The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Can Micron (MU) Overcome the Market Hurdles for a Strong Rally?

Read MoreThe performance of Micron Technology Inc. (MU) stock has been a constant topic of interest in financial markets. Despite strong projections and a track record of innovation in the semiconductor industry, the ability of its stock to sustain a significant rally could be challenged by economic and sector-specific factors. In this article, we will explore […]

-

Visa Inc. (NYSE: V) 2022 Bullish Cycle Looking For New Highs

Read MoreVisa Inc. (NYSE: V) presented a good weekly buying opportunity in 2022 and it’s been rallying into new all time highs since then. Last year, we explained the Bullish Nest Structure taking place and the reasons to expect more upside for the stock. In this article, we continue exploring the bullish structure taking place within […]

-

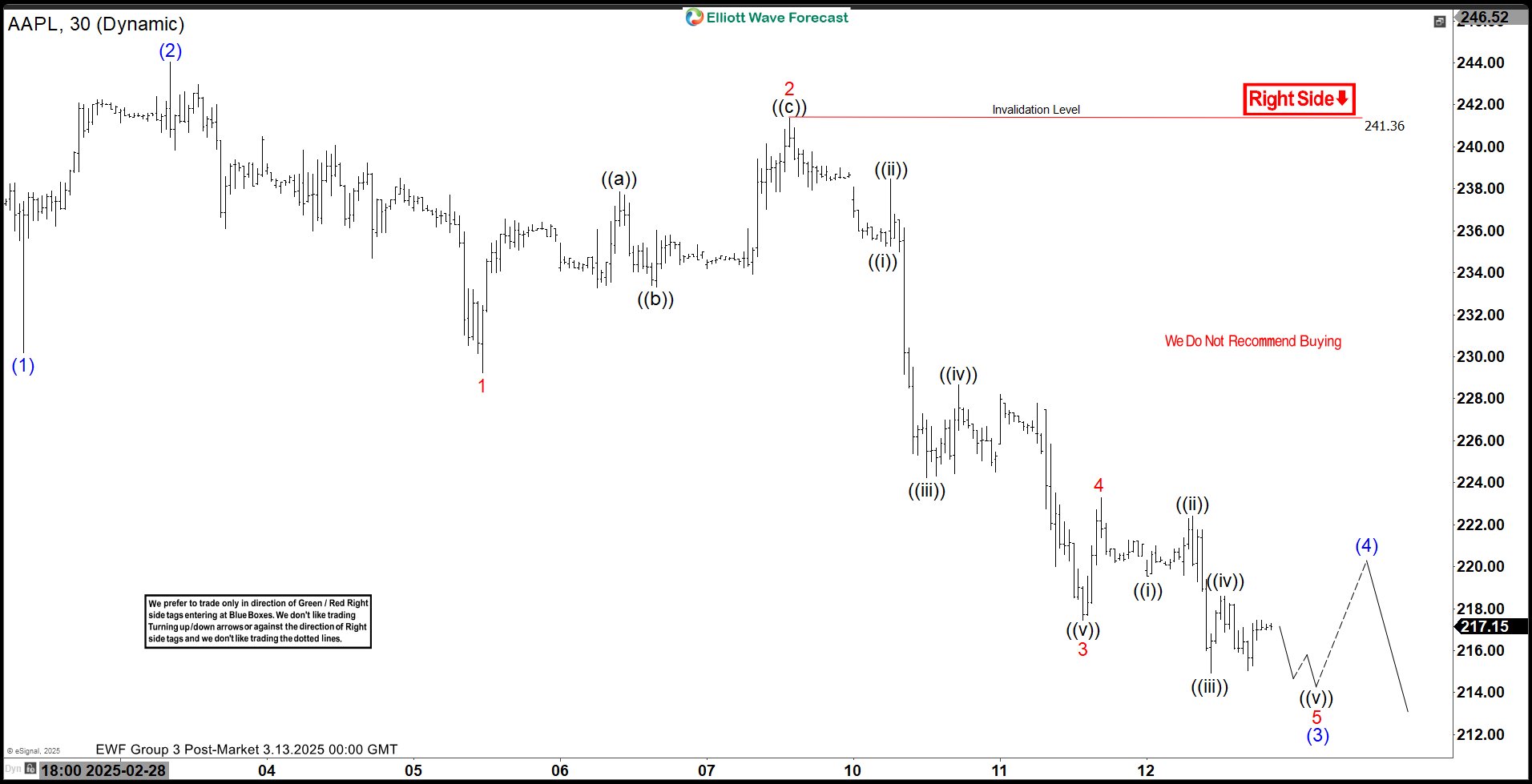

Elliott Wave View: Apple (AAPL) Should See Further Downside Within Bearish Sequence

Read MoreApple ( AAPL ) shows incomplete bearish sequence from 12.26.2024 peak and looking for further downside. Down from 12.26.2024 peak, wave ((A)) ended at 218.06 and wave ((B)) ended at 250. Wave ((C)) lower is in progress as a 5 waves impulse Elliott Wave structure. Down from wave ((B)), wave (1) ended at 230.2 and […]

-

Jet Blue: A Buying Opportunity and Definition Soon

Read MoreJet Blue Airways Corporation (JBLU), is a major U.S. airline headquartered in Long Island City, Queens, New York. Operating over 1,000 daily flights, it serves around 100 destinations across the Americas and Europe, with a focus on point-to-point travel and key hubs like New York’s JFK Airport. Known for its low-cost model paired with premium […]

-

Nike Inc. $NKE Blue Box Area Offered A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Nike Inc. ($NKE) through the lens of Elliott Wave Theory. We’ll review how the rally from the February 07, 2025, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 7 Swings WXY correction $NKE […]

-

Vistra (VST) Should Find Buyers In Support Zone

Read MoreVistra Corp., (VST) operates as an integrated retail electricity & power generation company in the United States. It operates through five segments like Retail, Texas, East, West & Asset Closure. It comes under Utilities sector & trades as “VST” ticker at NYSE. VST favors corrective pullback against March-2020 low in weekly. It expects to remain […]