The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

NIKKEI Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI NKD #F , published in members area of the website. As our members know, NIKKEI Futures has had incomplete bullish sequences according to Sequence Report. Consequently, we advised our members to avoid selling it […]

-

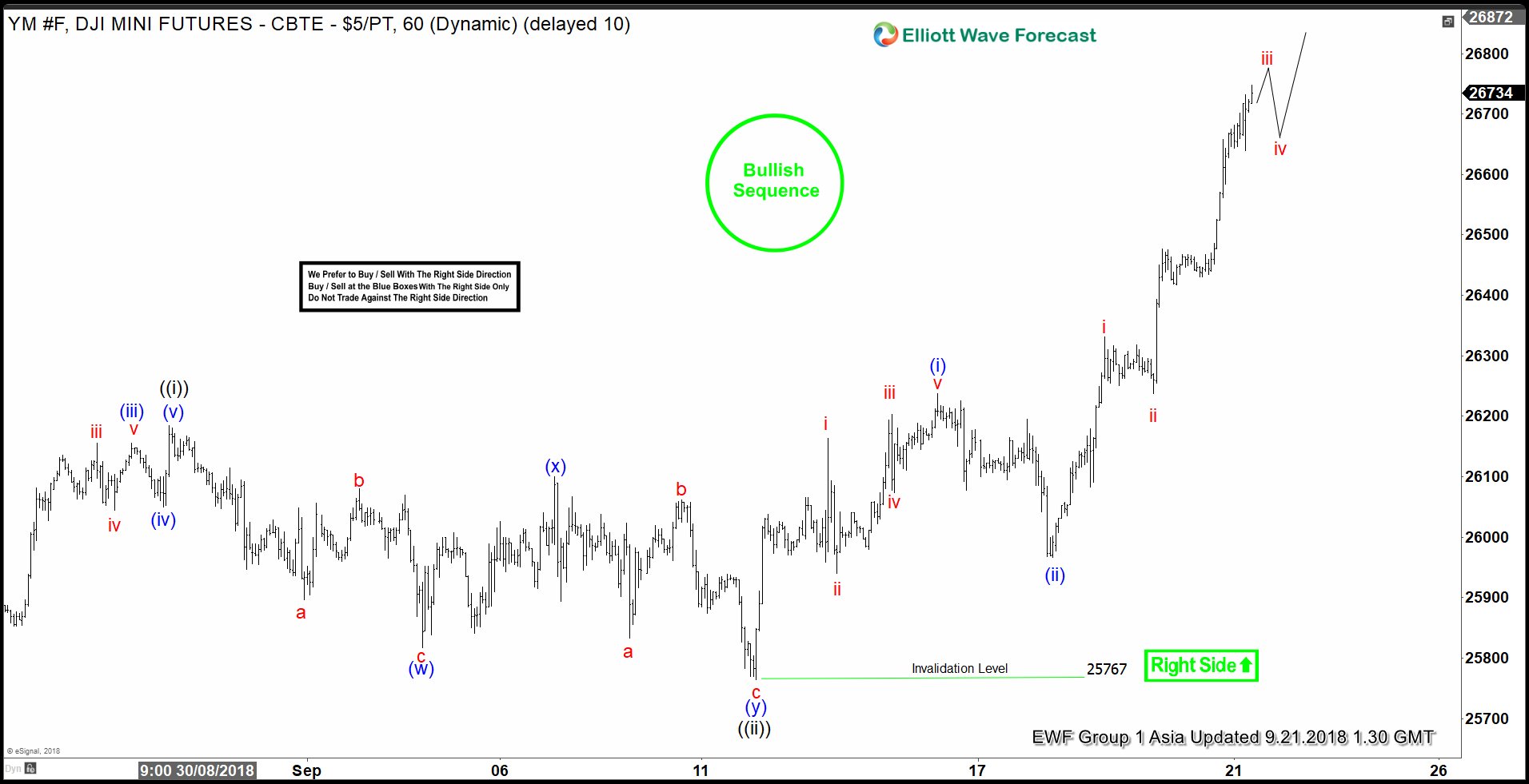

Elliott Wave: DJIA Mini Futures Nesting Higher Within Wave 3

Read MoreDJIA Mini Futures mid-term Elliott wave view suggests that the cycle from 2/05/2018 low is nesting higher as impulse structure & already managed to make new all-time highs. While shorter-cycles suggests that index should be extending higher in lesser degree wave ((iii)) of 3 still looking for more upside extension. The initial rally in index […]

-

Netflix Elliott Wave View: Dips Expected To Remain Supported

Read MoreNetflix ticker symbol: $NFLX short-term Elliott wave analysis suggests that the pullback to $335.67 low ended intermediate wave (2) pullback. The internals of that pullback unfolded as a Flat correction. Where Minor wave B bounce ended in 3 swings at $374.09 high. Down from there, Minor wave C unfolded in 5 waves impulse structure. And […]

-

AMAZON Elliott Wave View: Close To Finding Support?

