SPX is expected to rally further and set new record highs

SPX recovery from the March 2020 lows was remarkable. This was amidst skeptics favoring lower, as it was believed to have started crashing. Little did they know that it was setting up to make new, never seen before highs. From the March 2020 lows, we saw a relatively sharp and steady rise in the index.

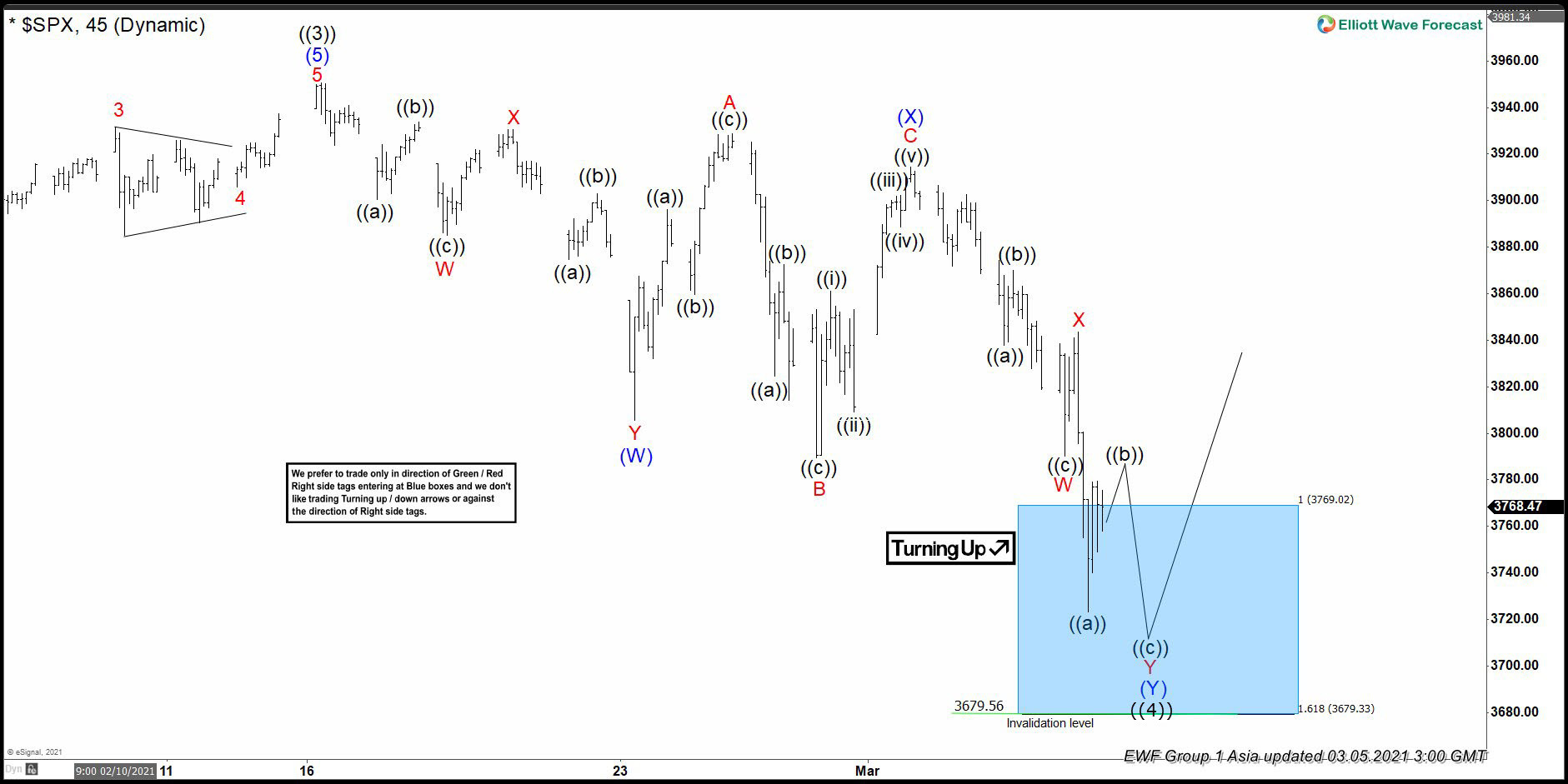

We completed red wave ((3)) in the 3950 area, as shown in the chart below. As per Elliott Wave theory, wave ((3)) would have been an impulse. Naturally, we expect the subdivisions within the third wave to also be impulses of a lesser degree. In other words, the intermediate or blue impulse waves.

