The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

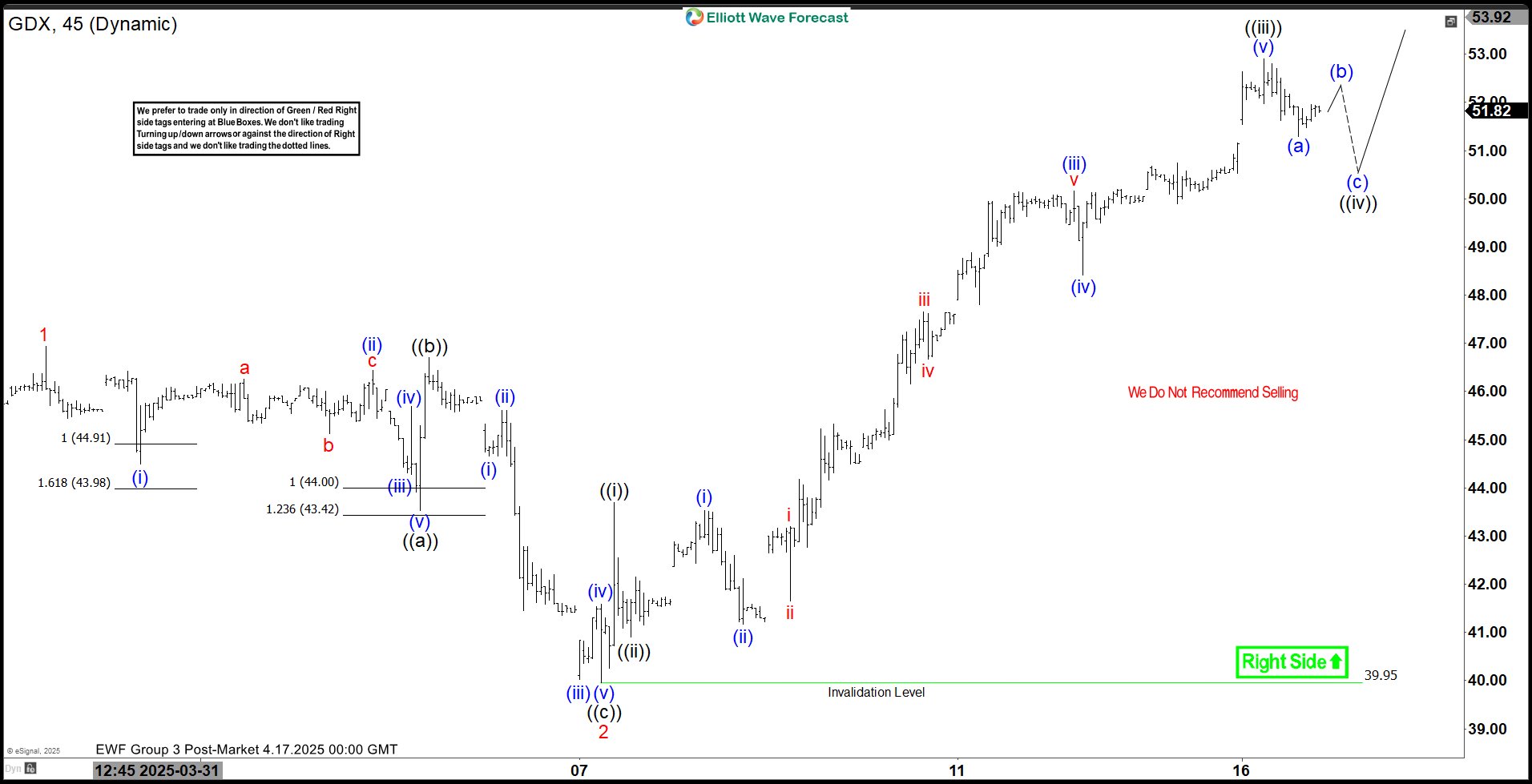

Elliott Wave Insight: Gold Miners ETF (GDX) Surges in Strong Nested Impulse

Read MoreGold Miners ETF (GDX) is rallying higher in a powerful nesting impulse. This article and video look at the Elliott Wave path.