Read MoreAMAZON ticker symbol: AMZN short-term Elliott wave view suggests that the rally to $2050.50 high ended intermediate wave (1) as impulse structure. Down from there, the instrument is doing a pullback in intermediate wave (2). The internals of that pullback unfolding in 3 swing structure with the sub-division of 5-3-5 structure in lesser degree cycles […]

-

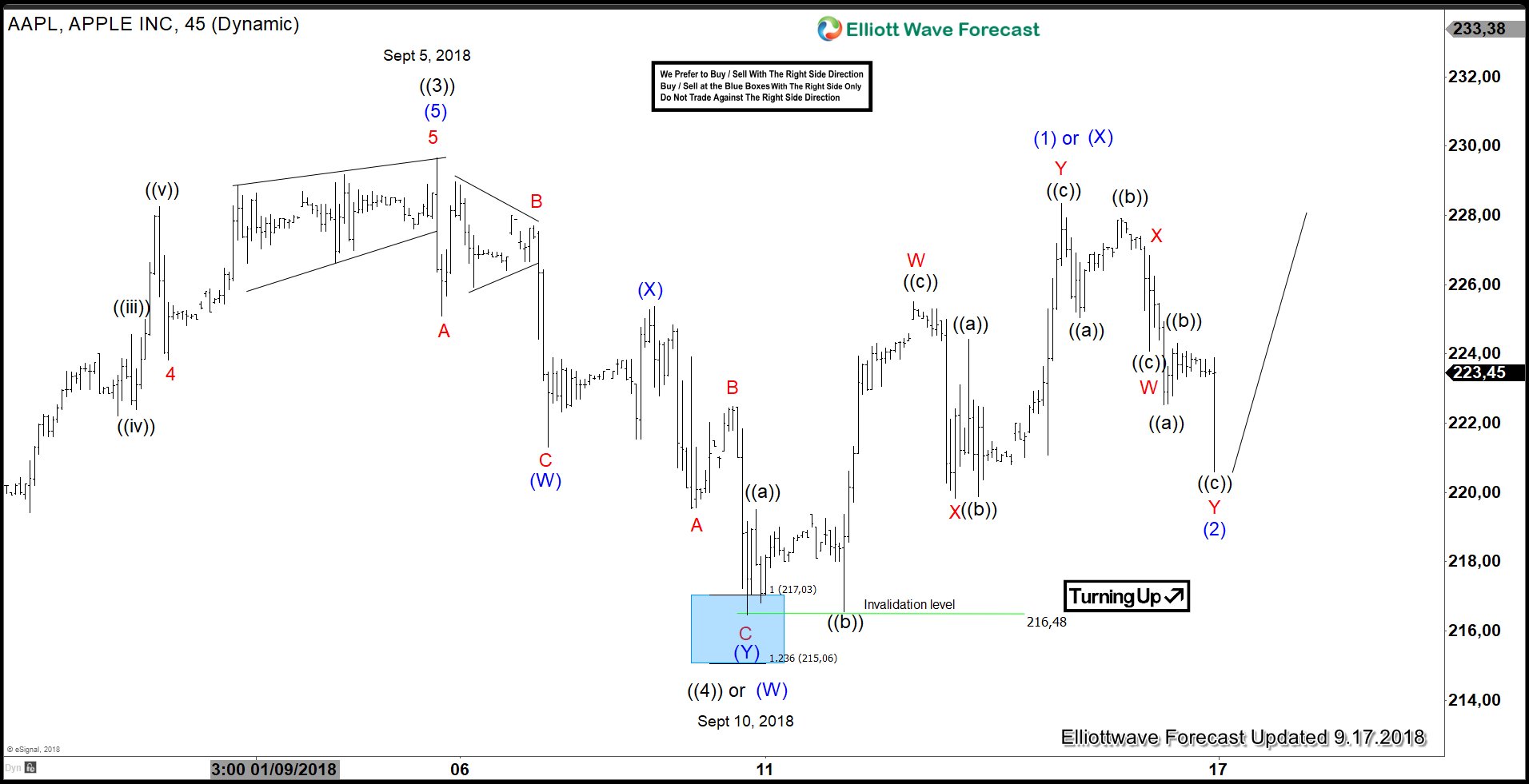

Apple (AAPL): Is the Next Trade War Decline Still a Buy?

