The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

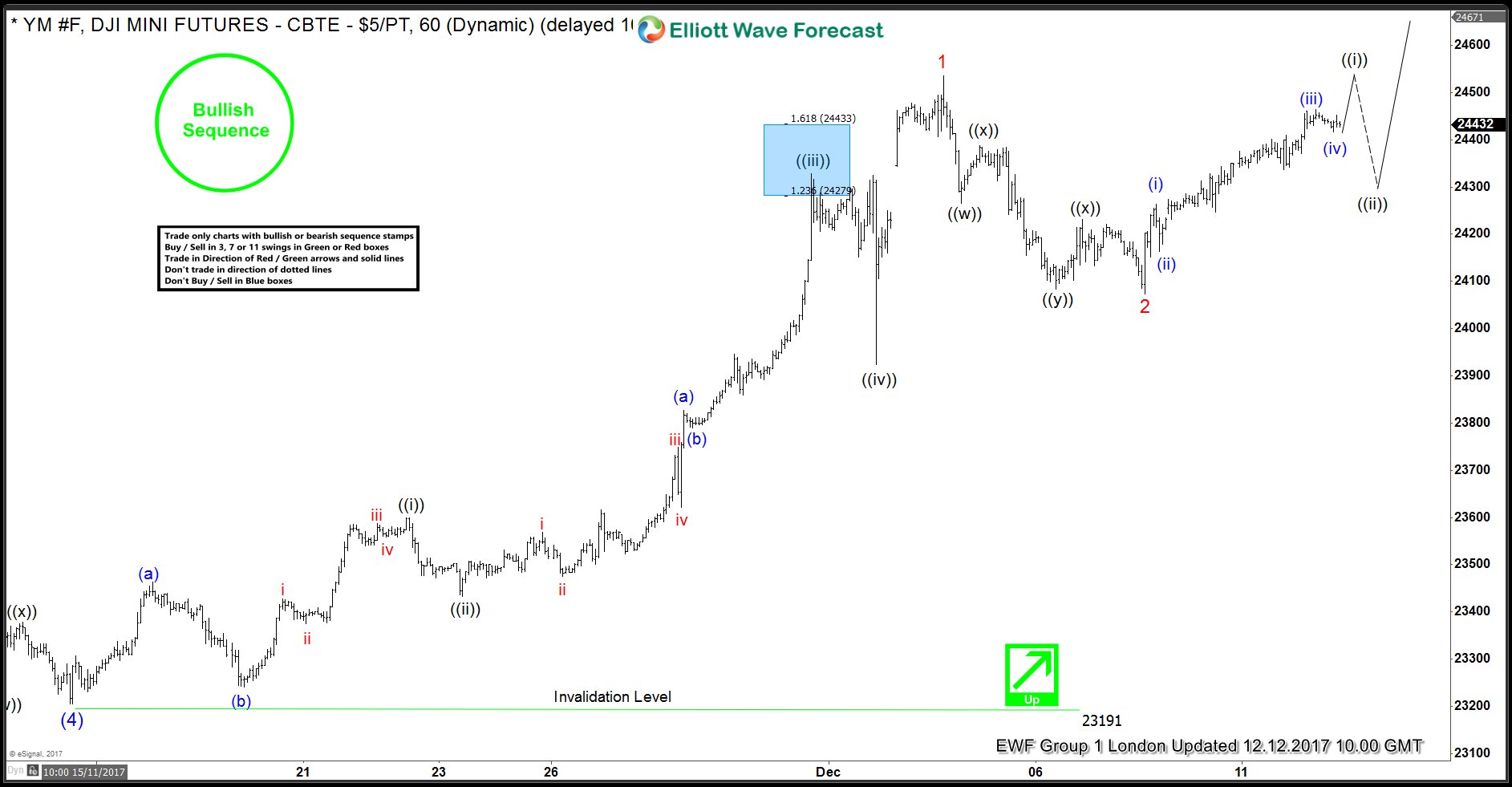

Dow Future Elliott Wave Analysis 12.12.2017

Read MoreDow Future Short Term Elliott Wave view suggests that the decline to 23205 ended Intermediate wave (4). Intermediate wave (5) is in progress as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index still needs to break above Minor wave (1) at 24536 to […]