-

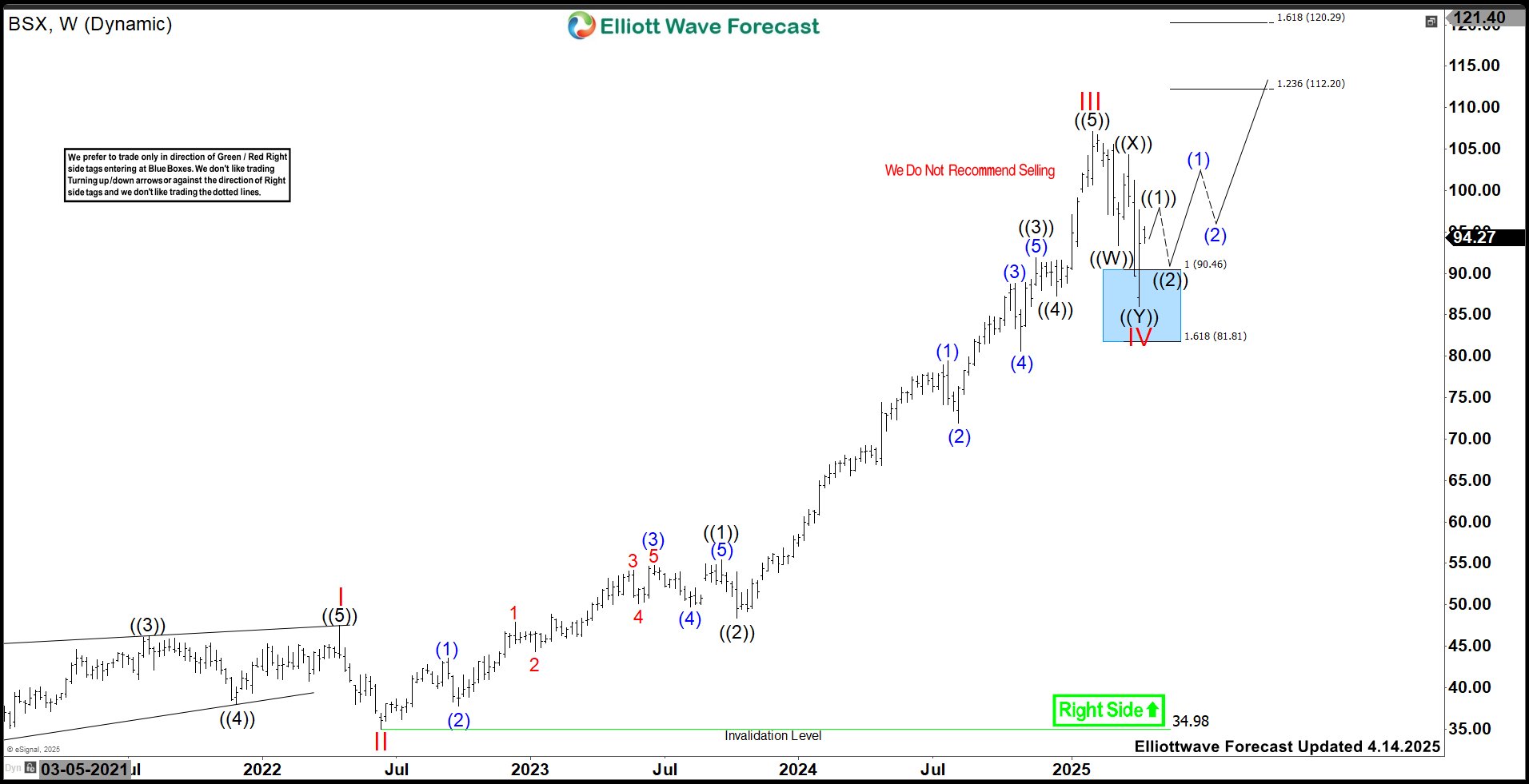

Boston Scientific (BSX) Poised For Rally Targeting $120.3

Read MoreBoston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions & offer remote patient management systems. It comes under Healthcare sector & trades as “BSX” ticker at NYSE. BSX favors […]

