The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Nifty looking to resume rally

Read MoreShort term Elliott Wave view on Nifty suggests that the decline to 10004 on Oct 26 low ended Primary wave ((2)). This means that Index has ended the selloff which started from Aug 28 high (11760.20). It is currently either in the process of eventually breaking to new high again or at least rallying in […]

-

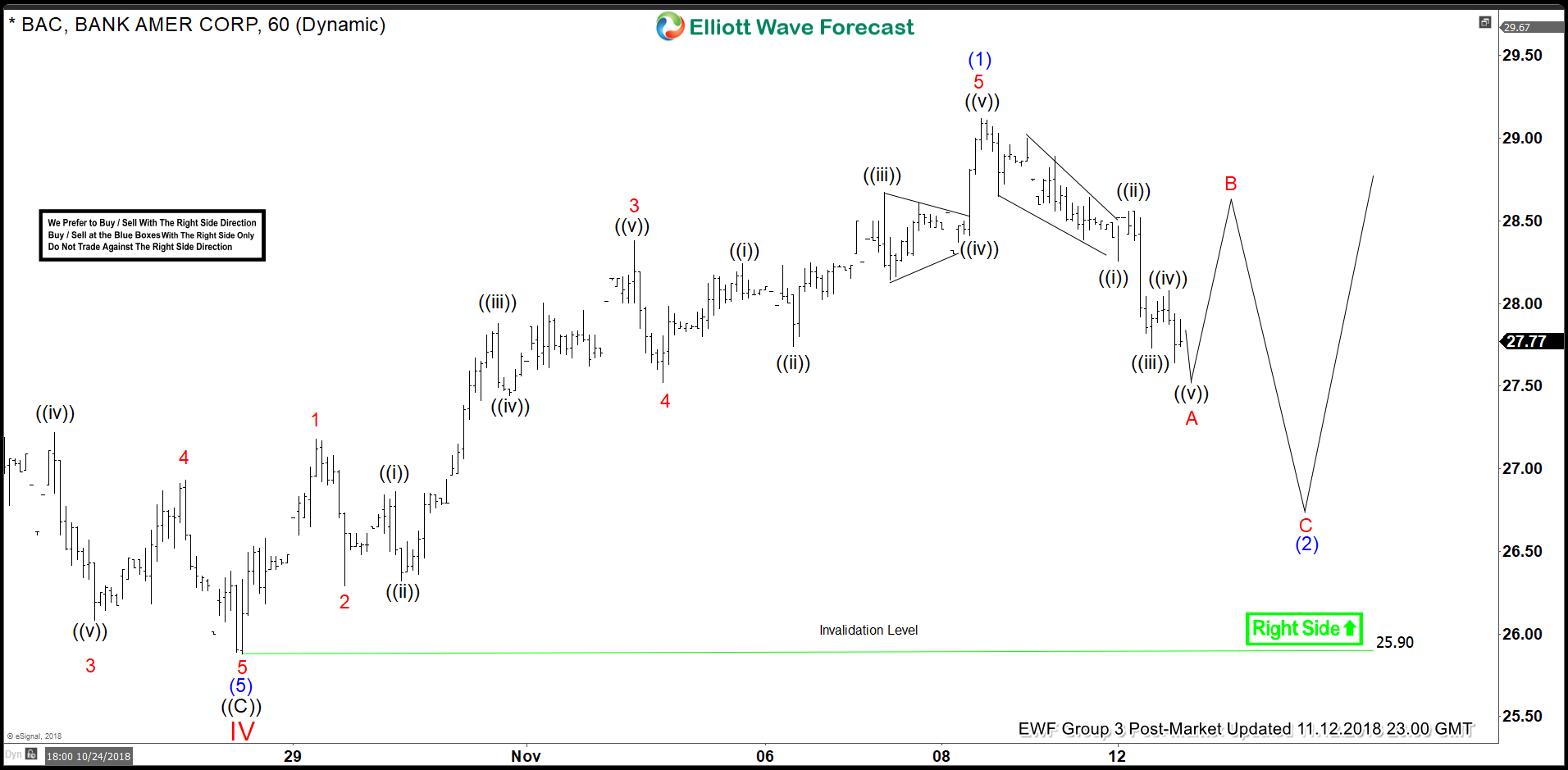

BAC Elliott Wave Dips Are Expected To Remain Supported

Read MoreBAC short-term Elliott wave view suggests that a decline to $25.90 low ended cycle degree wave IV pullback as a Flat correction. Up from there, the stock is expected to resume the next leg higher in cycle degree wave V or should do another extension higher from $25.90 low because the rally higher from that […]

