The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

S&P E-Mini (ES_F) Short Term Elliott Wave Update 5.21.2015

Read MoreDecline to 2057.41 completed wave X. Wave ((w)) rally from this level is unfolding in the form of a double correction (w)-(x)-(y), where wave (w) ended at 2113.5 and wave (x) ended at 2079.25. In our previous Chart of The Day at 5/19/2015, we said the last leg wave (y) is in progress towards 2136.43 – 2149.86 […]

-

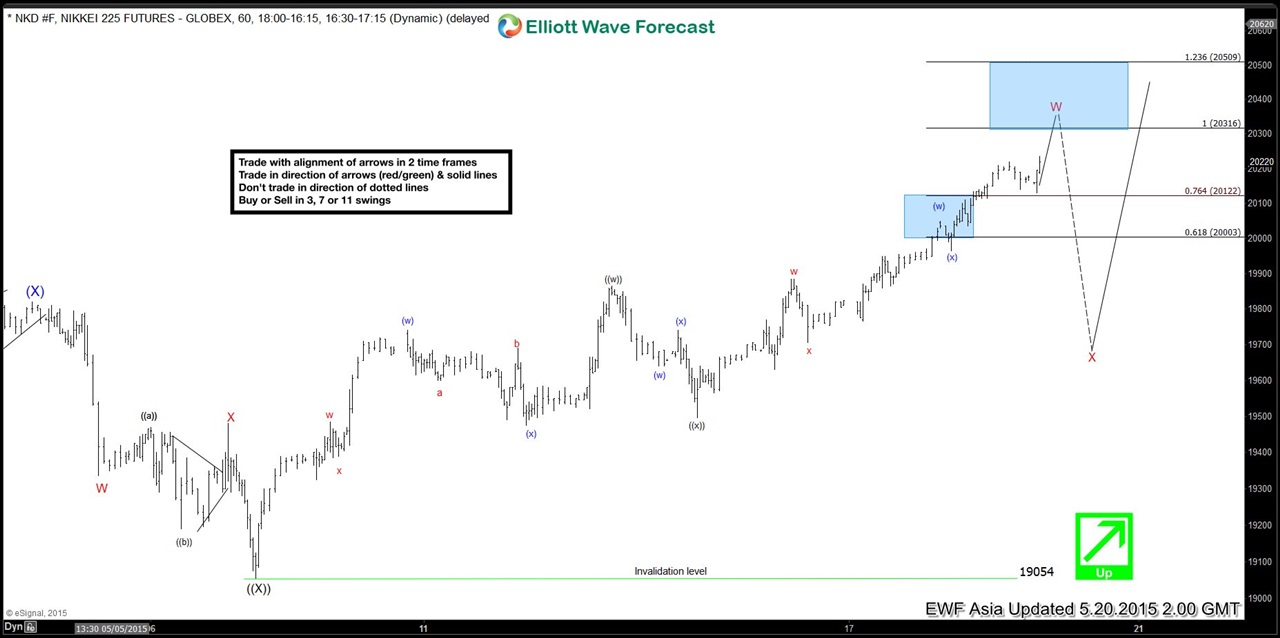

Nikkei 225 Short Term Elliott Wave Analysis 5.20.2015

Read MoreDecline to 19054 completed wave ((X)), and the Index has since resumed the rally in wave W in the form of a double correction ((w))-((x))-((y)) where wave ((w)) ended at 19865, wave ((x)) ended at 19495, and wave ((y)) is in progress towards 20314 – 20507. Expect some profit taking from 20314 – 20507 area and the Index to pullback 3 waves lower […]

-

S&P E-Mini (ES_F) Short Term Elliott Wave Analysis 5.19.2015

Read MoreDecline to 2057.23 completed wave X. Wave ((w)) rally from this level is unfolding in the form of a double correction (w)-(x)-(y). Wave (w) of ((w)) took the form of a double correction w-x-y and ended at 2113.5. Wave (x) of ((w)) also took the form of a double correction w-x-y and ended at 2079.25. Wave […]