-

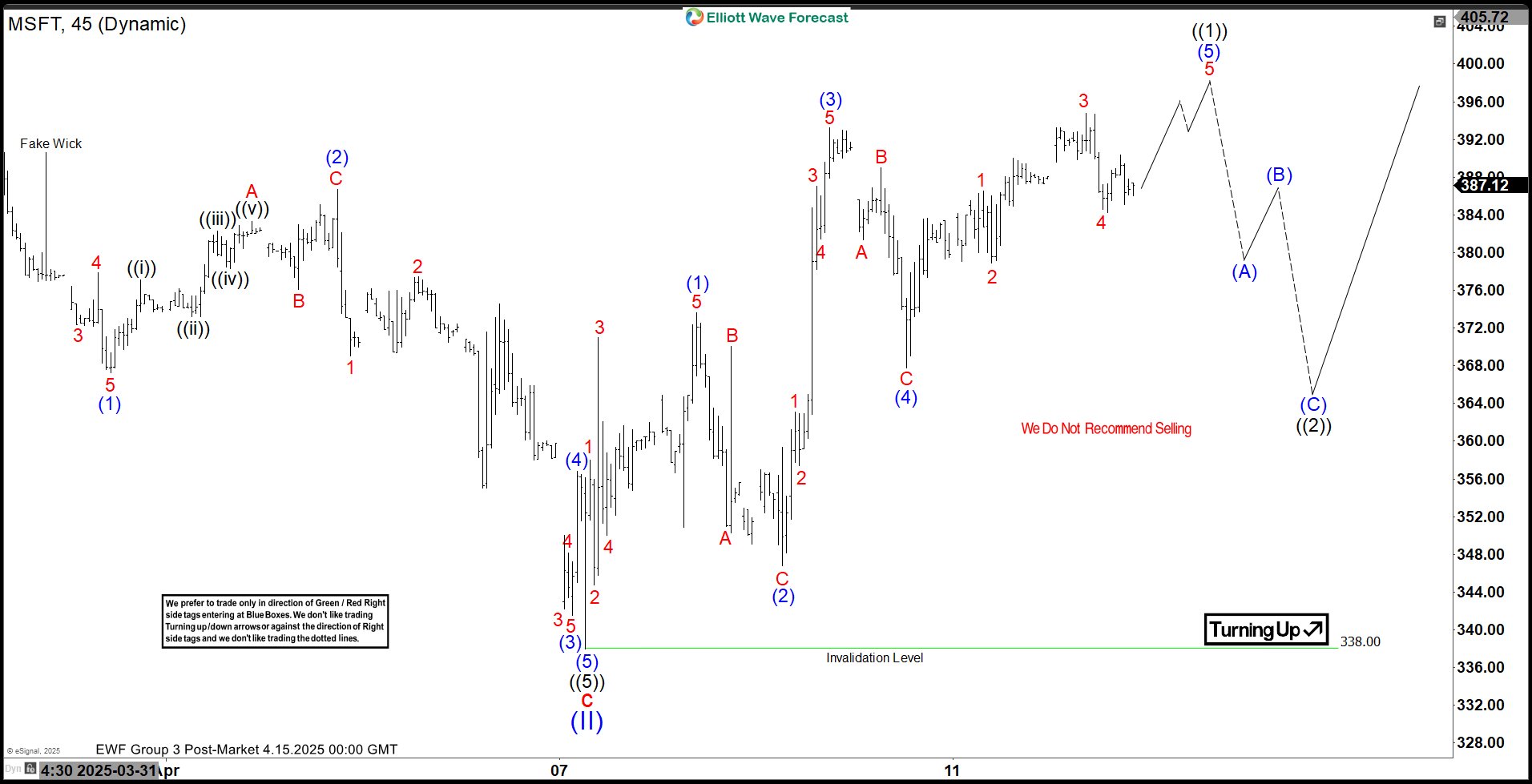

Microsoft (MSFT) Poised for Gains: Elliott Wave Analysis Signals the Next Leg Up

Read MoreAfter correction, Microsoft (MSFT) is charging into its next bullish phase. Our article & video break down Elliott Wave structure behind this rally

-

SPDR Metals & Mining ETF $XME Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of SPDR Metals & Mining ETF ($XME) through the lens of Elliott Wave Theory. We’ll review how the decline from the November 07, 2024, high unfolded as a big 3-swing correction and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

