The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Robinhood (NASDAQ: HOOD) Extension in Wave III Above $50

Read MoreSince our previous blog about Robinhood stock HOOD, the price tripled during a strong bullish upside move. Therefore, we’ll be looking at the daily Elliott Wave Structure and explain the current structure within the cycle. The recent daily rally started in August 2024, HOOD established an impulsive 5 waves structure to the upside within wave III. In addition, it exceeded […]

-

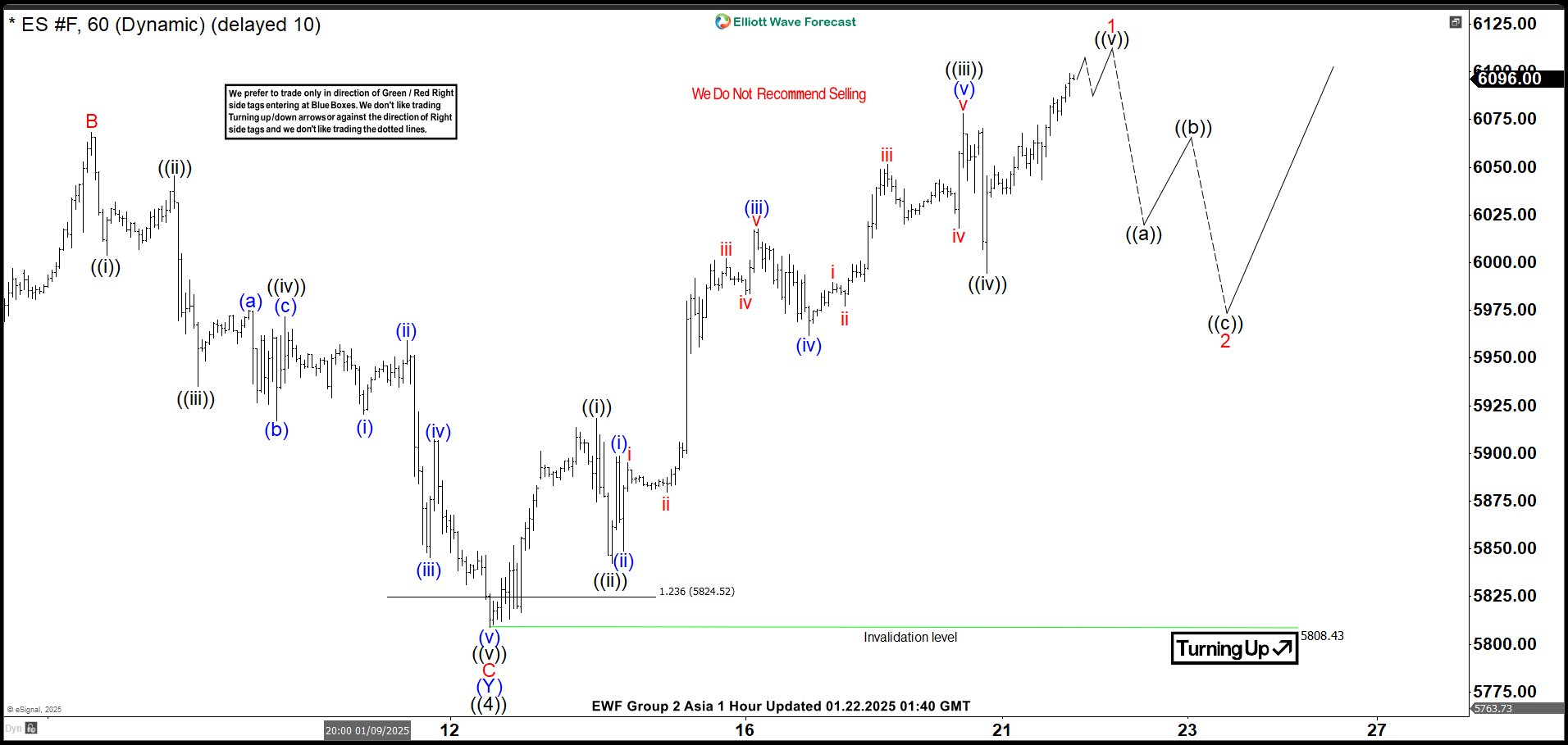

Elliott Wave View on S&P 500 Futures (ES) Looking to Resume Higher

Read MoreS&P 500 Futures (ES) is looking to resume higher in wave 5. This article and video look at the Elliott Wave path of the Index.

-

XLY Elliott Wave Rally Call: Near-Perfect Setup, Missed Entry

Read MoreHello fellow traders. As many of you know, we’ve had many profitable trading setups recently, some of which we’ve shared in previous blogs and on StockTwits and Twitter. In this technical article, we’re going to present something a bit different—an Elliott Wave setup that almost hit our entry point, missing it by just 0.67 points. […]

-

NASDAQ (NQ): Two Scenarios That Show Perfect Setup For Traders

Read MoreNASDAQ E-Mini Futures (NQ) appears to be extending the bullish sequence from October 2022. Will the sequence finish soon and lead to a big sell-off across the US indices? While the sequence persists, where should traders eye the next opportunity? The NQ chart is very clear. After the markets recovered from Covid in March/April 2020, […]

-

Uranium Miners ETF (URA) Looking to Resume Higher

Read MoreThe Global X Uranium ETF (URA) is an investment vehicle aimed at tracking a market-cap-weighted index of companies in the uranium mining and nuclear components sector. URA has gained attention due to the resurgence in nuclear energy demand, particularly from tech and AI sectors, with its performance recently showing strong recovery and volatility, reaching near […]

-

NU Holdings (NU) Favors Corrective Bounce Before Lower

Read MoreNU Holdings Ltd., (NU) provides digital banking platform in Brazil, Mexico, Colombia, Germany, Argentina, United States & Uruguay. It offers spending solutions comprising credit & prepaid cards, mobile payment solutions & integrated mall that enables customers to purchase goods & services from various ecommerce retailers. It comes under Financial services sector & trades as “NU” […]