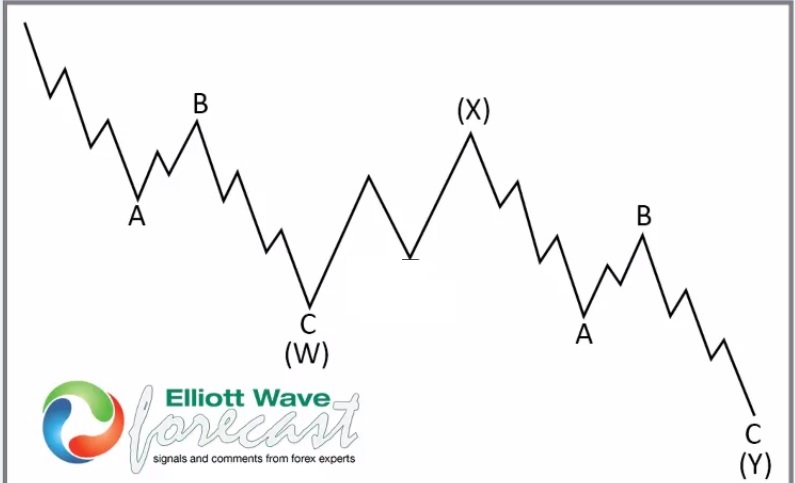

7 Swings WXY correction

$NKE 1H Elliott Wave Chart 3.03.2025:

In the 1-hour Elliott Wave count from March 03, 2025, we see that $NKE completed a 5-wave impulsive cycle beginning on February 07, 2025, and ending on February 26, 2025, at the blue (1). As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the equal legs area between $76.70 and $74.05.

This setup aligns with a typical Elliott Wave correction pattern (WXY), where the market pauses briefly before resuming the main trend.

$NKE 1H Elliott Wave Chart 3.10.2025:

The update, from March 10, 2025, shows that $NKE reacted as predicted. After the decline from the recent peak, the stock found support in the equal legs area, leading to a bounce. As a result, traders could adjust to go risk-free.

The update, from March 10, 2025, shows that $NKE reacted as predicted. After the decline from the recent peak, the stock found support in the equal legs area, leading to a bounce. As a result, traders could adjust to go risk-free.

Conclusion

In conclusion, our Elliott Wave analysis of Nike Inc. ($NKE) suggested that it could bounce in the short term. Therefore, traders should be risk-free and keep an eye out for any corrective pullbacks. By using Elliott Wave Theory, we can identify potential buying areas and enhance risk management in volatile markets.

Elliott Wave Forecast

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for 14 days Trial now and get access to new trading opportunities.

Welcome to Elliott Wave Forecast!