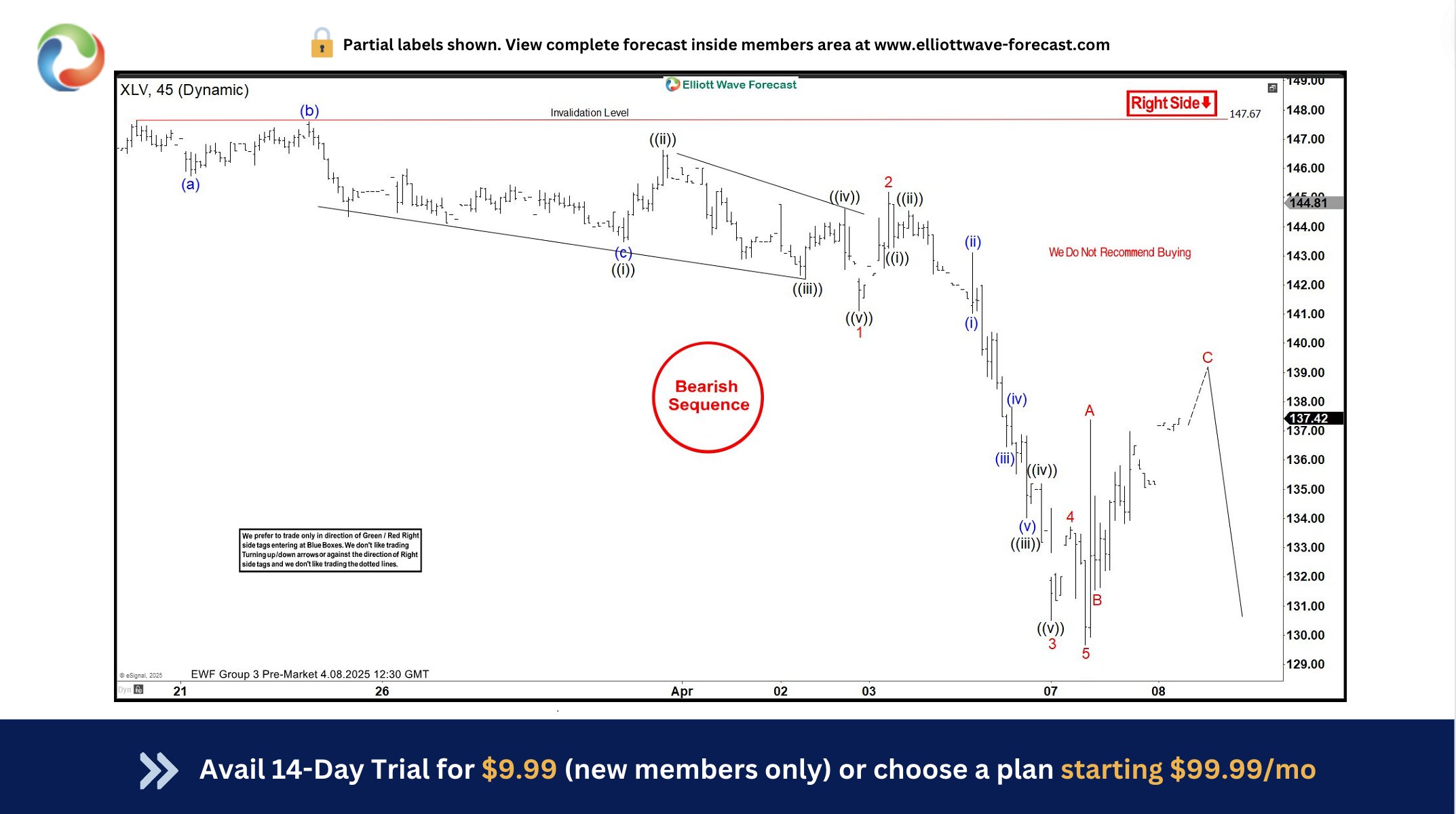

XLV Elliott Wave : Double Reaction from Equal Legs Zone

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of XLV ETF published in members area of the website. As our members know, XLV is showing incomplete bearish sequences in the cycle from the 159.64 peak (August high). The price structure indicated further weakness, targeting 126.53-120.91. In the following […]

