The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Market Volatility Leads to Palantir (PLTR), Bullish Sentiment Continues

Read MoreAbout Palantir Technologies Palantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. PLTR Daily Chart Analysis: February 8, 2025 PLTR daily chart showing wave V […]

-

GraniteShares Gold Trust ( BAR ) Weekly Bullish Sequence

Read MoreThe GraniteShares Gold Trust ( NYSEARCA: BAR ) is one of the lowest-cost, physically-backed gold ETFs on the market. Gold price keeps rising into new all time highs as demand for physicals shining metals surges, therefore, we’ll be looking at the weekly Elliott Wave structure within the cycle. BAR is currently showing an impulsive 3 […]

-

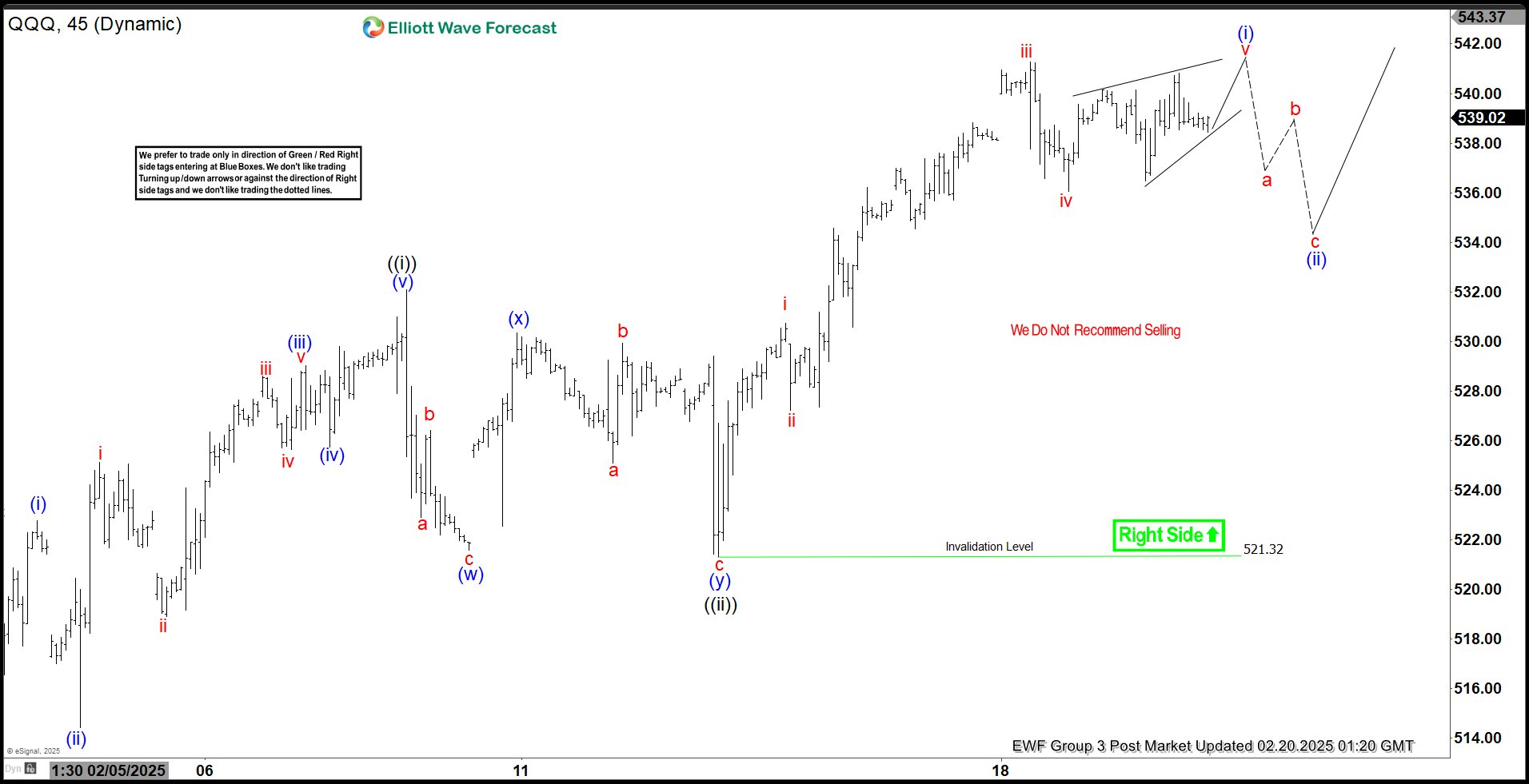

Elliott Wave View: Nasdaq 100 ETF (QQQ) Extending Higher

Read MoreNasdaq 100 ETF (QQQ) has broken to new all-time high favoring more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: S&P 500 (SPX) Breaking to New All-Time High

Read MoreS&P 500 (SPX) breaks to new all-time high favoring further upside. This article and video look at the Elliott Wave path of the Index.

-

Indraprastha Gas Ltd (IGL): Bullish Elliott Wave Outlook

Read MoreIndraprastha Gas Ltd (IGL) Shows a Promising Elliott Wave Setup, Indicating a Strong Bullish Trend with Clear Invalidation Levels Indraprastha Gas Ltd (IGL) displays a promising long-term bullish setup from an Elliott Wave perspective. The price action shows a clear impulsive structure over the years, supported by corrective phases that align with Elliott Wave principles. […]

-

Intuitive Machines (LUNR) Favors Rally Towards $26.73

Read MoreIntuitive Machines Inc., (LUNR) designs, manufactures & operates space products & services in the United States. Its systems & space infrastructure enable scientific & human exploration & utilization of lunar resources to support sustainable human presence on the moon. It comes under Industrial sector in Aerospace & Defense industry & trades as “LUNR” ticker at […]