The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

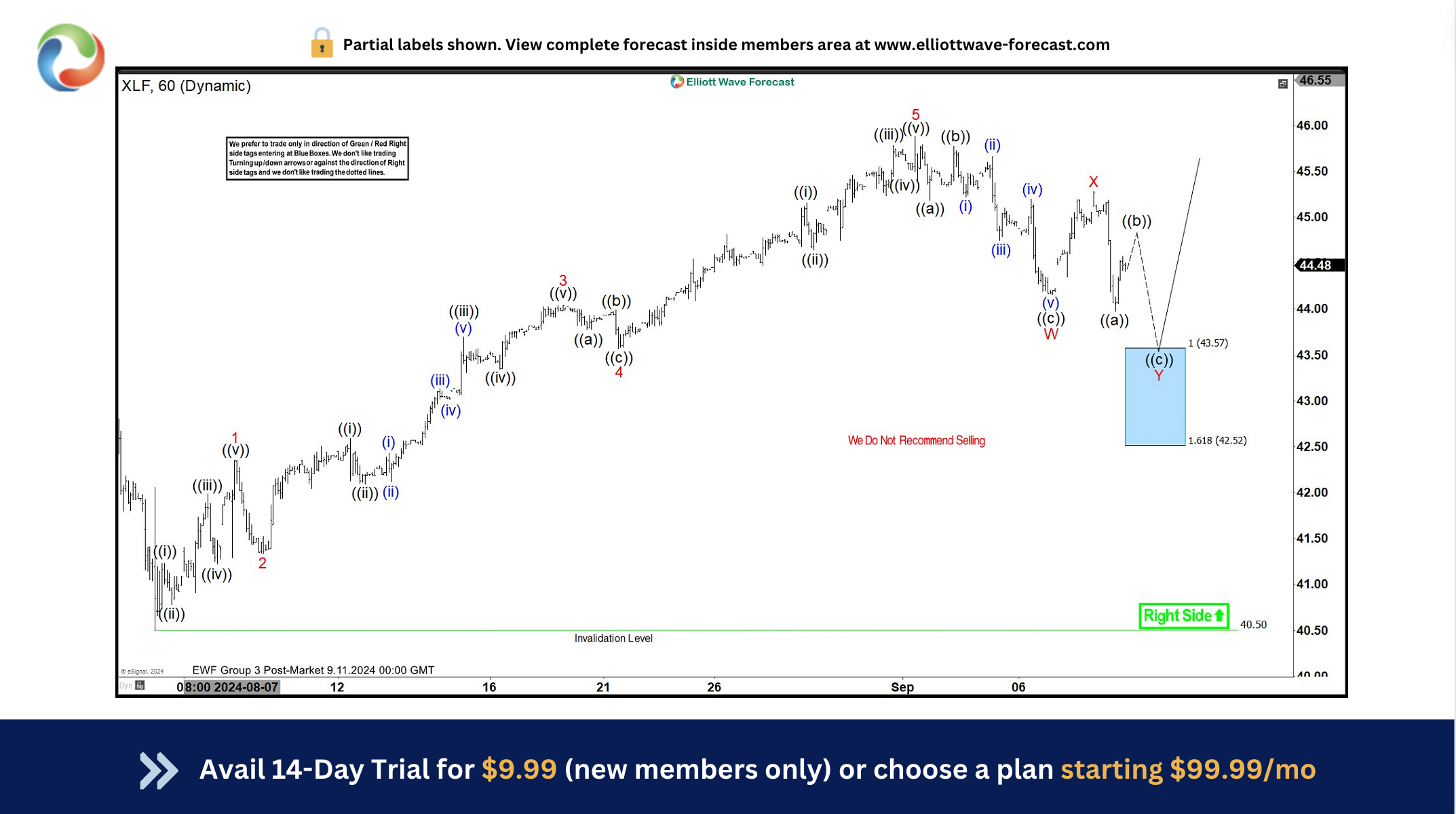

XLF Reaction Before & After Reaching The Blue Box Area

Read MoreIn this technical blog, we are going to take a look at the past performance of 1 hour Elliott Wave Charts of XLF a Financial ETF, which we presented to members at elliottwave-forecast.com. In which, the rally from 05 August 2024 lows, showed the higher high sequence in higher time frame charts favored more strength. Also, the right side tag […]

-

Will Berkshire Hathaway (BRK.B) Continue Rally Or Correcting Soon?

Read MoreBerkshire Hathaway Inc., (BRK.B) is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States. It operates as Insurance as major operations along with subsidiaries operate in diverse sectors such as confectionery, retail, railroads, home furnishings, machinery, jewelry, apparel, electrical power & natural gas distribution. It trades as “BRK.B” ticker at NYSE & […]

-

AT&T Inc. (T) Reacted from the Blue Box and Rally Must Continue

Read MoreAT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. AT&T (T) Monthly Chart April 2024 […]

-

Elliott Wave View on Gold Miners ETF (GDX) Expects Continuation of Bullish Trend

Read MoreGold Miners ETF (GDX) has ended correction to cycle from early August low and turned higher. This article and video look at the Elliott Wave path.

