The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

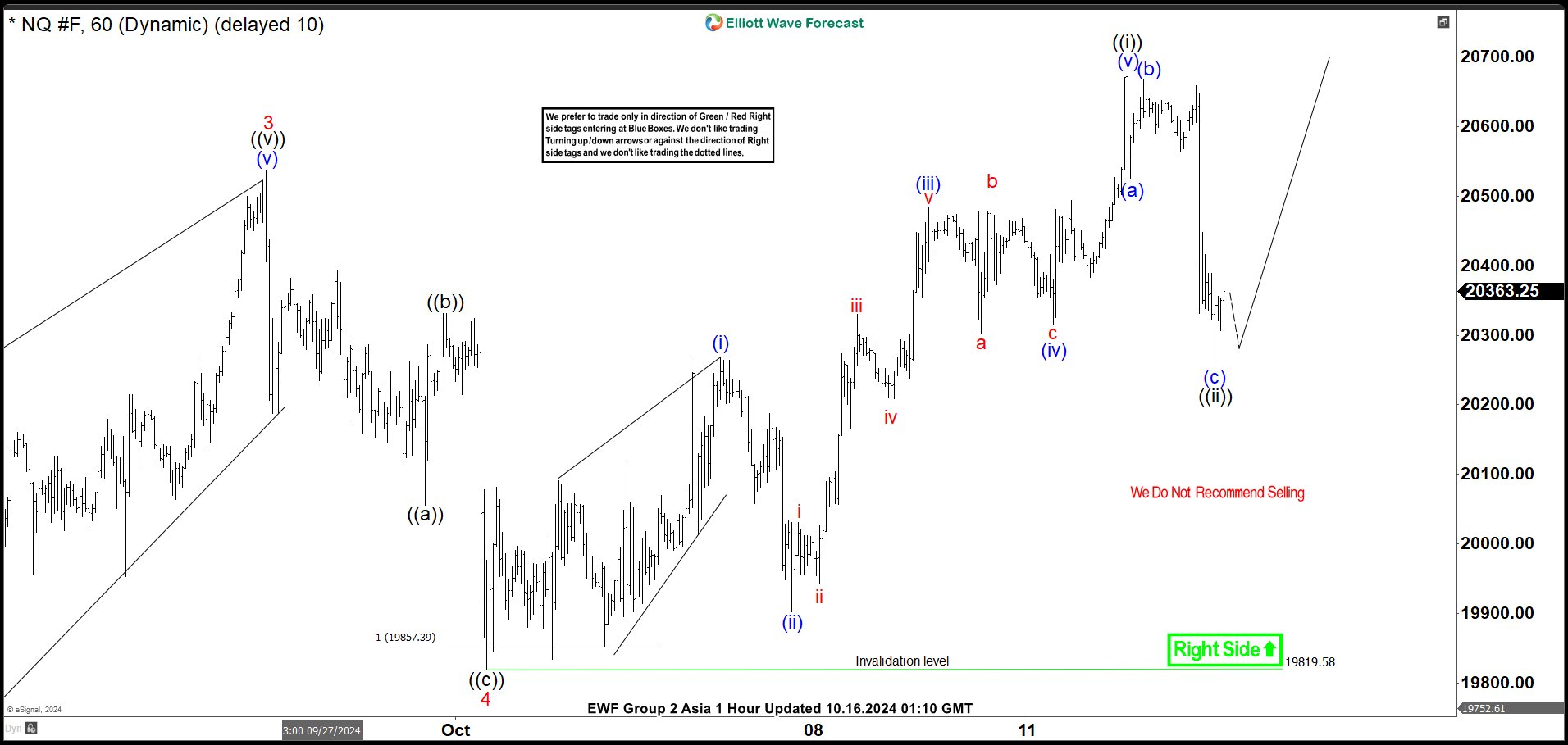

Nasdaq Futures (NQ) Favoring Upside Due to 5 Swing Elliott Wave Sequence

Read MoreNasdaq (NQ) shows 5 swing sequence from August 5, 2024 low favoring further upside. This article and video look at the Elliott Wave path.

-

Elliott Wave Expects Nvidia (NVDA) to Extend Impulsive Rally

Read MoreNvidia (NVDA) is looking to resume higher in impulsive rally. This article and video look at the Elliott Wave path of the stock.

-

Elliott Wave Suggests Double Correction in META to Provide Buying Opportunity

Read MoreMETA is looking to do a double three Elliott Wave correction and it will provide buying opportunity. This article and video look at the Elliott Wave path.

-

Elliott Wave Suggests Dow Futures (YM) Will Break to New All-Time High

Read MoreDow Futures (YM) ended correction and will break to new all-time high. This article and video look at the Elliott Wave path of the Index.

