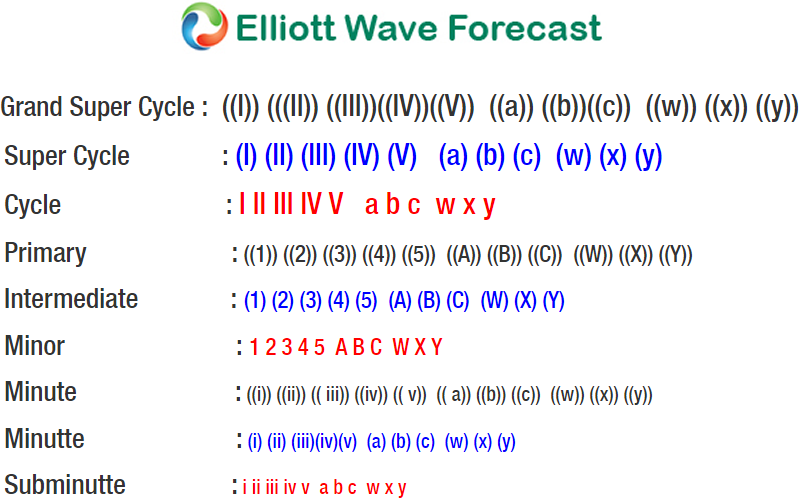

SPX Intra Day Elliott Wave view suggests that rally from 11.15 low at 2557.45 is unfolding as an Ending Diagonal where Minor wave 1 ended at 2665.19 and Minor wave 2 pullback ended as a zigzag correction at 2624.19 low. Minor wave 3 is in progress as a double correction with a target of 2731 – 2757. Up from 2624.19, Minutte wave (a) of ((w)) ended in 5 waves at 2671.88 high, where internals of that leg Subminutte wave i ended at 2633.66, Subminutte wave ii ended at 2626.53 low, Subminutte wave iii ended at 2669.72, Subminutte wave iv ended at 2663.49 and Subminutte wave v of (a) ended at 2671.88 peak. Index then pullback in Minutte wave (b) which ended 2651.78 low and Minutte wave (c) of ((w)) rally ended in another 5 waves at 2694.97 peak.

Minute wave ((x)) pullback is proposed complete at 2676.11 in 3 waves correction where Minutte wave (a) ended at 2680.78, Minutte wave (b) ended at 2691.01, and Minutte wave (c) of ((x)) ended at 2676.11. However, the Index still needs to break above Minute wave ((w)) at 2694.97 to add validity for this view and until then a double correction in Minute wave ((x)) can’t be ruled out. Near term, while pullbacks stay above 2676.11, but more importantly above 2624.19, expect the Index to extend higher. If the Index breaks below 2676.11 from here, then it is doing a double correction in Minute wave ((x)) and can open extension lower to 2669 – 2673 before the rally resumes. We don’t like selling the Index.