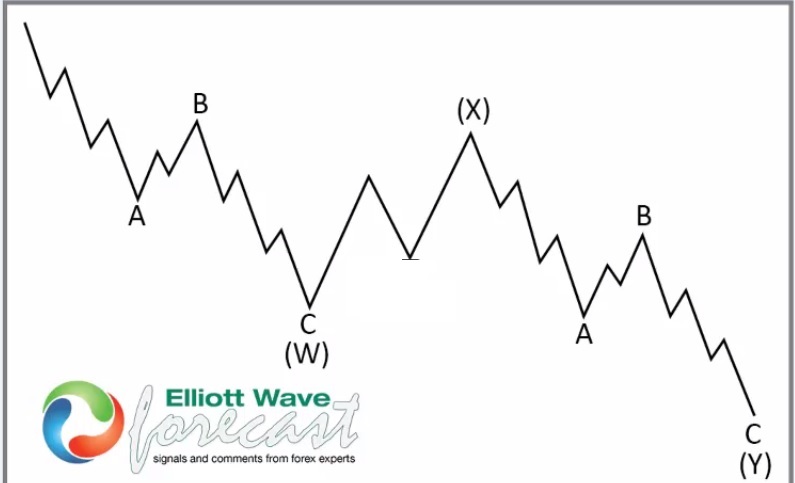

7 Swings WXY correction

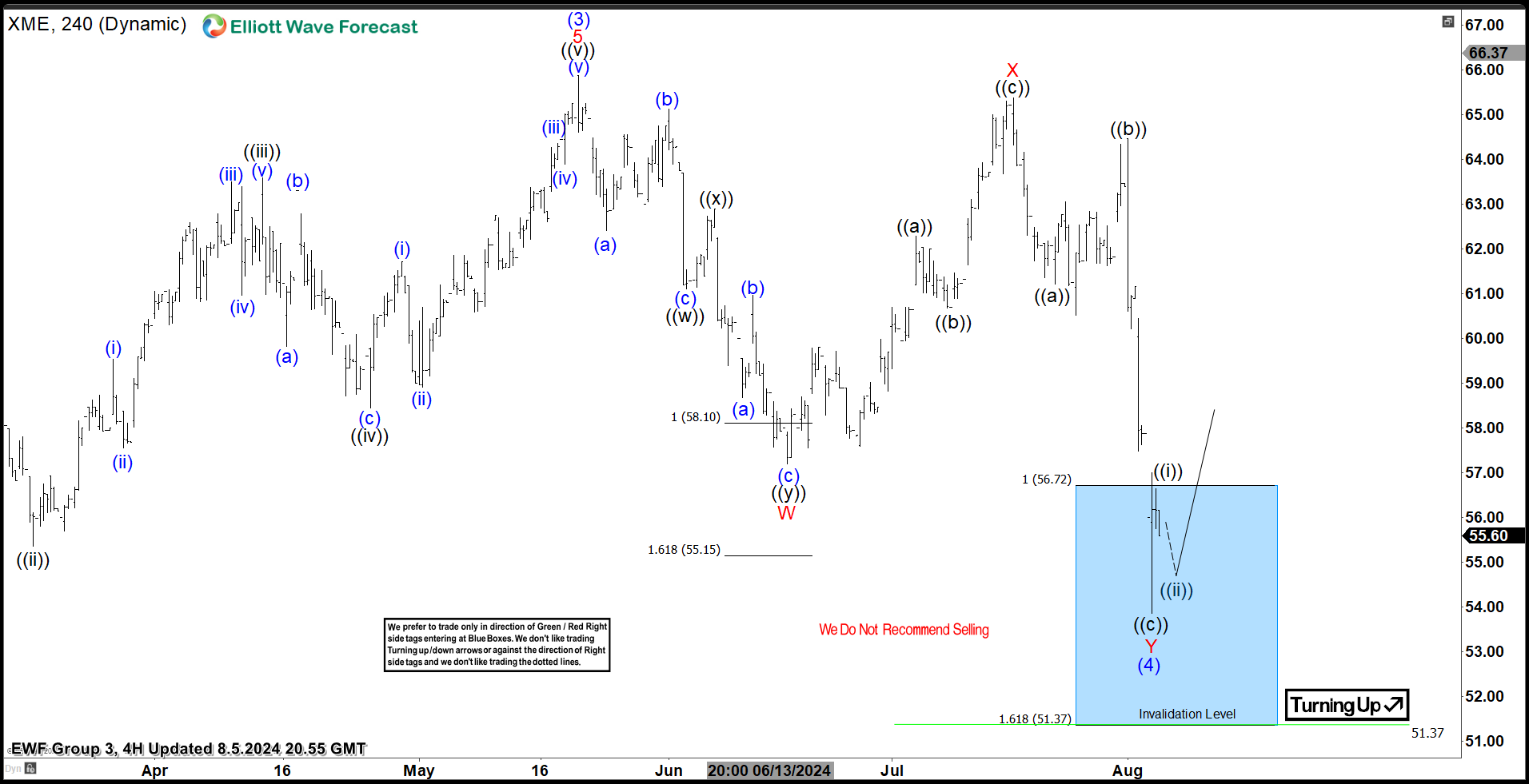

$XME 4H Elliott Wave Chart 8.05.2024:

Here is the 4H Elliott Wave count from 8.05.2024. The 5 wave impulsive cycle from 5.31.2023 ended on 5.21.2024 at blue (3) and started a pullback. We expected the pullback to find buyers at the blue box area at 56.72 – 51.37 in 7 swings.

Here is the 4H Elliott Wave count from 8.05.2024. The 5 wave impulsive cycle from 5.31.2023 ended on 5.21.2024 at blue (3) and started a pullback. We expected the pullback to find buyers at the blue box area at 56.72 – 51.37 in 7 swings.

$XME 4H Elliott Wave Chart 8.11.2024:

Here is the latest 4H update from 8.11.2024, showing the bounce taking place as expected. The cycle from the peak at red X has ended and the ETF has reacted higher from the blue box area allowing longs to get risk free. The ETF is expected to remain supported with a target area towards $68 – 72 area before another pullback can happen. Alternatively, the bounce can fail and continue lower in a 11 swings correction so chasing now can be risky. A break of blue (3) high will confirm the next leg higher and negate the possibility of a double correction.

Here is the latest 4H update from 8.11.2024, showing the bounce taking place as expected. The cycle from the peak at red X has ended and the ETF has reacted higher from the blue box area allowing longs to get risk free. The ETF is expected to remain supported with a target area towards $68 – 72 area before another pullback can happen. Alternatively, the bounce can fail and continue lower in a 11 swings correction so chasing now can be risky. A break of blue (3) high will confirm the next leg higher and negate the possibility of a double correction.

Elliott Wave Forecast

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for 14 days Trial nowand get access to new trading opportunities.

Welcome to Elliott Wave Forecast!