-

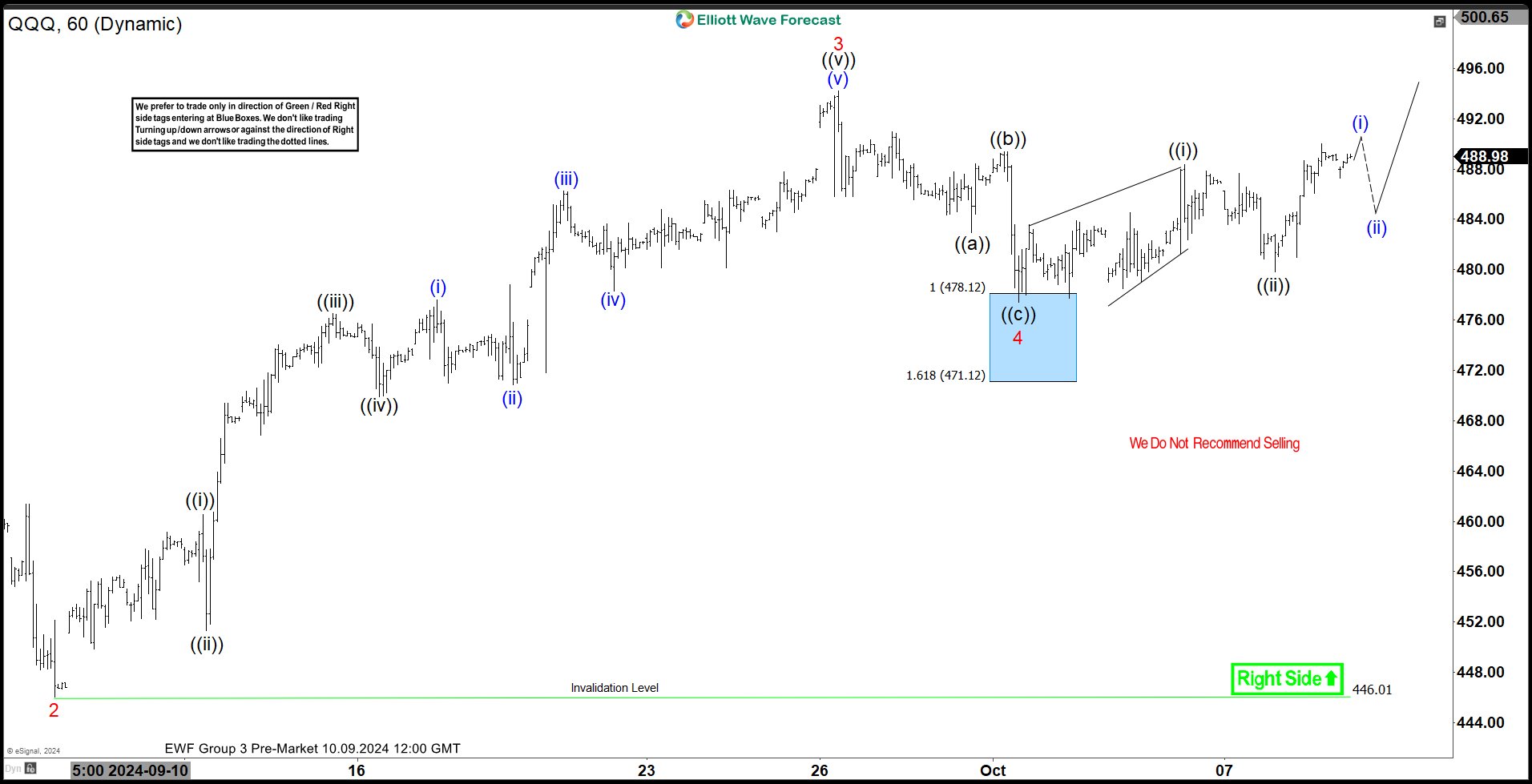

QQQ (Nasdaq ETF) reaches risk free area from blue box

Read MoreHello traders. Welcome to a new ‘blue box’ blog post where we discuss our most recent trade setups shared with Elliottwave-Forecast members. In this one, we will discuss the Qs – QQQ (Investico QQQ ETF). The Invesco QQQ ETF tracks the Nasdaq-100 Index, focusing on 100 large non-financial companies, mainly in technology, healthcare, and consumer […]

-

![PLTR [Palantir] Elliott Wave Structure Calls for New All Time Highs](https://elliottwave-forecast.com/wp-content/uploads/2024/10/PLTR-W20241008212241.jpg)

PLTR [Palantir] Elliott Wave Structure Calls for New All Time Highs

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers, and acquisitions solutions. PLTR has been rallying strongly since forming a low in December 2022. The rally has gained […]