-

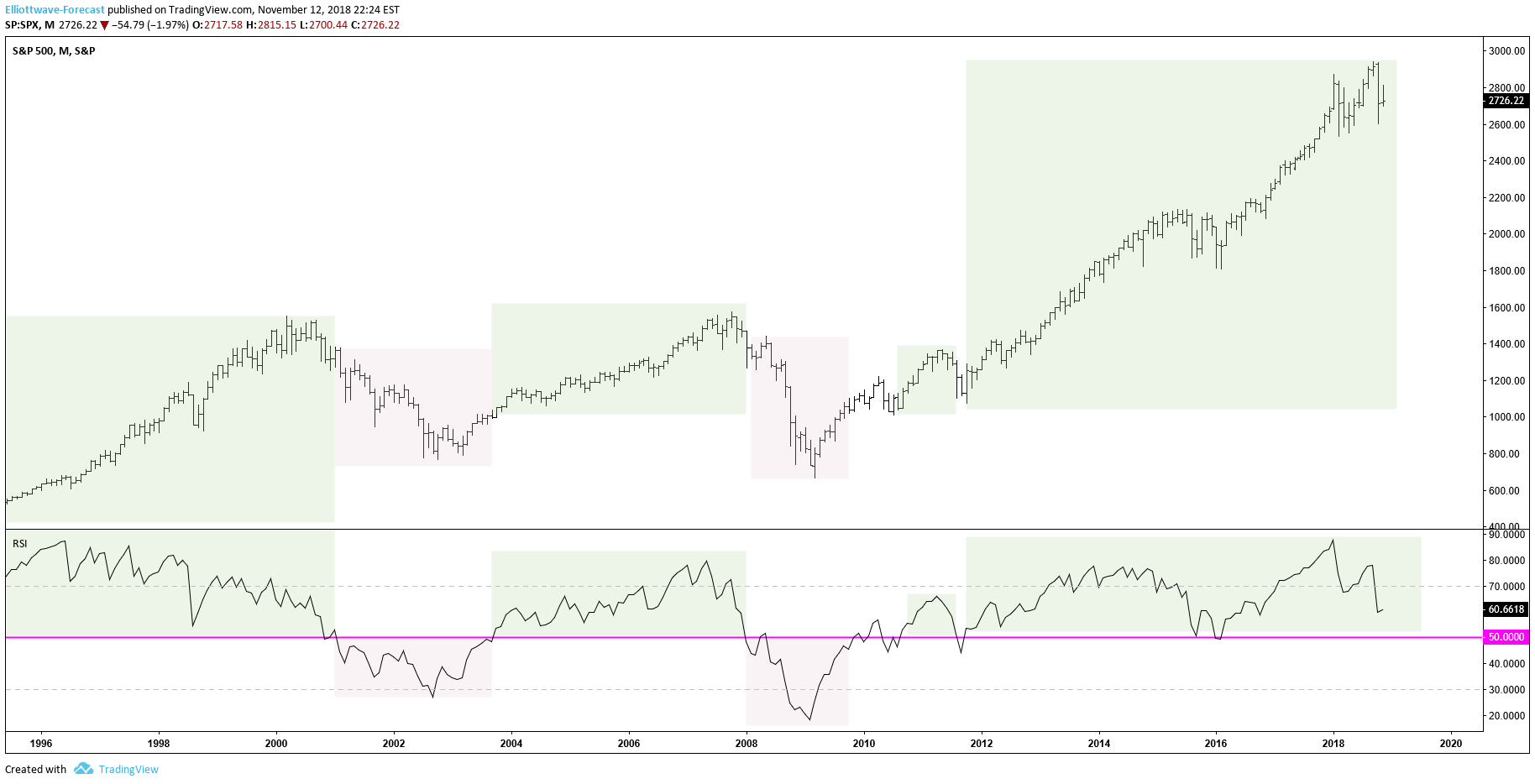

SPX RSI Analysis Suggests the Sky Isn’t Falling – Yet

Read MoreTo be kind, it’s been quite a challenging couple of months for the emotional health of all of us, including traders. There’s been state sponsored attempted cover-up of a murder that could threaten the geo-political environment depending upon what the strong hand of the U.S. considers toward a so called “ally”, world record lottery jackpots […]

-

JNJ Bullish Sequence Calling for New All Time Highs

Read MoreJohnson & Johnson (NYSE: JNJ) is one of the oldest companies around the market as it was founded in 1886. It manufactures medical devices, pharmaceutical and consumer packaged goods and its stock JNJ represent 10.8% of the Health Care ETF “XLV” weight. J&J beats Earnings & Sales Estimates in Q3 and since the release in mid […]

