The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DAX Elliott Wave Analysis: Further Weakness Ahead?

Read MoreShort term Elliott Wave view in DAX suggests Primary wave ((B)) ended at 12434.7 on 3.16.2018. The decline from there is unfolding as a 5 waves impulse Elliott Wave structure. Down from 12434.7, Minor wave 1 ended at 12160, Minor wave 2 ended at 12375.5, Minor wave 3 ended at 11827, Minor wave 4 ended […]

-

Will Trade War Weigh on the Market?

Read MoreTrade war with China Hurt Global Economy Last week global stock market slumped due to the prospect of all-out trade war which could destabilize global economy. US market closed sharply lower for the week with S&P 500 falling 5.6% and Dow Jones Industrial Average falling 6%. Asia markets also skidded with Nikkei 225 falling 6.3%, […]

-

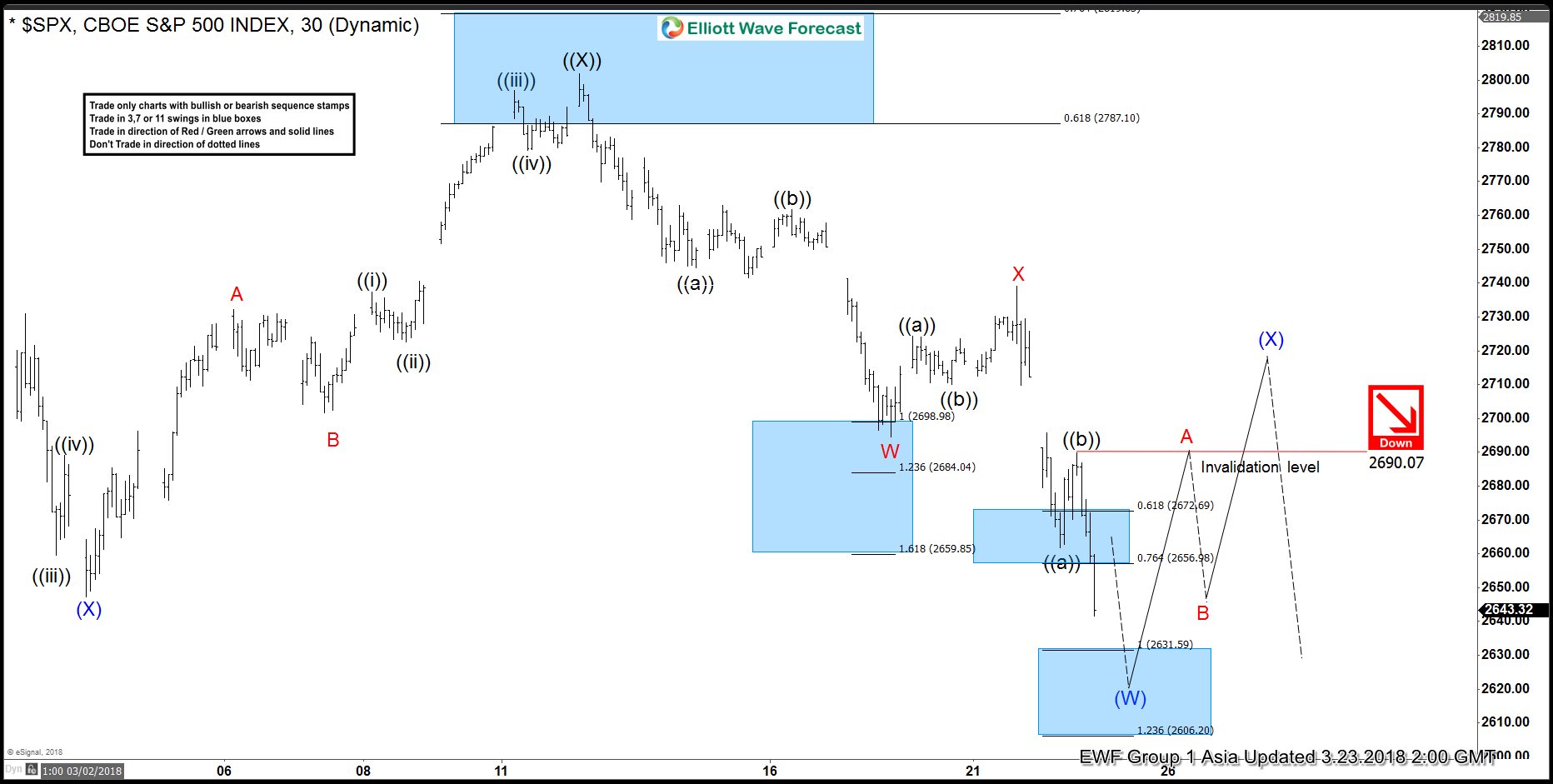

Elliott Wave Analysis: SPX Should See More Weakness

Read MoreSPX rally to 2801.9 on 3.13.2018 ended Primary wave ((X)). Since then, the decline from there is unfolding as a double three Elliott Wave structure where Minor wave W ended at 2694.59 and Minor wave X ended at 2739.14. A double three is a WXY structure where the subdivision of each leg is corrective. Subdivision […]