Elliott Wave 1 Hour chart from 3/5/2021

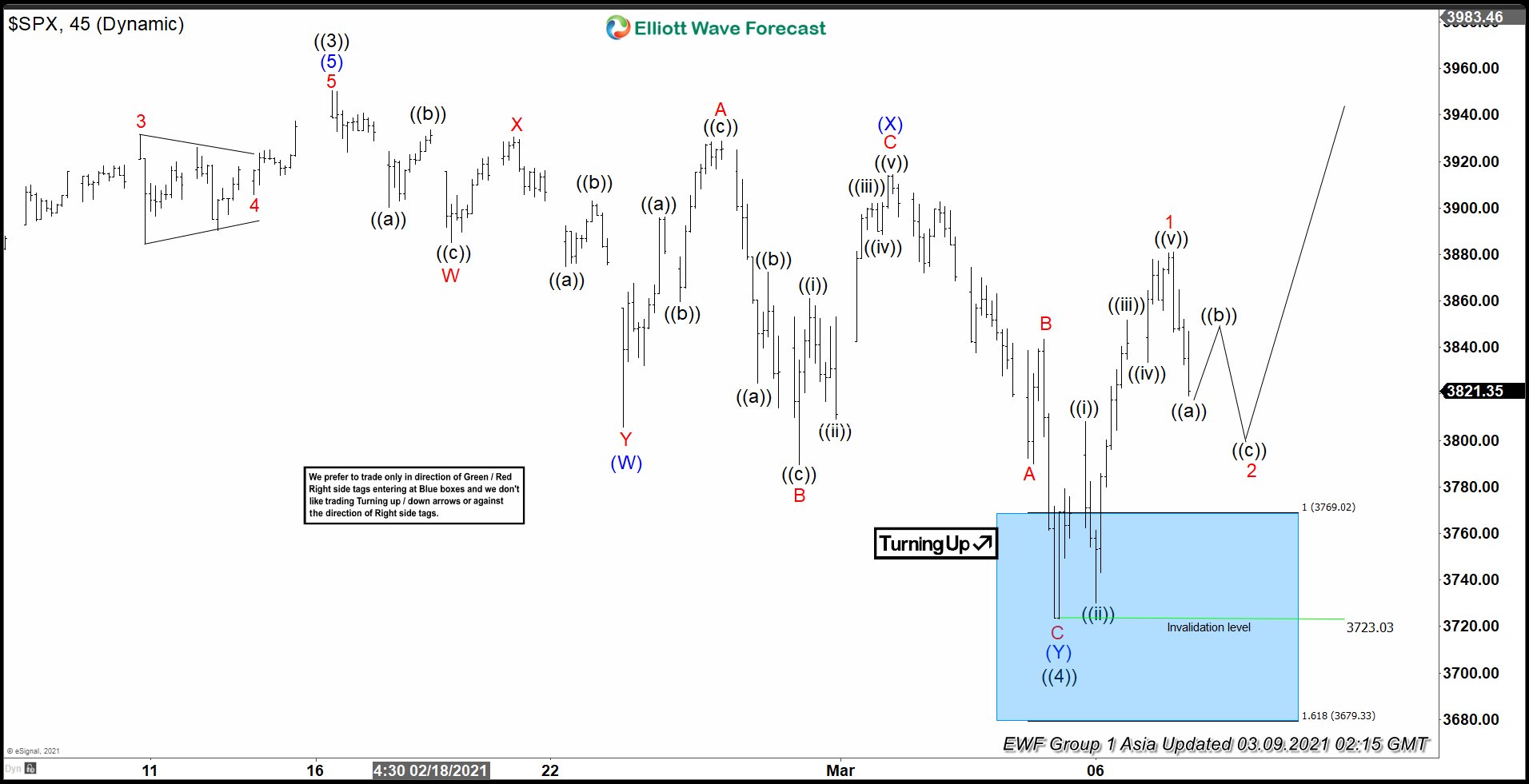

The chart below is from 3/9/2021. We see in it that black wave ((3)) was followed by what was favored to be a correction in ((4)). We saw 7 swings in ((4)) reaching the blue box. As per our system, we expect a reaction higher from the blue box. Indeed, we saw the expected reaction higher as shown in the chart below. We proposed wave ((4)) low to have set at 3723.76. And we expect more upside while price stays above there.

Theoretically, we need to see a break above ((3)) peak. After such a break above, we can then confirm a leg higher in ((5)). This is because we cannot rule out a double correction lower in ((4)) while price is below wave ((3)) peak. Long positions from the blue box were already running risk free as at 3/9/2021. And since we broke above wave ((3)) peak, we will be looking for dips in 3, 7 or 11 swings to add to our long positions from the blue box.

Elliott Wave 1 Hour chart from 3/9/2021

In the chart below, we see further extension higher in SPX. One should note that the degrees were revised, and it is still favored in ((3)). However, this does not change the view on long positions from the blue box. We saw the extension higher from the blue box as we had correctly anticipated. The right side remains upside.

Learn more about our blue box system, and a lot more about how we approach the market. Subcribe to our 14 Day Free Trial today!!

Learn more about our blue box system, and a lot more about how we approach the market. Subcribe to our 14 Day Free Trial today!!