The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Home Depot (HD) Elliott Wave Forecast: Key Levels for Buyers

Read MoreThe Home Depot (HD) stock prices are correcting the long term bullish trend. This could provide buyers will an opportunity in the coming days. This blog post will discuss the key price levels that should interest buyers from the Elliott wave perspective. Home Depot Company Overview and Market Position The Home Depot, Inc. leads the […]

-

Xiaomi Corp (1810.HK) Pulling Back in wave (IV)

Read MoreXiaomi Corporation (1810.HK), founded in 2010 and headquartered in Beijing, China, is a leading global technology company known for its innovative smartphones, IoT devices, and lifestyle products. Listed on the Hong Kong Stock Exchange since July 2018, it operates through four main segments: Smartphones, IoT and Lifestyle Products, Internet Services, and Others, offering a wide […]

-

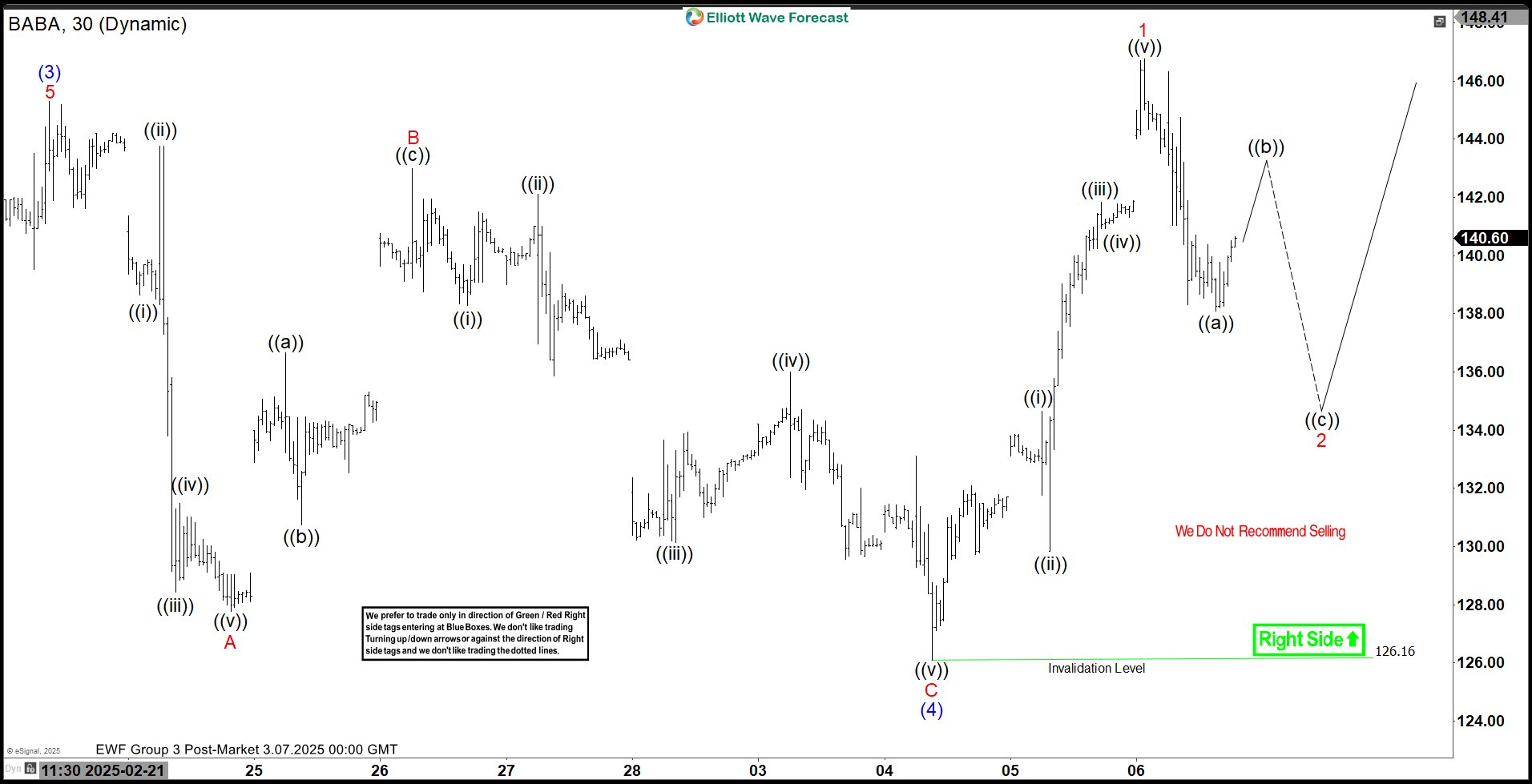

Elliott Wave View: Alibaba (BABA) Rallying in 5 Waves

Read MoreAlibaba (BABA) extends higher in wave 5 of an impulse. This article and video look at the short term Elliott Wave path of the stock