-

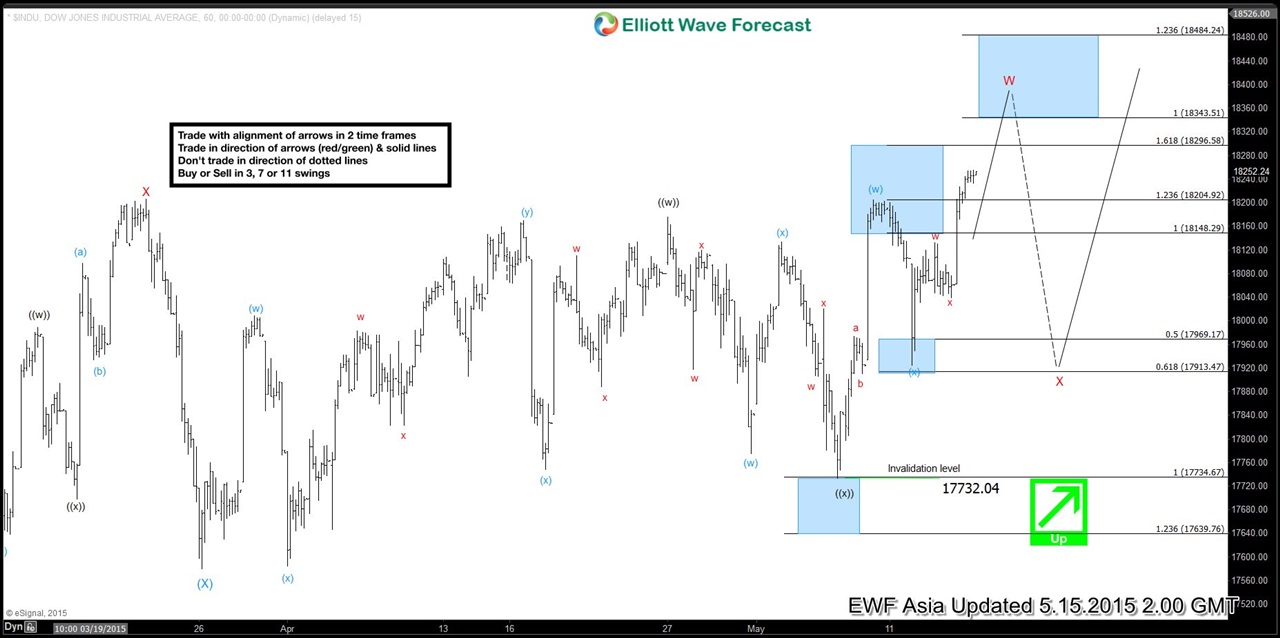

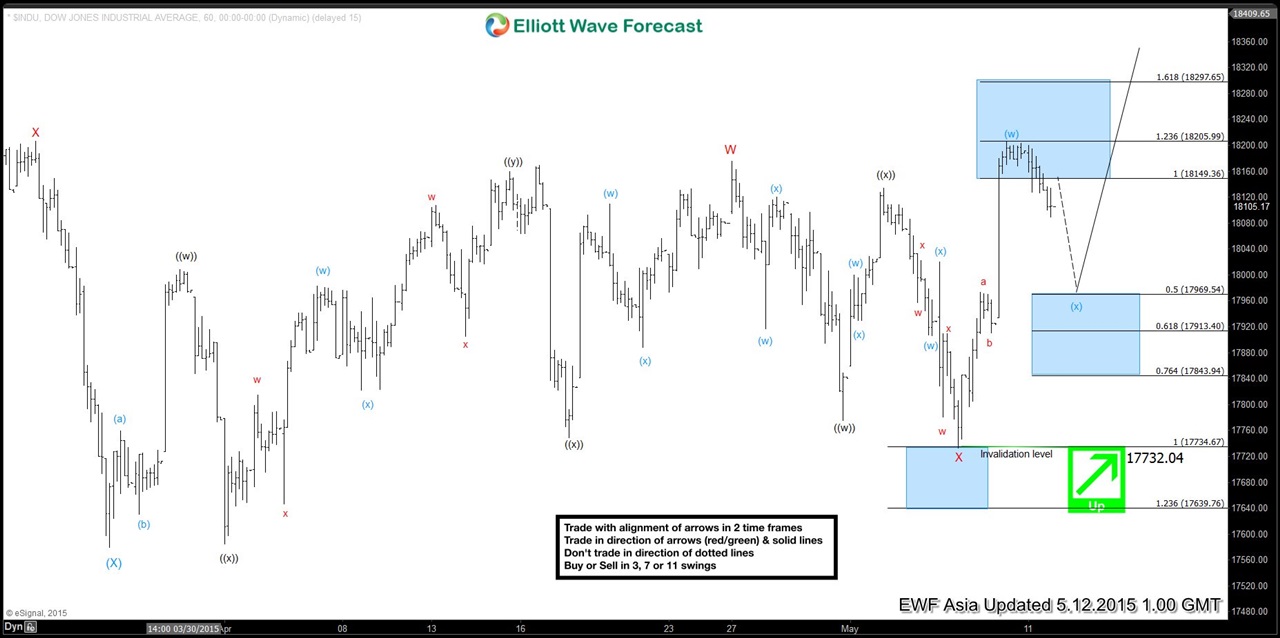

Dow Jones (INDU) Elliott Wave Chart of the Day Summary Week 5.11.2015 – 5.15.2015

Read MoreBelow is a recap of our Chart of The Day for Dow Jones (INDU) for the week of 5/11/2015 – 5/15/2015: Dow Jones (INDU) Chart of The Day posted at 5/12/2015 In our Chart of The Day at 5/12/2015, we said wave (x) pullback is in progress and expected to complete at 17843.94 – 17969.54. As […]

-

Dow Jones (INDU) Short Term Elliott Wave Update 5.13.2015

Read MoreDecline to 17732.04 completed wave X and the Index has since moved higher. From wave X low, the rally took the form of a zigzag a-b-c, where wave a ended at 17973.07, wave b ended at 17910.15, and wave c of (w) completed at 18205.23. In our last Chart of The Day update, we said that wave (x) pullback is in progress towards […]

-

Dow Jones (INDU) Short Term Elliott Wave Analysis 5.12.2015

Read MoreDecline to 17732.04 completed wave X and the Index has since moved higher. From wave X low, the rally took the form of a zigzag a-b-c, where wave a ended at 17973.07, wave b ended at 17910.15, and wave c of (w) completed at 18205.23. Wave (x) pullback is currently in progress towards an ideal target of 17843.94 – […]