Read MoreThe latest trade war between U.S. and China may affect U.S. companies with big operations in China, such as Apple. Saturday’s report by The Wall Street Journal suggests that President Trump has given a go ahead to his aides to implement a fresh $200 billion tariffs ahead of scheduled trade talks with China. This can […]

-

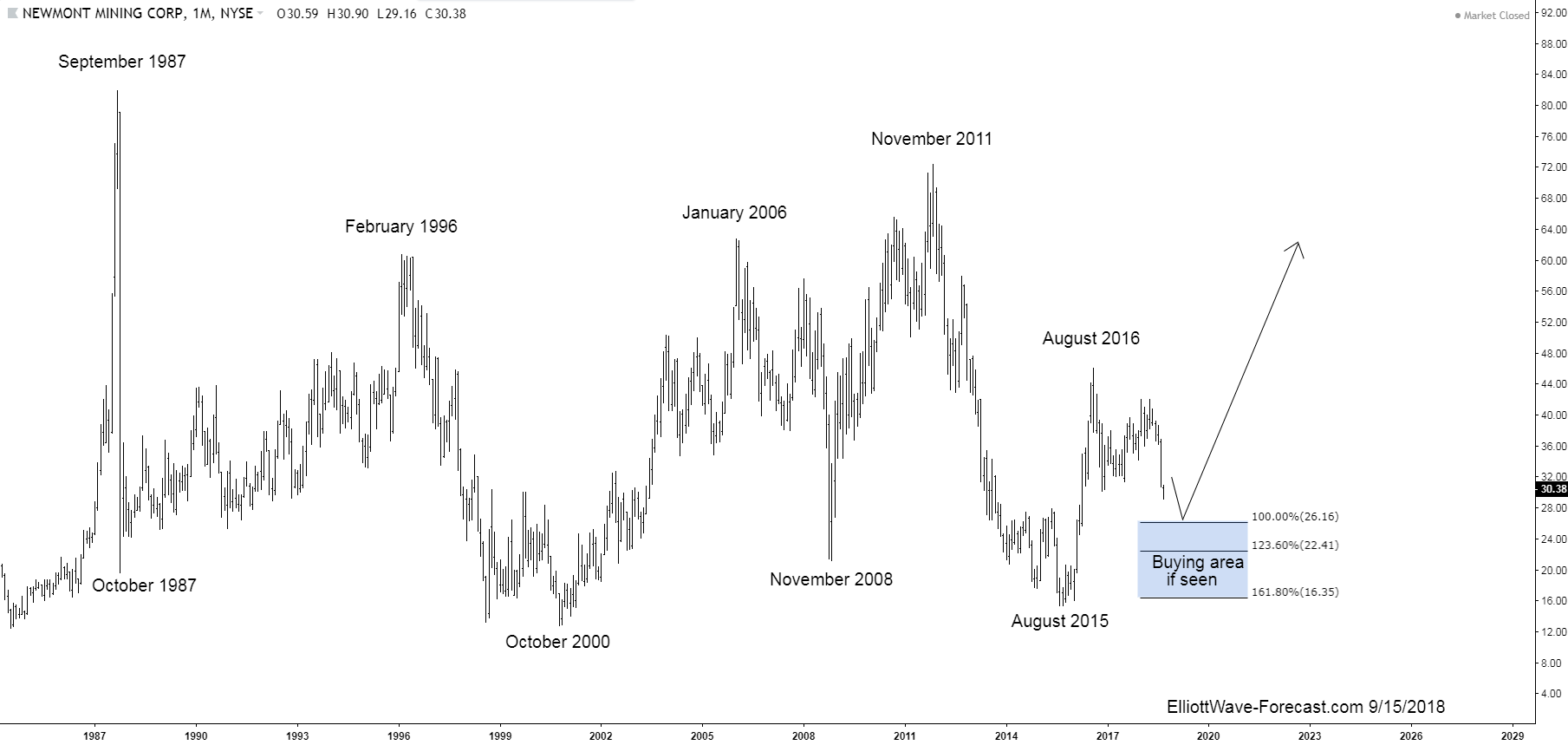

NEM Could Newmont Mining Begin a Larger Bullish Cycle Soon?

Read MoreNEM Could Newmont Mining Begin a Larger Bullish Cycle Soon? Could Newmont Mining Begin a Larger Bullish Cycle Soon? In short answer form is yes. The area from where I think that will happen from is highlighted on the chart below. Before getting to that point again later I would like to talk about some […]