The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

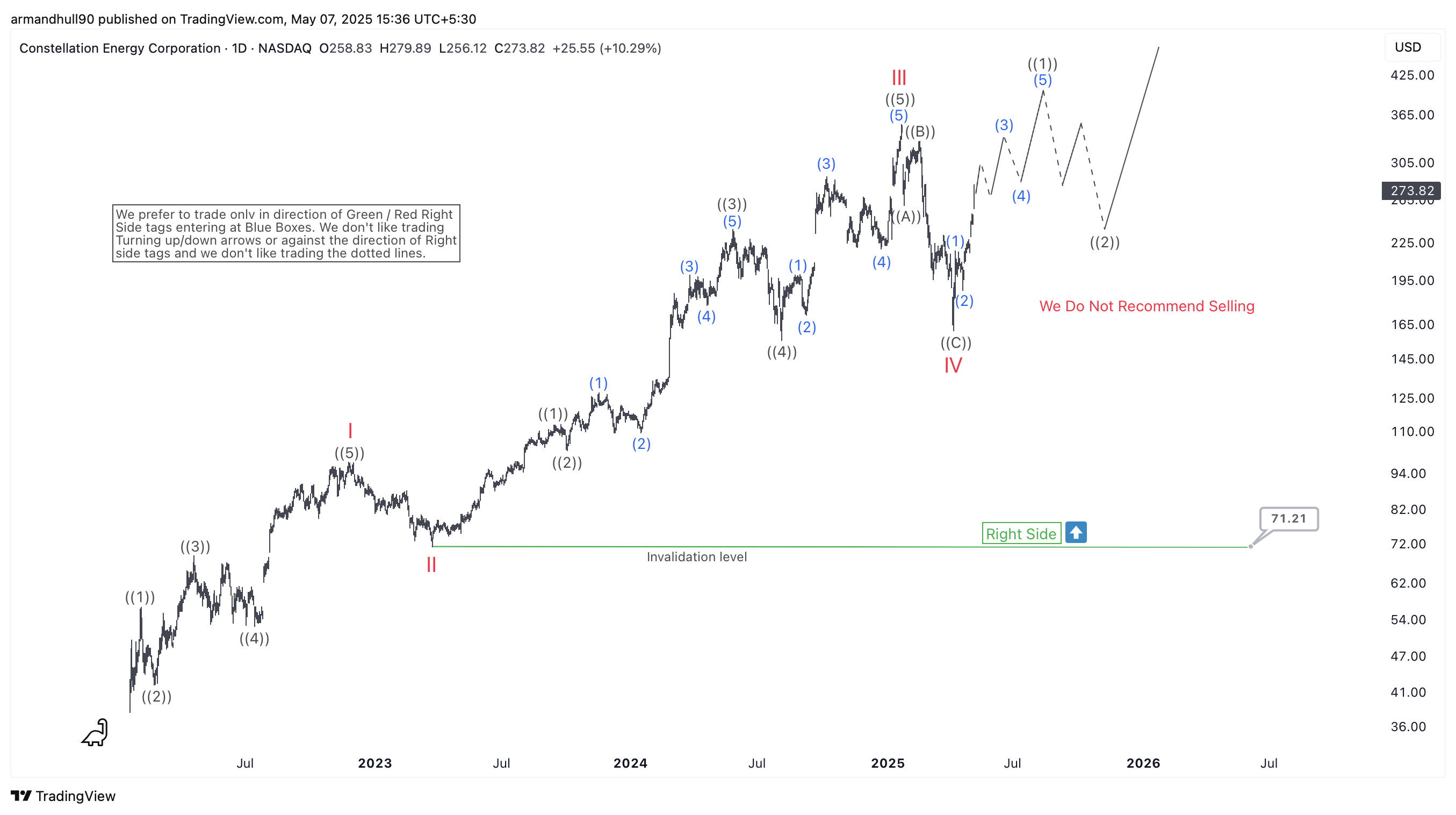

Constellation Energy (CEG) Elliott Wave Update: Wave V Has Likely Started

Read MoreConstellation Energy resumes its uptrend after completing wave IV. Bullish Elliott Wave structure points toward a strong wave V rally. Constellation Energy Corporation (CEG) has completed a textbook Elliott Wave correction and appears to have resumed its bullish trend. The stock experienced a powerful advance from mid-2022, which unfolded in five clear waves, completing a higher-degree […]

