The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

XLY – Don’t Count the American Consumer Out Yet

Read MoreThe U.S. Consumer Measured Via the XLY “The U.S. economy is the global economic driver. And within the U.S. economy, the U.S. consumer is the global driver.” James P. Gorman We’re Entering In Negative Territory for 2018 The stock market (measured via the S&P 500 and Dow Jones Industrial Average) has officially erased all of […]

-

Facebook Ends Cycle from IPO. What’s Next For The Social Networking Giant

Read MoreEven today with the explosion of advancements in quantitative analysis utilizing the most sophisticated algorithms and artificial intelligence available the debate rages on between whether a technical-based trading methodology is superior to a fundamental-based trading methodology and vice versa. That debate is examined below via analysis of individual financial instruments such as Facebook (FB). The […]

-

Amazon (AMZN) – Highlighting Next Area For Buyers

Read MoreWe recently wrote an article explaining why Mr Jeff Bezos had nothing to worry about after being down $45B in October’s market sell off and also stated the obvious fact that trend in Amazon (AMZN) is up and pull backs are a buying opportunity. AMZN reached our blue box area starting from $1477 at the […]

-

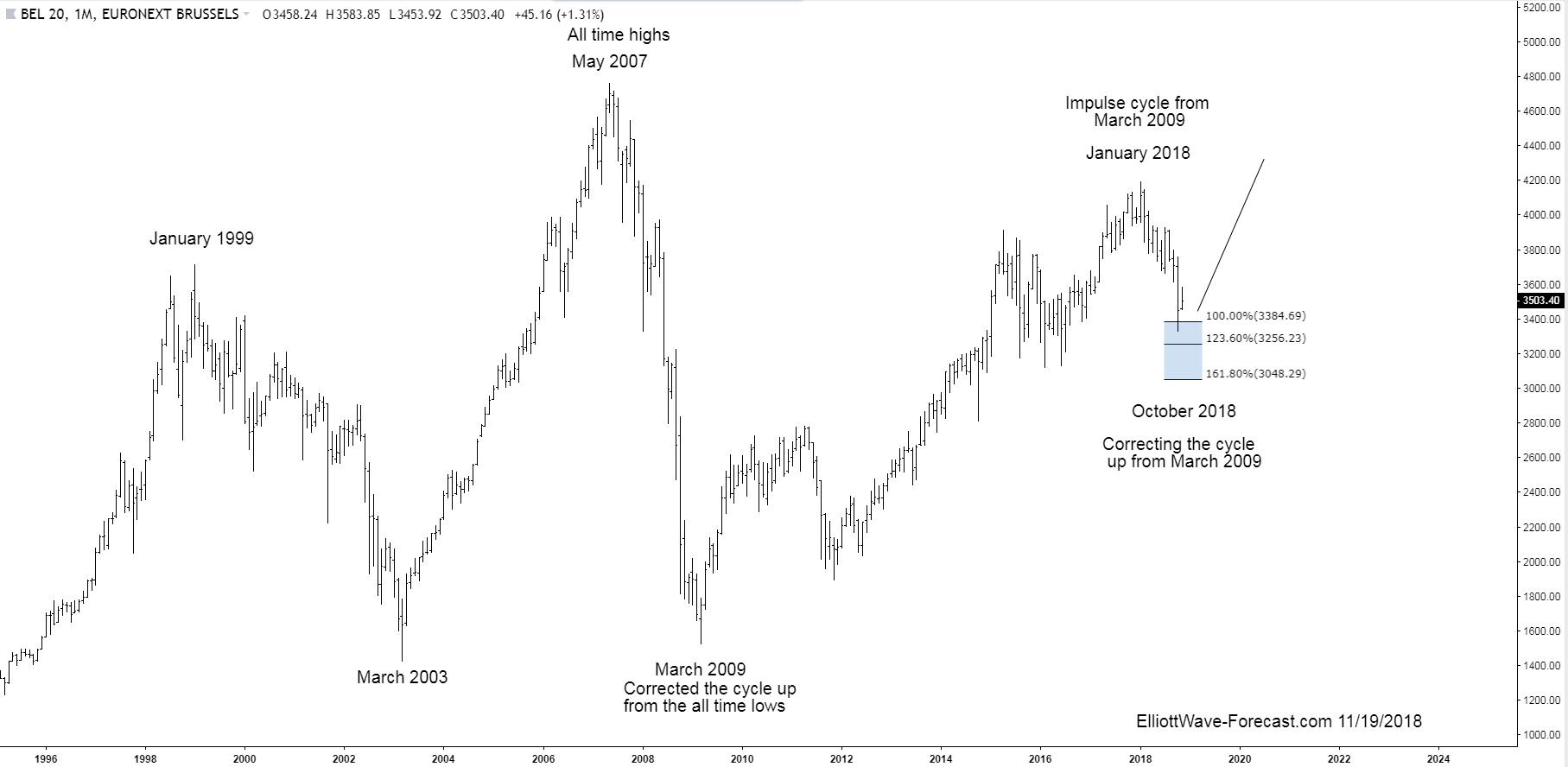

The BEL20 Index Long Term Bullish Trend and Cycles

Read MoreThe BEL20 Index Long Term Bullish Trend and Cycles Firstly, the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other […]