-

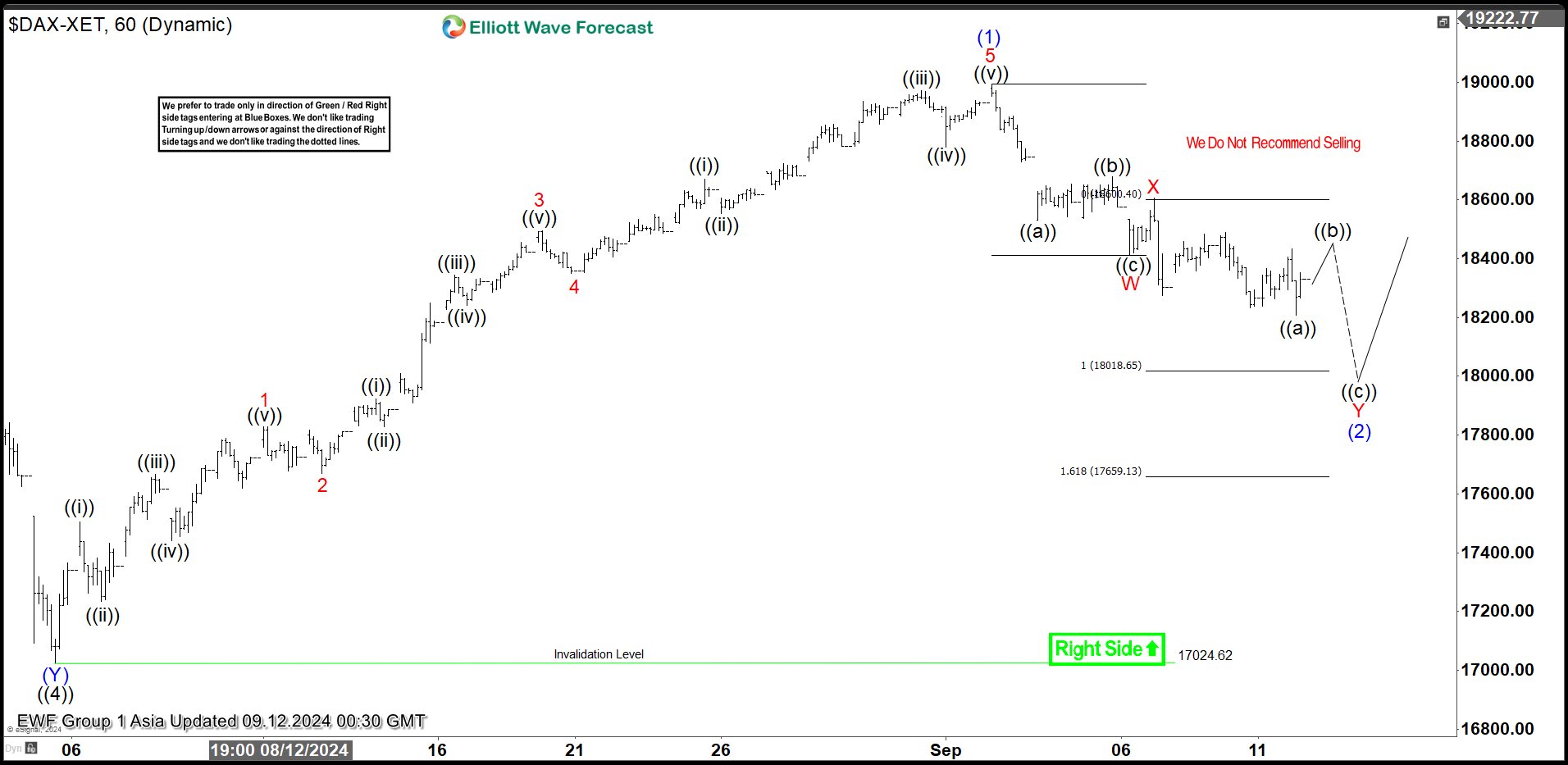

Elliott Wave Intraday Analysis Expects DAX to Turn Higher Soon

Read MoreDAX is correcting cycle from 8.5.2024 low in 3 or 7 swing before it resumes higher. This article and video look at the Elliott Wave path for the Index.

-

MicroStrategy ( MSTR ) Potential Daily Buying Area

Read MoreMicroStrategy (NASDAQ: MSTR) is currently still one of the best performing stocks of 2024. In our previous article, we explained the bullish nature of the impulsive structure taking place and what we expect next. In this article, we’ll take a look at the current correction and highlight the potential buying area. MSTR ended the impulsive 5 waves advance at $200 […]