The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

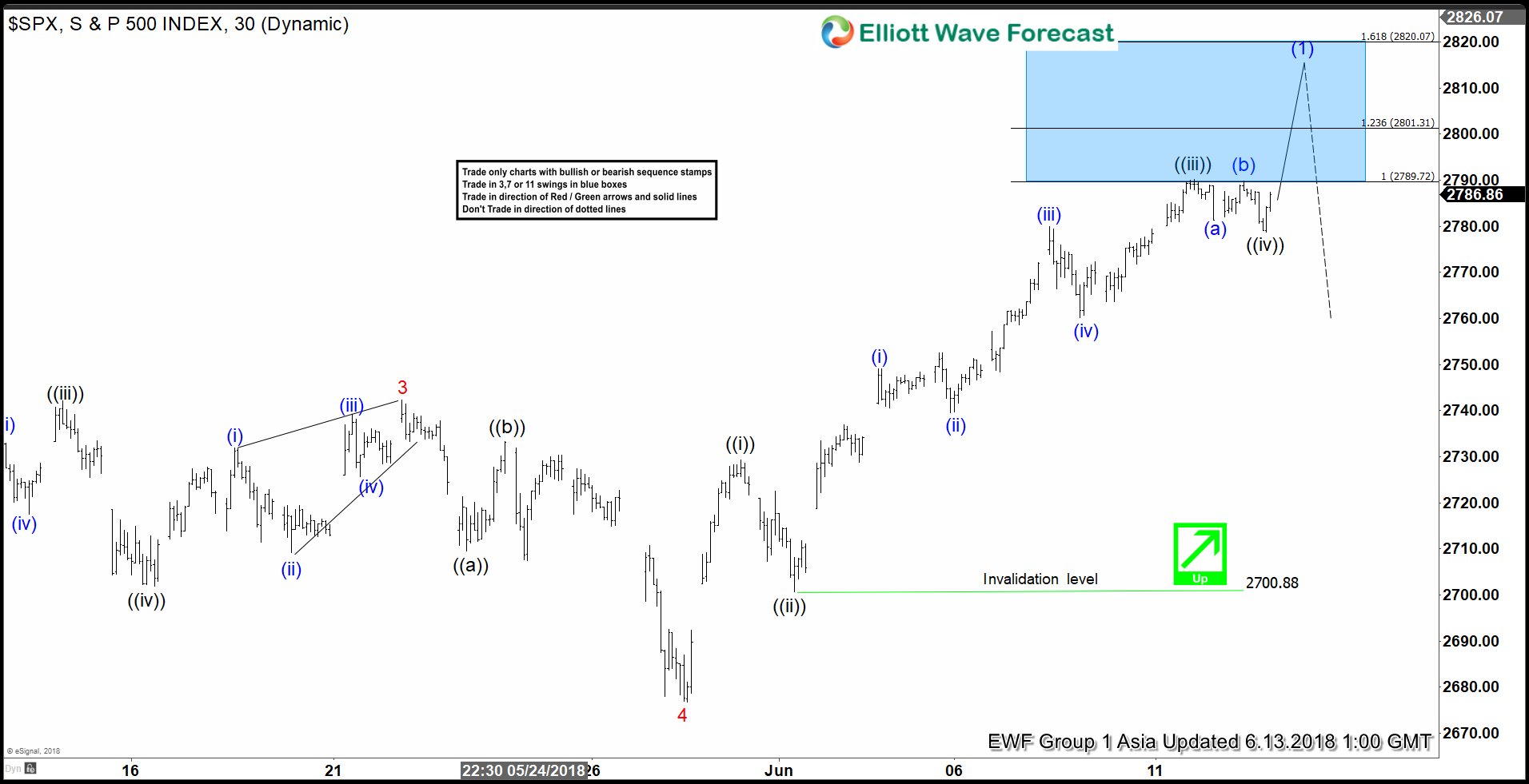

Intraday Elliott Wave Analysis: SPX Due for Pullback Soon

Read MoreSPX short-term Elliott wave view suggests that the rally to 2742.24 high ended Minor wave 3 as Elliott wave impulse. Below from there the pullback to 2676.81 on 5/29/2018 low ended Minor wave 4 as Zigzag structure. Up from there, Minor wave 5 rally is unfolding as impulse Elliott wave structure with extension in 3rd wave […]

-

The Sensex Index Long Term Bullish Cycles

Read MoreThe Sensex Index Long Term Bullish Cycles The Sensex Index long term bullish cycles have been trending higher with other world indices. Firstly in it’s base year 1978 to 1979 the index’s point value was set at 100. From there it rallied with other world indices trending higher into the January 2008 highs. It then corrected […]

