WOOD tracks the S&P Global Timber & Forestry Index, a cap-weighted index of the 25 largest forestry firms around the world. The fund starts with all the eligible securities from the S&P Global BMI that are classified under agriculture, forestry, homebuilding, and paper industry.

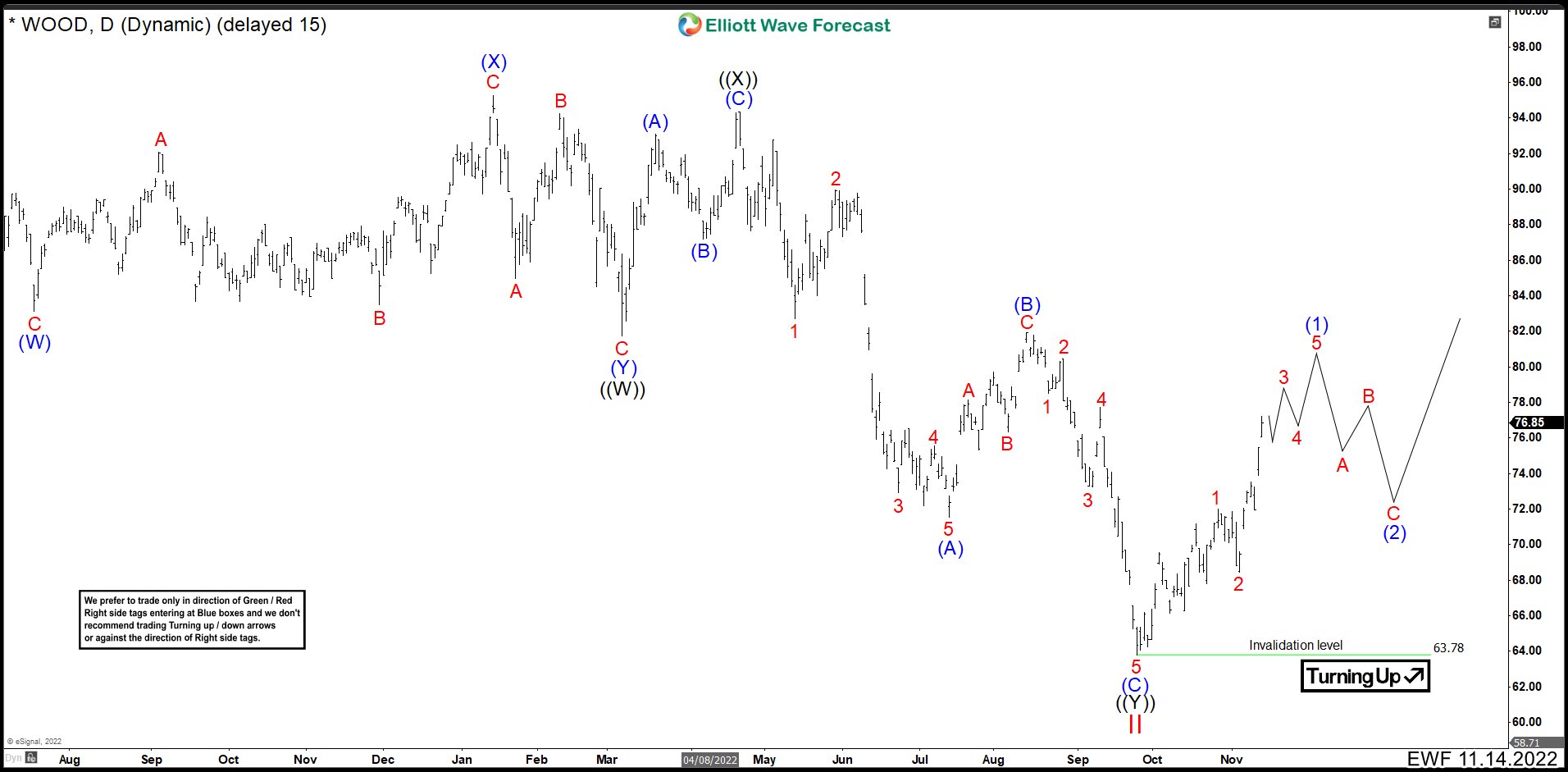

ETF WOOD Daily Chart

ETF WOOD ended an uptrend cycle in May 2021 reaching the 99.05 level. Since then, it began a corrective movement that was oscillating sideways for a year and then turned down. We have called the structure of this retracement a double correction ((W)), ((X)) and ((Y)), which ended in September 2022. (If you want to learn more about double correction or Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

ETF WOOD ended an uptrend cycle in May 2021 reaching the 99.05 level. Since then, it began a corrective movement that was oscillating sideways for a year and then turned down. We have called the structure of this retracement a double correction ((W)), ((X)) and ((Y)), which ended in September 2022. (If you want to learn more about double correction or Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

From 99.05 we can see that we had a double correction ending at 81.69 as ((W)). Connector ((X)) bounced in 3 waves ending at 94.35 to continue the drop. The decline started strongly, ending wave (A) of ((Y)) at 71.50 as an impulse. Then we saw a retracement (B) reaching 81.93, to fall again in wave (C). This completed a zigzag structure ((Y)) at 63.78 and wave II.

Since then, the rally has continued and appears to be building an impulse. Wave 1 made a leading diagonal that ended at 72.02. Wave 2 pullback ended at 68.51 and the market moved higher again. We now expect to complete an impulse as wave (1), as the chart indicates, and then see a retracement in 3, 7, or 11 swings as wave (2). This retracement must hold above 68.51 for the count to be valid and continue with the rally.

TAKE 14 DAYS TRIAL

Elliottwave Forecast updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Let’s trial 14 days for only $9.99 here: I want 14 days trial. Cancel Any time.