-

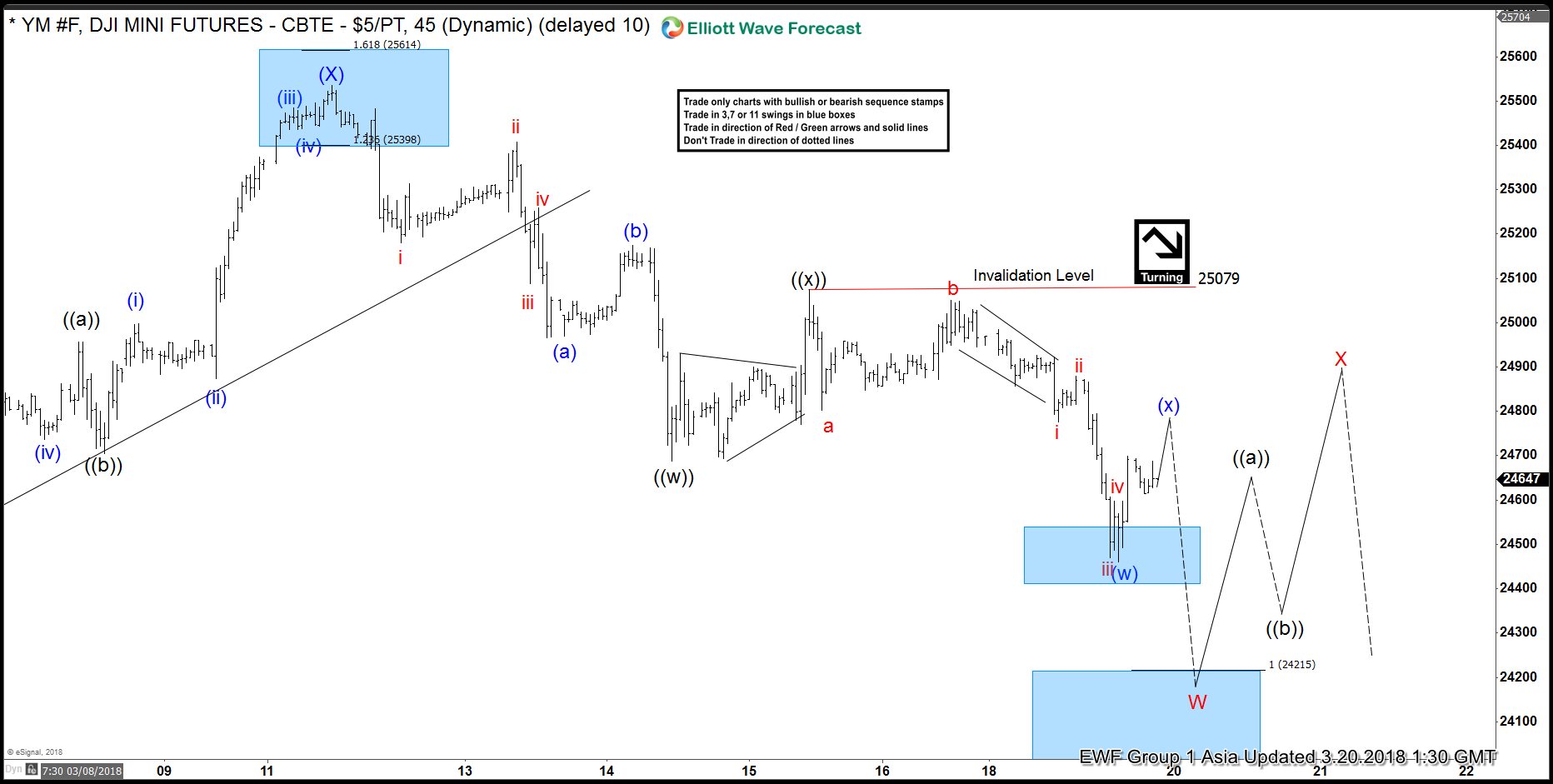

Dow Jones (YM_F) Elliott Wave Analysis: Further Weaknesses Expected to 24215

Read MoreDow Jones (YM_F) Short Term Elliott Wave view suggests that the rally to 25535 on 12 March 2018 ended Intermediate wave (X). Intermediate wave (Y) is currently in progress to the downside and subdivision of Intermediate wave (Y) unfolded as a double three Elliott Wave structure. Down from 25535, Minute wave ((w)) ended at 24688, and […]