-

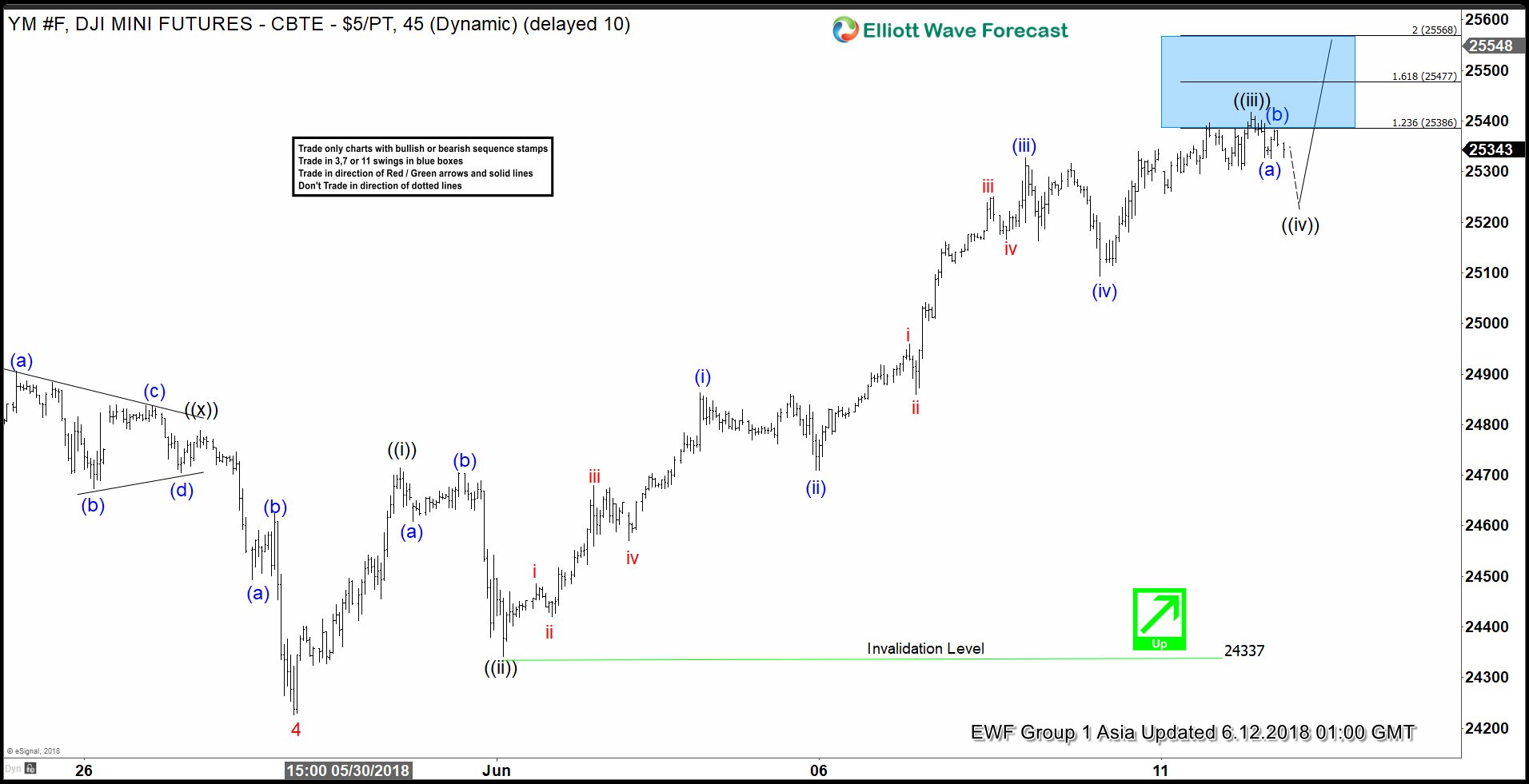

Dow Jones Nearing Completion of 5 Waves Impulse

Read MoreDow Jones futures ticker symbol: $YM_F short-term Elliott wave view suggests that the pullback to 24227 low on 5/29/2018 ended Minor wave 4 pullback. Above from there, the rally is unfolding as impulse Elliott wave structure with extension in 3rd wave higher. As impulse, the internal of Minute degree wave ((i)), ((iii)) and ((v)) should […]

