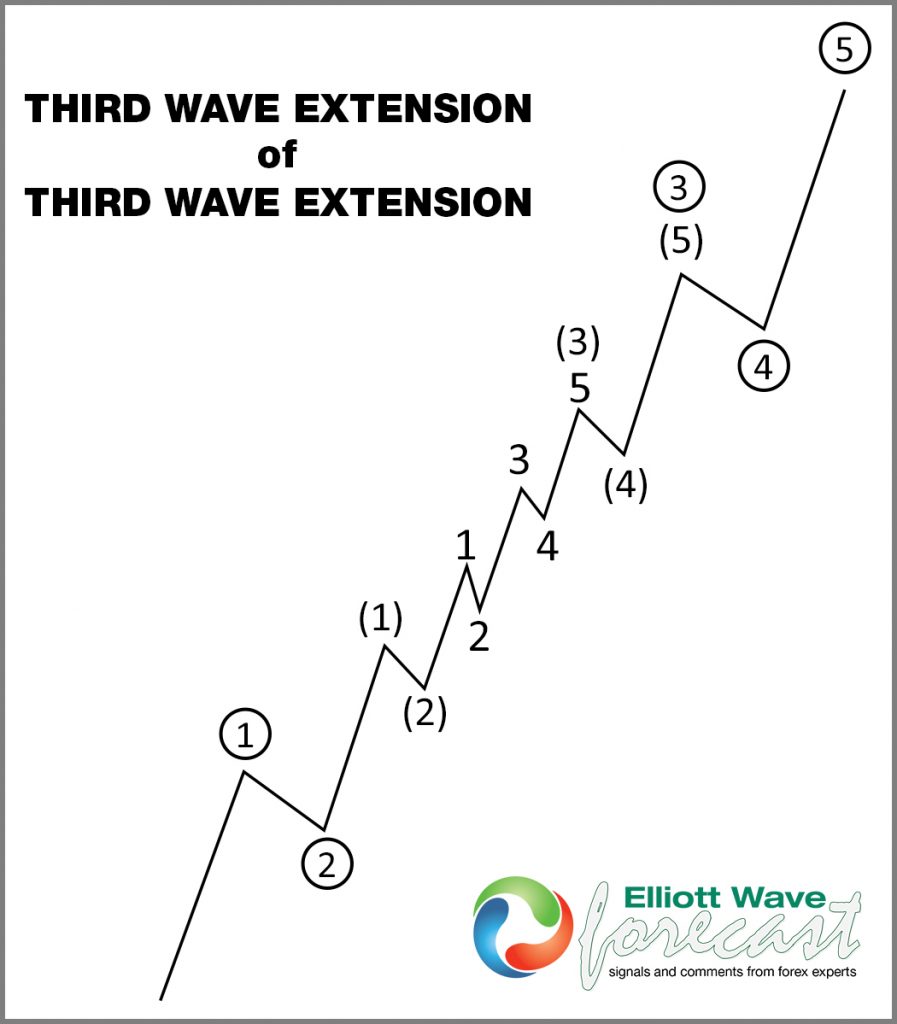

#TRAN (Dow Jones Transportation) is trading in an interesting swing sequence. It shows five swings advance in Grand Super Cycle degree. The idea that five waves or swings develop from the all-time lows make the sector bullish overall. However, we favor a nest, a series of I-II with a higher extension still to come. A nest is shown in the chart below:

As we can see in $TRAN chart below, the instrument creates a series of higher highs and lower high with market continues to break higher. After the extension, it should do a series of IV-V.

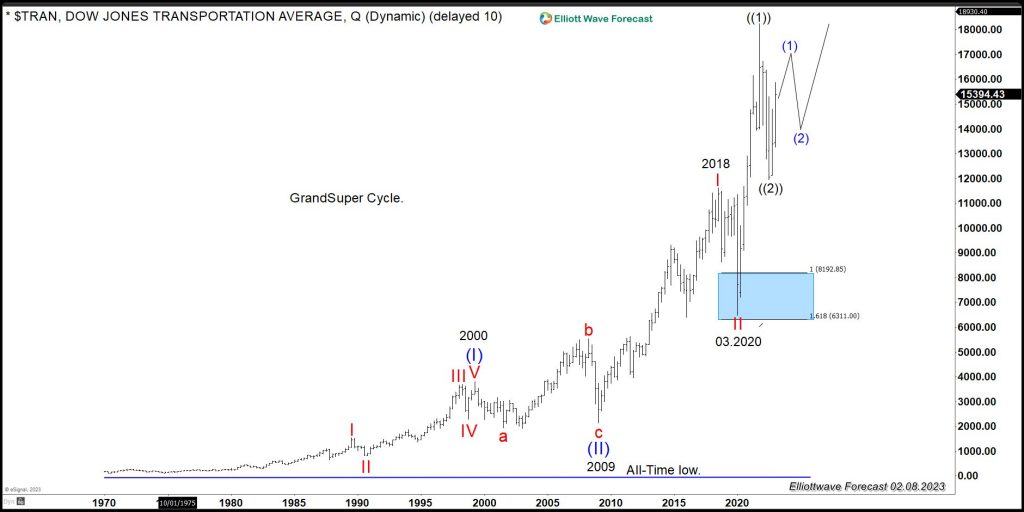

Quarterly $TRAN Elliott Wave Chart

The quarterly chart above shows the nesting with the labeling and the strong reaction from the Blue Box area in 2020. If this is the case, then we are trading within wave (1) of ((3)) of III, and the separation should happen after the cycle off the lows at 07.2022 ends. A nest will suggest a huge rally across the Sector. Here is an article from 2020 showing the Blue Box area and more upside is expected.

The second possible path is that the Sector will do two more highs within the Grand Super Cycle, and the pullback in 2020 was a red wave IV. In this case, the Sector is trading within a regular five waves advance and now entering a wave five, but it should still be supported. The extension from red II to red III makes a case for wave V taking place and new all-time highs. The chart below illustrates this alternate path

Alternate $TRAN Quarterly Elliottwave Chart

The quarterly chart above shows the Impulse idea and how the Sector will extend within a wave V red, and consequently another wave (IV) and wave (V) will come.

The third possible outcome is that the Index has ended the Grand Super Cycle and will now enter a correction that will take years. We at EWF do not support that view for many reason. One of the reasons is $FTSE Grand Super Cycle does not allow labeling to call it completed. Secondly, pullback in the Airlines and Cruises sectors, which is very deep and does not allow more downside. Please, watch the following seminar to understand the idea.

In conclusion: The Sector is showing five swings within the Grand Super Cycle and should remain supported. We are favoring the nest due to Indices like $FTSE and the correlation with Airlines and Cruises. Buying the dips against the low at 07.2022 might provide an excellent buying opportunity.

Back