-

Elliott Wave Analysis: Calling more Upside In JPM

Read MoreIn this blog, we will have a look at a past Elliott wave short-term structures of the JP Morgan Chase (JPM) Stock. In the chart below, you can see the 1-hour chart presented to members in our Live Session Webinar on the 03/02/18. We said to members that the JPM stock made a marginal new […]

-

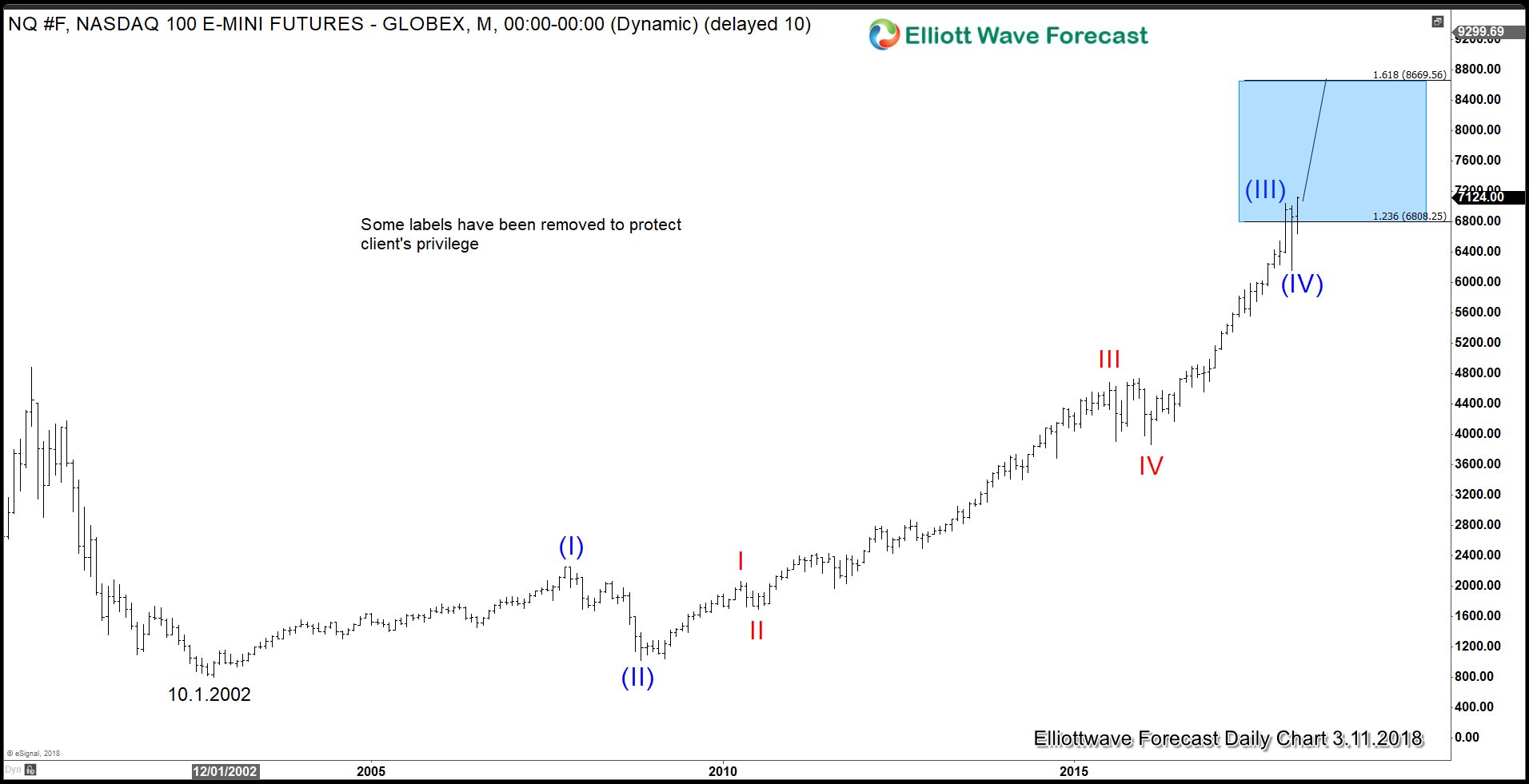

Nasdaq Soars to New Record High After Strong Job Reports

Read MoreNasdaq soars to an all-time high after last Friday’s U.S. employment report which saw a massive 313,000 growth in February. This is the biggest number of jobs since July 2016, handily smashing the expectation of 200,000 jobs gain. For the fifth month in a row, the jobless rate remains unchanged at 4.1%, a 17-year low. […]