-

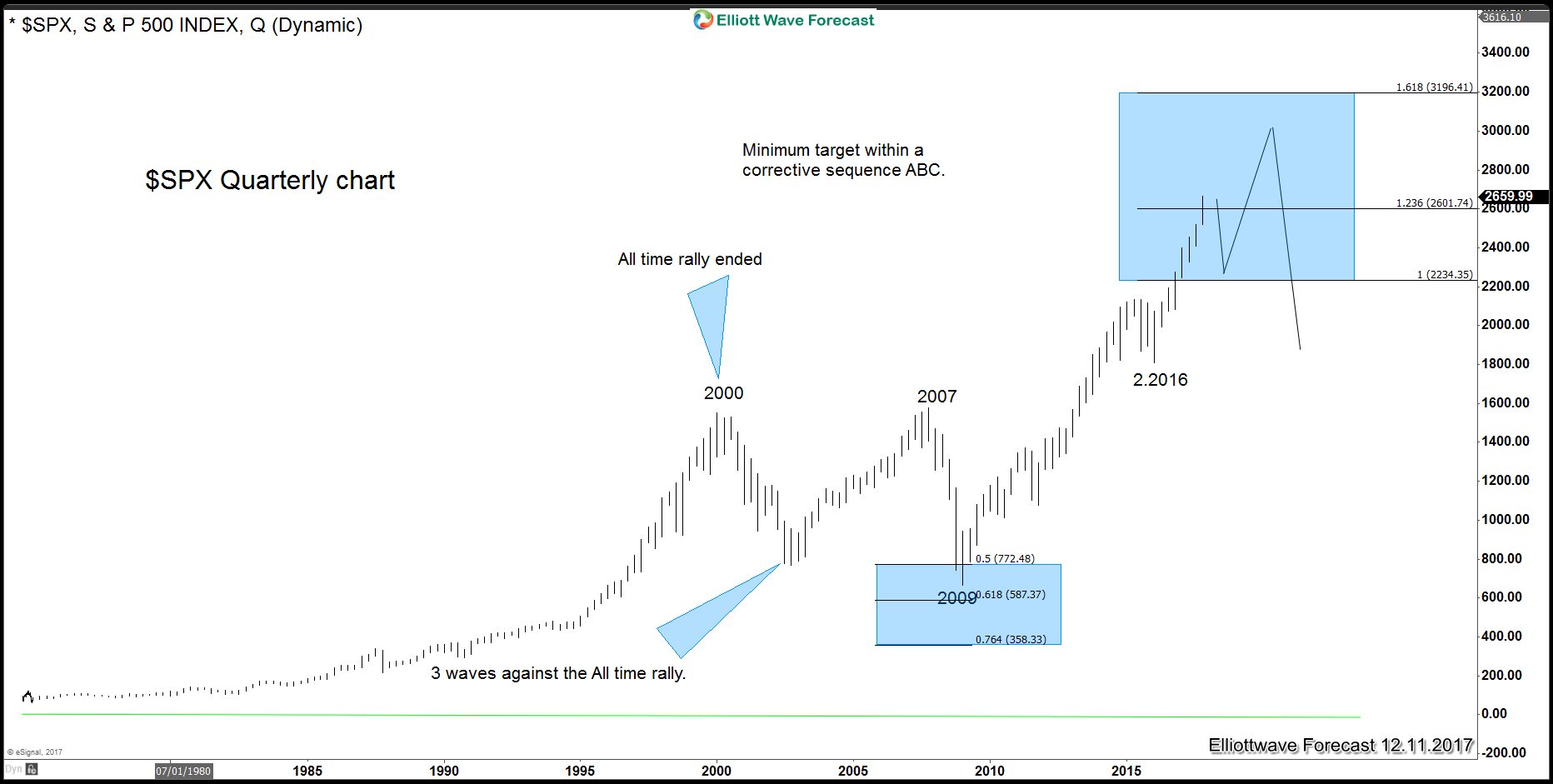

Is the World coming to the end?

