The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Forecast: Nike ($NKE ) Rally to Fail in 7-Swing Pattern

Read MoreNike (NKE) is correcting in 7 swing pattern which is likely to fail. This article and video look at the Elliott Wave path of the stock.

-

NVIDIA Corp. $NVDA Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of NVIDIA Corp. ($NVDA) through the lens of Elliott Wave Theory. We’ll review how the decline from the January 07, 2025, high unfolded as a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 7 Swing WXY […]

-

TJX Companies (TJX) Extends Bullish Sequence

Read MoreTJX Companies, Inc., (TJX) operates as an off-price apparel & home fashions retailer in Unites States, Canada, Europe & Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada & TJX International. It comes under Consumer Cyclical sector & trades as “TJX” ticker at NYSE. TJX favors rally as discussed in previous article, targeting $137 […]

-

Uranium Miners ETF ($URA): Correction Likely Over, Now Rising

Read MoreThe Global X Uranium ETF (URA) tracks a market-cap-weighted index of companies in the uranium mining and nuclear components sector. The ETF, featuring key holdings like Cameco Corp, has a market cap of approximately $3.9 billion and a dividend yield of about 6.07%. Elliott Wave Technical Analysis point to continued growth potential. $URA Elliott Wave […]

-

Elliott Wave Outlook: IBEX Poised to Surge to 6-Year High

Read MoreIBEX is about to break above the previous peak prior to the trade war. This article and video look at the Elliott Wave of the Index.

-

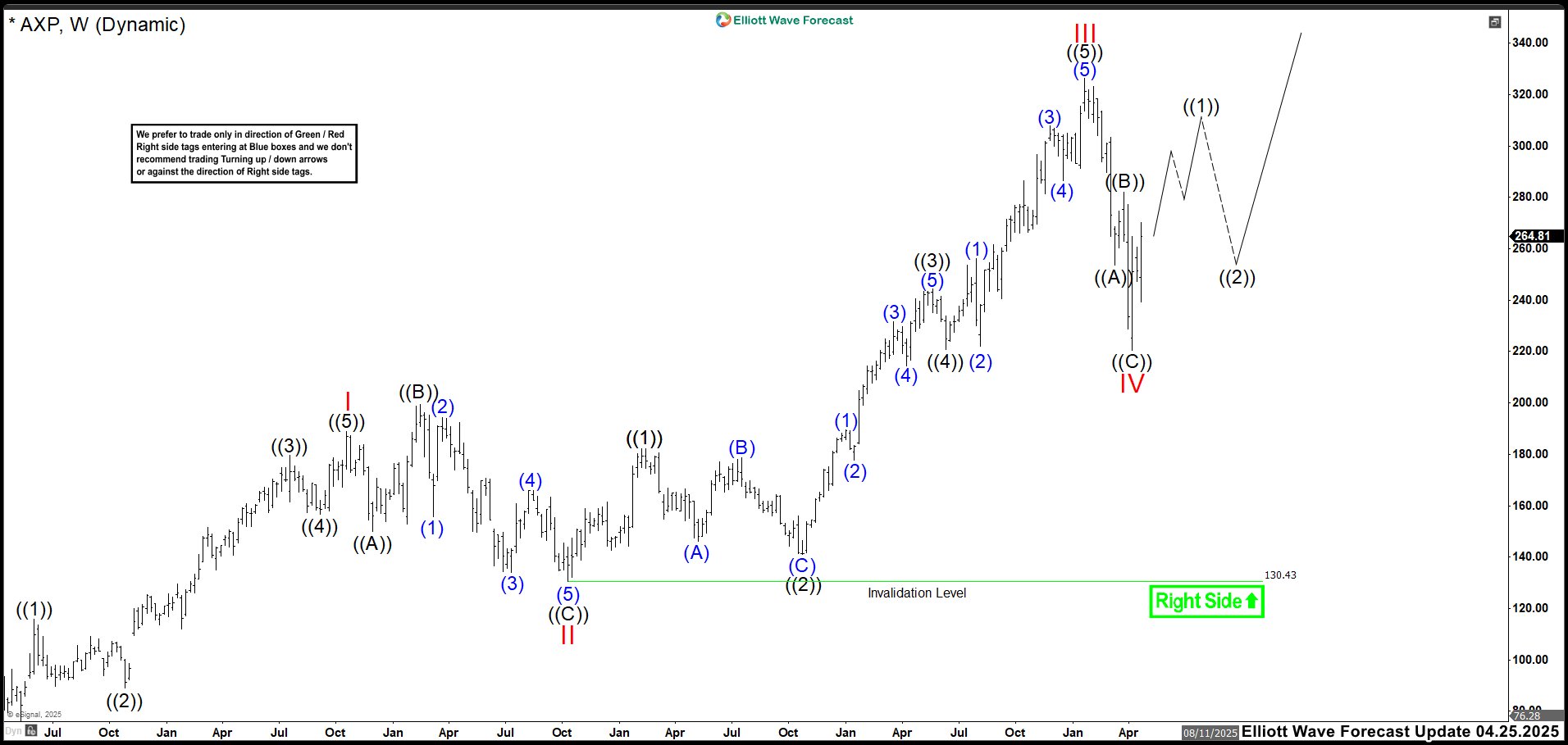

AXP’s Bullish Momentum: Eyes Set on All-Time Highs Post Correction

Read MoreAmerican Express Company (NYSE: AXP), a leading multinational financial services corporation based in New York City, continues to solidify its position as a prominent player among the Dow Jones Industrial Average’s 30 components. As it specializes in payment cards, the company consistently demonstrates significant market performance, further enhancing its reputation. Meanwhile, analysts hold mixed opinions […]