-

Carvana Co (CVNA) Kicks Off a Fresh Bullish Cycle

Read MoreCarvana Co (NYSE: CVNA) has rebounded impressively over the past 2 years after a 98% decline between 2021 and 2022. The stock recovered most of its losses, forming a strong impulsive structure that signals further upside potential. With a continuation pattern in place, CVNA appears poised to challenge new all-time highs. This article delves into […]

-

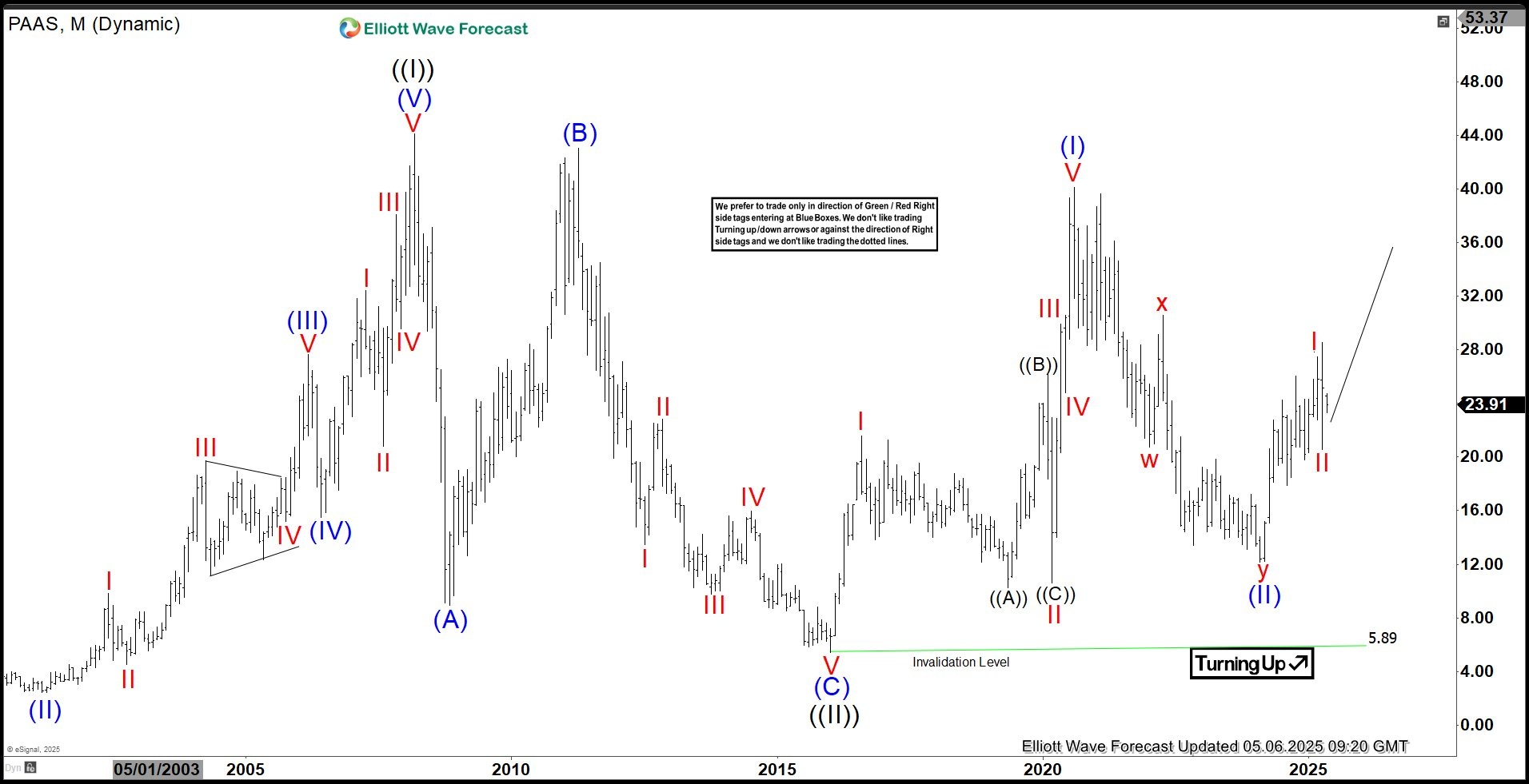

Pan American Silver (PAAS): Pullback Nearing End, Upside Potential Ahead

Read MorePan American Silver Corp. (PAAS) is a mining company based in Vancouver, Canada, focused on silver, gold, zinc, lead, and copper. Founded in 1979, it handles exploration, development, extraction, processing, and refining. The company operates in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. Below we will take a look at the Elliott Wave technical […]