Read MoreWe now live in an interesting time. Every day we wake up with the news about either World Indices make all-time records or bad news about terrorist attack and nuclear test. Historically, humans have gone through these stages and we were able to withstand all these events. At ElliottwaveForecast.com, we try to ignore all these events […]

-

Dow Jones Transportation Average Index Still Calling Higher

Read MoreIn this blog-post, I want to discuss with you guys, why we think that the Dow Jones Transportation Average can still see more upside. First of all, let me explain what the Dow Jones Transportation Average Index is. The DJT is made off of the top 20 delivery, airline, trucking and railroad stocks. In the […]

-

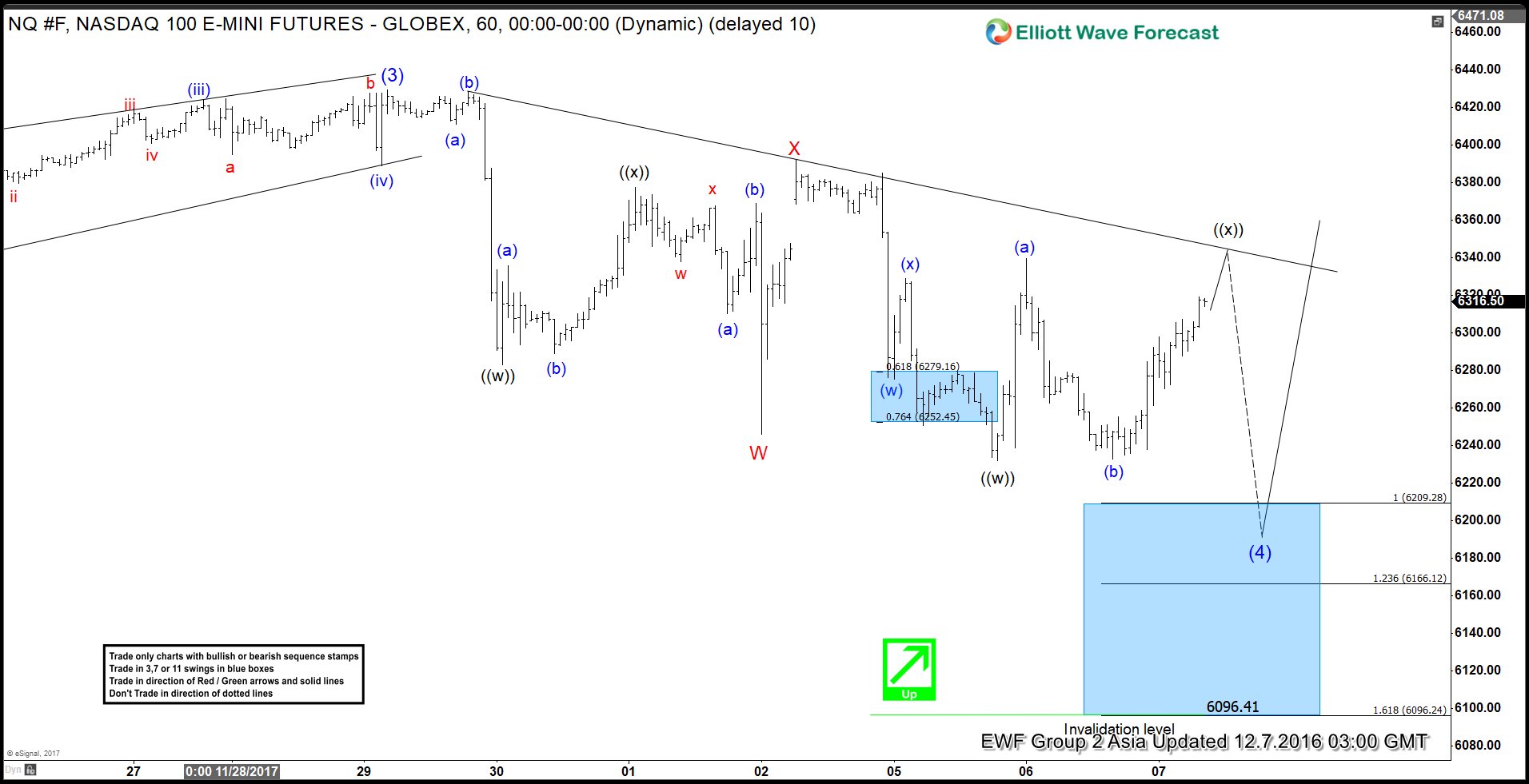

Nasdaq Elliott Wave Analysis 12-8-2017

Read MoreNasdaq Short Term Elliott Wave view suggests that Intermediate wave (3) ended at 6429.5 and Intermediate wave (4) pullback is proposed complete at 6231.75. Subdivision of Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended at 6283, Minor wave X ended at 6391.75, and Minor wave Y of (4) ended at 6231.75. Index still needs to […]