-

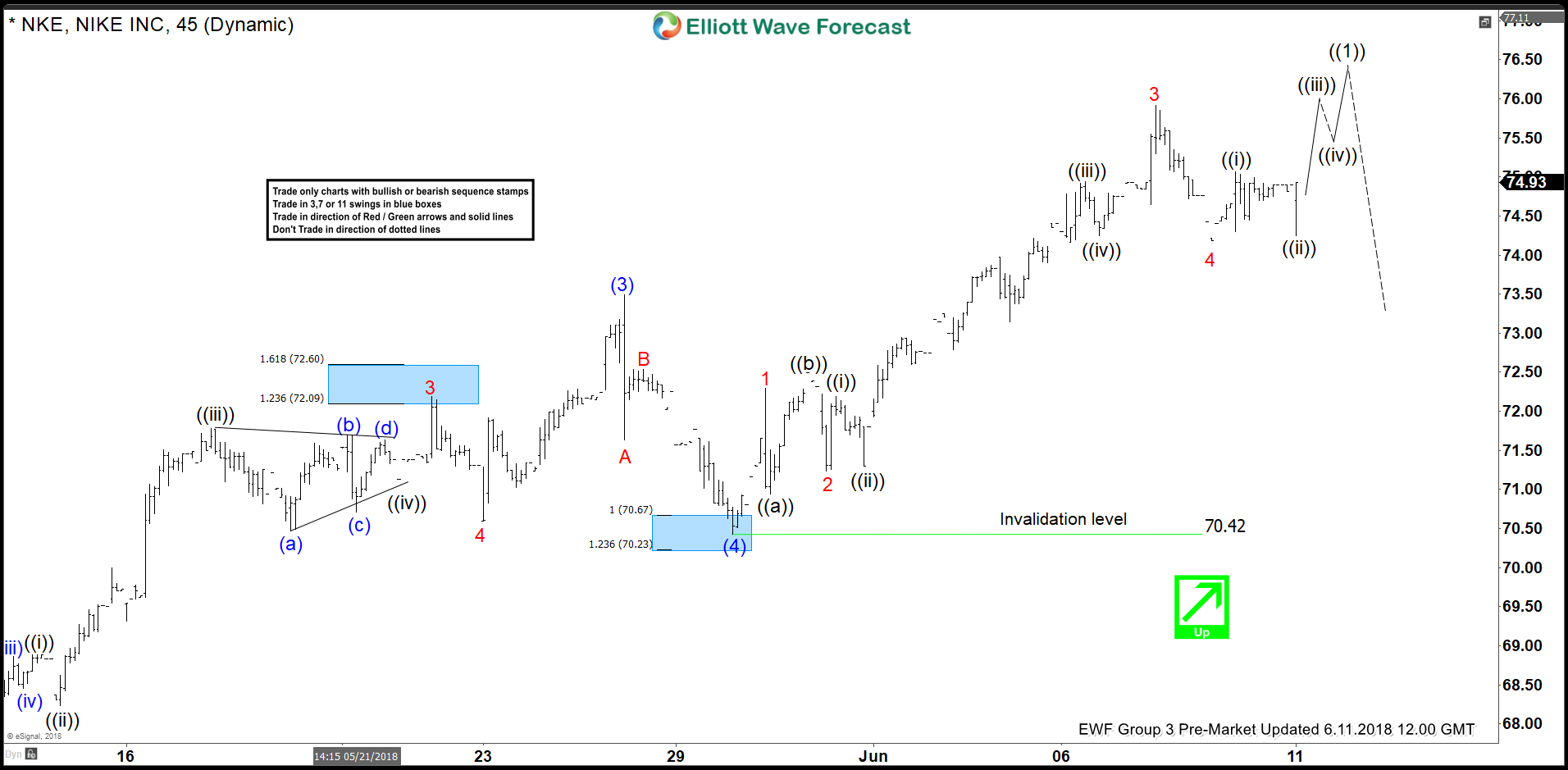

Nike Ending Elliott Wave 5 Waves Soon?

