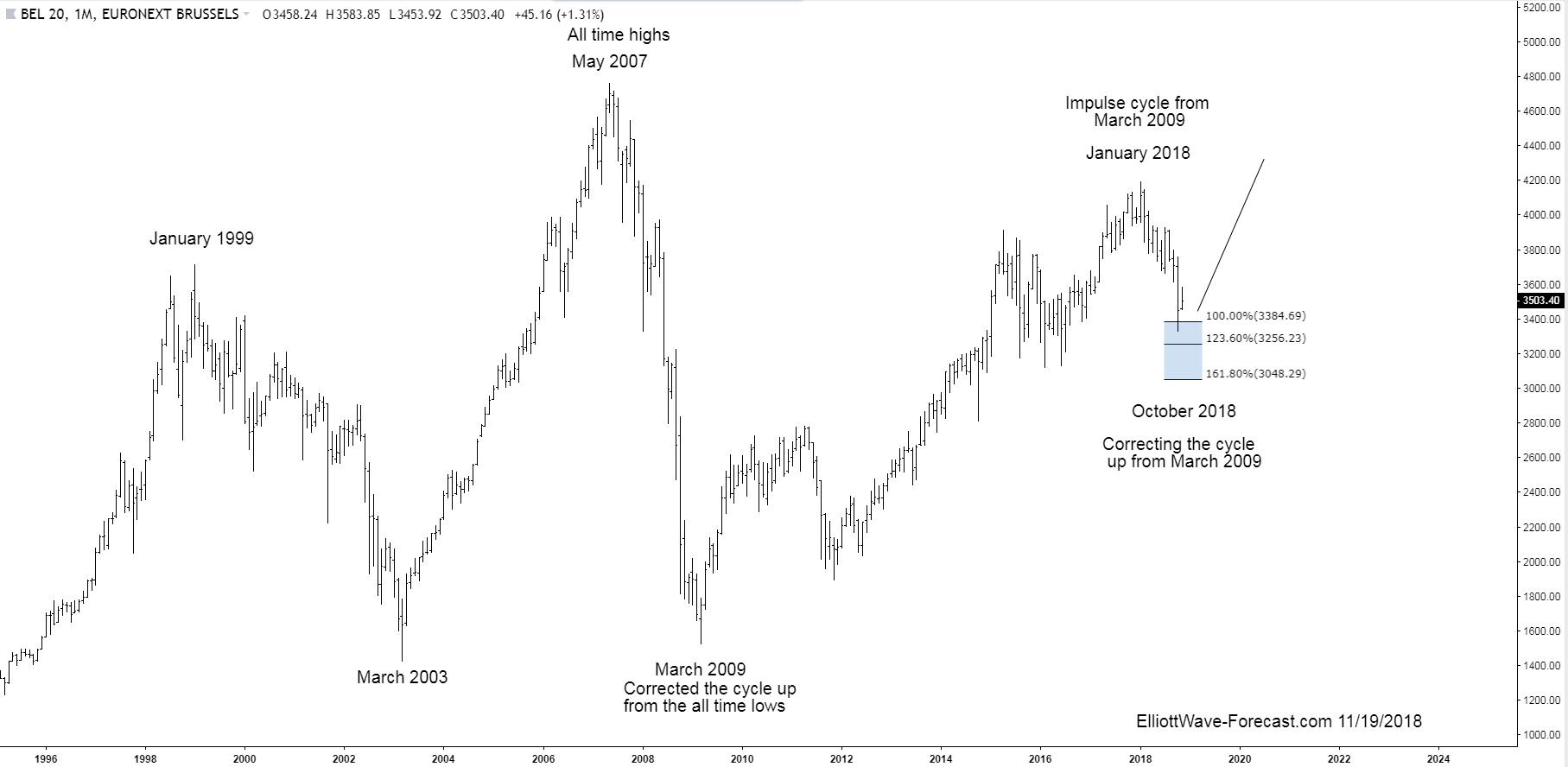

The BEL20 Index Long Term Bullish Trend and Cycles

Firstly, the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other world indices. That is where the index corrected the whole long term bullish cycle from the all time lows. At this point is where this bullish trend, cycle and swing analysis begins. The analysis continues below the monthly chart.

BEL20 Monthly Chart

Secondly, I will mention again as before, the 2009 lows corrected the whole longer term cycle higher from inception in the benchmark index. The bounce from the March 2009 lows into the January 2018 highs was a clear five swing impulse. The pullback lower from that high is strong enough to suggest it is correcting the whole cycle up from the March 2009 lows. This is determined by reading the RSI and other momentum indicators. The analysis and conclusion continues below the daily chart.

BEL20 Daily Chart

Thirdly in conclusion. Previously mentioned earlier, the pullback from the January 2018 high to the October 2018 low was strong enough to suggest it is correcting the cycle up from the March 2009 lows. The daily chart above shows this decline with the cycles and swings numbered. At this October 2018 low point, the index appears to have potentially completed a seven swing corrective sequence. This pullback Fibonacci extension area shown on the chart is measured by the following. Take the Fibonacci extension tool on a charting platform and use January 23rd as point one. Go down from there to the third swing low of July 2nd as point two. From there make the point three at the July 27th high which gives the Fibonacci extension target area for the 7th swing that was reached.

This double three correction is a typical and common Elliott Wave corrective structure. Previously mentioned earlier, this is correcting the cycle from the 2009 low. It’s possible the index only sees a bounce that would fail to achieve new highs above the January 2018 highs. If so, it could see another corrective pullback similar in time and price of the one that appears ended at the October 2018 lows before resuming the uptrend. At this point in time the preferred view is while pullbacks remain above the October 26th lows it can resume the longer term bullish trend.

Thanks for looking and feel free to come visit our website and check out our services Free for 14 days and see if we can be of help.

Kind regards & good luck trading.

Lewis Jones of the ElliottWave-Forecast.com Team

Back