-

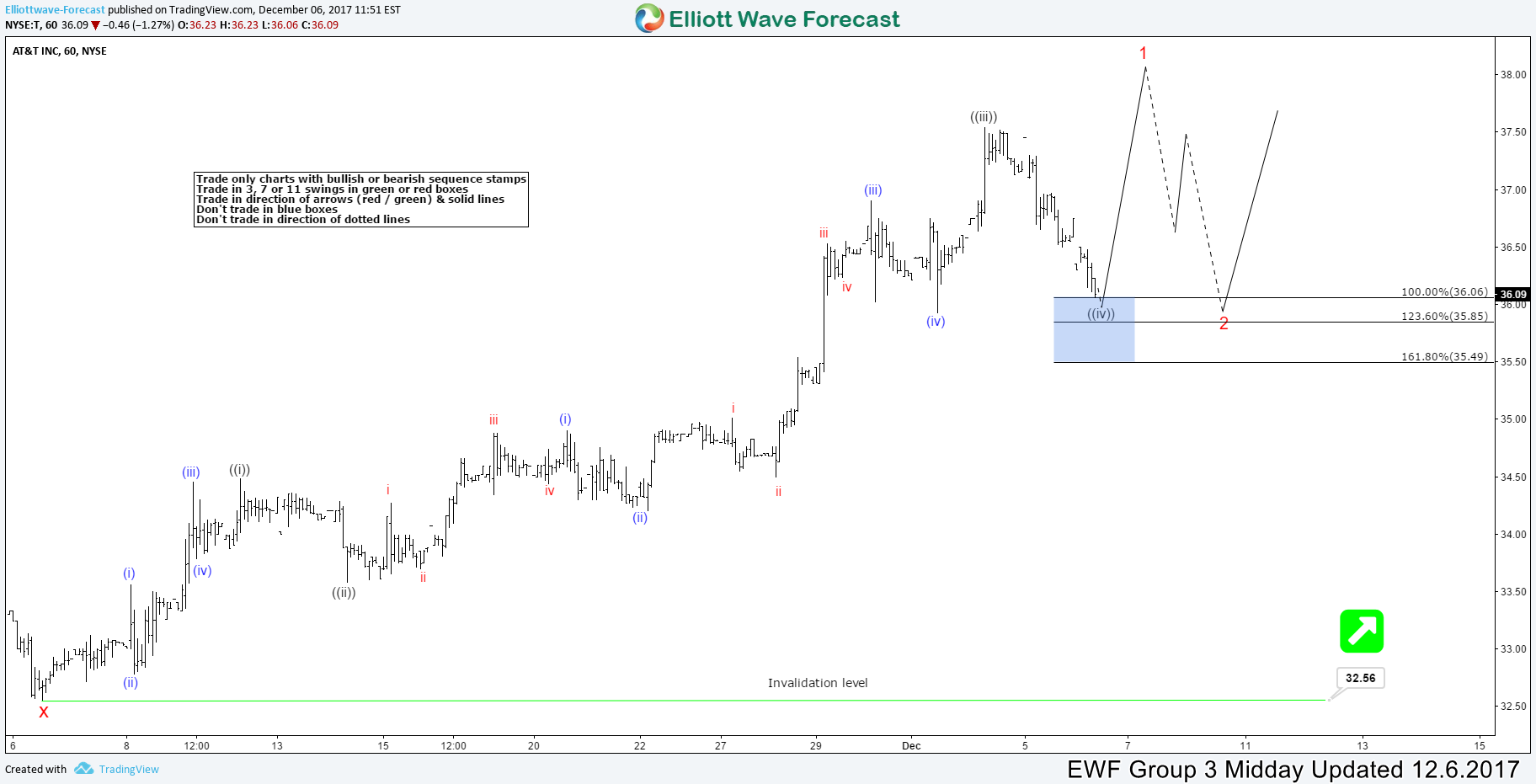

AT&T Showing Elliott Wave Impulsive Sequence

Read MoreAT&T Short term Elliott Wave view suggests that the decline to November 06 low 32.56 ended Cycle wave X. A rally from there is unfolding as an impulse Elliott Wave structure with extension in 3rd swing higher and each leg has internal oscillations of 5 waves thus favoring it to be an impulse. These possible 5 waves move higher should end […]

-

Nasdaq Intra-Day Elliott Wave Analysis

Read MoreNasdaq Intraday Elliott Wave view suggests that rally to 6429.5 ended Intermediate wave (3). Intermediate wave (4) pullback is currently in progress to correct cycle from 8/21 low (5753.6) in 3, 7, or 11 swing before the rally resumes. Subdivision of Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended at 6246 and […]