The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

S&P500 (SPX) Elliott Wave Forecasts Amid Tariff Uncertainties

Read MoreThere has been a back and forth regarding the tariff headlines as traders and investors are clouded in uncertainties. Clearly, the economic war has narrowed to a face-off between the US and China. Meanwhile, if we take our eyes away from the headlines, what’s price telling us? In this article, we will use the Elliott […]

-

Royal Gold (RGLD) Bullish Nest for a Break Above $200

Read MoreRoyal Gold (NASDAQ: RGLD), founded in 1991, is a global leader in precious metals royalty and streaming. With interests in 194 properties across 20+ countries, it manages gold, silver, copper, lead, and zinc assets. This article evaluates its bullish Elliott Wave framework and highlights potential paths for further growth. Following 5 years of consolidation in […]

-

CRWD’s Leading Diagonal: Grand Super Cycle Points to More Upside

Read MoreCrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. Analysts have a positive outlook for CrowdStrike Holdings, Inc. (CRWD) in 2025. The stock has a consensus rating of “Moderate Buy,” with 33 analysts recommending it as a buy. The average price target for CRWD is […]

-

QQQ Elliott Wave : Forecasting the Rally From Equal Legs Zone

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of QQQ ETF . As our members know QQQ is trading within the cycle from the 396 low. Recently the ETF has reached the extreme zone from the April 9th peak and found buyers as expected. In the following sections, […]

-

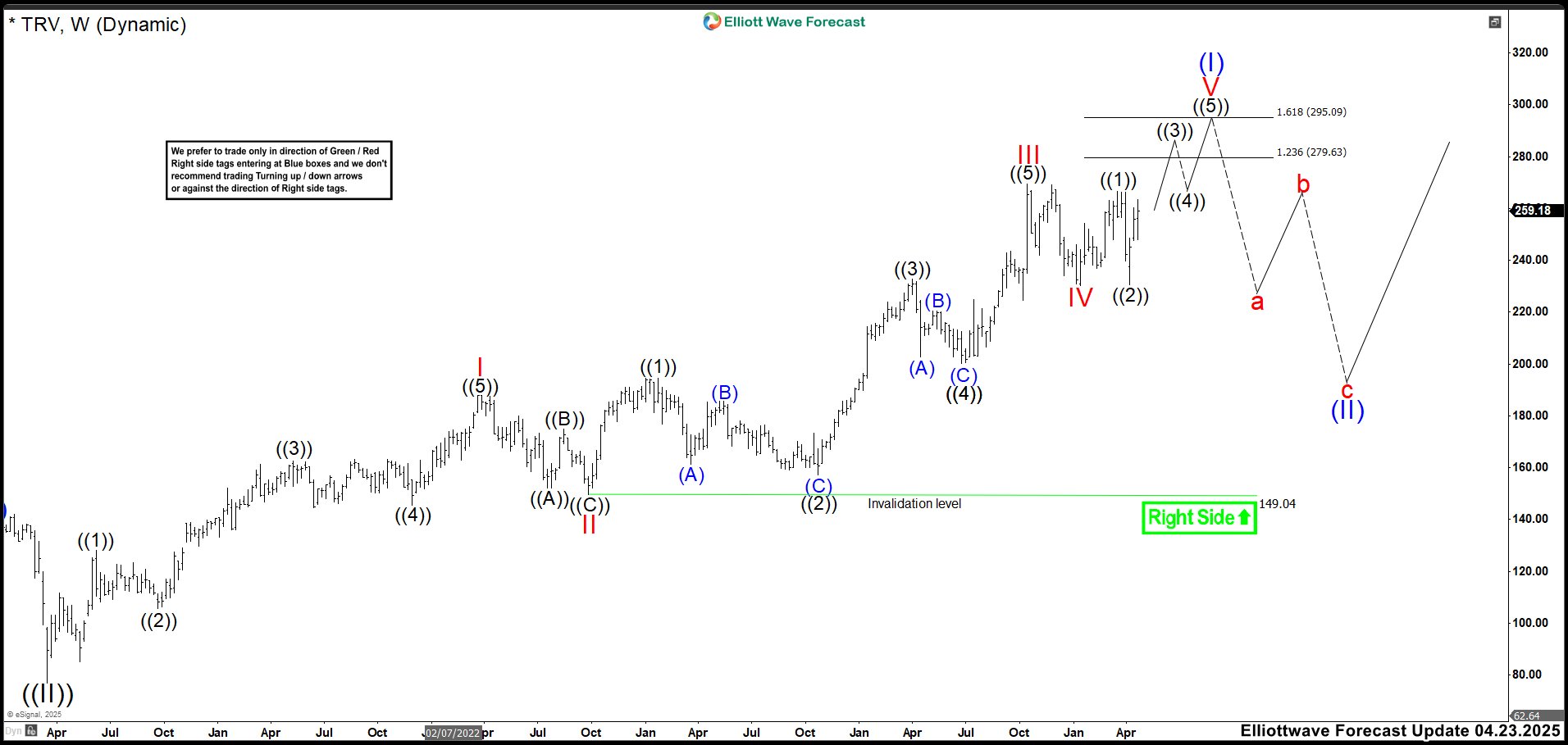

TRV Approaches Final Stage of Impulse Structure: Anticipating a Pullback

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Experts have mixed opinions about Travelers Companies (TRV) stock for 2025. Analysts have provided a consensus price target of $263.37, with estimates ranging […]

-

SHOP Completes Key Corrective Cycle: Bulls Ready to Take Control

Read MoreShopify Inc. is a Canadian multinational e-commerce company in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. Experts hold varied perspectives on Shopify (SHOP) stock for 2025. On one hand, some analysts recommend a moderate buy rating, citing a […]