-

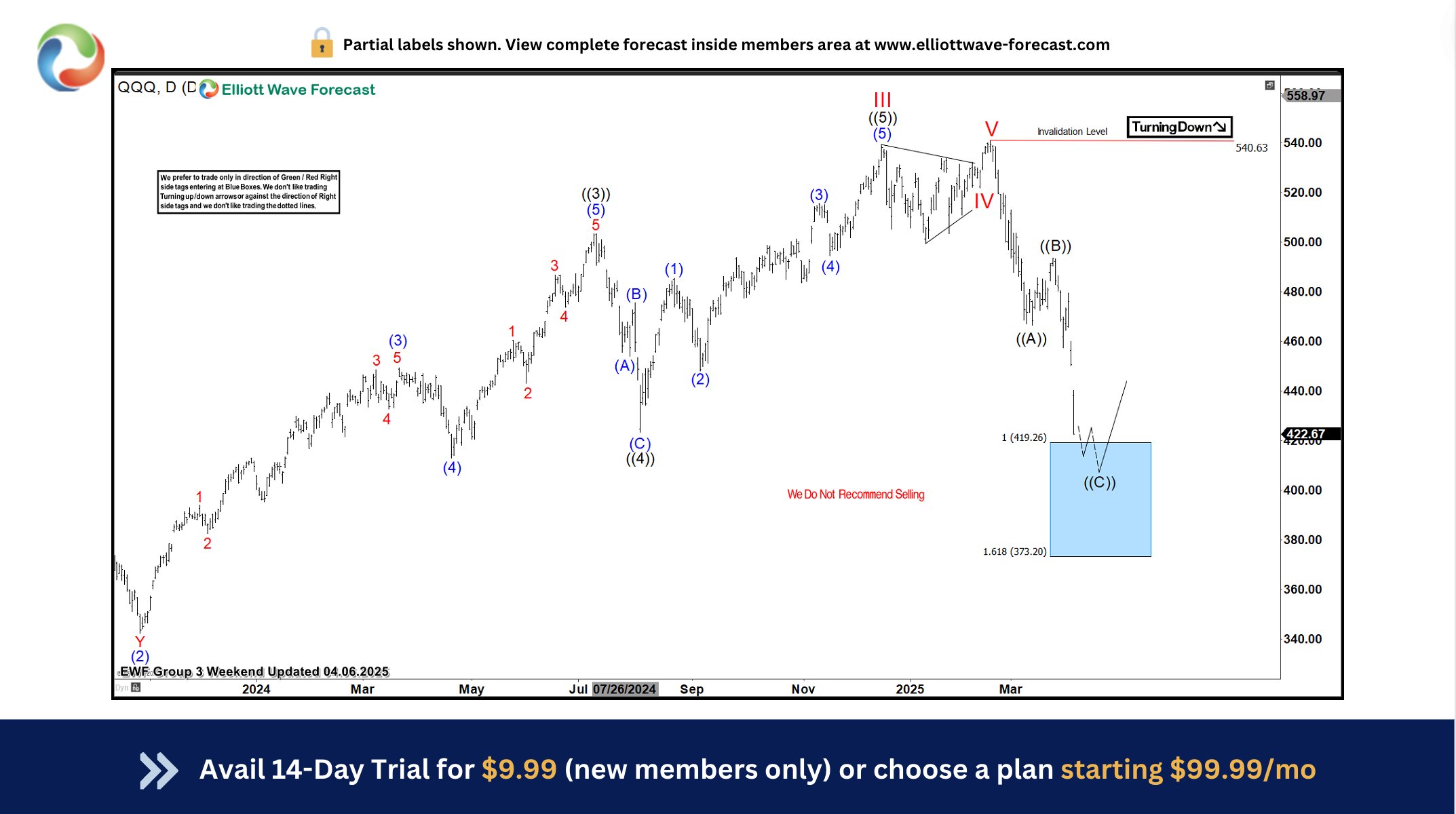

QQQ Elliott Wave : Forecasting the Rally From the Blue Box

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of QQQ ETF . As our members know QQQ has recently bounce from the Equal Legs area. The ETF has reached the extreme zone from the 540.6 peak and found buyers as expected. In the following sections, we will explain […]