-

Eli Lilly & Company (LLY) Favors Rally Targeting New Weekly High

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY is bullish in weekly sequence from all time low. It favors rally in (V) after double correction ended at $677.09 low in April-2025 low. It favors rally to continue in […]

-

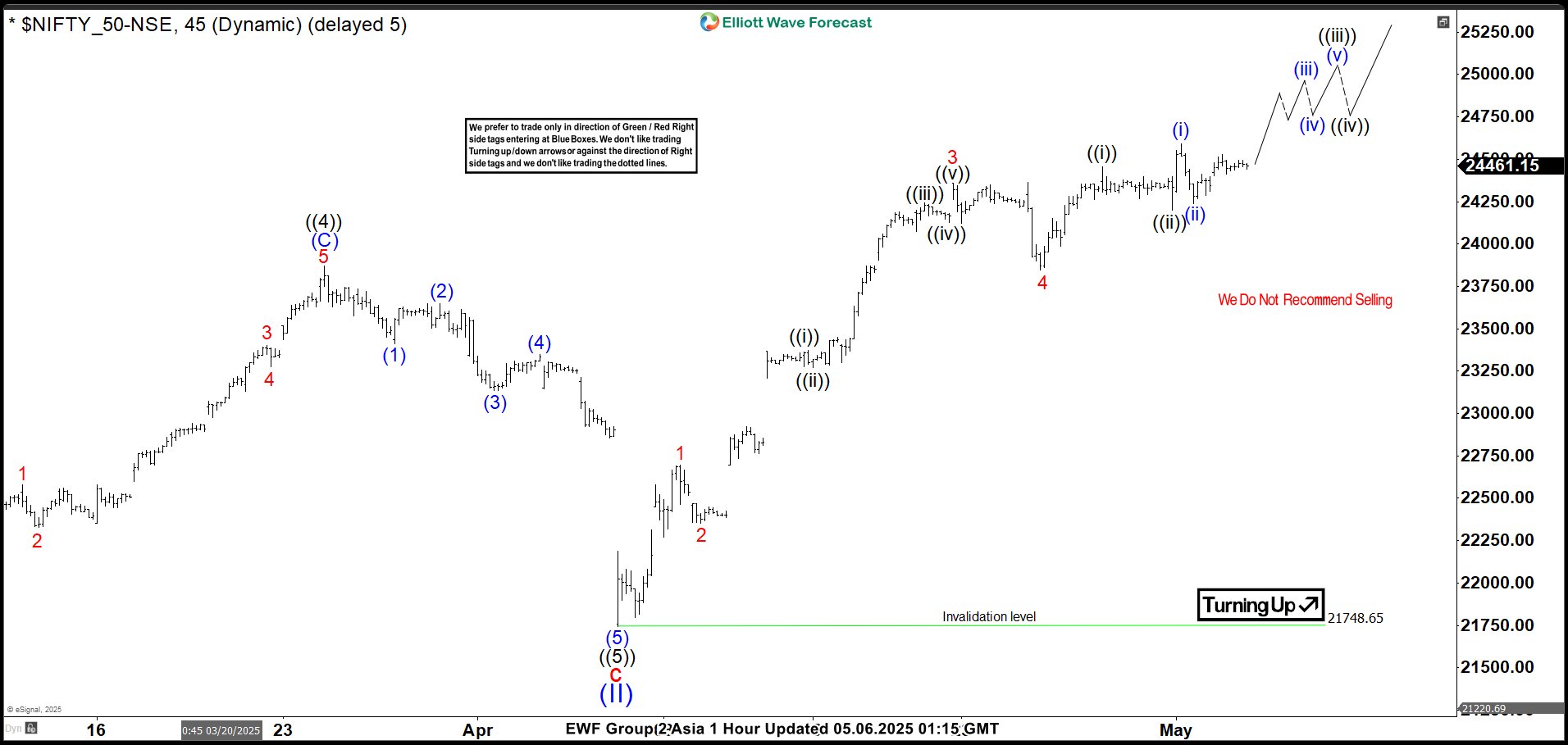

Nifty Elliott Wave Forecast: Impulsive Sequence Approaching Its End

Read MoreNifty ended cycle from 9.27.2024 high and turned higher. This article and view look at the Elliott Wave path for the Index.