-

Recession in 2020? Technical or Fundamental

Read MoreIf you have been reading the headlines lately, something would have come to your attention, several prominent economists and investors are calling for a recession in the year 2020. Market is a product of many participants, some trade on Fundamental grounds and some trade on Technical or a combination of both. Many keep calling and […]

-

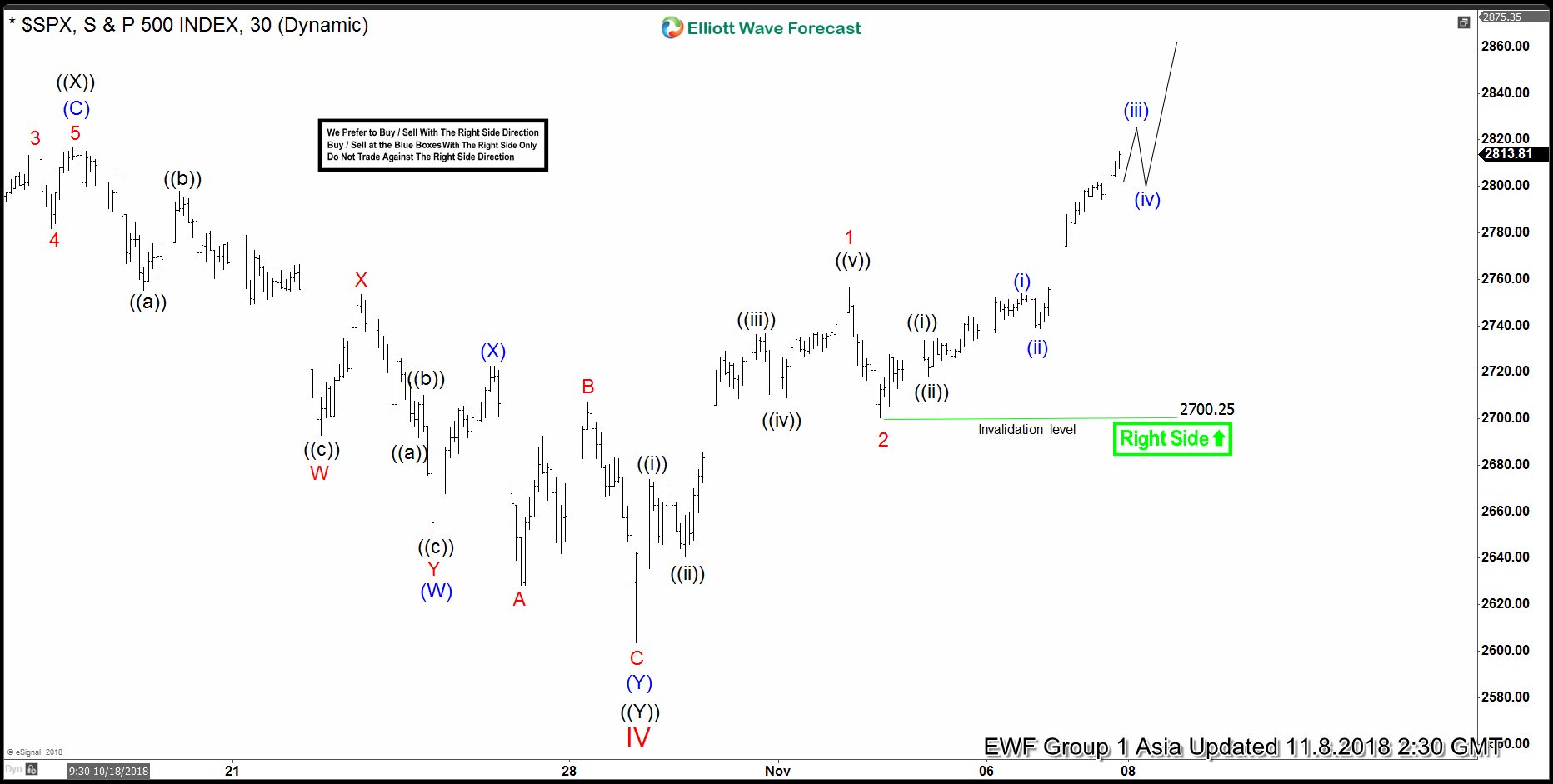

Elliott Wave View: SPX Starts a New Impulsive Rally

Read MoreShort term S&P 500 (SPX) Elliott wave view suggests that the selloff starting from Sept 21 high (2940.9) has ended at Oct 29 low (2603.54). We take the most aggressive view and call the low at 2603.54 as wave IV in Cycle degree. This suggests that SPX is ready to rally in a new bullish […]