-

3M Company (MMM) Elliott Wave Forecast: A New Bullish Cycle Begins

Read MoreAfter completing a major Wave IV correction, 3M (MMM) is poised for a strong bullish trend as Wave V unfolds. Learn what’s next for the stock. 3M Company (MMM) has experienced a significant corrective phase after completing a major bullish cycle. The long-term Elliott Wave structure suggests that the stock has finished a multi-year Wave […]

-

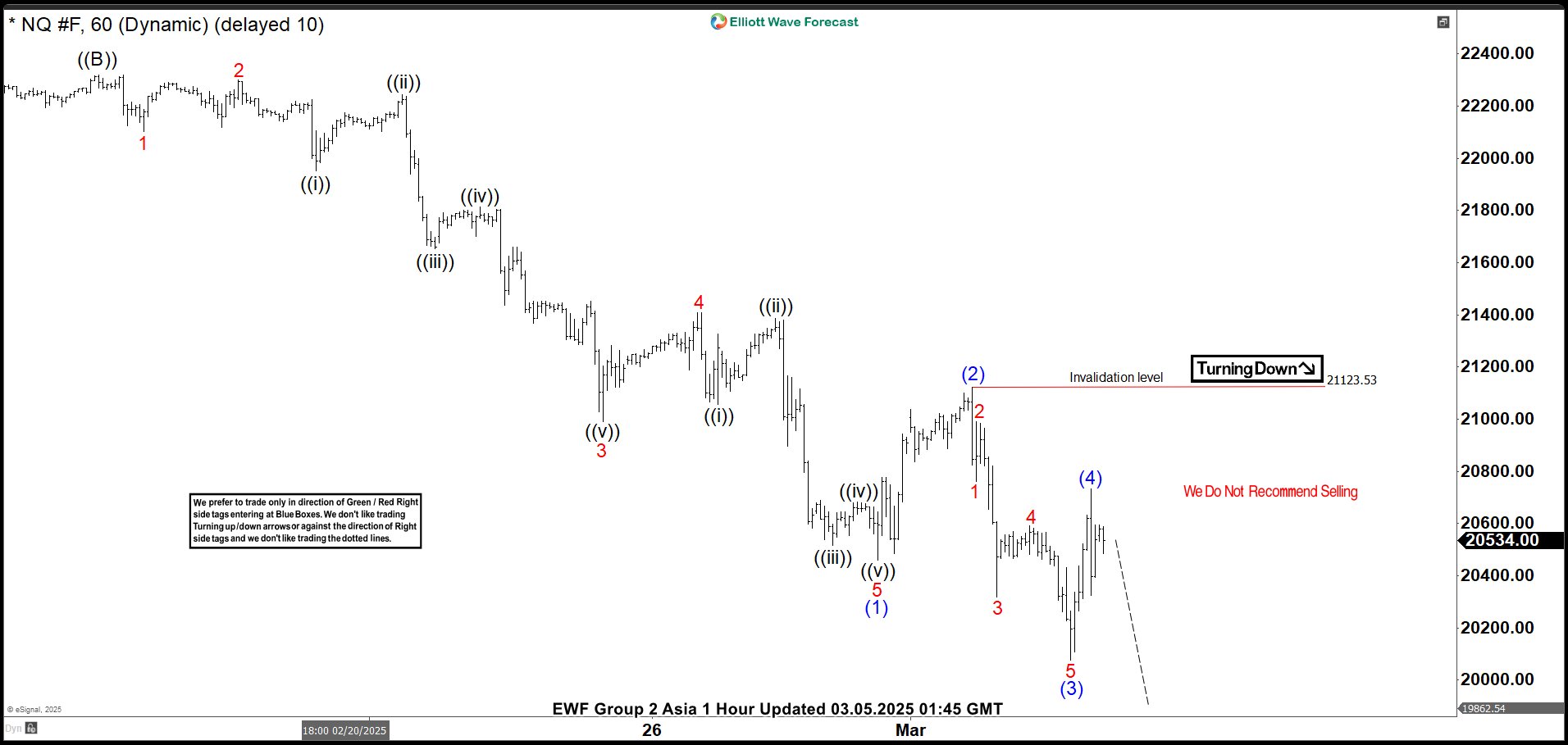

Elliott Wave View: Nasdaq (NQ) Has Reached Support Area

Read MoreNasdaq (NQ) has reached the extreme area from 12.14.2025 peak and soon may see support. This article and video look at the Elliott Wave path.

-

QuantumScape’s (QS) Shares: Waiting for the Spark to Ignite the Rally

Read MoreQuantumScape Corporation (QS) develops and commercializes solid-state lithium-metal batteries. These batteries power electric vehicles and other applications, delivering higher energy density and faster charging compared to traditional lithium-ion batteries. QS Weekly Technical Analysis: March 2025 Outlook QS weekly chart showing critical support break and potential final bearish phase before reversal The price action of QS […]