-

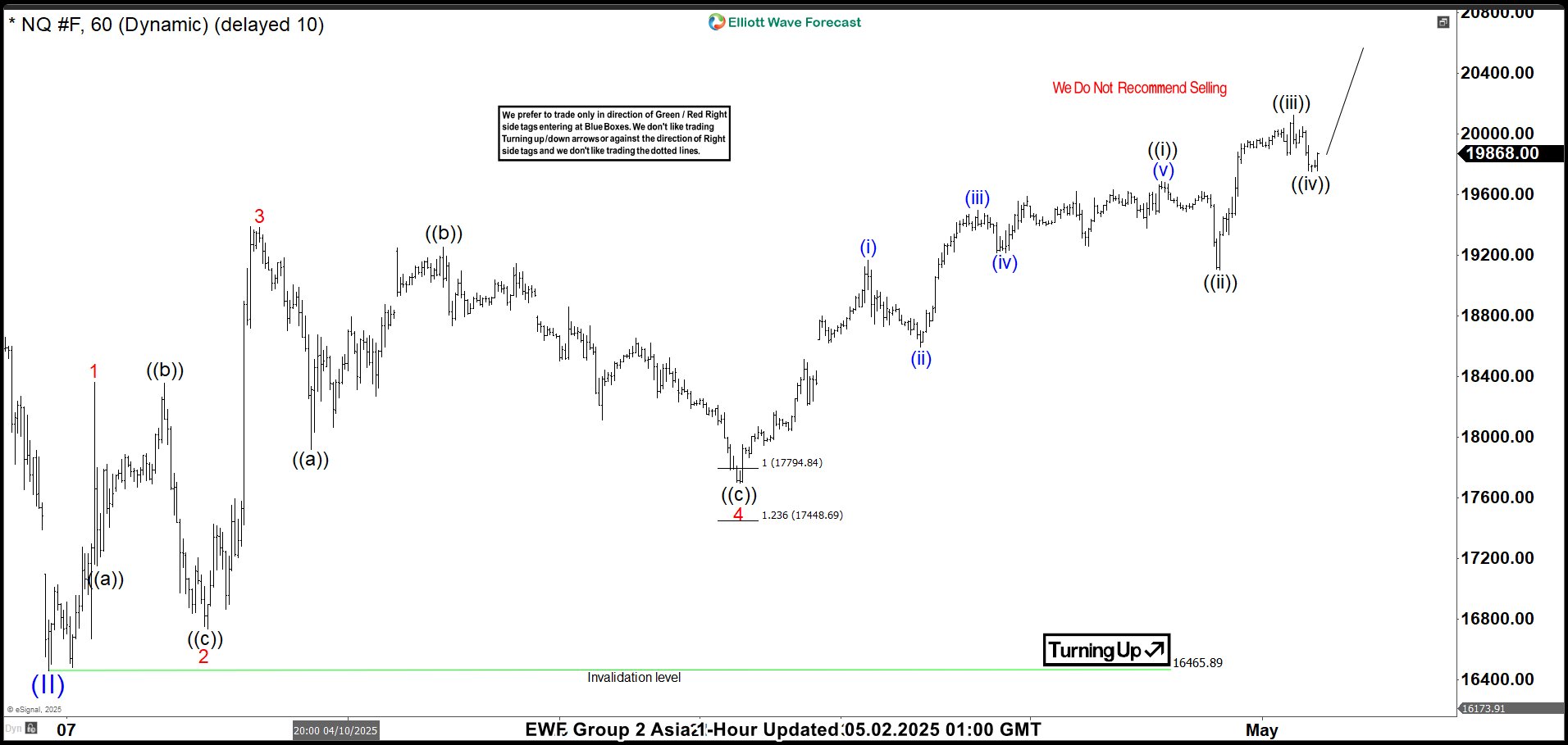

Nasdaq Futures (NQ): 5 Swing Pattern Points to Further Gain

Read MoreNasdaq (NQ) ended the selloff after tariff announcement and turning higher. This article and video look at the Elliott Wave path