Read MoreNike ticker Symbol: $NKE short-term Elliott wave view suggests that the rally to 73.47 high ended intermediate wave (3) as impulse. Down from there, the stock made a pullback in intermediate wave (4) pullback as Zigzag correction when internal Minor wave A ended at 71.65. Minor wave B ended at 72.53 high and Minor wave […]

-

NIFTY MIDCAP Index Elliott Wave Analysis: Buying Opportunity Soon

Read MoreNifty MIDCAP super cycle from 2009 low remains in progress as an impulse and we believe the Index is still within the powerful wave (III). Rally from March 2009 low to November 2010 was wave (I), dip to August 2013 low completed wave (II). Up from there rally to April 2015 peak (3581) completed wave […]

-

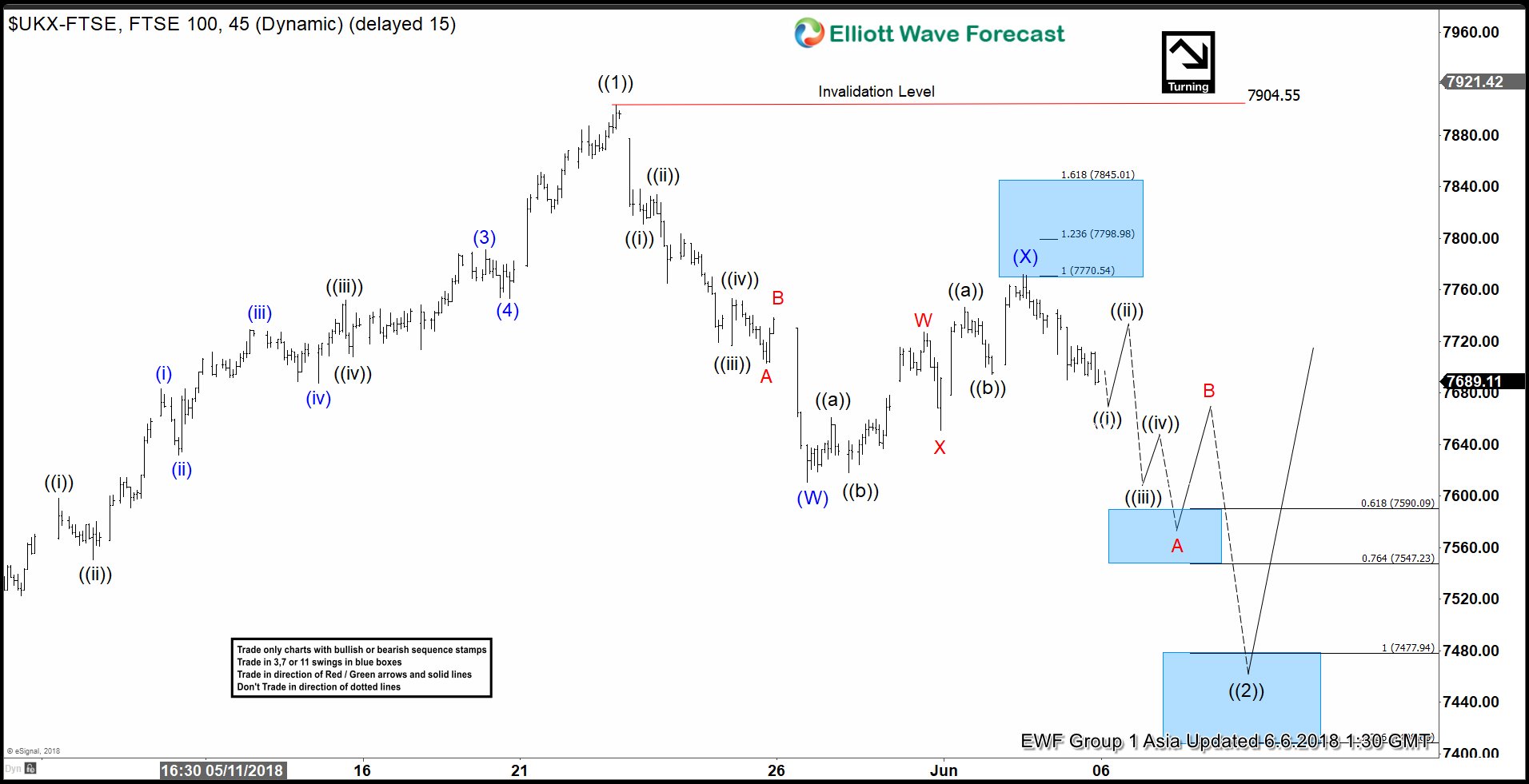

FTSE Elliott Wave View: Buying Opportunity Soon

Read MoreFTSE short-term Elliott wave view suggests that the rally to 7903.50 high on 5/22/2018 peak ended primary wave ((1)). This rally to 7903.5 starts from 3/23/2018 low and took the form of an impulse Elliott wave structure. The index is currently in Primary wave ((2) pullback to correct cycle from 3/23/2018 low. So far the […]