Gaming is one of the sectors that has really taken the spot light since COVID-19 hit the world by storm. Some companies in this sector have vastly outperformed the marketplace since the March 2020 low. Sea Ltd. is one of those stocks that have had explosive upside since the low that printed in March 2020. It is an internet service provider company. It offers Digital Entertainment, E-Commerce and Digital Financial Services known as Garena, Shopee and AirPay. The company operates primarily in Indonesia, Taiwan, Vietnam, Thailand, Philippines, Malaysia and Singapore.

SE is counting clean off the 2018 all time low low, lets take a look at the Daily chart below and then we’ll get into the shorter term 4H chart.

Sea Daily Elliott Wave View:

On a Daily Time Frame. From the 2018 lows, Sea Ltd. has a great looking structure that favours further extension higher in the future. Off the 2018 low of 10.06 on May 09, I am favouring an extended blue (I) wave in progress. From May 2018 to September 2020 Sea has had a very impulsive rally favoured to be peaked in Red III. Currently, it is favoured that Sea Ltd. is correcting in Red IV before moving higher into Blue (I). After that, a larger degree correction is favoured to take place.

It is favoured that 5 waves down for ((A)) of Red IV has been set, and a bounce in ((B)) is underway. Lets take a look at the 4H chart below.

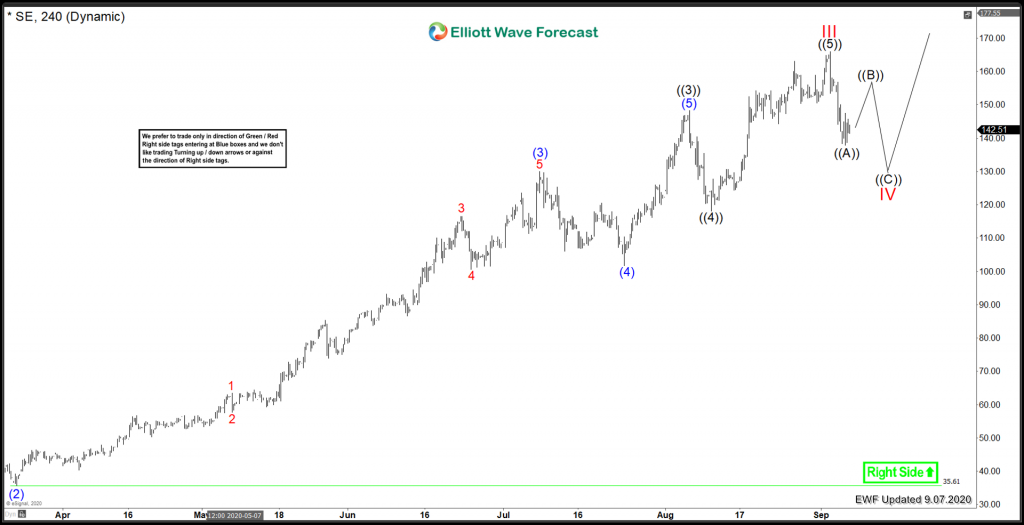

Sea Ltd. 4H Elliott Wave View:

Taking a look at the Medium term term view from 3/23/2020 lows of 35.61 where Blue (2) is set. An extended rally has taken place off that March 2020 low. Blue (3) peaked on 7/08 at 130.00 even. After that, blue (4) found a low on 7/24 at 101.70. After that, black ((3)) topped on 8/06 at 148.24. And black ((4)) bottomed on 8/11 at 118.08.

After That, Red III is favoured peaked on 9/02 at a price of 165.95. Red IV is currently underway. After Red IV is set, one more high is favored to complete the cycle from the 2018 lows.

In conclusion, the risk is getting higher to entertain new long positions with leverage. With that said, one more high is still favoured to take place, but 5th waves are usually not the most lucrative. Generally, if there has been an extended wave 3, the wave 5s usually are lack luster. This isn’t a hard fast rule, but true more often than not.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our free 14 day trial today.

Back