The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

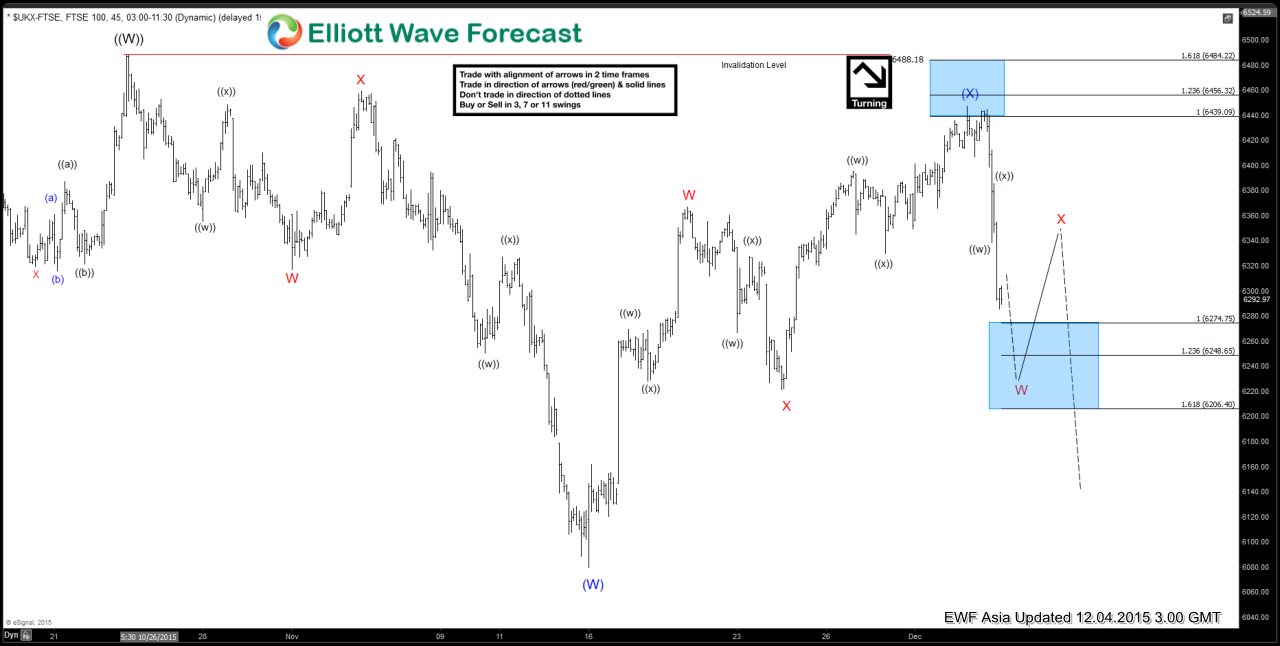

FTSE Short Term Elliott Wave Update 12.4.2015

Read MoreRevised short term reading of the Elliott Wave cycle suggests the decline from 10/23 peak at 6488.18 is unfolding as a double three where wave (W) ended at 6079.8, wave (X) ended at 6447.34, and wave (Y) is in progress. Internal of wave (Y) is also in a double three where wave W is expected to complete at 6206.4 […]