-

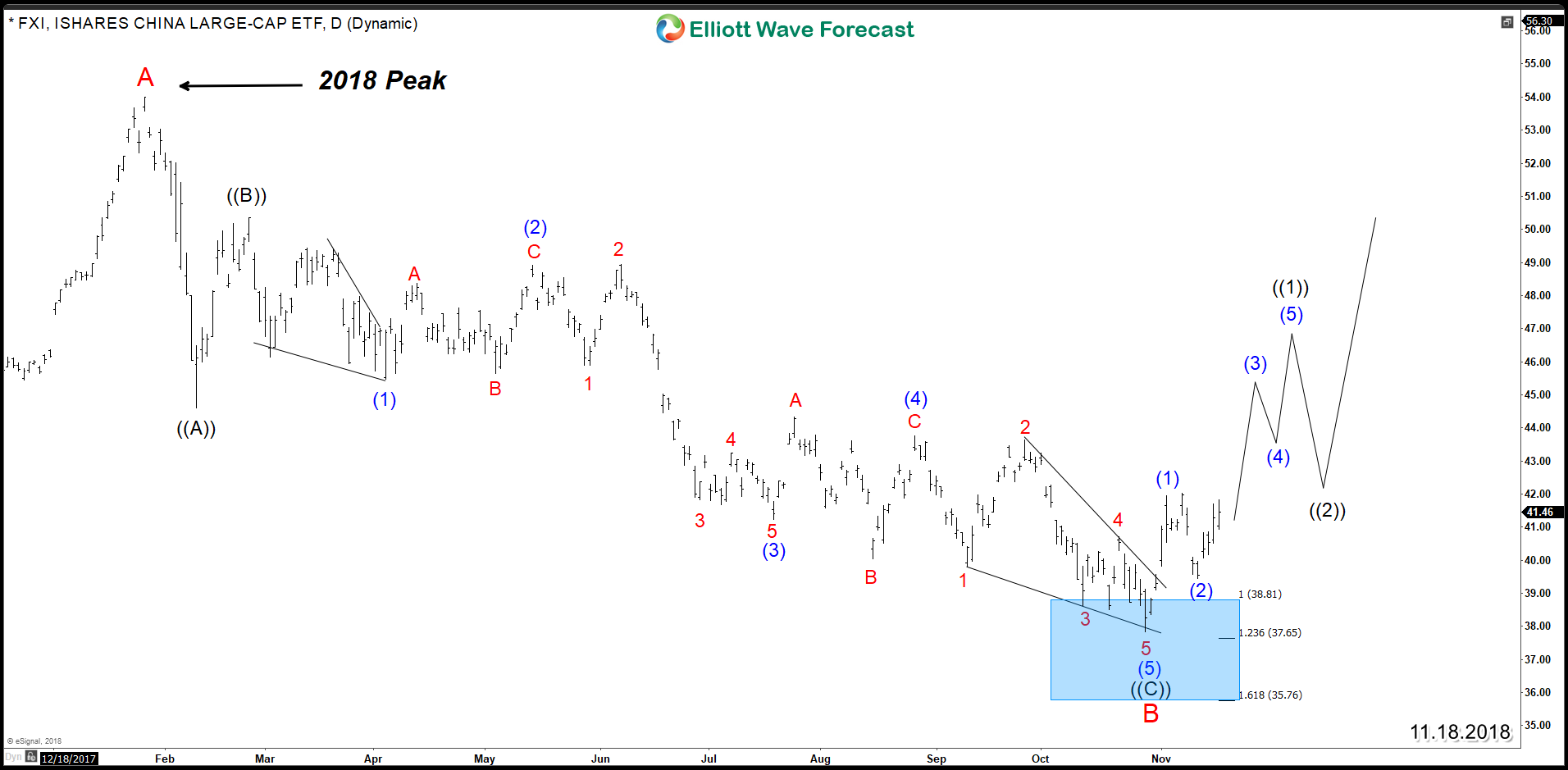

China Stock Market Preparing New Elliott Wave Bullish Cycle

Read MoreThe trade war between USA & China had led to a global fear around the stock market and causing a mid-term “bear market” in China which lost 30% since the start of 2018. The latest plan is that the two leaders US President Donald Trump and Xi Jinping would meet for dinner on December 1 immediately after the G20 […]

-

IYR Elliott Wave View: Found Buyers in Blue Box and Rallied

Read MoreHello fellow traders. Today, I want to share some Elliott Wave charts of the IYR ETF which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 11/06/18. showing that IYR ended the cycle from 10/12/18 low (75.15) at the peak of 10/30/18 (79.47) in red wave […]