-

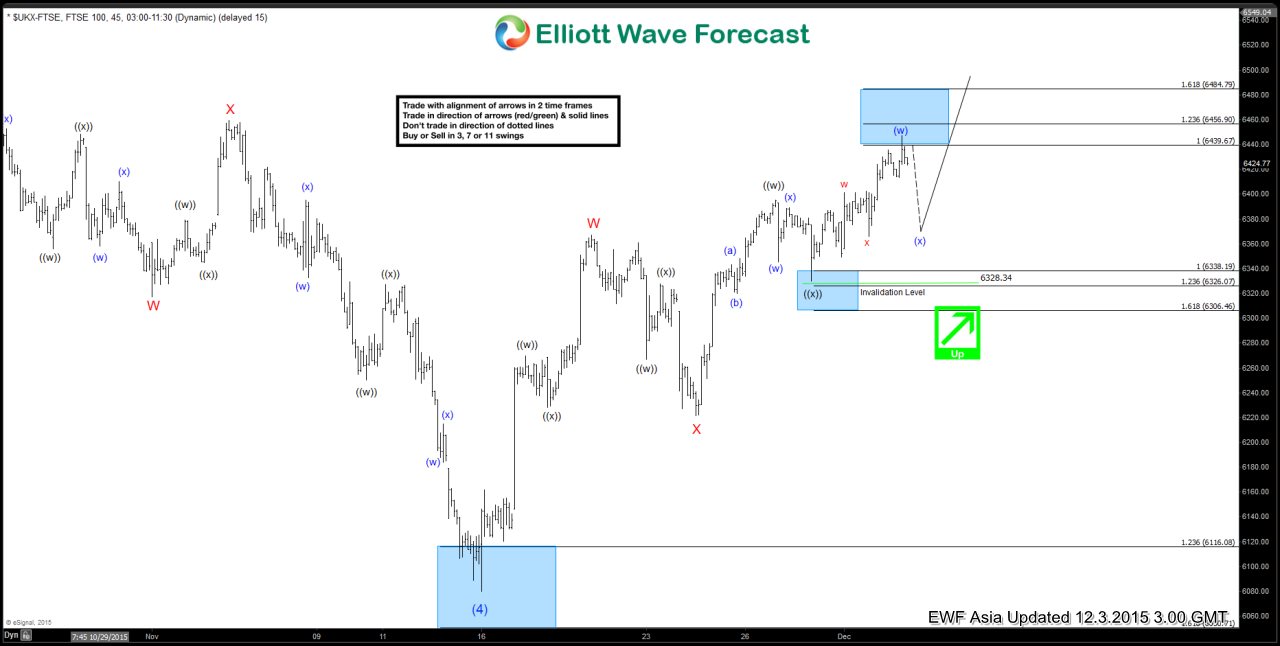

FTSE Short Term Elliott Wave Update 12.3.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the rally from wave (4) low at 6079.8 is unfolding in a double three structure where wave W ended at 6366.8, wave X ended at 6221.04, and wave Y is in progress. Internal of wave Y is unfolding also in a double three where wave ((w)) ended at 6395.3, […]

-

FTSE Short Term Elliott Wave Update 12.3.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the rally from wave (4) low at 6079.8 is unfolding in a double three structure where wave W ended at 6366.8, wave X ended at 6221.04, and wave Y is in progress. Internal of wave Y is unfolding also in a double three where wave ((w)) ended at 6395.3, […]

-

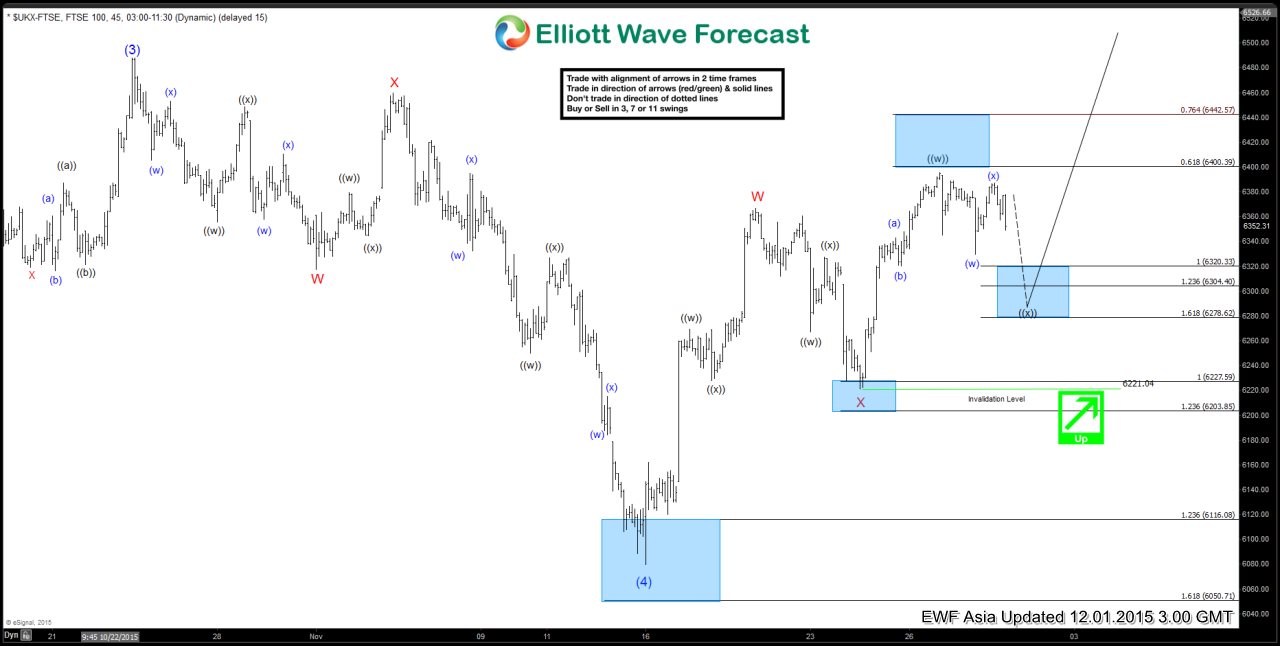

FTSE Short Term Elliott Wave Update 12.1.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the rally from wave (4) low at 6079.8 is unfolding in a double three structure where wave W ended at 6366.8, wave X ended at 6221.04, and wave Y is in progress. Internal of wave Y is unfolding also in a double three where wave ((w)) ended at 6395.3 […]

-

Russel 2000 Short Term Elliott Wave Update 10.2.2015

Read MoreBest reading of the cycle suggests the decline to 1105.9 ended wave ((W)), then the index bounced in wave ((X)) to 1193.85. From this level, the index has resumed the decline lower with the first leg of the decline wave (W) completed at 1078.63. Wave (X) bounce is currently in progress in 3, 7, or 11 swing. Most […]

-

Russel 2000 Short Term Elliott Wave Update 10.1.2015

Read MoreBest reading of the cycle suggests that the decline to 1105.9 ended wave ((W)). From this level, the index bounced and ended wave ((X)) at 1193.85. The index has since resumed the decline lower, unfolding in a double corrective structure WXY where wave W ended at 1124.75, wave X ended at 1146.72, and wave Y […]